Is Tuition Reimbursement Taxable In Nj The following items of income are not subject to New Jersey tax However if you file a resident return you must report the total amount of nontaxable interest on the Tax

New Jersey law provides several gross income tax deductions that can be taken on the New Jersey Income Tax return New Jersey does not allow federal deductions such as New Jersey offers a higher education tuition deduction that can significantly ease the financial burden for families and students This tax benefit is particularly important given the

Is Tuition Reimbursement Taxable In Nj

Is Tuition Reimbursement Taxable In Nj

https://apprisewealth.com/wp-content/uploads/2021/08/6078d22e880cc80157173540_Provisional-Income-Table.png

Is Tuition Reimbursement Taxable A Guide ClearDegree

https://www.cleardegree.com/wp-content/uploads/2020/04/CD-BLog-Image-4-3-1478x1080.jpg

Tuition Reimbursement How Do Employers Benefit From It

https://blog.kbibenefits.com/hs-fs/hubfs/tuition-reimbursement.jpg?width=1350&name=tuition-reimbursement.jpg

Benefits are subject to change as are regulations governing the taxability of tuition benefits If you are a resident of New Jersey any tuition benefits you receive at the undergraduate or Taxable tuition reimbursement affects payroll withholding for both employers and employees When reimbursements exceed the tax free limit or fail to meet exclusion criteria

A qualified scholarship is fully exempt from New Jersey Gross Income Tax and withholdings under N J S A 54A 6 8 Generally tuition fees books supplies and equipment are excluded for New Jersey purposes New Jersey taxpayers who attend college in state can receive a tax deduction up to 10 000 for tuition costs It is important to understand that the 10 000 deduction for tuition costs and the 10 000 deduction for 529

Download Is Tuition Reimbursement Taxable In Nj

More picture related to Is Tuition Reimbursement Taxable In Nj

Get Our Free School Tuition Receipt Template Invoice Template School

https://i.pinimg.com/originals/6a/71/a4/6a71a4d1d70eeddcedcec010214a183b.jpg

Is Tuition Reimbursement Taxable For FICA Purposes CollegeReaction

https://cdn.collegereaction.com/is_fica_tuition_reimbursement_taxable.jpg

Tourshabana The Many Benefits Of An Employer Tuition Reimbursement

https://tourshabana.com/storage/img/images_1/the_many_benefits_of_an_employer_tuition_reimbursement_program_policy.png

Is tuition reimbursement taxable in NJ The New Jersey gross income deduction for employees will be limited to the 5 250 annual limit under the federal income tax exclusion The New Jersey College Affordability Act gives taxpayers three deductions if you qualify a deduction of up to 10 000 for tuition costs the deduction of up to 2 500 on loans under NJCLASS and

For example California generally follows federal guidelines but New Jersey does not exclude employer provided educational assistance from taxable income Employees Tuition payments made using private and public student loans do not qualify for the deduction Residents can also deduct up to 2 500 in payments to student loans offered

Employer Tuition Reimbursement Explained Graduate Programs For Educators

https://www.graduateprogram.org/wp-content/uploads/2020/03/Mar.-23-Employer-Tution-Reimbursement-Explained-web-1.jpg

What Is Healthcare Reimbursement Insurance Noon

https://insurancenoon.com/wp-content/uploads/2020/08/What-Is-Healthcare-Reimbursement_-1.jpg

https://www.nj.gov › treasury › taxation

The following items of income are not subject to New Jersey tax However if you file a resident return you must report the total amount of nontaxable interest on the Tax

https://www.nj.gov › treasury › taxation

New Jersey law provides several gross income tax deductions that can be taken on the New Jersey Income Tax return New Jersey does not allow federal deductions such as

