Is Tuition Reimbursement Taxable In Pa The tuition reductions received by employees of an institute of higher learning that provide free or low cost education would not be taxable for PA personal

PA is all or nothing The entire amount or none of the amount could be taxable in PA depending on who your employer is Gross Compensation PA A taxpayer may deduct educational expenses only when 1 The education is specifically required by law or by the employer to keep a job or rate of pay 2 The

Is Tuition Reimbursement Taxable In Pa

Is Tuition Reimbursement Taxable In Pa

https://www.cleardegree.com/wp-content/uploads/2020/04/CD-BLog-Image-4-3-1478x1080.jpg

Tuition Reimbursement How Do Employers Benefit From It

https://blog.kbibenefits.com/hs-fs/hubfs/tuition-reimbursement.jpg?width=1350&name=tuition-reimbursement.jpg

Get Our Free School Tuition Receipt Template Invoice Template School

https://i.pinimg.com/originals/6a/71/a4/6a71a4d1d70eeddcedcec010214a183b.jpg

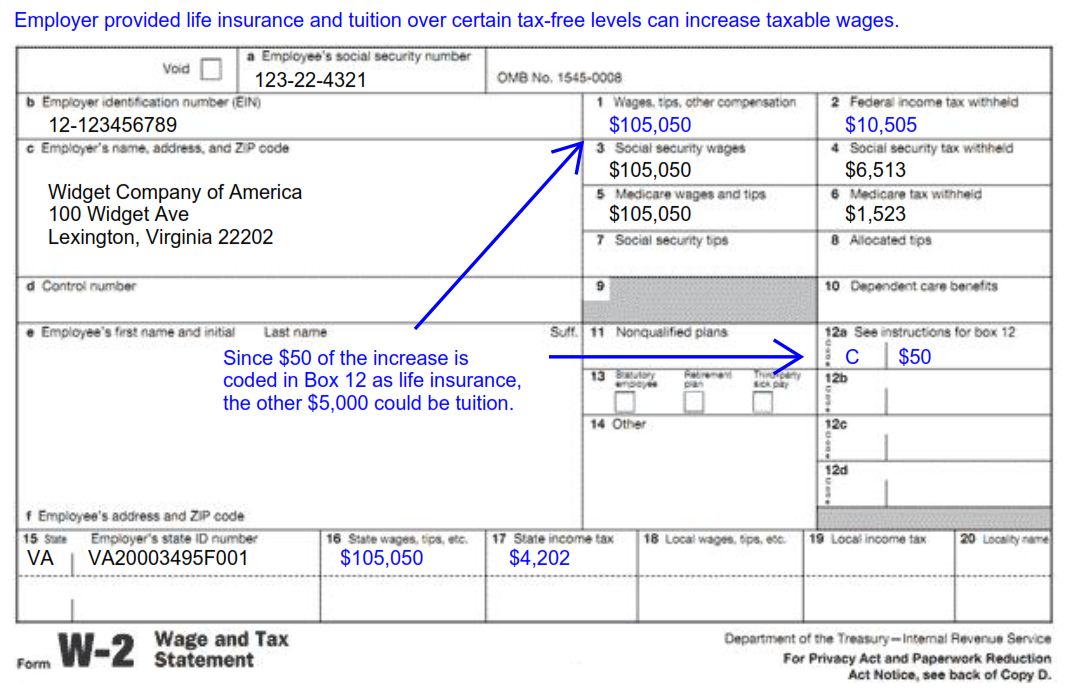

Generally anything of value including payments of tuition and other educational assistance that an employer provides to an employee is treated as taxable Tuition benefit payments that exceed 5 250 in the calendar year are subject to withholding at approximately 33 09 Any applicable taxes are withheld directly from your benefit

Pennsylvania allows four deductions against income Deductions are allowed for Medical Savings Account contributions Health Savings Account contributions IRC Section 529 Payments also will constitute compensation if they would be taxable under the Pennsylvania Personal Income Tax if made by the employer outside a cafeteria plan

