Kentucky State Income Tax Reduction Kentucky s income tax rate is set to decline from 4 to 3 5 in Jan 2026 House Bill 8 passed in 2022 established yearly reductions on the state s income tax by 5 provided certain conditions are met The bill helped

FRANKFORT Ky AP Kentucky s individual income tax rate is set to remain the same in 2025 after the state failed to meet certain fiscal requirements that would have ushered in another reduction under a A goal was to make Kentucky s income tax rate more competitive with its neighbors HB 8 cut the income tax rate from 5 to 4 5 effective Jan 1 2023 And it allowed for future

Kentucky State Income Tax Reduction

Kentucky State Income Tax Reduction

https://imageio.forbes.com/specials-images/imageserve/458195635/0x0.jpg?format=jpg&width=1200

Kentucky Senate Sends Income Tax Cut Bill To Governor AP News

https://storage.googleapis.com/afs-prod/media/229503e254da431ba61aa0a38740b928/3000.jpeg

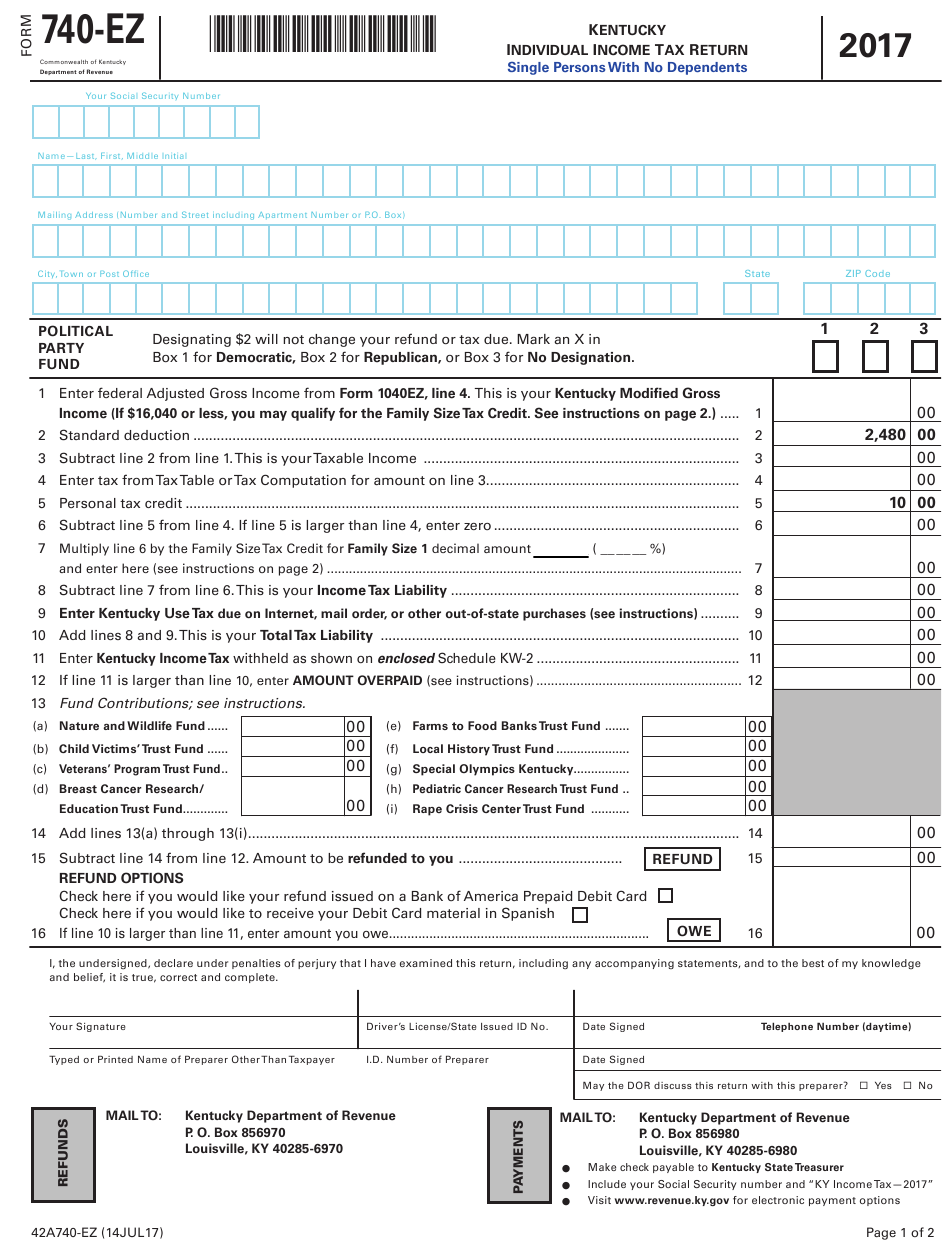

Printable Kentucky State Tax Forms Printable World Holiday

https://www.printableform.net/wp-content/uploads/2021/06/form-740-ez-download-fillable-pdf-or-fill-online-kentucky.png

