Is There Any Deduction In New Tax Regime Budget 2024 has increased the standard deduction limit under the new tax regime from 50 000 to 75 000 for the AY 2025 26 FY 2024 25 However taxpayer has to keep in mind that for the AY 2024 25 standard deduction

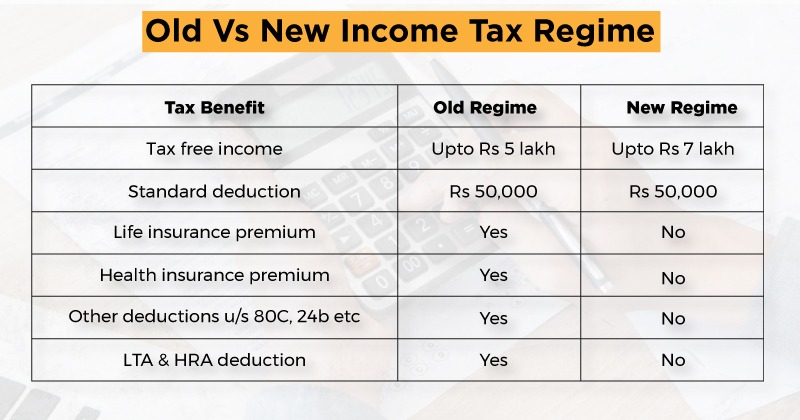

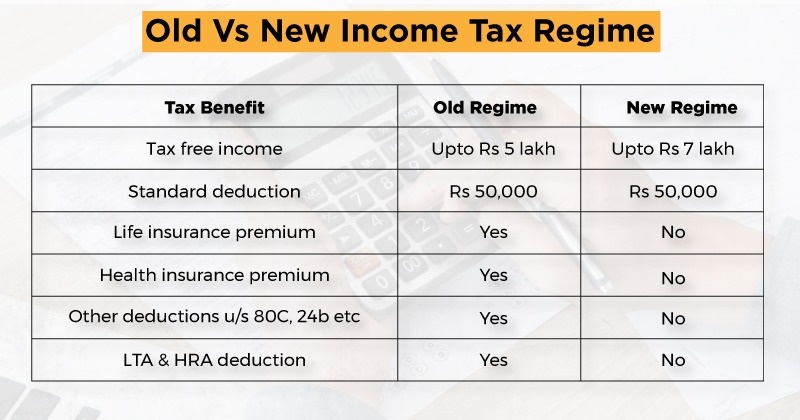

Yes Standard deduction of Rs 50 000 or the amount of salary whichever is lower is available for both old and new tax regimes from AY 2024 25 onwards 6 In the new tax regime can I claim deductions under chapter VIA like section 80C 80D 80DD 80G etc while filing the ITR for AY 2024 25 Here s a list of the main exemptions and deductions that taxpayers will have to forgo if they opt for the new regime The new income tax regime became effective from April 1 2020 Salaried taxpayers were allowed to select between the new and old tax regime in every financial year

Is There Any Deduction In New Tax Regime

Is There Any Deduction In New Tax Regime

https://im.indiatimes.in/content/2023/Feb/Old-Vs-New-Tax-Regime-Which-One-To-Pick-After-Budget-2023_63db747264d86.jpg

New Tax Regime Exemption And Deduction 2023 List After Budget 2023

https://i.ytimg.com/vi/hGWvrWSxX0E/maxresdefault.jpg

Do You Know When Old And New Tax Regimes Give The Same Tax Liability

https://akm-img-a-in.tosshub.com/businesstoday/styles/medium_crop_simple/public/images/story/202302/break-even-point-for-old-and-new-tax-regime-.jpg?itok=h3-wLBy8

