Kentucky Earned Income Tax Credit Web Personal tax credits are reported on Schedule ITC and submitted with Form 740 or 740 NP A 40 tax credit is allowed for each individual reported on the return who is age 65 or over Also a 40 tax credit is allowed if an individual is legally blind Persons who are both age 65 or older and legally blind are eligible for both tax credits for a

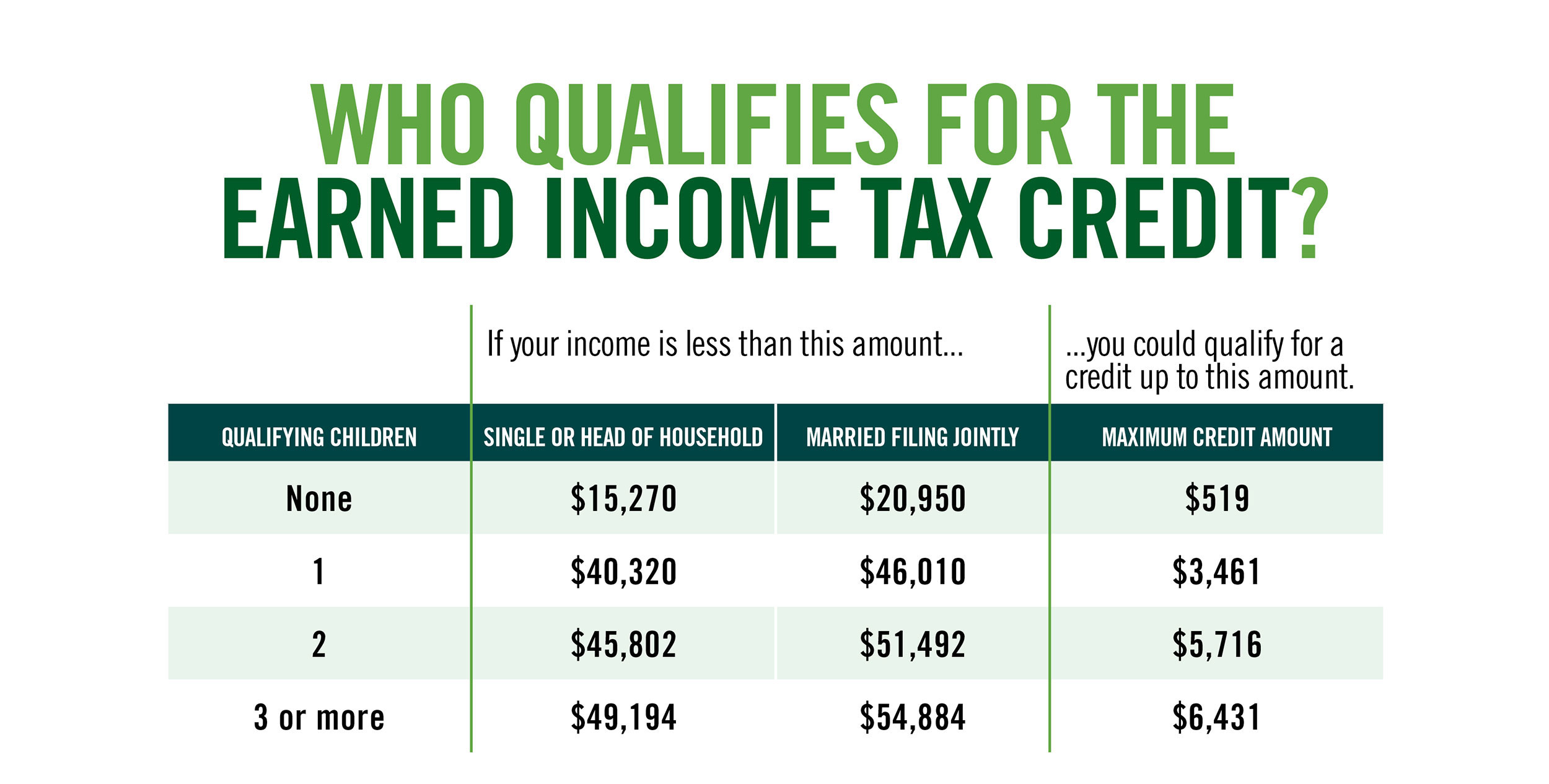

Web 4 Dez 2023 nbsp 0183 32 For tax year 2024 the taxes you ll likely file in spring 2025 the maximum EITC amount will rise to 632 for taxpayers without a qualifying kid 4 213 for taxpayers with one qualifying kid Web Kentucky Federal EITC Earned Income Tax Credits Rates and Thresholds in 2023 Note you must be between the ages of 25 and 65 to claim EITC in 2023 unless you have 1 or more children EITC Tables for Unmarried Taxpayers single and head of

