Kentucky Income Tax Deductions Find out how much you ll pay in Kentucky state income taxes given your annual income Customize using your filing status deductions exemptions and more

FRANKFORT Ky September 21 2022 Each year the Kentucky Department of Revenue DOR calculates the individual standard deduction in accordance with KRS 141 081 STANDARD DEDUCTION For 2023 the standard deduction is 2 980 FAMILY SIZE TAX CREDIT This credit provides benefits to individuals and families at incomes up to 133

Kentucky Income Tax Deductions

Kentucky Income Tax Deductions

https://lh3.googleusercontent.com/proxy/QVkOpowbDPTrtYU8-sL1rdOzK12kFI8VUr0s68eA2M3BahJdaT8dRbb1vut1prh13lxmWO3ds3f5-IPWC_6vuaroPhyLQvznWmEwLfvNtIe9v-aoTyQG6Ys=w1200-h630-p-k-no-nu

Tax Deductions Armstrong Economics

https://www.armstrongeconomics.com/wp-content/uploads/2020/09/Tax-Deductions-2048x1536.jpg

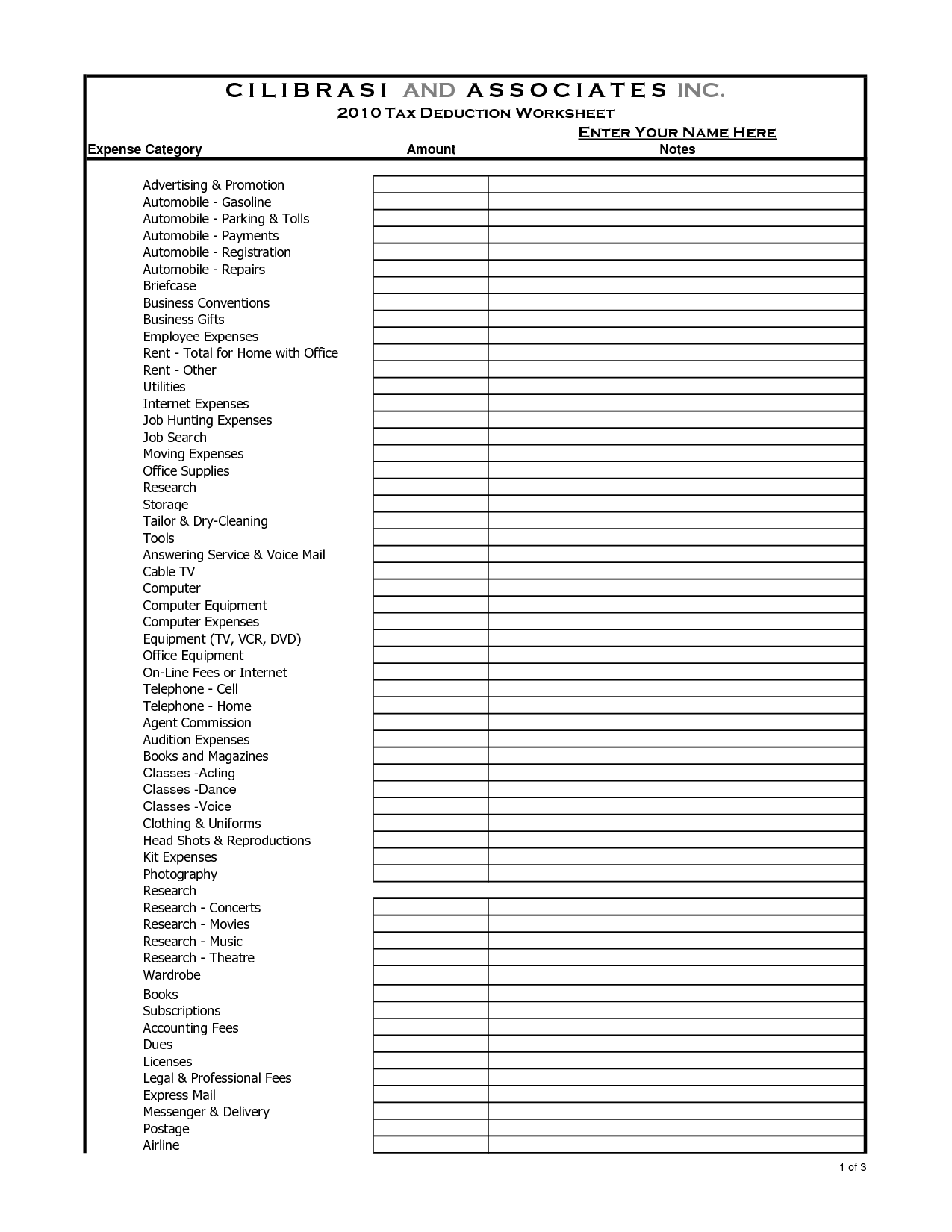

16 Tax Organizer Worksheet Worksheeto

https://www.worksheeto.com/postpic/2011/03/tax-deduction-worksheet_652627.png

Income Taxes The Kentucky Department of Revenue is committed to helping you understand Kentucky income tax law changes keeping you updated and answering The Tax Cuts and Jobs Act increased the federal limitation threshold for cash contributions and Kentucky adopted that provision For most gifts by cash or check the total amount of

The standard deduction for a Single Filer in Kentucky for 2021 is 2 690 00 Kentucky Single Filer Tax Tables Kentucky Married Joint Filer Standard Deduction The standard Program PPP loans or Economic Injury Disaster Loans EIDL grants and advances are authorized to be deducted for Kentucky income tax purposes and federal income tax

