Invite to Our blog, an area where interest meets info, and where everyday subjects become engaging conversations. Whether you're seeking understandings on lifestyle, modern technology, or a bit of everything in between, you've landed in the appropriate area. Join us on this exploration as we study the realms of the common and remarkable, making sense of the world one post each time. Your journey right into the remarkable and varied landscape of our Is Tax Credits Based On Household Income begins below. Check out the fascinating web content that awaits in our Is Tax Credits Based On Household Income, where we decipher the details of different subjects.

Is Tax Credits Based On Household Income

Is Tax Credits Based On Household Income

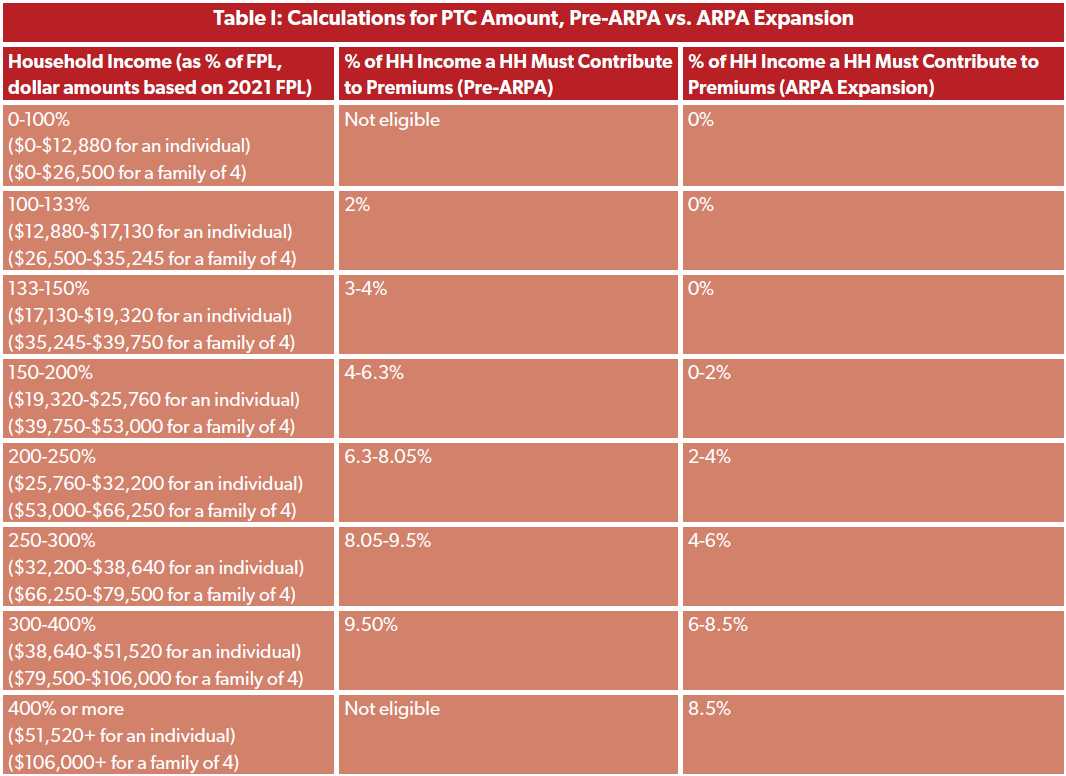

What s The Deal With Premium Tax Credits Publications National

What s The Deal With Premium Tax Credits Publications National

Students Eligible For Benefits Or Aged 60 Or Over 2017 18 Student

