Is There Sales Tax In Costa Rica VAT is the consumption tax throughout Costa Rica levied on almost everything sold in the country There are specific rules around digital products which you must follow closely to stay tax compliant

Costa Rica has a national Value added tax VAT of 13 as of 2024 administered by the Ministry of Finance Visit this page for an executive summary of Costa Rica s tax structure and rates by SalesTaxHandbook The Sales Tax Rate in Costa Rica stands at 13 percent Sales Tax Rate in Costa Rica averaged 12 79 percent from 2006 until 2024 reaching an all time high of 13 00 percent in 2007 and a record low of 9 00 percent in 2021

Is There Sales Tax In Costa Rica

Is There Sales Tax In Costa Rica

https://www.centralamericalink.com/storage/images/2017/02/07/201507310941090.conciertos.jpg

Kentucky Sales Tax Increase Includes Utilities Exemption Form

https://dehayf5mhw1h7.cloudfront.net/wp-content/uploads/sites/1180/2022/12/13173528/ky-dept-of-revenue-1024x1024.png

States Without Sales Tax Sales Tax Data Link

https://www.salestaxdatalink.com/wp-content/uploads/2023/03/AdobeStock_223751615.jpeg

Capital gains tax in Costa Rica applies to the profit made from the sale of certain assets such as real estate or stocks The rate is generally 15 of the profit However if the asset was held for more than a year it might qualify for a lower tax rate or even an exemption The value added tax is levied on the sale of goods on the provision of services and on the consumption in national territory of digital services or intangible goods from abroad regardless of the means by which they are provided carried out in Costa Rica

What are Costa Rica s taxes and fees March 28 2023 Sarah Mayo There is a 13 sales tax at restaurants and retail stores and an additional 10 service tax is added to meals as a tip for the staff For one there s the original 13 sales tax which companies previously charged for some services before the new VAT tax was established Then there s the new 13 VAT tax described in our article above which applies to previously untaxed tourism services such as tours

Download Is There Sales Tax In Costa Rica

More picture related to Is There Sales Tax In Costa Rica

Sales Tax By State How To Discount Your Sales Tax Bill TaxJar

https://www.taxjar.com/wp-content/uploads/Calculations-calculators-100-1.jpg

WEIGHING YOUR OPTIONS HOW TO MANAGE SALES TAX COMPLIANCE

https://www.taxconnex.com/hubfs/AdobeStock_111137818.jpeg#keepProtocol

TaxConnex Releases New Research That Reveals Top Concerns Among

https://www.taxconnex.com/hubfs/Screen Shot 2020-12-02 at 4.13.33 PM.png#keepProtocol

The VAT Law VATL came into force in Costa Rica on 1 July 2019 amending the prior Sales Tax Law Relevant changes all services will be taxable the concept of goods includes all transfers of tangible assets fixed assets or inventories and intangible assets software payment of royalties etc which are also deemed as a service and taxable Sales tax in Costa Rica Sales tax the equivalent to VAT stands at 13 and is levied both at the point of importation and at the point of sale unless the sale is by way of export It is levied on all goods with the exception of foodstuffs medicinal products and certain other items

The standard Value Added Tax Impuesto al Valor Agregado IVA rate in Costa Rica is 13 with some services exempt from Costa Rica VAT such as education services residential electricity and water supply and terrestrial transportation services Costa Rica has long had a sales tax of 13 on all receipts for goods However the VAT now applies for all services rendered in the country Every legal service has a VAT tax

