Is There An Income Limit For Energy Tax Credit If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022

Q Are there limits to what consumers can claim A Consumers can claim the same or varying credits year after year with new products purchased but some credits have an annual limit See the table above Annual overall limitation The credit allowed for any tax year cannot exceed 1 200 Annual limitation for qualified energy property The credit allowed for any tax year with respect to any item of qualified energy property cannot exceed 600

Is There An Income Limit For Energy Tax Credit

Is There An Income Limit For Energy Tax Credit

https://assets-eu-01.kc-usercontent.com/77bbf83a-1306-0152-fea5-3b5eaf937634/5dc931e1-fc39-41d3-9470-e7d3675c5a5e/GettyImages-1413038230.jpg

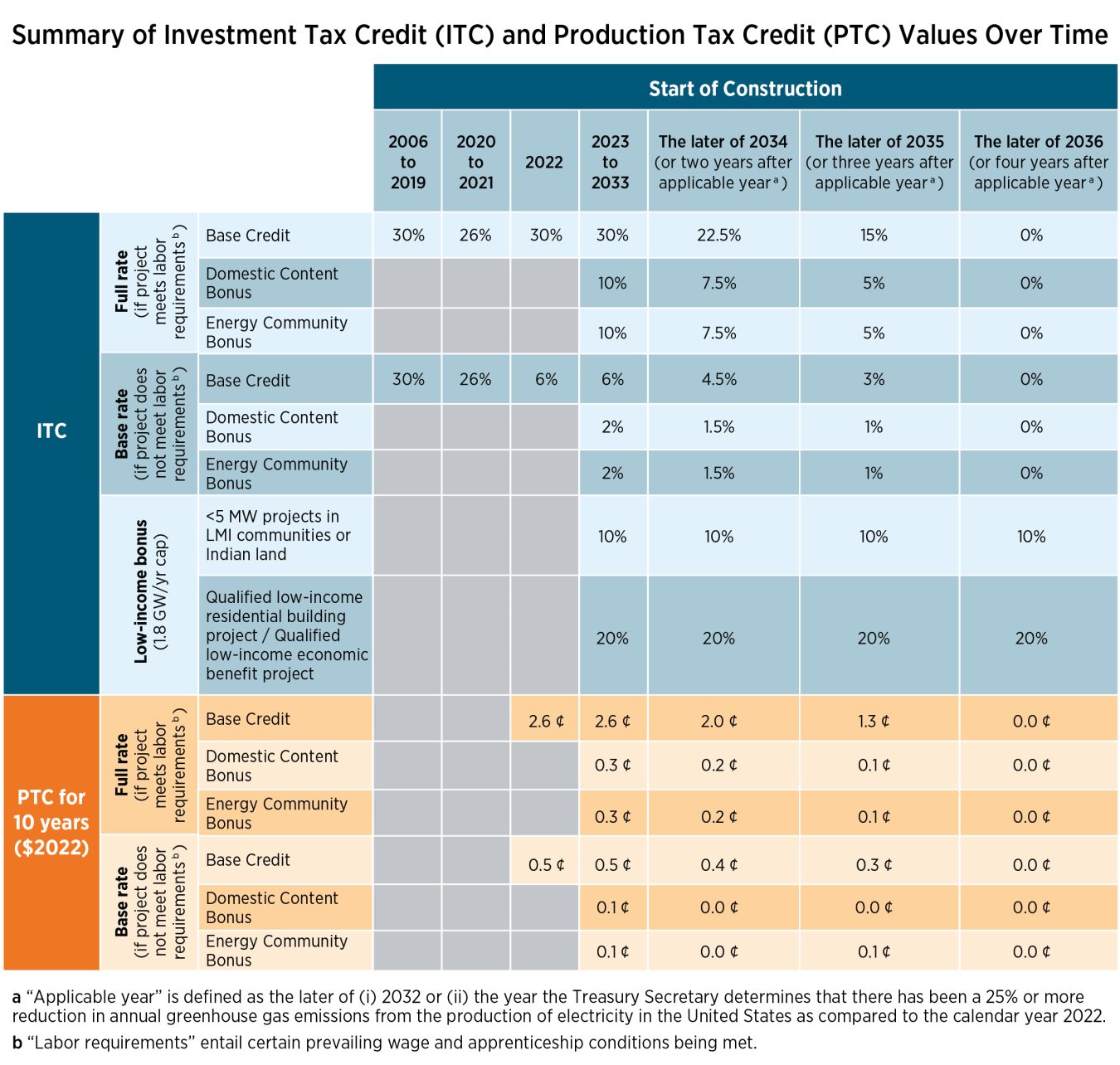

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Summary-ITC-and-PTC-Values-Table.png?itok=_72eWNBC

