Journal Entry For Cash Sales Return The sales return journal entry is required to debit sales returns and allowances account and credit cash or accounts receivable as below There are usually three circumstances

Sales return and allowances refer to the sales adjustment as a result of the return of goods or merchandise inventory or a reduction from the original selling price due to damages Guide to what is Sales Return Journal Entry We explain it with example credit memo and estimated points to understand regarding the concept

Journal Entry For Cash Sales Return

Journal Entry For Cash Sales Return

https://jkbhardwaj.com/wp-content/uploads/2022/02/Screenshot-807.png

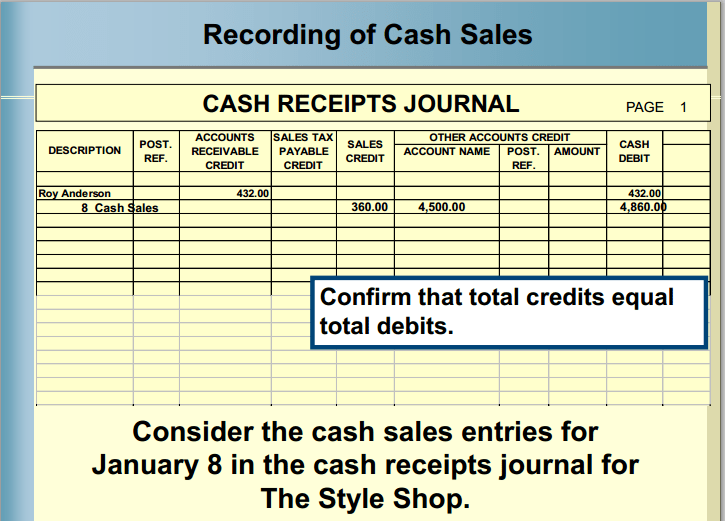

Cash Sales Journal Entry CArunway

https://www.carunway.com/wp-content/uploads/2022/07/Cash-Sales-1024x576.png

Accounting For Sales Return Journal Entry Example Accountinguide

https://accountinguide.com/wp-content/uploads/2020/01/Sales-return-journal-entry.png