Students Eligible For Benefits Or Aged 60 Or Over 2017 18 Student

Gallery Image for Is Tax Credits Based On Household Income

What Is A Tax Credit Tax Credits Sales Tax Goods Services

Exploring Tax Credits For Affordable Housing Benefits And Eligibility

Tax Credits Save You More Than Deductions Here Are The Best Ones

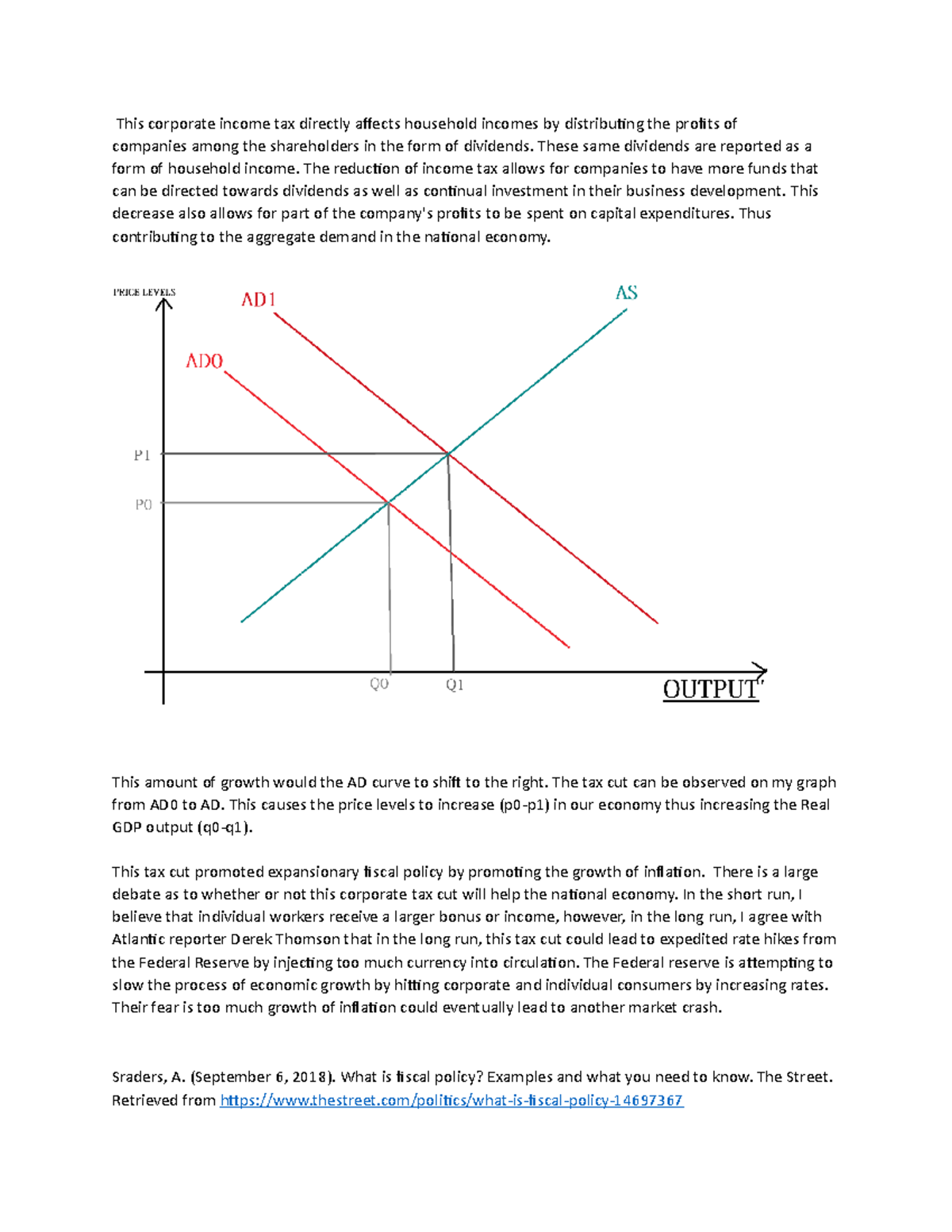

Discussion 3 Tax Cut Grade A This Corporate Income Tax Directly

Explainer What Are Tax Credits

Making The Income Tax Fair Zenconomics

Making The Income Tax Fair Zenconomics

4 Commonly Overlooked Tax Credits Fusion CPA

Thank you for selecting to explore our internet site. We best regards wish your experience surpasses your expectations, which you discover all the info and resources about Is Tax Credits Based On Household Income that you are seeking. Our dedication is to supply an easy to use and interesting system, so do not hesitate to navigate through our web pages effortlessly.