Download Is Tuition Reimbursement Taxable In Pa

More picture related to Is Tuition Reimbursement Taxable In Pa

Is Tuition Reimbursement Taxable For FICA Purposes CollegeReaction

https://cdn.collegereaction.com/is_fica_tuition_reimbursement_taxable.jpg

Tuition Reimbursement Program Options For Small Businesses

https://paycor.imgix.net/ample_admin/attachments/files/000/038/401/screen_sm/tuition-reimbursement.png?ixlib=rails-2.1.4&auto=format%2Ccompress&w=4300

Tourshabana The Many Benefits Of An Employer Tuition Reimbursement

https://tourshabana.com/storage/img/images_1/the_many_benefits_of_an_employer_tuition_reimbursement_program_policy.png

The tuition benefits you receive for courses taken through a graduate program degree or non degree are considered taxable income by the government once you exceed Is Tuition Reimbursement Taxable If your employer pays less than 5 250 for educational benefits for you during the year you often don t need to pay federal income tax on it If you receive more than

Generally the entire amount is taxable if you are not a candidate for a degree If you are a candidate for a degree you generally can exclude from income that part of the grant A private school however charges a tuition that often makes access to that type of education out of reach for many families including middle income families Many

What Is Healthcare Reimbursement Insurance Noon

https://insurancenoon.com/wp-content/uploads/2020/08/What-Is-Healthcare-Reimbursement_-1.jpg

Rejuvenating Tuition Reimbursement Programs

https://shrm-res.cloudinary.com/image/upload/c_crop,h_2339,w_5461,x_155,y_545/w_auto:100,w_2100,h_900,q_auto,f_auto/v1/Magazine/tuition_assistance_dnommk

https://revenue-pa.custhelp.com/app/answers/detail...

The tuition reductions received by employees of an institute of higher learning that provide free or low cost education would not be taxable for PA personal

https://ttlc.intuit.com/community/state-taxes/...

PA is all or nothing The entire amount or none of the amount could be taxable in PA depending on who your employer is Gross Compensation PA

