Is There A Tax Deduction For Hybrid Cars The biggest news is the ten fold increase in first year car tax rates for cars emitting between 1 50g km of CO2 which includes hybrids These will increase from the current rate

This tax information and impact note sets out an extension to the availability of the 100 first year allowances for zero emission cars and electric vehicle charge points Clean vehicle credits Determine whether your purchase of an electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit Find more information on the clean vehicle

Is There A Tax Deduction For Hybrid Cars

Is There A Tax Deduction For Hybrid Cars

https://www.expatustax.com/wp-content/uploads/2022/05/Tax-Credit-vs-Tax-Deduction.jpg

Tax Deductions For Job Seekers

https://www.kbic.com/blog/wp-content/uploads/tax-deduction.jpg

10 Most Common Small Business Tax Deductions Infographic

https://triplogmileage.com/wp-content/uploads/2018/08/rev02-01-min-33-min.jpg

Luxury Vehicles over 6000 lbs and the Section 179 Deduction While luxury vehicles are generally not eligible for the Section 179 deduction there is an exception for SUVs and trucks that are used for business Commercial fleets and tax exempt organizations that buy a qualified commercial clean vehicle may qualify for a clean vehicle tax credit per vehicle these include all electric plug in hybrid

A new federal tax credit of 4 000 for used EVs priced below 25k Subject to other requirements like lower annual income see below Revised credit applies to battery 30 October 2024 Tax and Legislation Fuel duty has been frozen and new benefit in kind BIK tax rates will continue to incentivise the uptake of fully electric company cars the

Download Is There A Tax Deduction For Hybrid Cars

More picture related to Is There A Tax Deduction For Hybrid Cars

Not All Hybrids Alike With New Tax Credit

https://media-cldnry.s-nbcnews.com/image/upload/t_fit-760w,f_auto,q_auto:best/ap/ny11012310437.jpg

Donate Car For Tax Credit 2016 Car Donation Tax Deduction How To Get

https://3.bp.blogspot.com/-I2ZnysVTsCw/V0MFtS_ztYI/AAAAAAAAAAY/Aq_AEm6A9LE47-HnrHKpziRJSvLjgVpYwCLcB/s1600/tax.jpg

Tax Breaks For Hybrid Cars 5 Things To Know And Consider Reliable

https://blog.reliablenv.com/wp-content/uploads/2018/02/Tax-Breaks-for-Hybrid-Cars-5-Things-to-Know-and-Consider.jpg

Electric and hybrid vehicles can have significant emissions benefits over conventional vehicles All electric vehicles produce zero tailpipe emissions and PHEVs produce no tailpipe emissions when operating in all electric mode Today s guidance marks a first step in the Biden Administration s implementation of Inflation Reduction Act tax credits to lower costs for families and make electric vehicles

Mercedes Benz S 580e hybrid Edmunds Rating 8 4 10 Mercedes Benz took what was already one of the best luxury sedans on the road and made it quicker more efficient and marginally less October 30 2024 at 4 51pm GMT Drivers of new petrol diesel and hybrid vehicles are set to face higher first year tax rates following today s Budget

