Is Transport Allowance Exempt From Income Tax In the 2021 tax year my client received a non taxable reimbursed travel allowance under code 3703 resulting in a nice refund However for the 2022 tax year the payroll person changed the code to 3702 making it a taxable allowance which has impacted the client negatively

Normal tax is levied on taxable income of companies trusts and individuals from sources within or deemed to be within Namibia Individual Income Tax All individuals incl deceased estates and trusts other than companies Employees fringe benefits Fringe benefits are taxable Transport Allowance is covered by section 10 14 ii of the Income Tax Act It is the tax exempt to the extent of the amount notified by the Income Tax Department Actual expenditure is not required in order to claim the tax exemption Conveyance Allowance is covered by section 10 14 i of the Income Tax Act

Is Transport Allowance Exempt From Income Tax

Is Transport Allowance Exempt From Income Tax

https://s3.studylib.net/store/data/008745489_1-48b7bcba1320697857246c3686c37f93-768x994.png

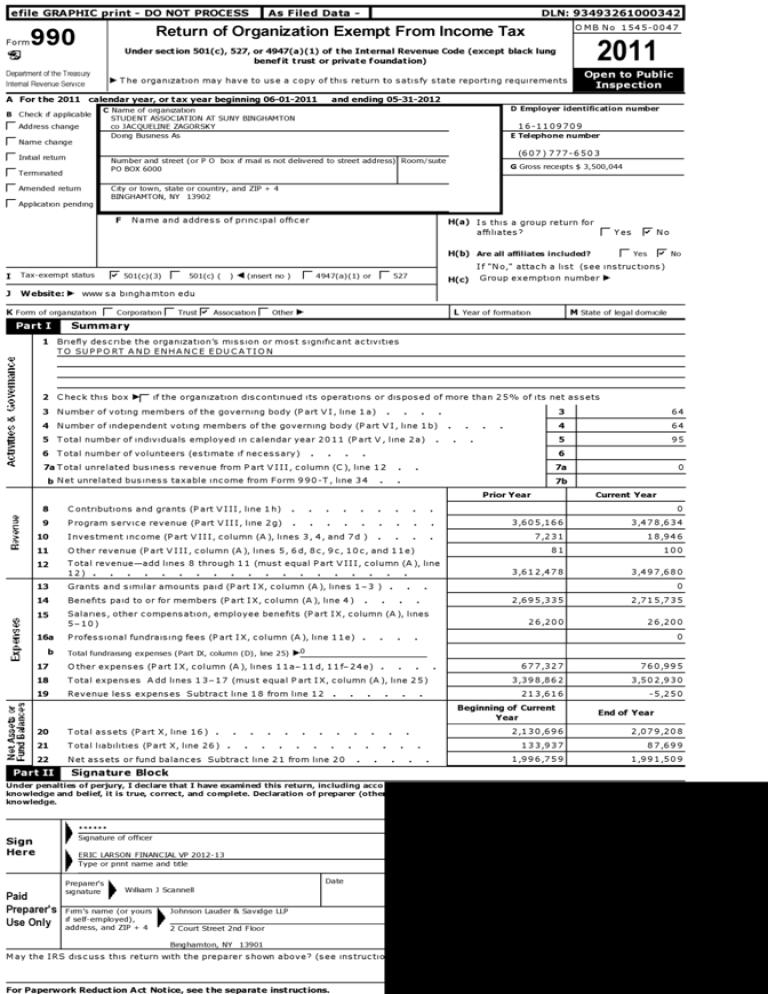

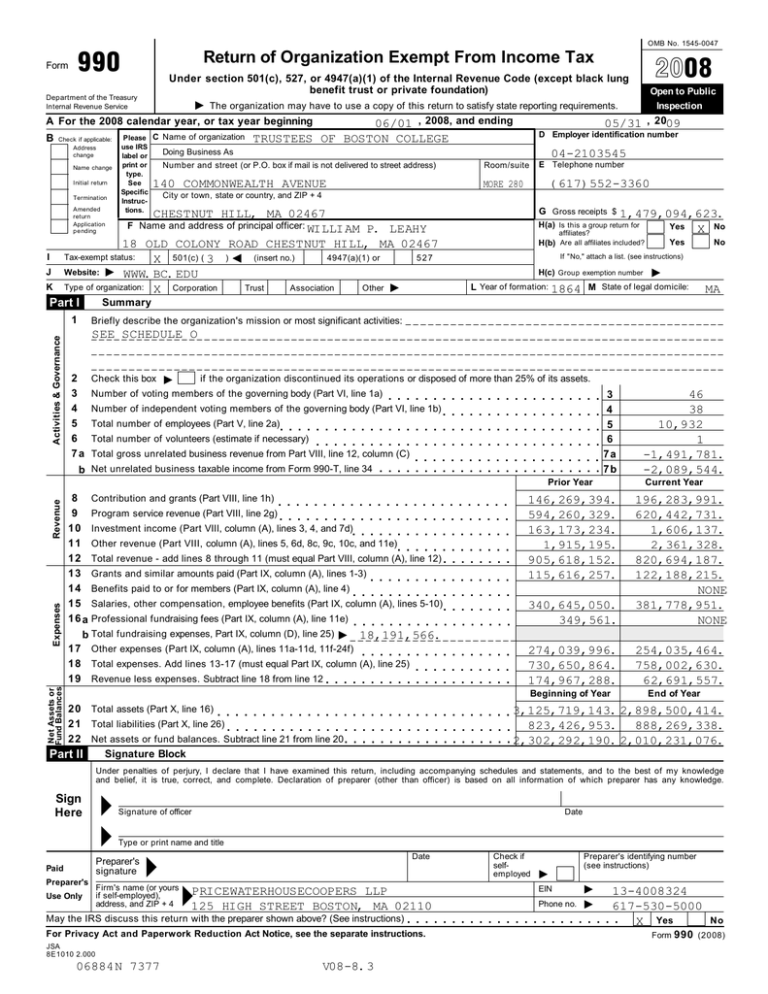

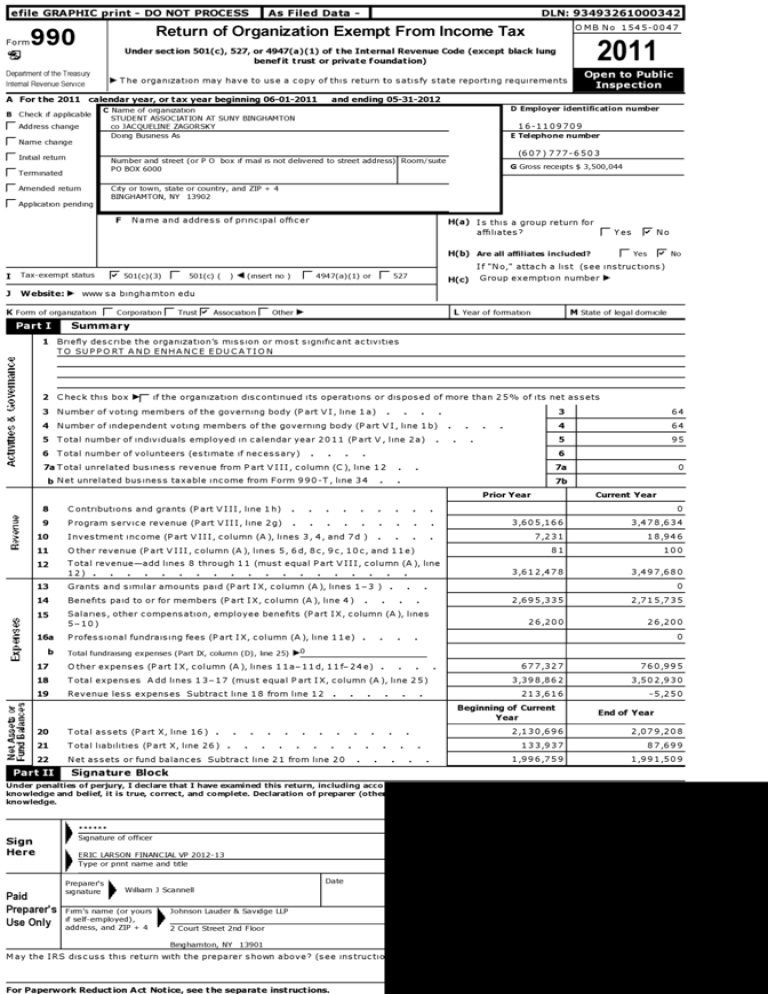

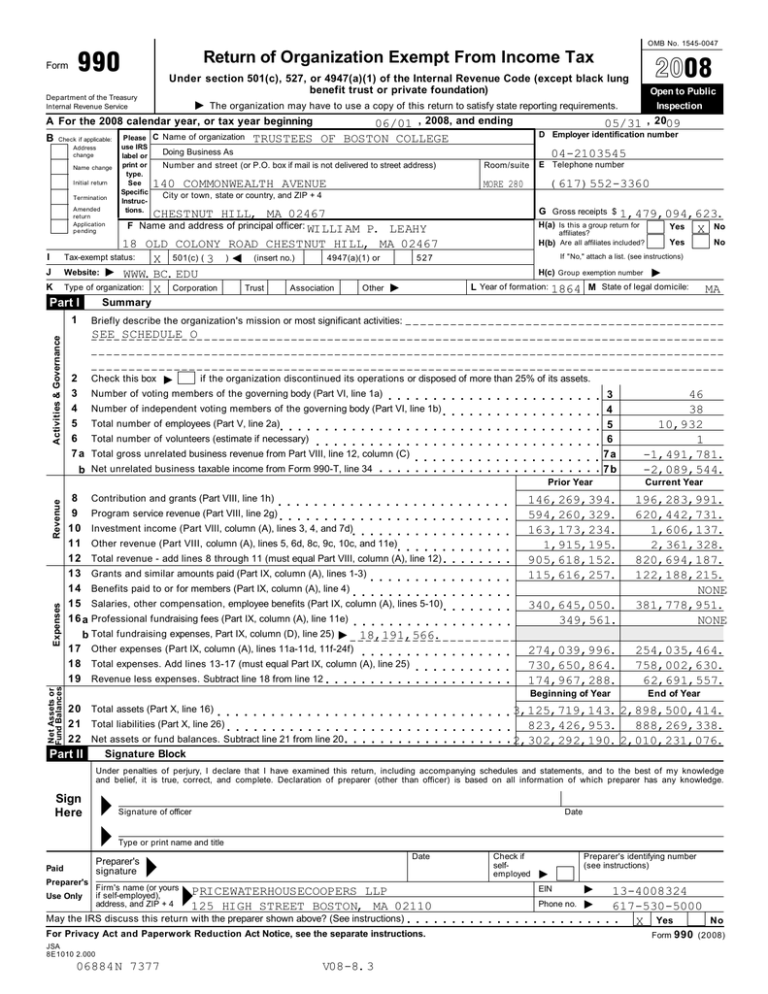

Return Of Organization Exempt From Income Tax

https://s2.studylib.net/store/data/011162563_1-682d946a30ca6322d9d33ebd26b9794a-768x994.png

Sample Letter Tax Exemption Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/497/332/497332566/large.png

Where an allowance or advance is based on the actual distance travelled by the employee for business purposes employees tax will not be withheld on the allowance paid by an employer to an employee if the rate does not exceed 398 previously 361 cents per kilometre regardless of the value of the vehicle You are only able to claim travel expenses as a tax deduction if you travelled for business related reasons AND kept a valid logbook AND you fit into one of these categories You received a travel allowance source code 3701 or 3702 on your IRP5 or You have a company provided vehicle source code 3802 or 3816 on your IRP5 or

If an employer withheld employees tax on only 20 of an employee s travel allowance and circumstances change such that the employer realizes that the employee will no longer use the vehicle at least 80 for business purposes during the year of assessment from the month in which the circumstances change employees tax must The Income Tax Act does not define what is regarded as travel for business purposes and what constitutes private use of a travel allowance The travel between home and work exclusion has caused interpretation problems for as long as can be remembered

Download Is Transport Allowance Exempt From Income Tax

More picture related to Is Transport Allowance Exempt From Income Tax

Georgia Sales Tax Exemption Form St 5 ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/fillable-form-st-5-sales-and-use-tax-certificate-of-exemption-georgia-10.png