Kentucky Earned Income Tax Credit

Kentucky Earned Income Tax Credit

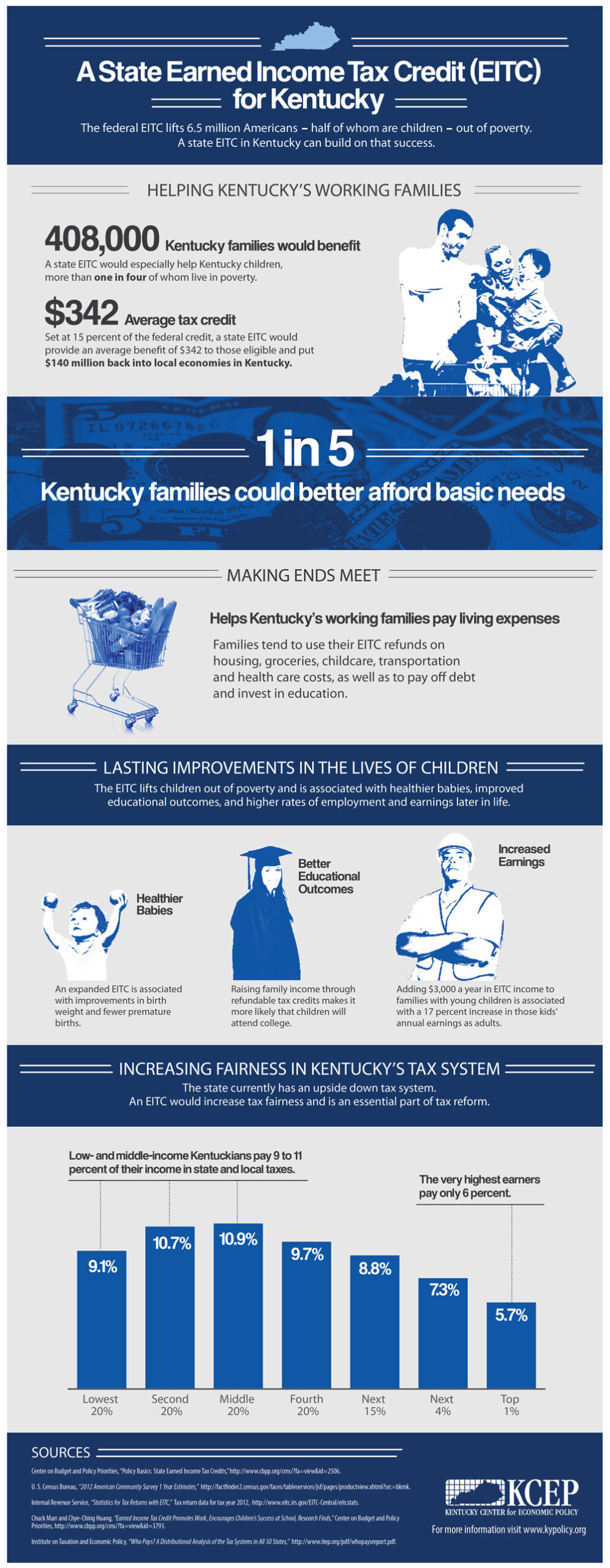

https://kypolicy.org/wp-content/uploads/2014/04/Infographic-EITC-scaled.jpg

Earned Income Credit EIC Calculator 2023 2024

https://www.taxuni.com/wp-content/uploads/2023/01/Earned-Income-Credit-EIC-Calculator-TaxUni-Cover-1.jpg

