Is There Any Employer Contribution In Nps The eligibility criteria for employees to receive NPS scheme employer contribution under the National Pension System NPS are as follows Employee Type Both salaried and self

Employer s contribution towards NPS of an employee is eligible for a tax deduction of up to 10 of salary i e basic plus DA or 14 of salary if such As per the PFRDA the government sector employees automatically receive the NPS Contribution from the employer either the state government or

Is There Any Employer Contribution In Nps

Is There Any Employer Contribution In Nps

https://www.businessleague.in/wp-content/uploads/2020/12/What-is-National-Pension-Scheme-NPS-Advantages-Tax-Benefits-More-cover-747x420.jpg

Whether Deduction On Employer s Contribution In NPS Can Be Claimed

https://i.ytimg.com/vi/NxDRI4DRr5I/maxresdefault.jpg

How Is The Employer s Contribution To EPF NPS Over 7 5 Lakh

https://certicom.in/wp-content/uploads/2020/09/Employee-Provident-Fund.png

Employees contributing to NPS are eligible for following tax benefits on their own contribution Tax deduction up to 10 of salary Basic DA under section 80 CCD 1 How is employer s contribution to NPS treated in income tax calculation of salaried employee Is it deductible within the overall limit of Rs 1 50 lakhs under

With your employer s contribution to NPS you get an additional retirement savings boost while minimising your tax liability By taking advantage of employer The employer contribution to NPS is eligible for additional tax benefit under Section 80CCD 2 And there is no absolute cap on the tax benefit you can get for the

Download Is There Any Employer Contribution In Nps

More picture related to Is There Any Employer Contribution In Nps

Record Employer s PF Contribution Payroll

https://help.tallysolutions.com/docs/te9rel65/Payroll/Images1/045_pf_process_-3.gif

Creating NPS Contribution Pay Head For Employers Payroll

https://help.tallysolutions.com/docs/te9rel63/Payroll/Images1/5_NPS_Employer_contribution.gif

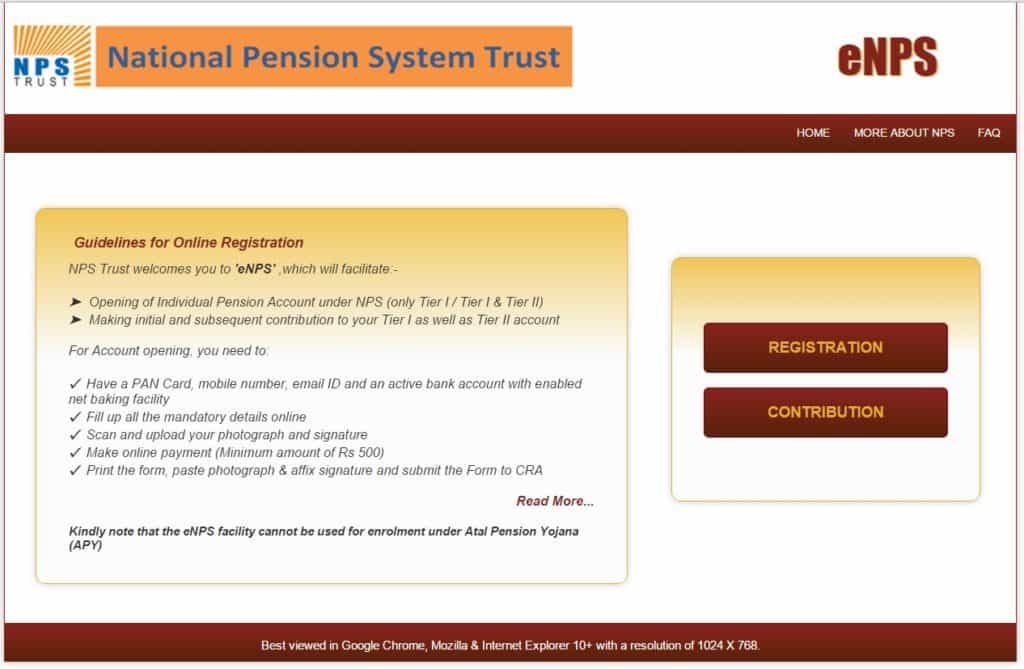

How To Make Online Contributions To NPS Tier I And Tier II Accounts

https://freefincal.com/wp-content/uploads/2015/12/Online-contribution-NPS.jpg

Employer s Contribution Tax benefits can also be claimed if the contribution has been made by the employer into your NPS account This tax exemption is available To become a subscriber of NPS you are required to pay nominal charges as part of the onboarding process There is a clear break up of the charges that you need to pay and

Employer s contributions to NPS qualify for tax benefits under Section 80CCD 2 For Private Sector Employees the deduction for employer contribution is As per the announcement made in Budget 2020 if an employer s total contribution to the EPF NPS and superannuation fund exceeds Rs 7 5 lakh in an FY

Sss Contribution Schedule 2021 Sss Inquiries CLOUD HOT GIRL

https://mattscradle.com/wp-content/uploads/2015/07/sss-contribution-table-effective-2021-for-self-employed-members.jpg

Deduction Under Section 80CCD 2 For Employer s Contribution To

https://img.etimg.com/thumb/msid-97694570,width-640,resizemode-4,imgsize-406338/deduction-under-section-80ccd-2-for-employers-contribution-to-employees-national-pension-system-nps-account.jpg

https://www.kotak.com/en/stories-in-focus/national...

The eligibility criteria for employees to receive NPS scheme employer contribution under the National Pension System NPS are as follows Employee Type Both salaried and self

https://cleartax.in/s/nps-national-pension-scheme

Employer s contribution towards NPS of an employee is eligible for a tax deduction of up to 10 of salary i e basic plus DA or 14 of salary if such

Steps To Voluntary Contribution In NPS News 1

Sss Contribution Schedule 2021 Sss Inquiries CLOUD HOT GIRL

NPS Contribution Latest Income Tax Rules Explained In 10 Points

How To View And Download NPS Statements

What Are The Investment Options Available Under NPS What Happens If

Govt Notifies NPS Tier II Tax Deduction For Central Govt Employees Mint

Govt Notifies NPS Tier II Tax Deduction For Central Govt Employees Mint

NPS 14 Major Change In

Employer EPF Contribution Limit How Much Does Your Employer Contribute

NPS Contribution Online And Offline Procedure And Charges Scripbox

Is There Any Employer Contribution In Nps - Employees contributing to NPS are eligible for following tax benefits on their own contribution Tax deduction up to 10 of salary Basic DA under section 80 CCD 1