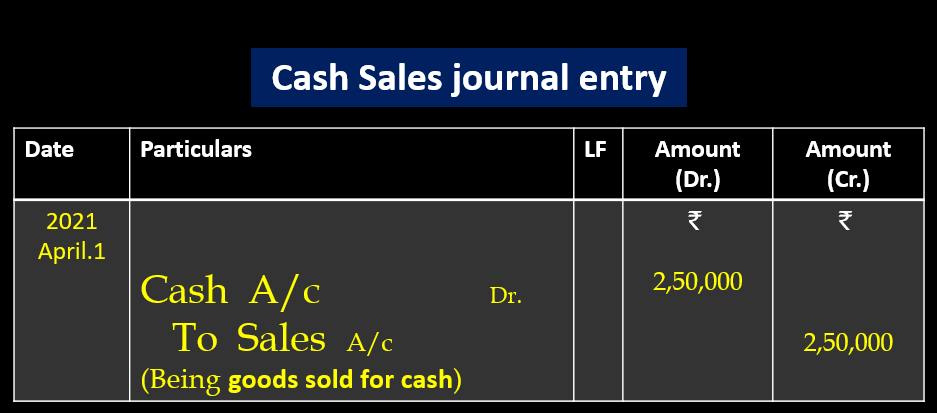

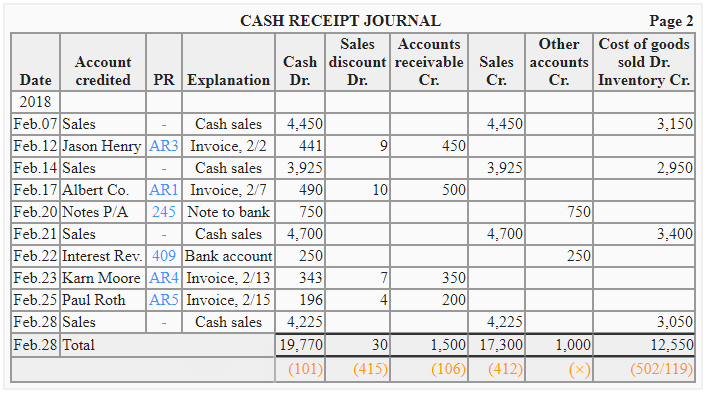

Sales Journal Entry Examples Here are a few different types of journal entries you may make for a sale or a return depending on how your customer paid Cash Sales Journal Entry Let s take a look at an Journal Entry for a Sales Return The accounting records will show the following bookkeeping entries for the sales return of inventory Sales Return Bookkeeping Entries Explained Debit The goods are

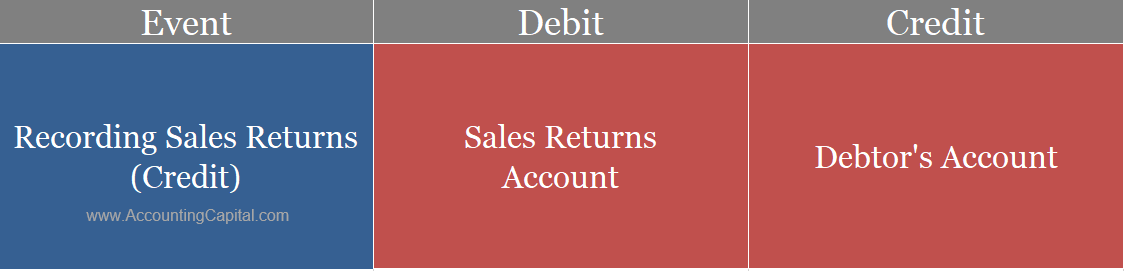

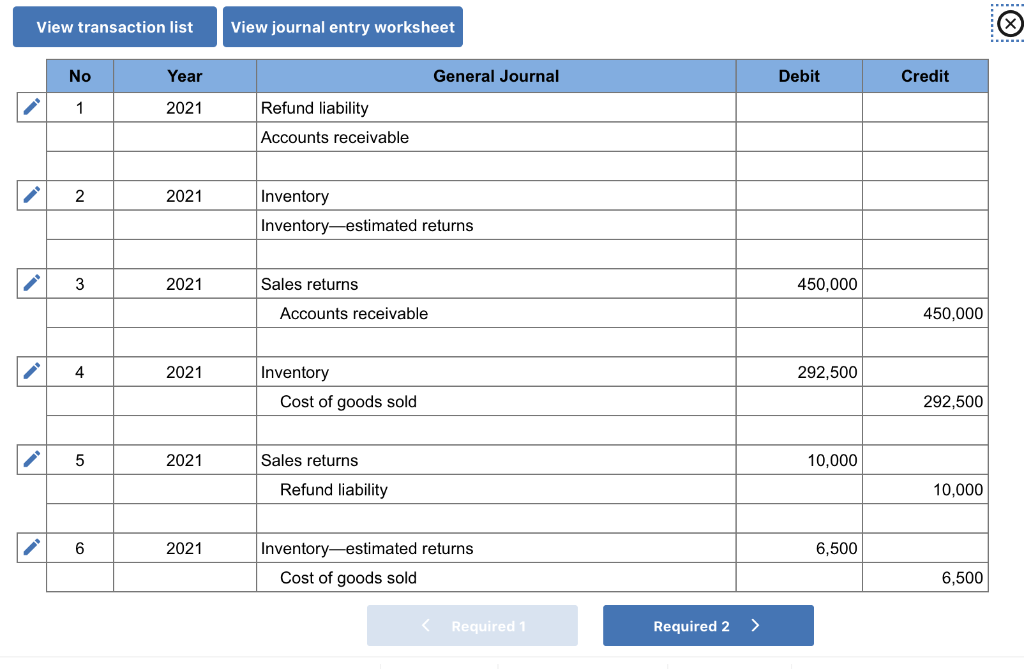

When sales are returned by customers or an allowance is granted to them due to delayed delivery breakage or quality issues an entry is made in the sales When a sales return occurs the customer physically returns the product and receives his cash back Accounting for a sales return involves reversing a the revenue