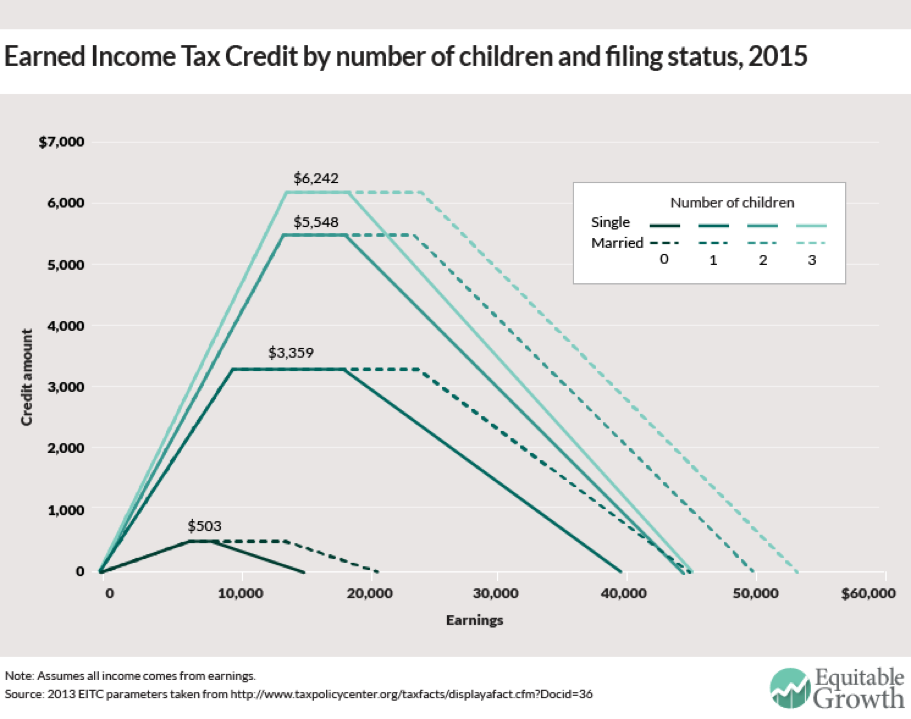

Earned Income Tax Credit What You Need To Know

https://youngandtheinvested.com/wp-content/uploads/2019/01/Earned-Income-Tax-Credit-Limits-by-Filing-Status-2018-1.png

Web Department of Revenue Enter name s as shown on tax return KENTUCKY INDIVIDUAL 2021 TAX CREDIT SCHEDULE Enclose with Form 740 or 740 NP Your Social Security Number SECTION A BUSINESS INCENTIVES AND OTHER TAX CREDITS 210349 42A740ITC 10 21 Page 1 of 8 SCHEDULE ITC 2021 Page 2 of 8 SECTION Web Income Tax Credit Issues and Options for Kentucky by Erica Meade and James P Ziliak Ph D The Issue The federal Earned Income Tax Credit EITC has proven to be the most effective anti poverty program for working low income families in the United States Established in 1975 to offset payroll taxes and to provide a modest supplement to low