In Kentucky however lawmakers enacted permanent cuts in the individual income tax first in 2022 and again in 2023 The state budget director s report attributes the largest reduction in the revenue forecast to tax credits due Republican leaders in the General Assembly announced this week that the state s budget has hit the required triggers to lower Kentucky s income tax rate from 4 to 3 5 as

The Kentucky House voted 90 7 to lower the state s individual income tax rate on Thursday have reduced taxes on the average Kentucky household by 1 549 50 said The first reduction moving the individual income tax from 5 percent to 4 5 percent took effect January 1 2023 And now House Bill 1 will codify this as well as reduce the tax by another 0 5 percent to 4 percent

Download Kentucky State Income Tax Reduction

More picture related to Kentucky State Income Tax Reduction

Ky Tax Refund Schedule 2020 QATAX

https://support.taxslayerpro.com/hc/article_attachments/360032163574/ky_seal.jpg

The Kentucky Income Tax Rate Is 5 Learn How Much You Will Pay On

https://foreignusa.com/wp-content/uploads/kentucky-income-tax-rate.png

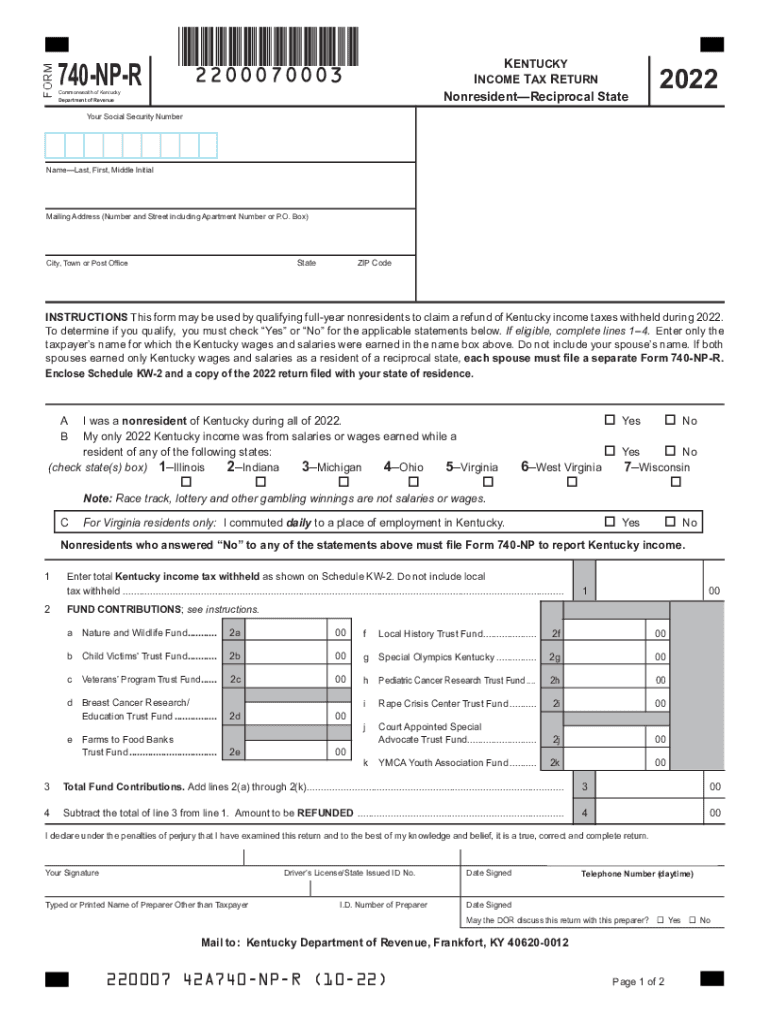

2022 2024 Form KY 740 NP R Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/625/173/625173001/large.png

