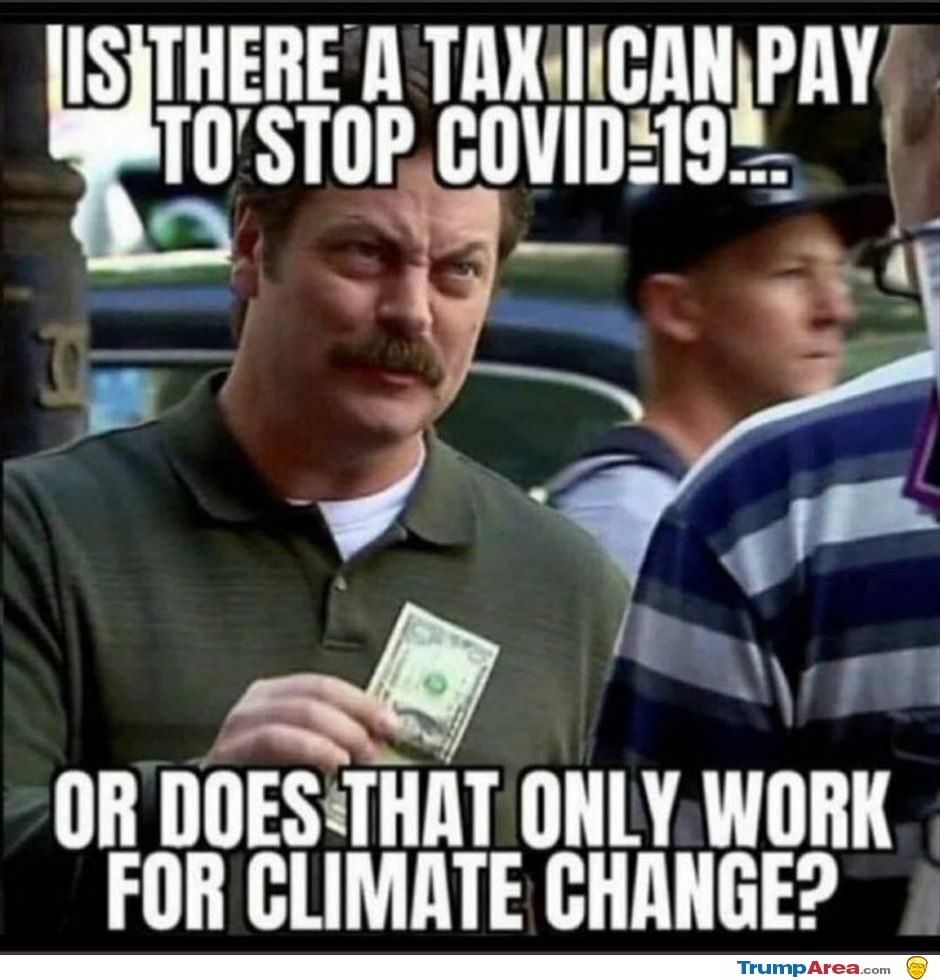

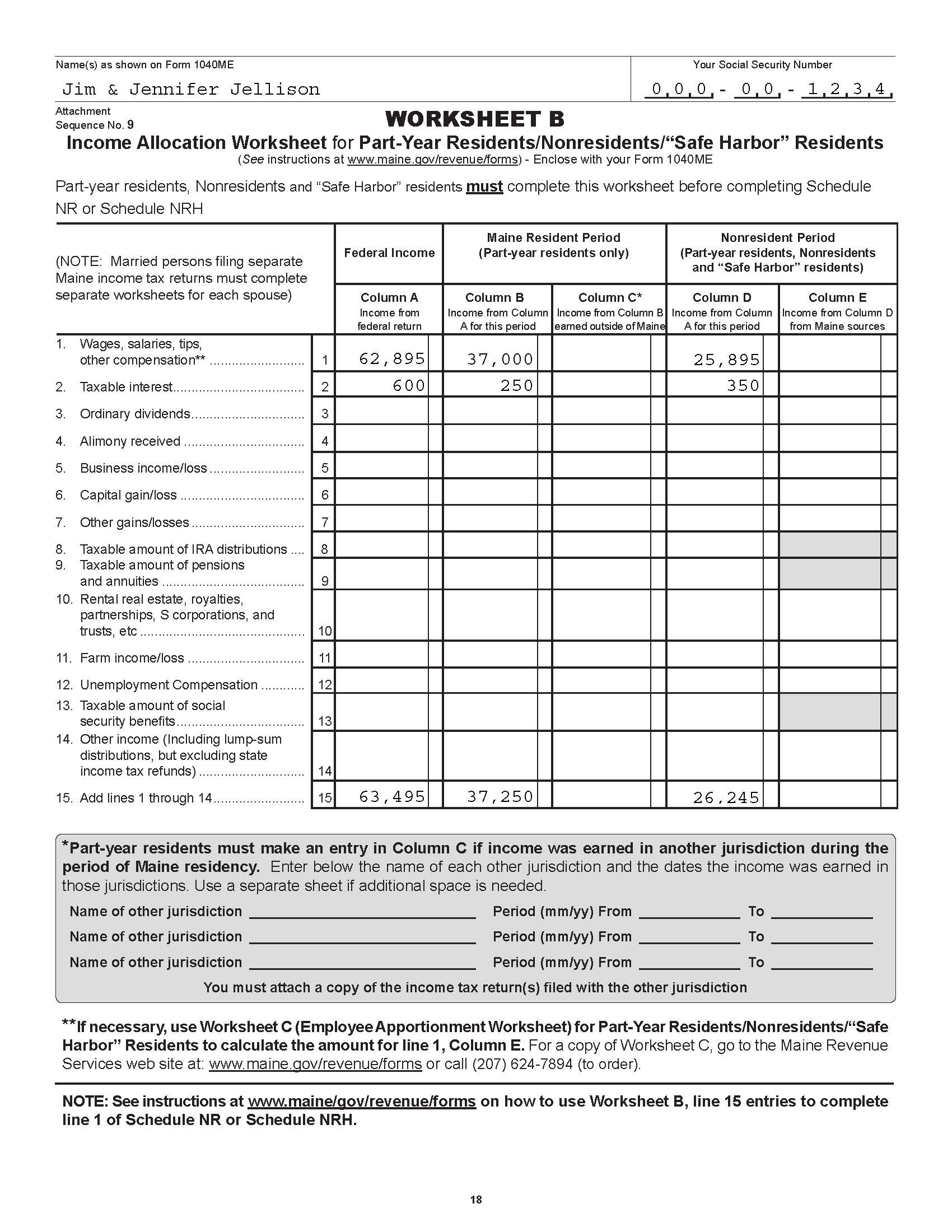

Is There A Tax Deduction For Hot Water Heaters If you replace your water heater the following year you would be eligible for another 30 tax credit up to 2 000 plus up to 600 if you need an electric panel upgrade to accommodate the new water heater

If you are a personal homeowner not a landlord then purchase of a new hot water heater is not a tax deduction It might be eligible for an energy efficiency credit of up to 600 for a conventional hot water heater or up to 2000 for a heat pump hot water heater if it meets the required energy efficiency standard as shown in the instructions Installing alternative energy equipment in your home such as solar panels heat pumps windows doors and roofing can qualify you for a credit up to 30 of your total cost See the details below for details on the programs available to

Is There A Tax Deduction For Hot Water Heaters

Is There A Tax Deduction For Hot Water Heaters

https://mathewsplumbing.com/wp-content/uploads/FI-Direct-Vent-Water-Heater-1.jpg

Tax Credit Vs Tax Deduction What s The Difference Guide

https://www.expatustax.com/wp-content/uploads/2022/05/Tax-Credit-vs-Tax-Deduction.jpg

SHARP Water Heaters 3500 Watt WH B55 Eco One White Without

https://pub.thisshop.com/shop/pop/category/11514/01150404/20210803/189973_1627961457753.jpg?x-oss-process=image/resize,w_500

Advanced main air circulating fans This fan must use no more than 2 percent of your furnace s total energy to qualify for a 50 tax credit Water heaters non solar 300 for most ENERGY STAR certified heat pump water heaters Taxpayers that make qualified energy efficient improvements to their home after Jan 1 2023 may qualify for a tax credit up to 3 200 As part of the Inflation Reduction Act beginning Jan 1 2023 the credit equals 30 of certain qualified expenses Exterior doors windows and skylights Insulation and air sealing materials or systems

Since a heat pump is a type of qualified energy property not subject to the 600 per item cap or the 1 200 overall limit the taxpayer can claim a credit of 1 500 for the cost of the heat pump Accordingly the taxpayer s total credit is 2 600 500 for the exterior doors 600 for the windows and skylights 1 500 for the heat pump The Inflation Reduction Act IRA of 2022 introduced enhanced tax credits for energy efficiency and extended them through 2032 They cover many improvements including heat pumps insulation heat pump water heaters and energy efficient windows and doors The maximum annual credit available is 30 of the project cost up to 3 200