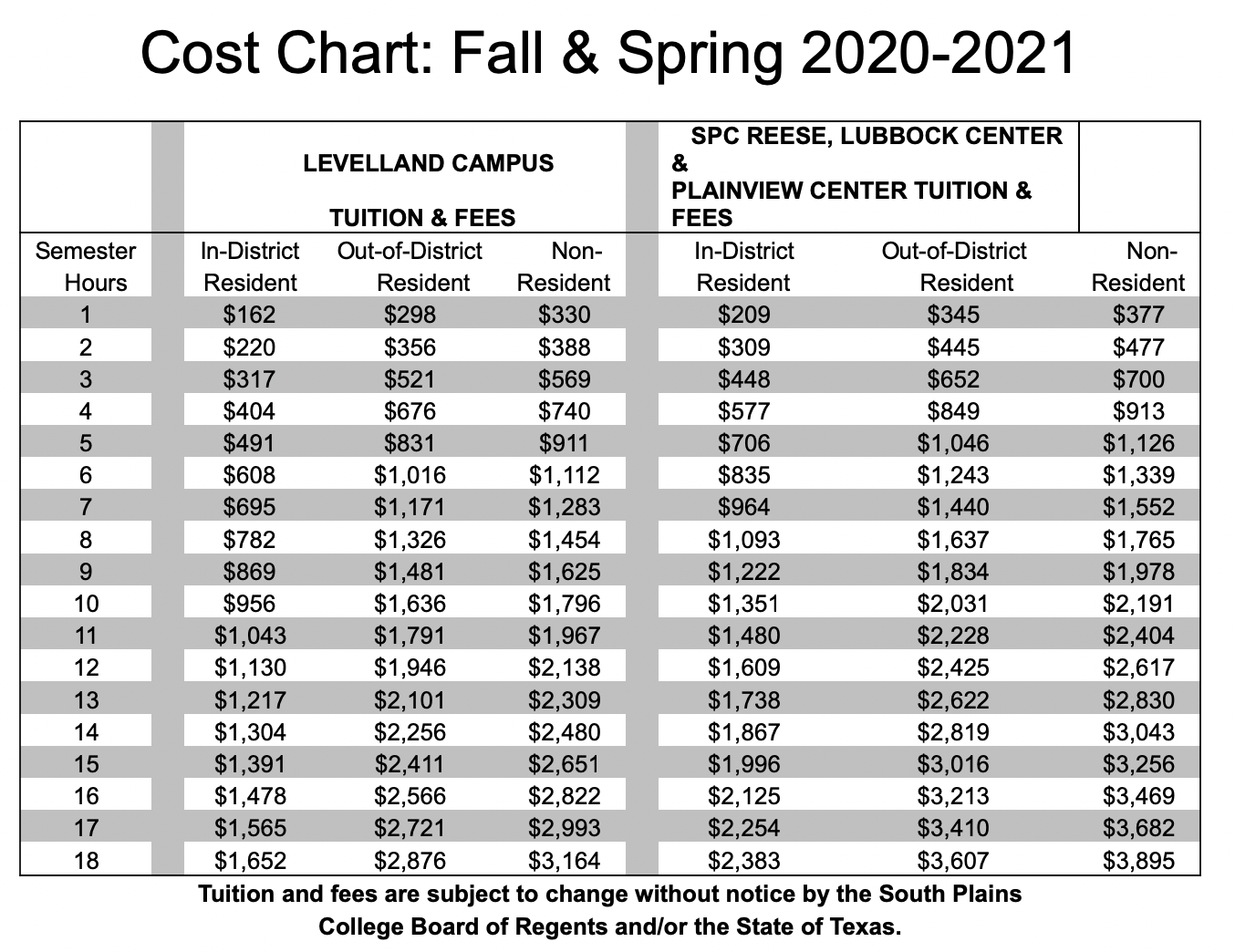

Tuition And Fees

What Is Healthcare Reimbursement Insurance Noon

What Is Tuition Reimbursement And How Do You Get It

Is Tuition Reimbursement Worth It For Employers Tolbert Associates

Tuition Reimbursement Policy Benefits You Can t Live Without

Is Tuition Reimbursement Right For Employers Payroll Management Inc

Is Tuition Reimbursement Right For Employers Payroll Management Inc

What Is Pre Tax Commuter Benefit

Asking For Tuition Reimbursement SeattleU

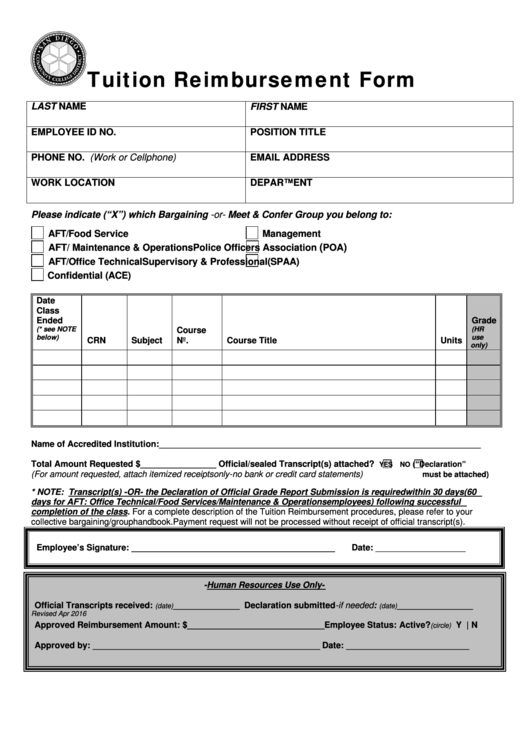

Tuition Reimbursement Form Printable Pdf Download Gambaran

Is Tuition Reimbursement Taxable In Pa - Generally anything of value including payments of tuition and other educational assistance that an employer provides to an employee is treated as taxable