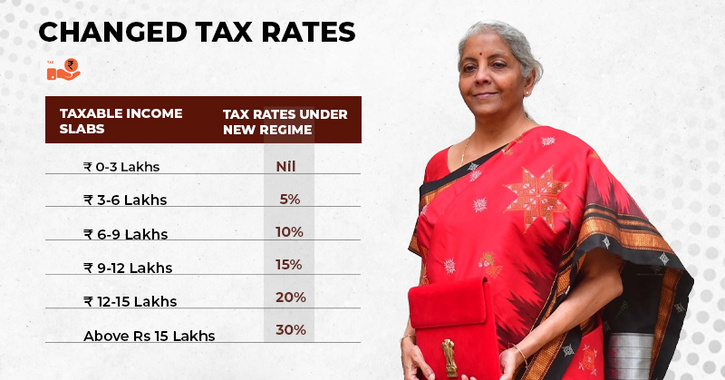

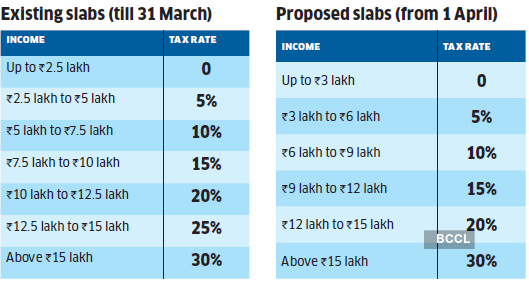

Budget 2024 has increased the standard deduction under the new tax regime to 75 000 The family pension deduction has also been increased from 15 000 to 25 000 With the revised tax structure the taxpayer will save 17 500 Let s look at both regimes and see which regime to opt for in 2024 The Budget 2020 introduces a new regime under Section 115BAC giving individuals and HUF taxpayers an option to pay income tax at lower rates with fewer exemptions and deductions to claim Keep reading to learn more about Section 115BAC of the Income tax Act 1961

What deductions are still not allowed in the revised new tax regime effective April 2023 Under the revised new tax regime the individual will forego 70 deductions and tax exemptions which includes HRA tax exemption LTA tax exemption deduction up to Rs 1 5 lakh under Section 80C Budget 2023 proposes to make the following deductions available to eligible individuals under the new tax regime from April 1 2023 ii Deduction under Section 80CCD 2 for employer s contribution to employee s National Pension System NPS account iii Deduction for contribution made to Agniveer Corpus Fund

Download Is There Any Deduction In New Tax Regime

More picture related to Is There Any Deduction In New Tax Regime

Standard Deduction Benefit In New Tax Regime shortsfeed CommerceWale

https://i.ytimg.com/vi/JIzmnaXwlHk/maxresdefault.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ac4FgAKACooCDAgAEAEYICBlKB8wDw==&rs=AOn4CLA0Ld8GTjEyILJflbbVFoU7KZEHAQ

Section 80C Deductions List Save Income Tax With Section 80C Options

https://i.ytimg.com/vi/6nlYwNEIo48/maxresdefault.jpg

NOT ALLOWED Deductions In New Tax Regime Is Deduction Allowed In New

https://i.ytimg.com/vi/xGksEn4t4rI/maxresdefault.jpg

Is there any deduction in the new tax regime And the answer to both questions is yes There are a few new tax regime deduction options that help you save taxes in the new tax regime so let s look at them What does deduction mean in the new tax regime A standard deduction implies a flat rebate from taxpayers gross salary Taxpayers do not need to apply through a form to claim the deduction

Finance Minister Nirmala Sitharaman announced changes to the new income tax regime during the Union Budget 2024 presentation providing some relief to taxpayers The standard deduction limit has been increased from Rs 50 000 to Rs 75 000 and the tax slabs have been revised The new tax regime provides a lower tax rate but removes several deductions that are otherwise available under the old tax regime Here s what is permitted and what is not

ITR 1 Key Differences Between The Old And New Tax Regime

https://www.indiafilings.com/learn/wp-content/uploads/2023/07/ITR-1-Key-Differences-between-the-Old-and-New-Tax-Regime-2.jpg

New Tax Regime Vs Old Tax Regime Which Is Better Yadn Vrogue co

https://rupiko.in/wp-content/uploads/2020/08/New-vs-Old-Tax-Regime-1.png

https://cleartax.in/s/new-tax-regime-frequently-asked-questions

Budget 2024 has increased the standard deduction limit under the new tax regime from 50 000 to 75 000 for the AY 2025 26 FY 2024 25 However taxpayer has to keep in mind that for the AY 2024 25 standard deduction

https://www.incometax.gov.in/iec/foportal/sites...

Yes Standard deduction of Rs 50 000 or the amount of salary whichever is lower is available for both old and new tax regimes from AY 2024 25 onwards 6 In the new tax regime can I claim deductions under chapter VIA like section 80C 80D 80DD 80G etc while filing the ITR for AY 2024 25

10 FAQs About The New Income Tax Regime s Changes Effective From FY 2023 24

ITR 1 Key Differences Between The Old And New Tax Regime

Budget 2023 New Income Tax Slabs How To Calculate Your Tax Hindustan

Standard Deduction In New Tax Regime EXPLAINED FinCalC Blog

Old Vs New Tax Regime Which Is Better New Or Old Tax Regime For

Highlights Of Changes Proposed In The New Tax Regime Section 115BAC

Highlights Of Changes Proposed In The New Tax Regime Section 115BAC

The New Tax Regime Offers A Higher Tax Exemption Raises The Threshold

Old Versus New Regime Thousands Use Tax Department s Calculator To

7 0 What Is Standard Deduction In New Tax

Is There Any Deduction In New Tax Regime - Budget 2024 has increased the standard deduction under the new tax regime to 75 000 The family pension deduction has also been increased from 15 000 to 25 000 With the revised tax structure the taxpayer will save 17 500 Let s look at both regimes and see which regime to opt for in 2024