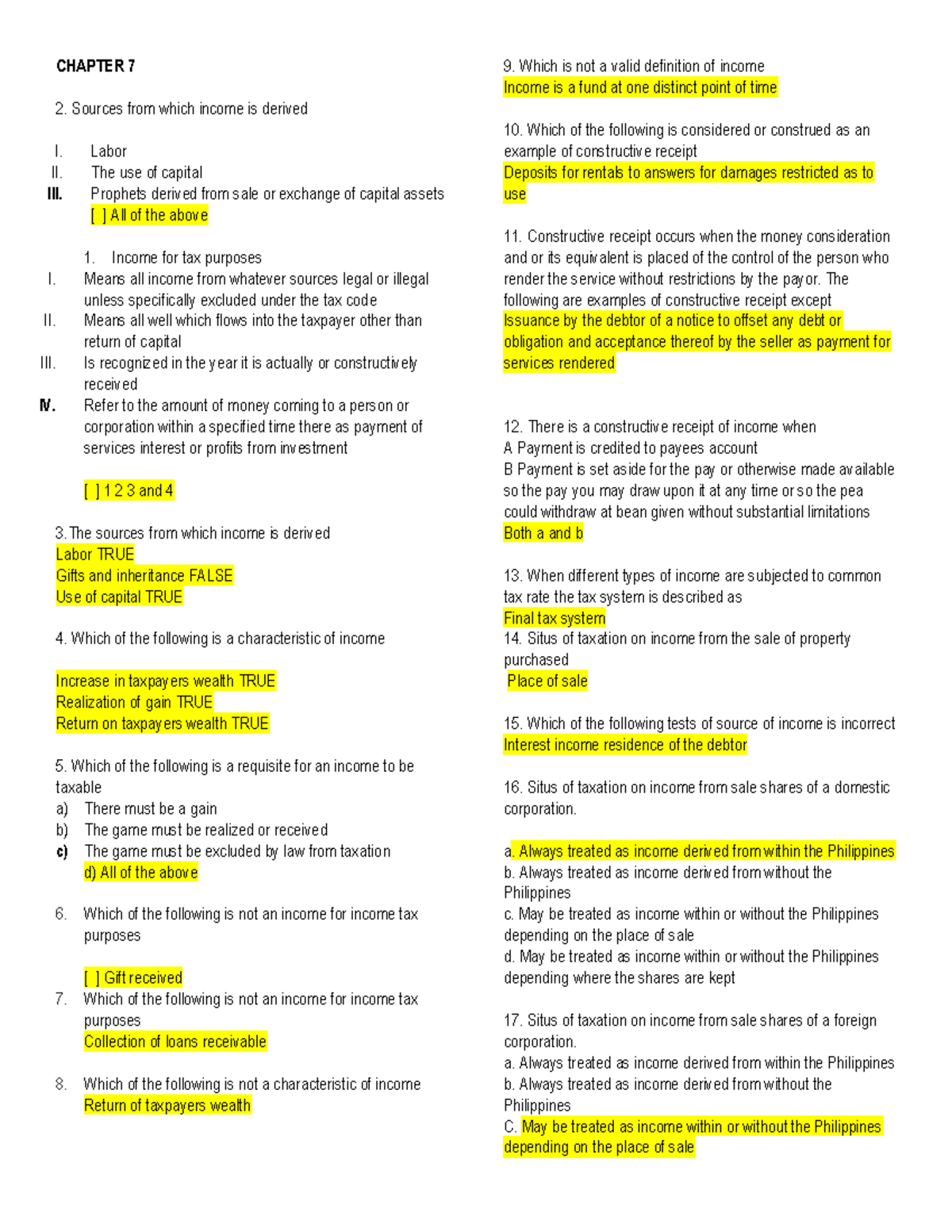

7 8 INCOME TAXATION CHAPTER 7 8 SOLMAN WITH QUESTIONS CHAPTER 7

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/6e5684456052e320dbda610ce45da4f2/thumb_1200_1553.png

Return Of Organization Exempt From Income Tax The Nature Fill

https://www.pdffiller.com/preview/576/271/576271342/big.png

As per the income tax act the conveyance allowance exemption is allowed to an employee to the extent of expenditure actually incurred for official purposes Because of such exemption conditions companies usually provide this allowance on a reimbursement basis The travel allowance deduction operates on the premise that an allowance is included in a person s taxable income see section 8 1 a i of the Income Tax Act to the extent that

[desc-10] [desc-11]

Money Received From Relatives Is Exempt From Income Tax

https://cdn.dnaindia.com/sites/default/files/styles/full/public/2019/06/25/840973-itr-filing-istock-052219.jpg

Image Of 2020 IRS Form 1040 With Line 2a Highlighted

https://studentaid.gov/sites/default/files/2020-tax-exempt-interest-income.PNG

https://taxfaculty.ac.za/news/read/faq-what-is-the...

In the 2021 tax year my client received a non taxable reimbursed travel allowance under code 3703 resulting in a nice refund However for the 2022 tax year the payroll person changed the code to 3702 making it a taxable allowance which has impacted the client negatively

https://www.pwc.com/na/en/assets/pdf/namibia-tax...

Normal tax is levied on taxable income of companies trusts and individuals from sources within or deemed to be within Namibia Individual Income Tax All individuals incl deceased estates and trusts other than companies Employees fringe benefits Fringe benefits are taxable

6 Things You Need To Know About Your Non profit s Tax Exempt Status

Money Received From Relatives Is Exempt From Income Tax

State Tax Exemption Map National Utility Solutions

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

How To Claim Income Tax Exemption On Conveyance Allowance

Section 10 Of Income Tax Act Deductions And Allowances

Section 10 Of Income Tax Act Deductions And Allowances

All About Allowances Income Tax Exemption CA Rajput Jain

TRANSPORT ALLOWANCE EXEMPTION LIMIT INCREASED BY CBDT SIMPLE TAX INDIA

Tax Exemptions For Property Managers Landlords First Light Property

Is Transport Allowance Exempt From Income Tax - The Income Tax Act does not define what is regarded as travel for business purposes and what constitutes private use of a travel allowance The travel between home and work exclusion has caused interpretation problems for as long as can be remembered