Home Energy Improvements Lead To Real Savings Infographic Solar

https://i.pinimg.com/originals/d9/ad/96/d9ad96393cb13907229e3e2b1609bcc1.jpg

There s a 1 200 annual credit limit for purchasing items such as energy efficient doors or windows and a 2 000 annual credit limit for heat pumps and biomass stoves or boilers You can The maximum limit also increased to 1 200 or 2 000 for certain heat pumps biomass stoves and boilers and it now resets every year until 2032 meaning it s possible to save five figures

Credits are typically applied to a taxpayer s income tax liability and thereby can offset the cost of energy saving improvements such as insulation windows and doors solar panel systems or other qualifying renewable energy sources Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent

Download Is There An Income Limit For Energy Tax Credit

More picture related to Is There An Income Limit For Energy Tax Credit

What Appliances Qualify For Energy Tax Credit ByRetreat

https://byretreat.com/wp-content/uploads/2023/12/energy_tax_credit_eligible_appliances-1000x575.jpg

What Insulation Qualifies For Energy Tax Credit Storables

https://storables.com/wp-content/uploads/2023/10/what-insulation-qualifies-for-energy-tax-credit-1696444561.jpg

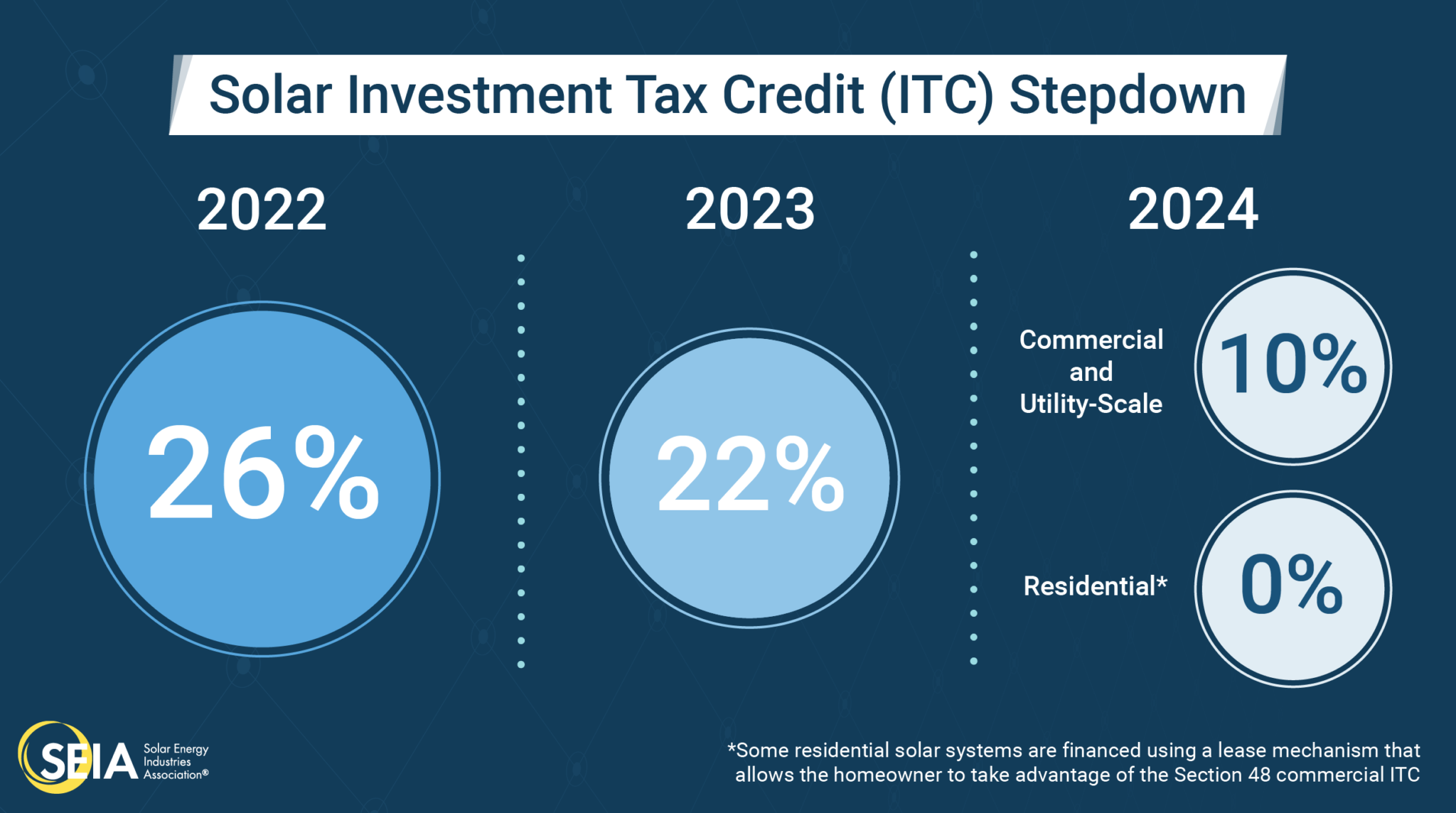

Solar Tax Credit What You Need To Know NRG Clean Power

https://nrgcleanpower.com/wp-content/uploads/2022/05/ITC-Step-Down-2022-01.png

The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after December 31 2021 you may be eligible to claim them on your taxes when you file for 2022 Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement credit is increased for years after 2022 with an annual credit of generally up to 1 200