A bill to lower Kentucky s individual income tax rate by half a percentage point next year is the first legislation to begin moving in the new 2025 session of the General Assembly The half point reduction was initially approved in 2022 as part of a bill that aims to incrementally reduce Kentucky s state income tax if certain conditions are met with a goal of eventually

In the 2022 session lawmakers passed House Bill 8 which established in statute a process for gradually and carefully reducing individual income taxes This legislation directed the Office of State Budget Director to UPDATE House Bill 1 legislation reducing the individual income tax from 4 to 3 5 passed out of the Senate Committee on Appropriations and Revenue unanimously and

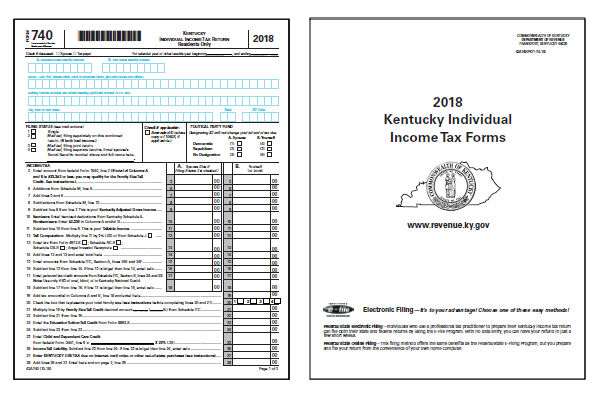

Printable Kentucky State Tax Forms Printable Form 2024

https://www.printableform.net/wp-content/uploads/2021/06/kentucky-tax-forms-2018-printable-state-ky-740-form-and.jpg

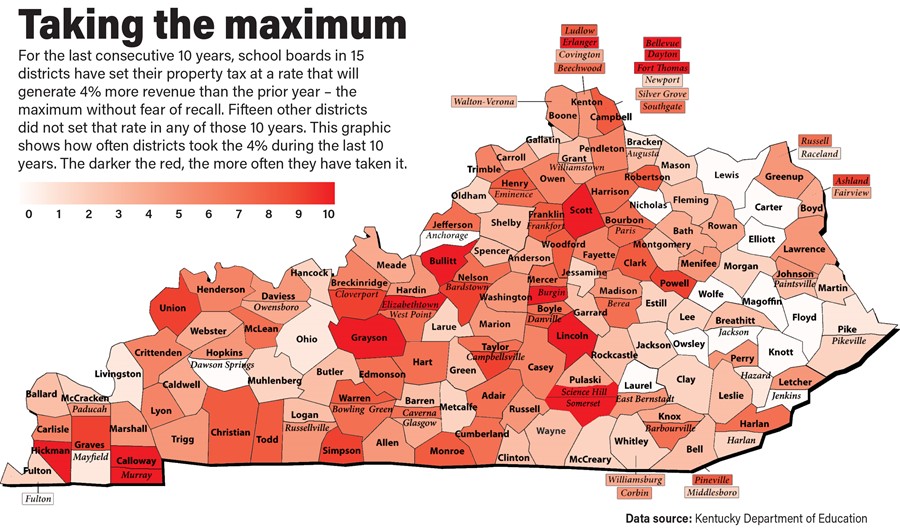

Tax Rates

https://www.ksba.org/WindowImages/20188241550879_image.jpg

https://spectrumnews1.com › ky › louisville …

Kentucky s income tax rate is set to decline from 4 to 3 5 in Jan 2026 House Bill 8 passed in 2022 established yearly reductions on the state s income tax by 5 provided certain conditions are met The bill helped

https://apnews.com › article

FRANKFORT Ky AP Kentucky s individual income tax rate is set to remain the same in 2025 after the state failed to meet certain fiscal requirements that would have ushered in another reduction under a