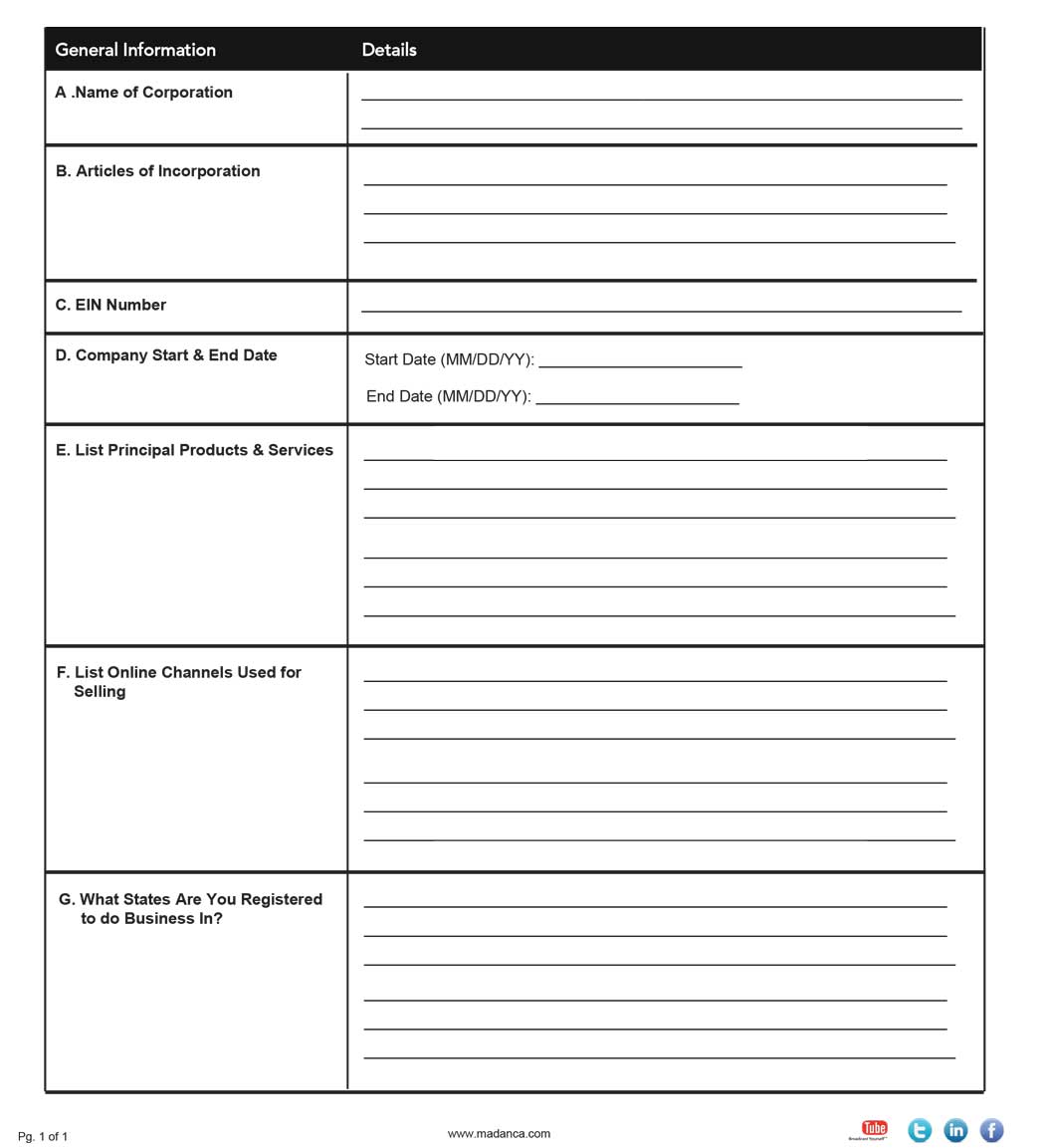

Sales Tax In UK The Government Collects Tax From Businesses That Make

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/30085a067af531c7e6ec9217bebe77f0/thumb_1200_1553.png