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695 Beginning Jan 1 2023 the credit equals 30 of certain qualified There are annual credit caps within the overall 1 200 annual limitation imposed on various qualified properties There are exceptions where the maximum credit may be up to 3 200 depending on the mix of property installed by

Is There An Income Limit To Contribute To Ira

https://www.bitxpace.com/img/ae066ca76a4de3c60e4eff5a0c72f73d.jpg?06

Is There An Income Limit For AOTC Fingerlakes1

https://www.fingerlakes1.com/wp-content/uploads/2022/03/is-there-an-income-limit-for-aotc.jpg

https://www.irs.gov/credits-deductions/home-energy-tax-credits

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022

https://www.energy.gov/policy/articles/making-our...

Q Are there limits to what consumers can claim A Consumers can claim the same or varying credits year after year with new products purchased but some credits have an annual limit See the table above

Inflation Reduction Act How To Apply For Energy Tax Credits Marca

Is There An Income Limit To Contribute To Ira

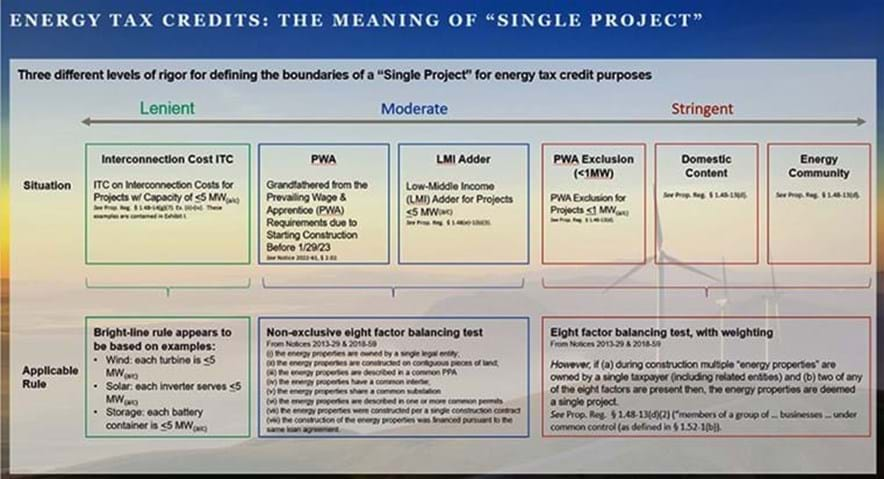

Multiple Definitions Of Project For Energy Tax Credit Purposes

Federal Solar Tax Credit Ecohouse Solar LLC

Medicare Latest Medicare News Status Updates

Is There An Income Limit For Medicare Advantage Plans

Is There An Income Limit For Medicare Advantage Plans

BanrdominiumUnlocking Energy Tax Credits For Insulating Your

Agnus Good

What Is The Income Limit For Child Tax Credit 2020 YouTube

Is There An Income Limit For Energy Tax Credit - Credits are typically applied to a taxpayer s income tax liability and thereby can offset the cost of energy saving improvements such as insulation windows and doors solar panel systems or other qualifying renewable energy sources