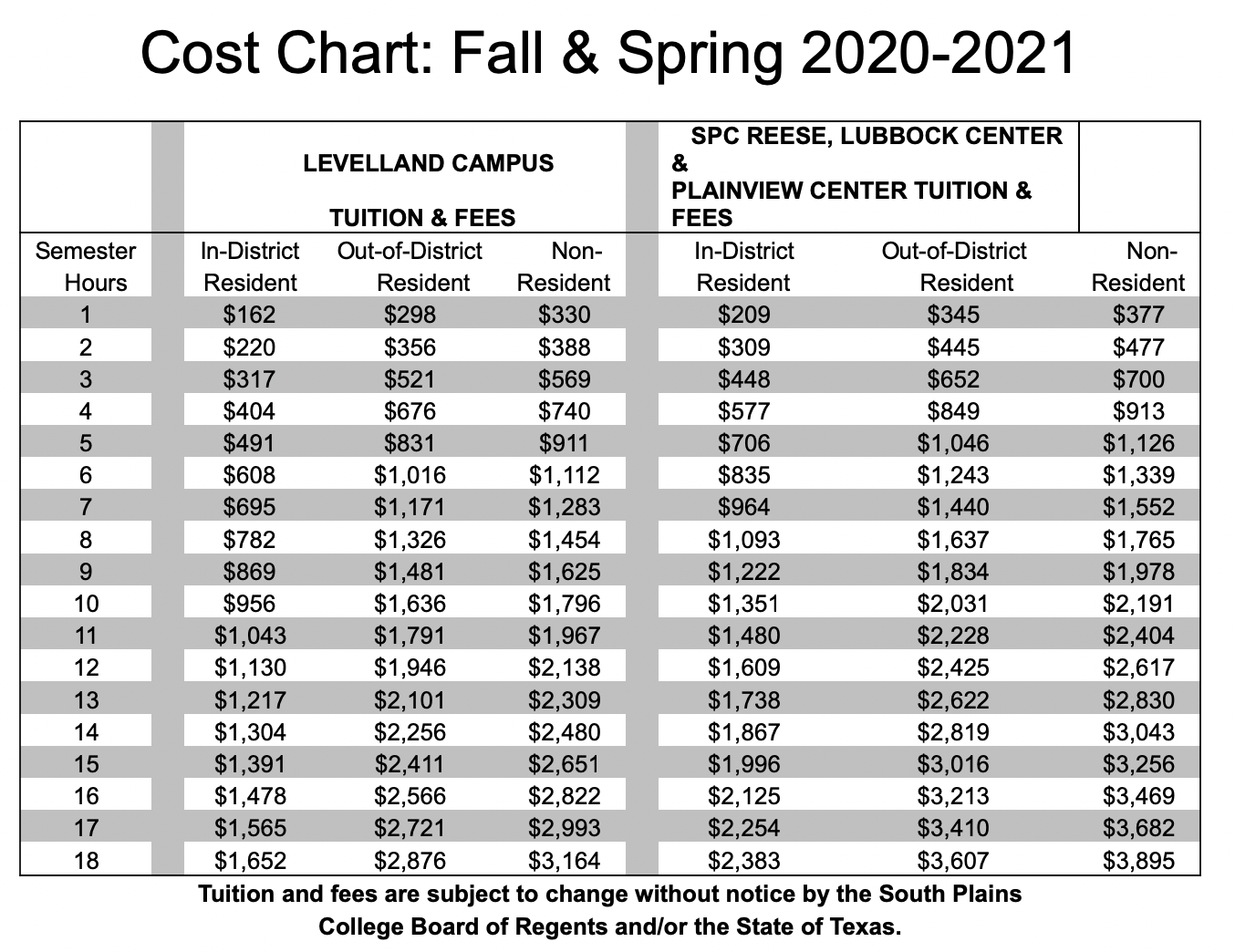

Tuition And Fees

Employer Tuition Reimbursement Explained Graduate Programs For Educators

What Is Tuition Reimbursement And How Do You Get It

Is Tuition Reimbursement Worth It For Employers Tolbert Associates

Tuition Reimbursement Policy Benefits You Can t Live Without

Is Tuition Reimbursement Right For Employers Payroll Management Inc

Is Tuition Reimbursement Right For Employers Payroll Management Inc

Rejuvenating Tuition Reimbursement Programs

Helpful Resources For Calculating Canadian Employee Taxable Benefits

Tuition Reimbursement Program Options For Small Businesses

Is Tuition Reimbursement Taxable In Nj - For eligible taxpayers contributions of up to 10 000 per taxpayer per year to a New Jersey Better Education Savings Trust NJBEST account can now be deducted The NJBEST