Is There Tax On Insurance Premiums In the case of fire insurance the tax on insurance premiums would amount to 2 472 euros 10 000 3 x 10 000 x 24 If the policyholder is liable to pay the tax on insurance premiums the policyholder must calculate the tax on the basis of the insurance premiums that it has paid during the month

Insurance Premium Tax IPT is not VAT but you might think of it as VAT for insurance It s a tax that s applied to insurance premiums received under taxable insurance contracts It s applied at two rates A standard rate of 12 and a higher rate of 20 for insurance supplied with selected goods and services However for specific risks parafiscal charges can be added which slightly increases the amount of tax due Mixed taxation of insurance premiums The last trend consists of territories that have opted for taxation based on the types of risk covered This applies to France where IPT rates range from 7 to 30 and Italy where IPT rates

Is There Tax On Insurance Premiums

Is There Tax On Insurance Premiums

http://static1.squarespace.com/static/623b48a3293e2847ebe155cc/625e95a79c5ec522c5f3c38d/628632b30484eb3b330be95b/1654612213254/are-health-insurance-premiums-tax-deductible.png?format=1500w

Tax On Insurance Premiums II Tax On Insurance Payout In Hindi shorts

https://i.ytimg.com/vi/Nkr8bu0fHsc/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AbYIgAKAD4oCDAgAEAEYKyBeKGUwDw==&rs=AOn4CLBlyihceXRw_gXKjJXwQdJgX5tMBg

/171106288_Aslan-Alphan_E-_GettyImages-56a6361f3df78cf7728bd97e.jpg)

Are Health Insurance Premiums Tax Deductible

https://www.investopedia.com/thmb/MlLHZTpP13VHUZz-t-fGGQ9EC7c=/2122x1415/filters:fill(auto,1)/171106288_Aslan-Alphan_E-_GettyImages-56a6361f3df78cf7728bd97e.jpg

Is Health Insurance Tax Deductible Health insurance costs may be tax deductible but it depends on how much you spent on medical care for the year and whether you re self employed The You cannot deduct life insurance premiums from your income taxes If your employer pays for a life insurance the premium paid on policy amounts above 50 000 is considered part of your

If you pay for health insurance premiums pre tax you cannot deduct the cost on your tax return However if you pay for premiums after taxes are taken out of your paycheck you might qualify for the medical expense deduction Just be aware that the hurdle for qualifying for the medical expense deduction is high You can only deduct There is an exception made to the 7 5 rule for individuals who run their businesses Are Health Insurance Premiums Tax Deductible For the 2022 and 2023 tax years you re allowed to deduct

Download Is There Tax On Insurance Premiums

More picture related to Is There Tax On Insurance Premiums

Is There A Tax On Car Insurance In Ontario Surex

https://cdn-brochure.surex.com/cdn-brochure-prod/cdn-files/2022-02/tax-time-reminder_0.jpg?VersionId=mhrrkGp0zMjqIJWlzUMB0EvwXmcN0GHc

Karvy Private Wealth Plan Your Taxes The Smart Way

http://1.bp.blogspot.com/-WmHjzoGbgKc/T3G_NRcrlWI/AAAAAAAABuw/OsvcVGMarrc/s1600/tax.jpg

Spending On Health Care In Oregon Soars 40 In Eight Years Report Says

https://oregoncapitalchronicle.com/wp-content/uploads/2023/08/money-cash-getty-2048x1402.jpg

If you would like to check whether you can deduct your medical expenses the IRS offers an Here are five medical expenses the that the agency allows to deduct Qualifying taxpayers can deduct the monthly that they pay for insurance coverage These include expenses to HMOs long term care insurance and Medicaid payments But there is a floor Medical expenses are deductible only to the extent the total exceeds 7 5 of your adjusted gross income AGI For example if you itemize your AGI is 100 000 and your

Generally Medicare premiums can be tax deductible if you itemize your deductions and have qualifying medical expenses that exceed 7 5 of your adjusted gross income If you re self employed you might be able to deduct premiums for Medicare or other eligible health insurance from your income without having to itemize or meet the What is Insurance Premium Tax Insurance Premium Tax IPT is a tax on general insurance premiums including car insurance home insurance and pet insurance There are two rates of IPT a standard rate of 12 and a higher rate of 20 which applies to travel insurance electrical appliance insurance and some vehicle

Save On Insurance Premiums 13 Actionable Strategies Car Insurance

https://i.pinimg.com/originals/4d/79/dc/4d79dc6e61ddf0c819abc2612ca86051.jpg

Sales Tax By State Here s How Much You re Really Paying Sales Tax

https://i.pinimg.com/originals/f6/99/3f/f6993f73fae9c87213464fd9ef538b8f.jpg

https://www.vero.fi/en/detailed-guidance/guidance/...