Download Journal Entry For Cash Sales Return

More picture related to Journal Entry For Cash Sales Return

Accounting And Journal Entry For Sales Returns With Example

https://www.accountingcapital.com/wp-content/uploads/2020/12/Journal-entry-for-sales-returns-or-return-inwards.png

H ng D n When Customer Returns Defective Goods Of A Company Which Of

https://learn.financestrategists.com/wp-content/uploads/Journal-Entry-for-Purchase-Returns_image-2.png

Self Study Notes Merchandising Businesses And Related Sales

https://lh5.googleusercontent.com/proxy/AXOp1mFPk8UlOSm02O4Rn6ZWsqjMwtc8L4ox0MD3z-UKN_sdlhLXNOLT0Aj3Wlf1uIK3T_ZncY2PbqlegddnRWzNi8EOAJWfBWAFMMEMGg=s0-d

When return goods are given by the customer a journal entry is required in two steps First the sales returns and allowances account is debited Second accounts payable is credited Then an Journal entry for sale return Hi friends here we are going to learn journal entry for sale return Usually in accounting software we need to pass journal entry but

A sales revenue journal entry records the income earned from selling goods or services debiting either Cash or Accounts Receivable and crediting the Sales Revenue account Accounting and journal entry for credit sales include 2 accounts debtor and sales In case of a journal entry for cash sales a cash account and sales account are used The

Cash Deposit Into Bank Journal Entry Bhardwaj Accounting Academy

https://jkbhardwaj.com/wp-content/uploads/2022/01/Screenshot-787.png

Cash Receipts Journal Personal Accounting

https://personal-accounting.org/wp-content/uploads/2020/10/image-JWt0psm4hBASbx7G.png

https://accountinguide.com/account-for-sales-return

The sales return journal entry is required to debit sales returns and allowances account and credit cash or accounts receivable as below There are usually three circumstances

https://www.accountinghub-online.com/sales-return...

Sales return and allowances refer to the sales adjustment as a result of the return of goods or merchandise inventory or a reduction from the original selling price due to damages

Debits And Credits T Accounts Journal Entries Bace Productions

Cash Deposit Into Bank Journal Entry Bhardwaj Accounting Academy

Cash Receipts Journal Explanation Format Example Accounting For

Journal Entry For Cash Sales GeeksforGeeks

Solved Exercise 7 8 Sales Returns L07 4 Halifax Chegg

8 Please Make The Journal Entry For Cash Sales Of 26 000 With A 6

8 Please Make The Journal Entry For Cash Sales Of 26 000 With A 6

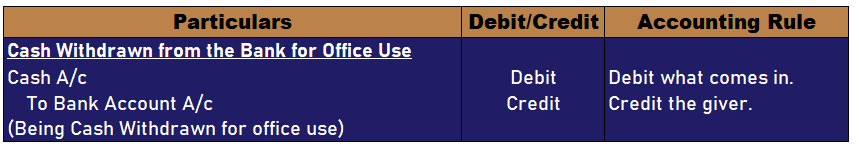

What Is The Journal Entry For Cash Withdrawn From Bank For Office Use

Returns Inwards Or Sales Returns Definition Journal Entries

Journal Entry Of Sales

Journal Entry For Cash Sales Return - Journal Entry for a Sales Return The accounting records will show the following bookkeeping entries for the sales return of inventory Sales Return Bookkeeping Entries Explained Debit The goods are