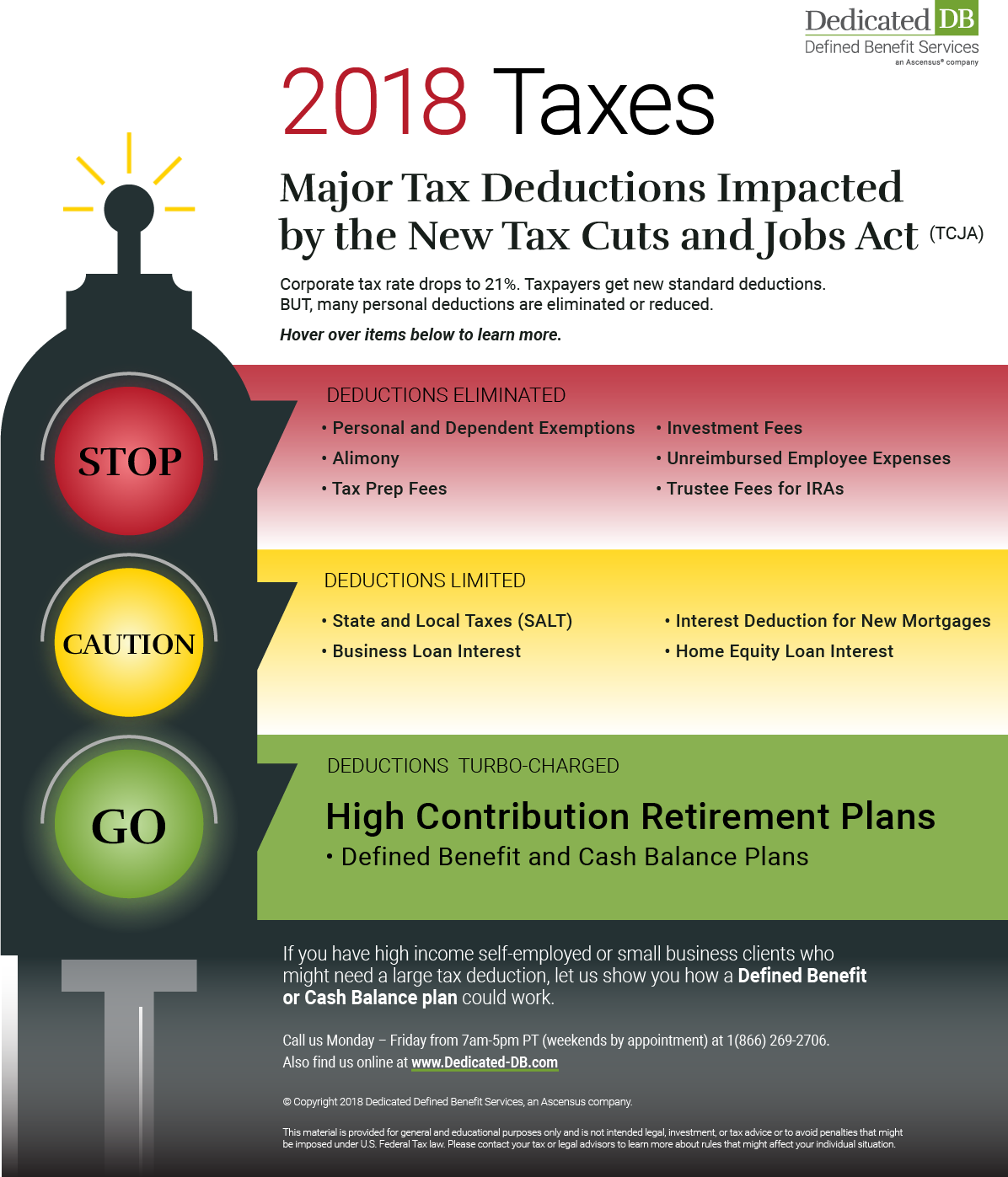

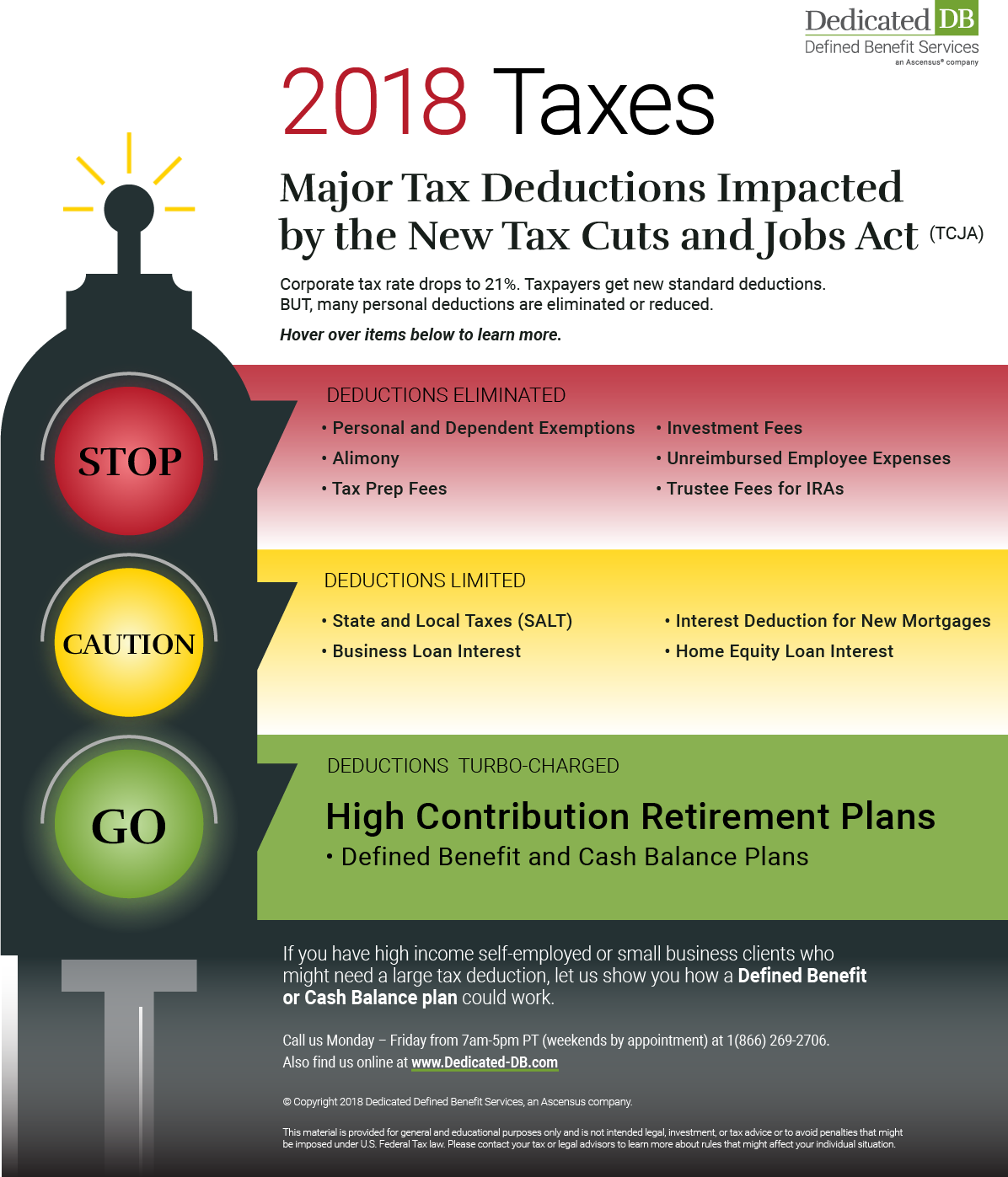

Tax Deduction Changes For 2018

http://galleryr.org/infographics/major-tax-deductions-impacted-image.png

D C Introduces New Tax Targeting Heavy Vehicles

https://drivingdc.com/wp-content/uploads/2022/06/tax-deduction-for-car-donation.png

https://www.rac.co.uk/drive/news/motoring-news/...

The biggest news is the ten fold increase in first year car tax rates for cars emitting between 1 50g km of CO2 which includes hybrids These will increase from the current rate

https://www.gov.uk/government/publications/capital...

This tax information and impact note sets out an extension to the availability of the 100 first year allowances for zero emission cars and electric vehicle charge points

How To Make Your Car A Tax Deduction YouTube

Tax Deduction Changes For 2018

Is There A Tax

What You Need To Know About Using Your Vehicle As A Tax Deduction

What Is A Tax Deduction

What Does A Tax Deduction Save You

What Does A Tax Deduction Save You

Vehicle Tax Deduction 8 Cars You Can Get TAX FREE Section 179 YouTube

Can You Claim Car Expenses As A Tax Deduction

What Are Tax Deductions The TurboTax Blog

Is There A Tax Deduction For Hybrid Cars - Luxury Vehicles over 6000 lbs and the Section 179 Deduction While luxury vehicles are generally not eligible for the Section 179 deduction there is an exception for SUVs and trucks that are used for business