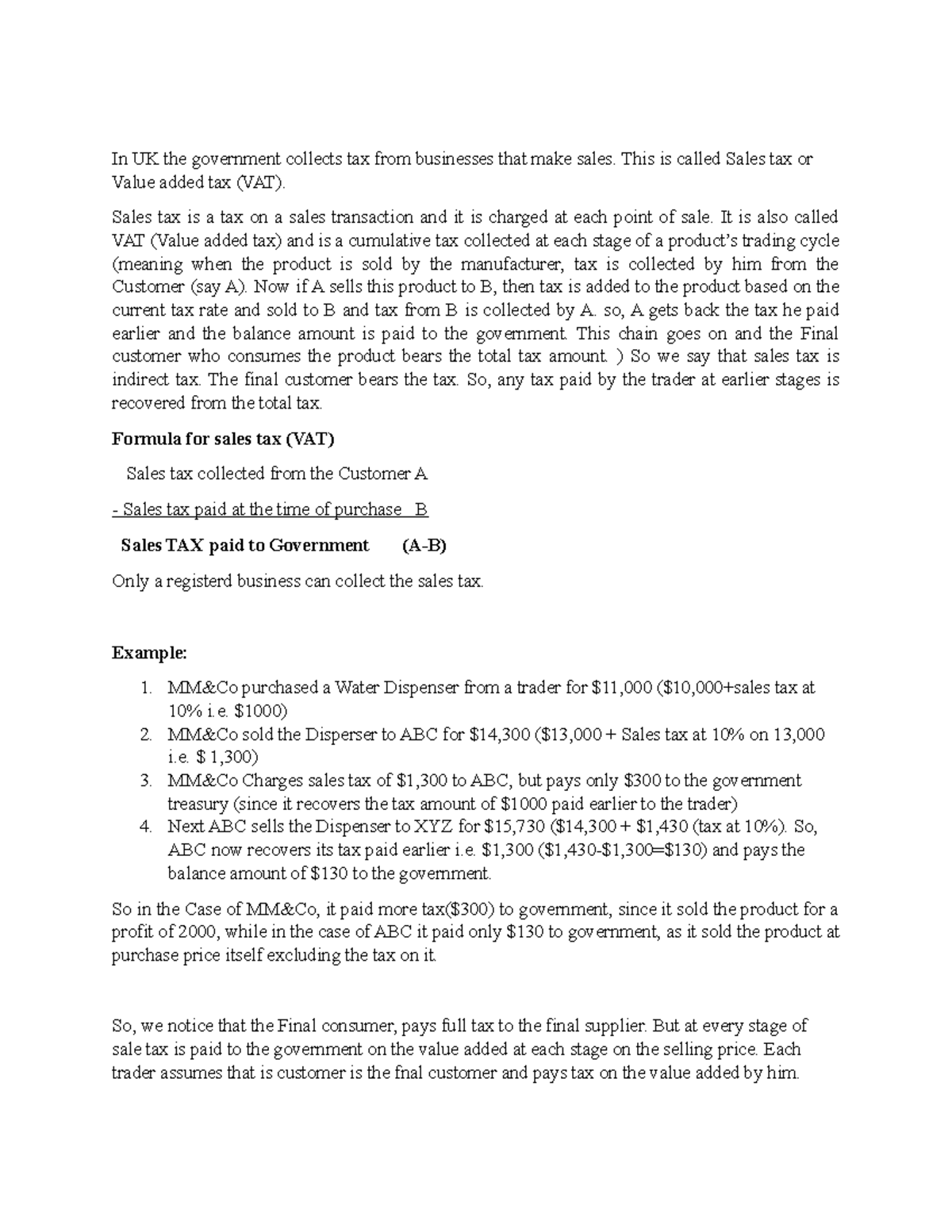

US Sales Tax Checklist Madan CA

https://madanca.com/wp-content/themes/camadan/images/documents/us-sales-tax-checklist.jpg

https://quaderno.io/guides/costa-rica-vat-guide

VAT is the consumption tax throughout Costa Rica levied on almost everything sold in the country There are specific rules around digital products which you must follow closely to stay tax compliant

https://world.salestaxhandbook.com/cr-costa-rica

Costa Rica has a national Value added tax VAT of 13 as of 2024 administered by the Ministry of Finance Visit this page for an executive summary of Costa Rica s tax structure and rates by SalesTaxHandbook