Download Kentucky Income Tax Deductions

More picture related to Kentucky Income Tax Deductions

Tax Rates Absolute Accounting Services

https://imageio.forbes.com/specials-images/imageserve/618be1b6d57aaf84e03b72d2/Standard-Deduction-2022/960x0.jpg?format=jpg&width=960

Standard Deduction For Salaried Employees Impact Of Standard

https://i.pinimg.com/originals/05/8c/32/058c32cbbbd99e3ad8dfee9a313112a1.jpg

Oct 19 Irs Here Are The New Income Tax Brackets For 2023 Free Nude

https://image.cnbcfm.com/api/v1/image/107136825-1666125851699-6clBX-marginal-tax-brackets-for-tax-year-2023-single-individuals_1.png?v=1666125859

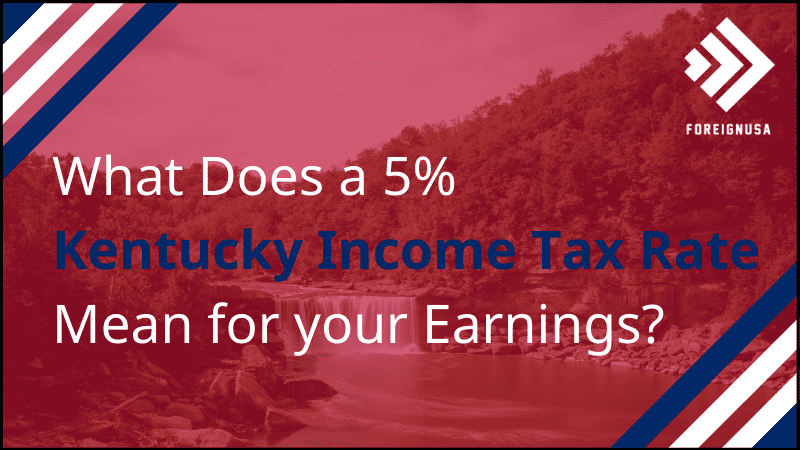

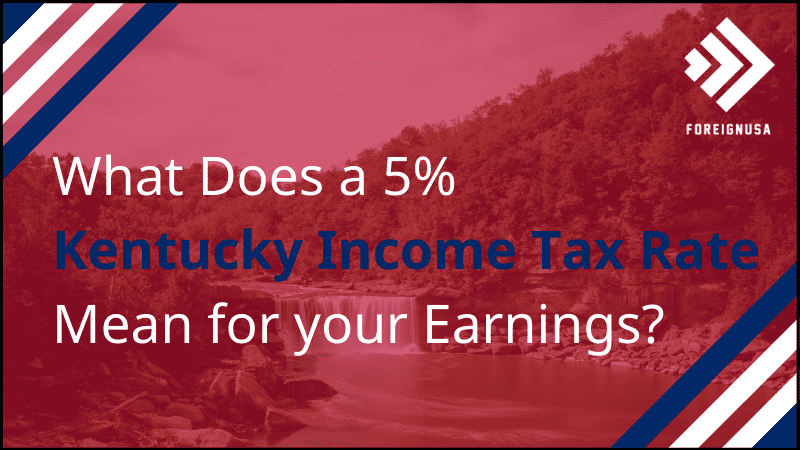

Here you can find how your Kentucky based income is taxed at a flat rate When you prepare your return on eFile this is all calculated for you based on your income State taxes Marginal tax rate 5 Effective tax rate 4 75 Kentucky state tax 3 325 Gross income 70 000 Total income tax 10 985 After Tax Income 59 015 Disclaimer

We last updated the Kentucky Itemized Deductions in January 2024 so this is the latest version of Schedule A 740 fully updated for tax year 2023 You can download or print Kentucky Residents State Income Tax Tables for Single Filers in 2023 Personal Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold 10 Income

The Kentucky Income Tax Rate Is 5 Learn How Much You Will Pay On

https://foreignusa.com/wp-content/uploads/kentucky-income-tax-rate.png

8 Tax Itemized Deduction Worksheet Worksheeto

https://www.worksheeto.com/postpic/2009/10/small-business-tax-deduction-worksheet_449384.png

https://smartasset.com/taxes/kentucky-tax-calculator

Find out how much you ll pay in Kentucky state income taxes given your annual income Customize using your filing status deductions exemptions and more

https://revenue.ky.gov/News/Pages/DOR-Announces...

FRANKFORT Ky September 21 2022 Each year the Kentucky Department of Revenue DOR calculates the individual standard deduction in accordance with KRS 141 081

Printable Itemized Deductions Worksheet

The Kentucky Income Tax Rate Is 5 Learn How Much You Will Pay On

10 2014 Itemized Deductions Worksheet Worksheeto

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

8 Best Images Of Tax Itemized Deduction Worksheet IRS 2021 Tax Forms

20 List Of Itemized Deductions Worksheet

20 List Of Itemized Deductions Worksheet

Income Tax Deductions For The FY 2019 20 ComparePolicy

Kentucky Itemized Deductions Free Download

Today We Are Discussing TAX DEDUCTIONS Tax Deductions Deduction Tax

Kentucky Income Tax Deductions - Program PPP loans or Economic Injury Disaster Loans EIDL grants and advances are authorized to be deducted for Kentucky income tax purposes and federal income tax