Download Is There A Tax Deduction For Hot Water Heaters

More picture related to Is There A Tax Deduction For Hot Water Heaters

Do You Need To File Taxes As A Small Business Owner Camino Financial

https://img.caminofinancial.com/wp-content/uploads/2019/09/25155936/iStock-508151968-1024x724.jpg

Tax Deductions You Can Deduct What Napkin Finance

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

EPRA Reviews Solar Water Heating Law Kenyan Wallstreet

https://kenyanwallstreet.com/wp-content/uploads/2020/01/solar-water-heater-on-roof-top-benedek-alpar.jpg

The energy efficient home improvement credit has a yearly combined limitation of 3 200 2 000 for electric or natural gas heat pump water heaters electric or natural gas heat pumps biomass stoves and biomass boilers and 1 200 for the other qualifying improvements There is no lifetime limitation In total a taxpayer could theoretically claim up to a 3 200 maximum annual Energy Efficient Home Improvement Credit 2 000 for heat pump and heat pump water heaters biomass stoves and boilers combined 1 200 combined for everything else

Here are eight ways you can claim a tax deduction or tax credit for home improvements Energy Efficient Improvements The federal government offers tax credits for specific energy efficient home improvements such as the installation of energy efficient windows doors roofing insulation and certain heating and cooling equipment Federal tax credit for water heaters As you are searching for the right water heater for your home keep in mind the incentive programs that are available for your purchase

Is There A Tax

https://www.trumparea.com/_pics/2201/is-there-a-tax34.jpg

What Is A Tax Deduction

http://taxreceipts.com/wp-content/uploads/2012/03/what-is-a-deduction.jpg

https://www.energystar.gov › about › federal-tax...

If you replace your water heater the following year you would be eligible for another 30 tax credit up to 2 000 plus up to 600 if you need an electric panel upgrade to accommodate the new water heater

https://ttlc.intuit.com › community › tax-credits...

If you are a personal homeowner not a landlord then purchase of a new hot water heater is not a tax deduction It might be eligible for an energy efficiency credit of up to 600 for a conventional hot water heater or up to 2000 for a heat pump hot water heater if it meets the required energy efficiency standard as shown in the instructions

Water Heaters Tankless Installation Repair Cary Raleigh

Is There A Tax

What Can I Deduct Freelance Tax Deductions Flowchart Rags To Reasonable

Is A New Hvac System Tax Deductible

Can You Claim Car Expenses As A Tax Deduction

14 Best Images Of Federal Itemized Deductions Worksheet Federal

14 Best Images Of Federal Itemized Deductions Worksheet Federal

Is There A Tax Deduction For Buying A House Buy Walls

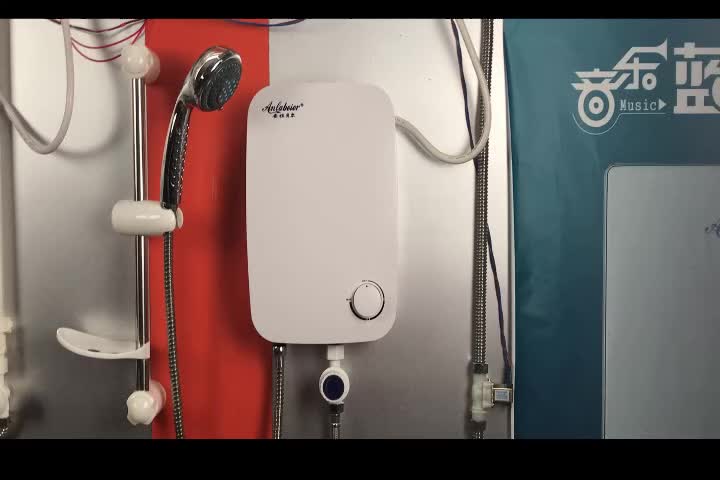

Anlabeier Brand Names Electric Instant Shower Hot Water Heaters Prices

Best Hot Water Heaters 30 Gallon Electric Home Tech Future

Is There A Tax Deduction For Hot Water Heaters - Homeowners who invest in an Energy Star certified heat pump water heater can receive an additional 30 off their electrification project for a tax credit of up to 2 000 This applies to all products purchased and installed from Jan 1 2023 to Dec 31 2032 High efficiency heat pump water heaters are four times more efficient than standard models and