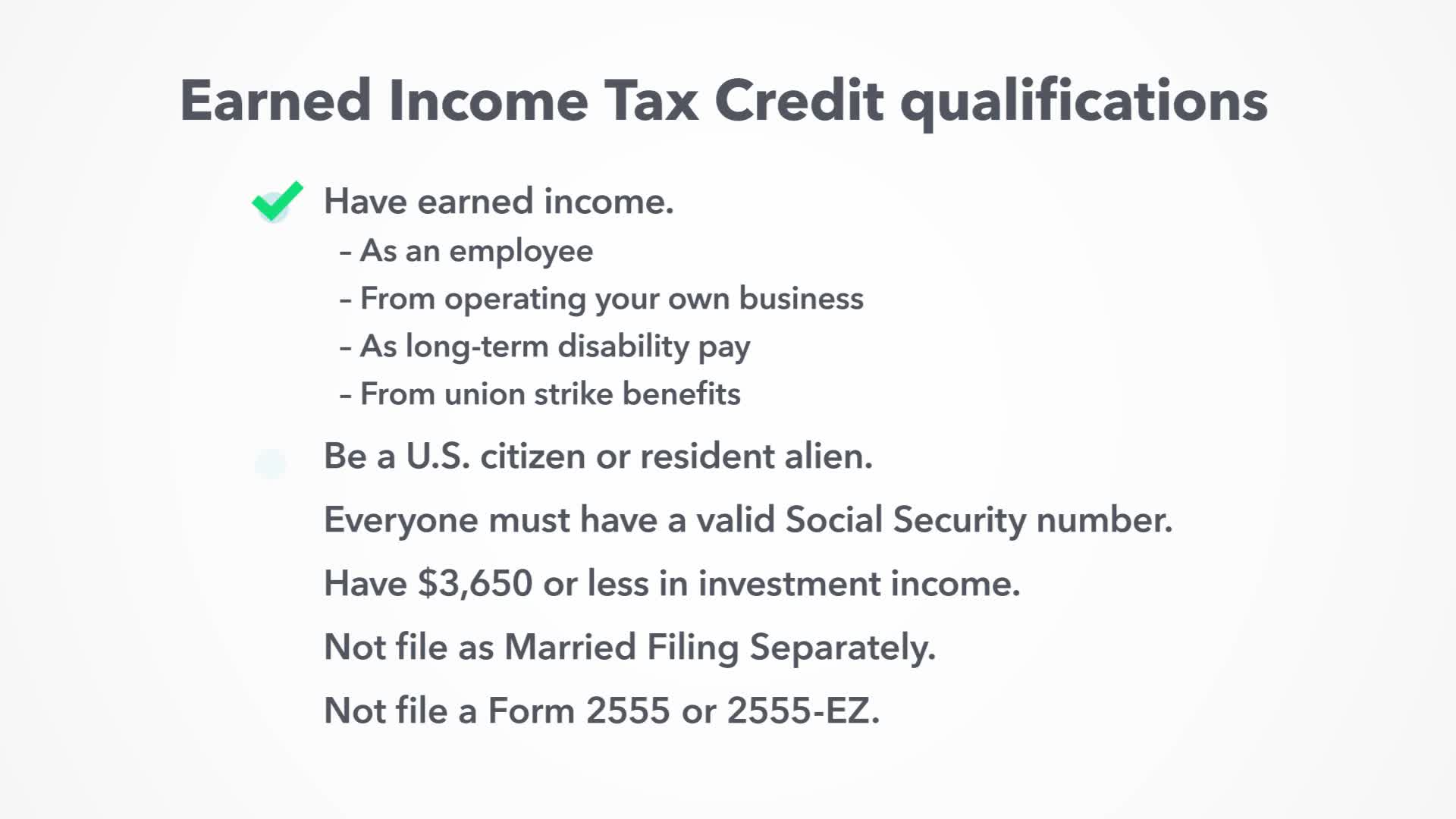

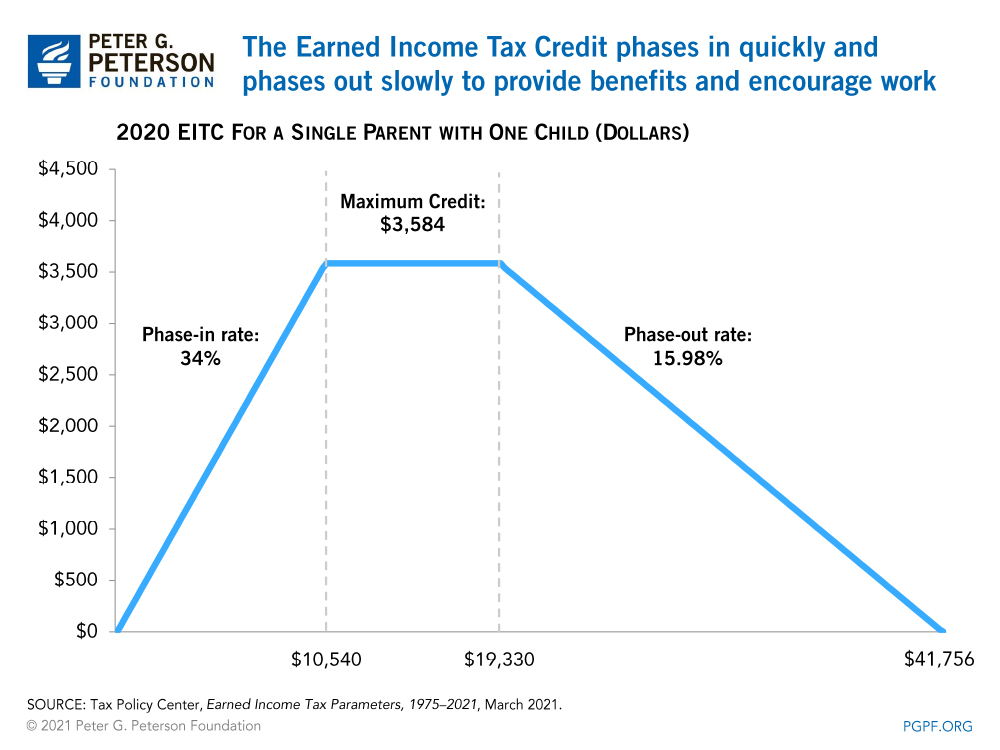

Web The Earned Income Tax Credit EITC for low and moderate income workers encourages and rewards work offsets federal payroll and income taxes and helps meet basic needs Web 18 M 228 rz 2014 nbsp 0183 32 A state EITC could help more than 400 000 Kentucky families better afford basic necessities lead to lasting improvements in the lives of children and increase fairness in Kentucky s tax system Currently 26 states including the District of

Download Kentucky Earned Income Tax Credit

More picture related to Kentucky Earned Income Tax Credit

2023 Tax Brackets The Best Income To Live A Great Life

https://i2.wp.com/financialsamurai.com/wp-content/uploads/2023/02/earned-income-tax-credit-income-threshold-2023.png

Earned Income Tax Credit Tax Credits For Workers And Their Families

http://www.taxcreditsforworkersandfamilies.org/wp-content/uploads/2016/06/EITC2015.png

Earned Income Credit Refund Chart INVOMERT

https://i.pinimg.com/originals/aa/af/be/aaafbed0a4b639f5c32ede742b5dd17b.png

Web The Kentucky Chamber of Commerce however raises concerns about an EITC for Kentucky in their recent publication Should Kentucky Adopt a Credit that is Based on the Federal Earned Income Tax Credit 5 This paper s Web 5 Feb 2022 nbsp 0183 32 The IRS representative said more than 20 of eligible Kentuckians don t claim the earned income tax credit During tax season some people are looking to take advantage of others Officials with the Internal Revenue Service are advising taxpayers to be on the lookout for phishing scams

Web EARNED INCOME TAX CREDIT EITC Kentucky does not currently offer a state level EITC Latest Legislative Action During the 2016 legislative session lawmakers considered a bill that would create a refundable state EITC at 10 of the federal credit SB 157 did not advance beyond the Senate Appropriations and Revenue Committee Notes Web 18 Dez 2023 nbsp 0183 32 Earned Income Credit EIC Earned Income Credit EIC is a tax credit in the United States which benefits certain taxpayers who have low incomes from work in a particular tax year The earned