In the case of fire insurance the tax on insurance premiums would amount to 2 472 euros 10 000 3 x 10 000 x 24 If the policyholder is liable to pay the tax on insurance premiums the policyholder must calculate the tax on the basis of the insurance premiums that it has paid during the month

https://blog.tapoly.com/vat-on-insurance

Insurance Premium Tax IPT is not VAT but you might think of it as VAT for insurance It s a tax that s applied to insurance premiums received under taxable insurance contracts It s applied at two rates A standard rate of 12 and a higher rate of 20 for insurance supplied with selected goods and services

Tax Burdens 7 States With The Highest Income Tax

Save On Insurance Premiums 13 Actionable Strategies Car Insurance

:max_bytes(150000):strip_icc()/homeowners-insurance-guide_final-88e7d3469dcc4920977498f08564b234.png)

Compare House Insurance Premiums What Is The Difference Business Blog

Top 1 Pay Nearly Half Of Federal Income Taxes

What Determines My Insurance Premiums

SG Young Investment How To Pay Lesser For Insurance Premiums While

SG Young Investment How To Pay Lesser For Insurance Premiums While

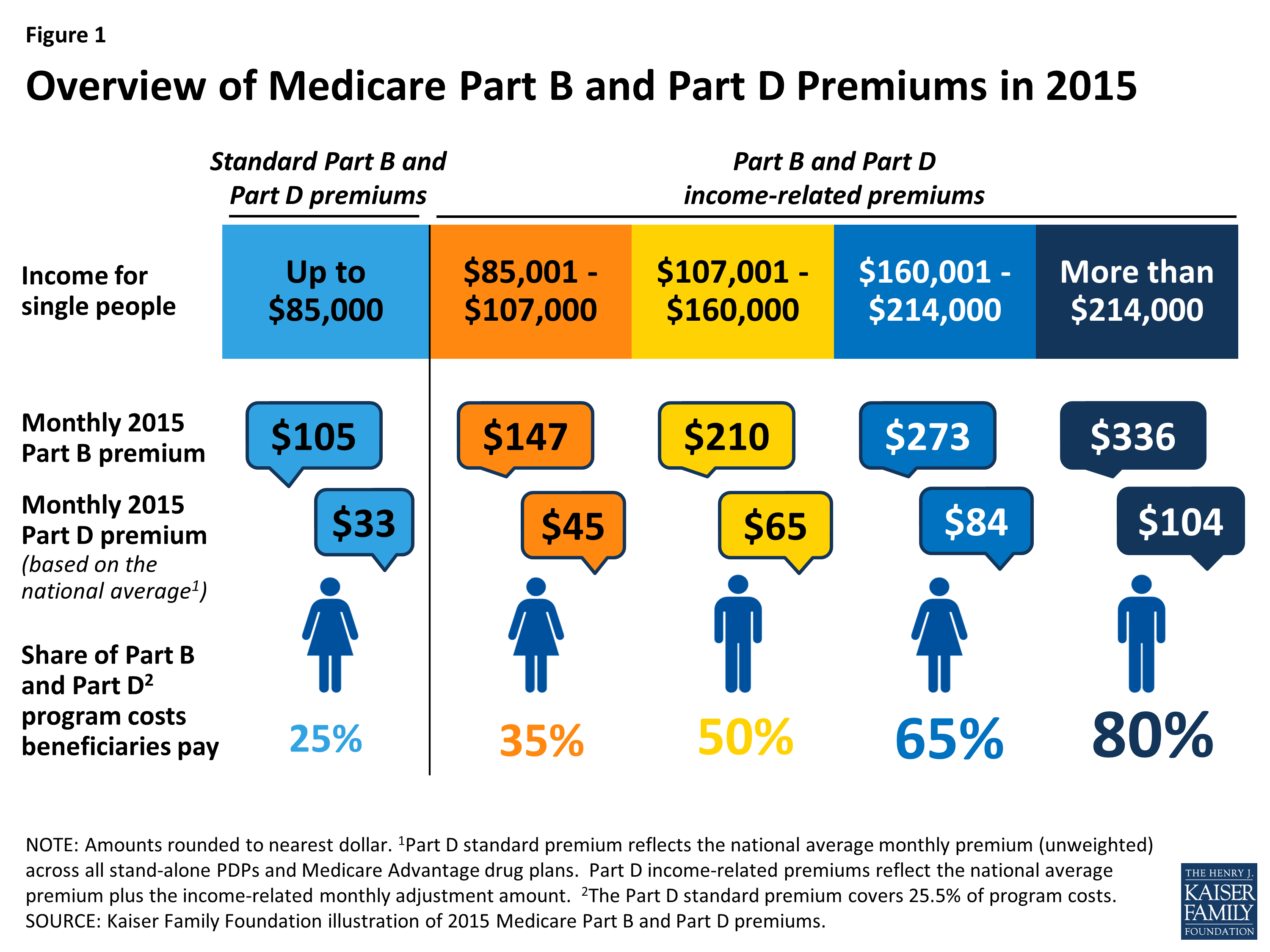

Medicare s Income Related Premiums A Data Note KFF

Insurance Premium Free Of Charge Creative Commons Green Highway Sign

The Tax Consequences Of Whole Life Insurance Nasdaq

Is There Tax On Insurance Premiums - The bottom line If you qualify the deduction for self employed health insurance premiums is a valuable tax break With the rising cost of health insurance a tax deduction can help you pay at least a portion of the premium cost And that will help to keep you healthy and happy in 2023 and beyond Let a local tax expert matched to