Is There A Tax Credit For Installing A New Furnace And Air Conditioner An existing home that you improve or add onto not a new home Make sure you are installing qualified energy property this means property that meets the energy savings requirements discussed below not all property will qualify for the credit Central air conditioners Natural gas propane or oil water heaters Natural gas propane or oil

The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights insulation electrical plus furnaces boilers and central air conditioners You can receive up to 3 200 in federal tax credits for installing qualifying HVAC equipment into an existing home split between ACs furnaces or boilers 1 200 and air source heat pumps and biomass stoves 2 000

Is There A Tax Credit For Installing A New Furnace And Air Conditioner

Is There A Tax Credit For Installing A New Furnace And Air Conditioner

https://iaqcolorado.com/wp-content/uploads/2022/03/does-a-new-furance-and-air-conditioner-add-value-to-your-home-may22.jpg

ALPHA OMEGA HEATING COOLING 10 Photos 3933 W Columbus Ave

https://s3-media0.fl.yelpcdn.com/bphoto/_X4VnhkqvoxWGacf_SyNIg/o.jpg

Costs Involved In Installing A New Furnace Architurn

https://www.architurn.com/wp-content/uploads/2020/09/Heating-Repair.jpg

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022 The renewed Energy Efficient Home Improvement Tax Credit 25C program increases the HVAC tax credit limit for installing CEE Top Tier high efficiency equipment it is retroactive to January 1 2022 and approved until 2032

Here are the highlights of ENERGY STAR certified equipment that is eligible for the tax credits Products That Qualify Central air conditioning 300 for air conditioners recognized as ENERGY STAR Most Efficient Air source heat pumps Energy Efficient Home Improvement Tax Credit The federal government offers tax credits for homeowners who install energy efficient HVAC systems Under the Energy Efficient Home Improvement Tax Credit extended through 2025 Credit Amount Up to 30 of the cost of the system with a maximum of 600 for air conditioning units and 2 000 for

Download Is There A Tax Credit For Installing A New Furnace And Air Conditioner

More picture related to Is There A Tax Credit For Installing A New Furnace And Air Conditioner

Is There A Tax Credit For A Whole House Generator

https://thisgenerator.com/wp-content/uploads/2021/09/Is-There-a-Tax-Credit-for-a-Whole-House-Generator.jpg

What To Know When Installing A New Furnace Frederick Heating Air

https://icalledfred.com/wp-content/uploads/2021/11/blog2-768x512.jpg

What The Inflation Act Means For You Red Rock Group

https://static.twentyoverten.com/content/featured/featured_whattheinflationactmeansforyou.jpg

Discover how installing a new furnace may impact your taxes including potential credits deductions and necessary documentation Energy efficient furnaces qualifying for tax credits are reported separately using Form 5695 Accurate documentation of the furnace s energy efficiency certification and costs is essential to properly complete Homeowners can qualify for a tax credit worth up to 1 200 a year for installing high efficiency air conditioners or furnaces and also for making certain other upgrades to improve their home s energy efficiency such as adding insulation or replacing windows and doors

It is a nonrefundable credit that can reduce or eliminate the amount of tax you owe The credit cannot be refunded The energy efficient home improvement credit has a yearly combined limitation of 3 200 2 000 for electric or natural gas heat pump water heaters electric or natural gas heat pumps biomass stoves and biomass boilers and In 2024 U S homeowners can benefit from federal tax credits for installing energy efficient HVAC systems as outlined in the Inflation Reduction Act of 2022 These incentives available through 2032 aim to encourage the

How Much Does It Cost To Install A New Furnace WM Buffington Company

https://wmbuffingtoncompany.com/wp-content/uploads/2020/06/How-Much-Does-it-Cost-to-Install-a-New-Furnace.jpg

Benefits On Installing A New Furnace Deltalis

https://www.deltalis.com/wp-content/uploads/2022/02/Energy-Efficiency-1-scaled-980x654.jpeg

https://www.irs.gov › credits-deductions › how-to...

An existing home that you improve or add onto not a new home Make sure you are installing qualified energy property this means property that meets the energy savings requirements discussed below not all property will qualify for the credit Central air conditioners Natural gas propane or oil water heaters Natural gas propane or oil

https://www.energystar.gov › about › federal-tax...

The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights insulation electrical plus furnaces boilers and central air conditioners

Most Efficient Natural Gas Furnaces Buying Recommendations

How Much Does It Cost To Install A New Furnace WM Buffington Company

New Furnace Cost Architurn

Want Bad Air Put A Heating Cooling System In Your Attached Garage

Is There A Tax

Before And After Installation Of A New Furnace And Air Conditioning

Before And After Installation Of A New Furnace And Air Conditioning

House Heater Not Blowing Hot Air Shopforguitarlearn

Does A New Furnace And Air Conditioner Add Value To Your Home The

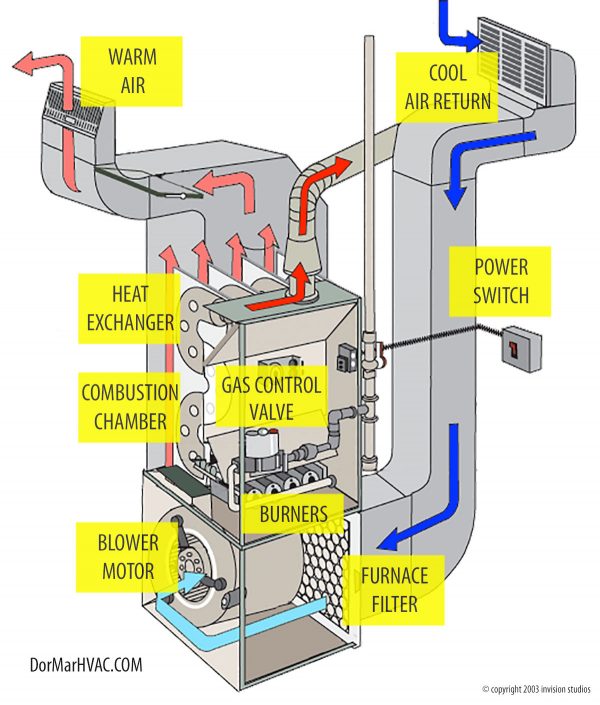

How Does A Furnace Work Dor Mar Heating Air Conditioning

Is There A Tax Credit For Installing A New Furnace And Air Conditioner - To qualify for the furnace tax credit your new furnace must meet specific energy efficiency standards The credit is usually available for furnaces that achieve a certain Annual Fuel Utilization Efficiency AFUE rating