Earned Income Tax Credit Rural Assembly

https://ruralassembly.org/wp-content/uploads/2021/04/Earned-Income-Tax-Credit-3.png

Earned Income Tax Credit For Households With One Child 2023 Center

https://www.cbpp.org/sites/default/files/2023-04/policybasics-eitc_rev4-28-23_f1.png

https://revenue.ky.gov/Individual/Individual-Income-Tax

Web Personal tax credits are reported on Schedule ITC and submitted with Form 740 or 740 NP A 40 tax credit is allowed for each individual reported on the return who is age 65 or over Also a 40 tax credit is allowed if an individual is legally blind Persons who are both age 65 or older and legally blind are eligible for both tax credits for a

https://www.kentucky.com/money/what-is-earned-income-tax-credit

Web 4 Dez 2023 nbsp 0183 32 For tax year 2024 the taxes you ll likely file in spring 2025 the maximum EITC amount will rise to 632 for taxpayers without a qualifying kid 4 213 for taxpayers with one qualifying kid

Are You Eligible For The Earned Income Tax Credit The Village

Earned Income Tax Credit Rural Assembly

Earned Income Tax Credit Crowe Mallette Associates

Earned Income Tax Credit City Of Detroit

Who Qualifies For The Earned Income Tax Credit Video

What Is The Earned Income Tax Credit And Can You Qualify FleetStar

What Is The Earned Income Tax Credit And Can You Qualify FleetStar

What Is The Earned Income Tax Credit

The Earned Income Tax Credit Overview Economic Analysis And

Interactive Map How A State Earned Income Tax Credit Would Benefit

Kentucky Earned Income Tax Credit - Web 18 M 228 rz 2014 nbsp 0183 32 A state EITC could help more than 400 000 Kentucky families better afford basic necessities lead to lasting improvements in the lives of children and increase fairness in Kentucky s tax system Currently 26 states including the District of