The Chance To Opt Out Of The New Car And Property Tax In Costa Rica

Sales Tax In UK The Government Collects Tax From Businesses That Make

SaaS Sales Tax For The US In 2020 A Complete Breakdown

5 States With No Sales Tax Kiplinger

New York Sales Tax Exemptions Agile Consulting Group

Income Tax In Costa Rica RelocationCostarica

Income Tax In Costa Rica RelocationCostarica

VAT Vs Sales Tax What s The Difference With Table Diffzy Sales

Costa Rica Property Tax How To Avoid Fines On Vacation Homes

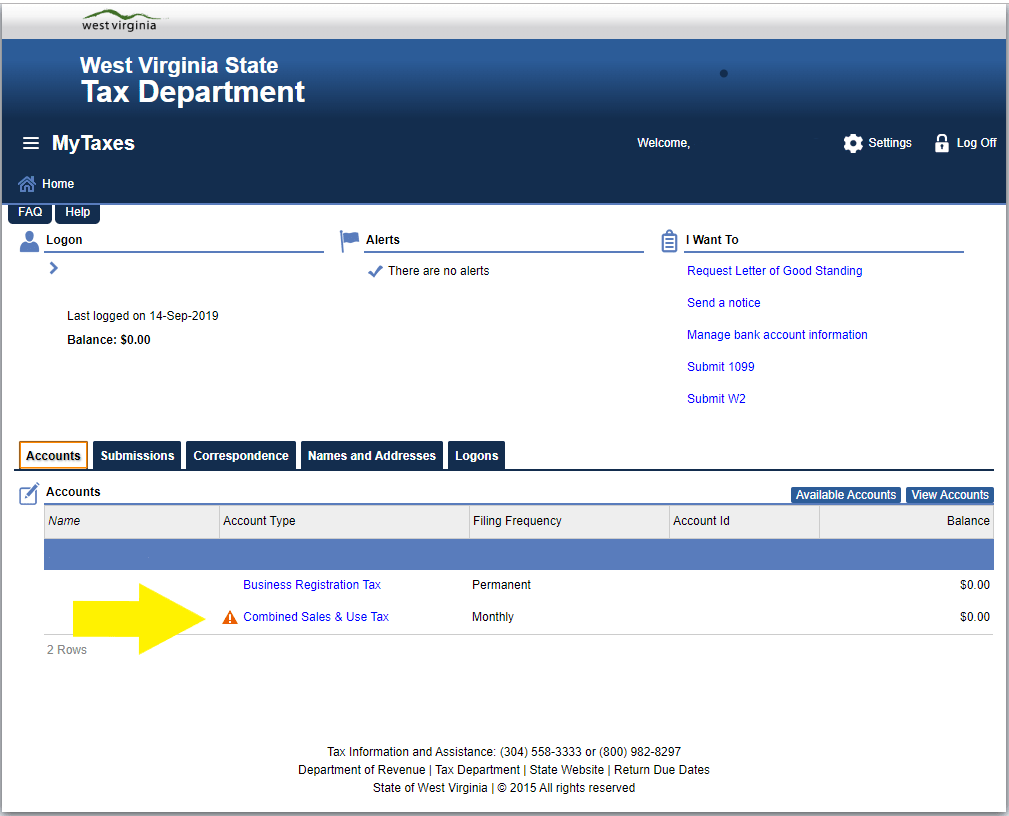

How To File And Pay Sales Tax In West Virginia TaxValet

Is There Sales Tax In Costa Rica - Capital gains tax in Costa Rica applies to the profit made from the sale of certain assets such as real estate or stocks The rate is generally 15 of the profit However if the asset was held for more than a year it might qualify for a lower tax rate or even an exemption