Kentucky Enacts Personal Income Tax Rate Reduction Harding Shymanski

Printable Kentucky State Tax Forms Printable Form 2024

Kentucky State Income Tax Rate Calculator Veche info 9

State Income Tax Filing Deadline Is Monday

Oklahoma Governor Pushing To Get State Income Tax on The Path To Zero

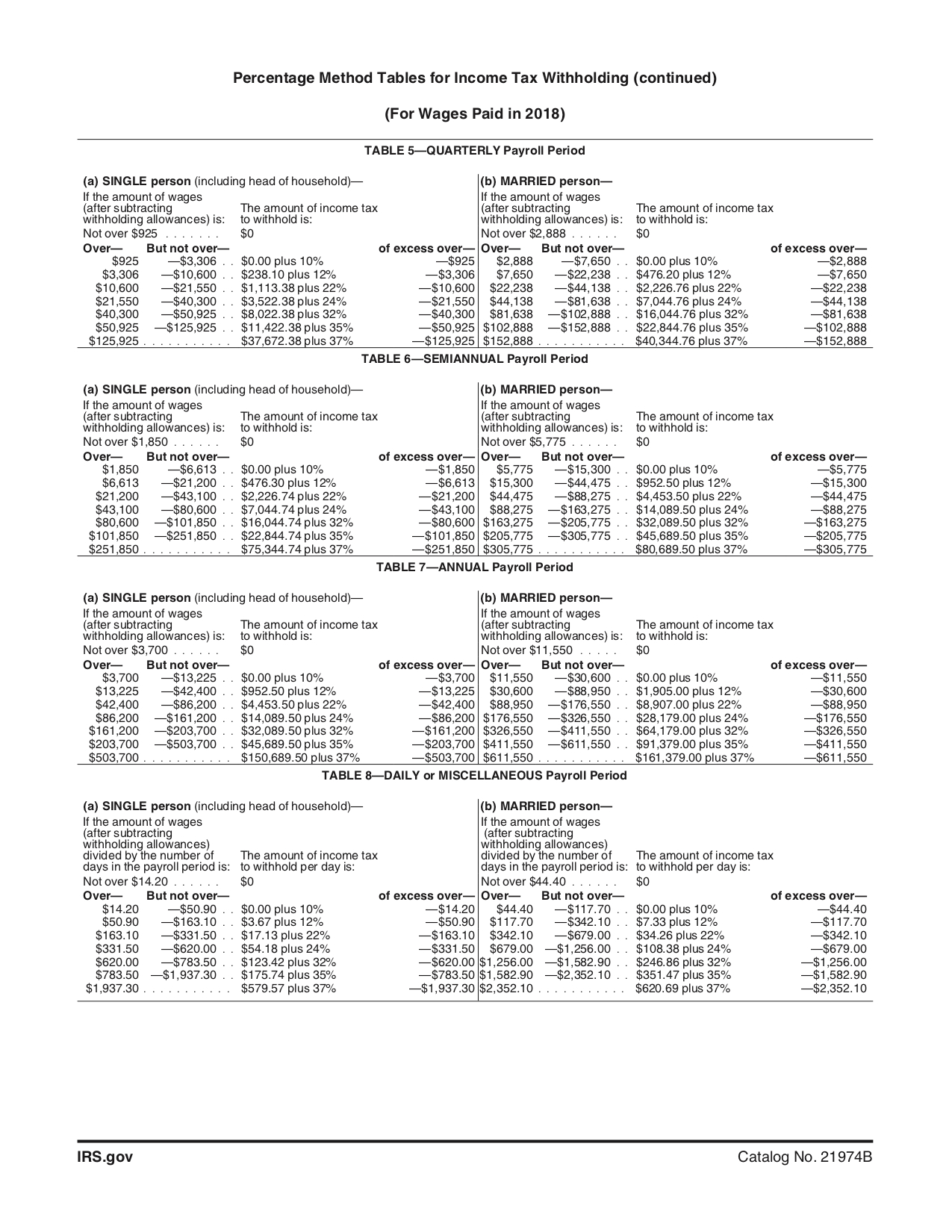

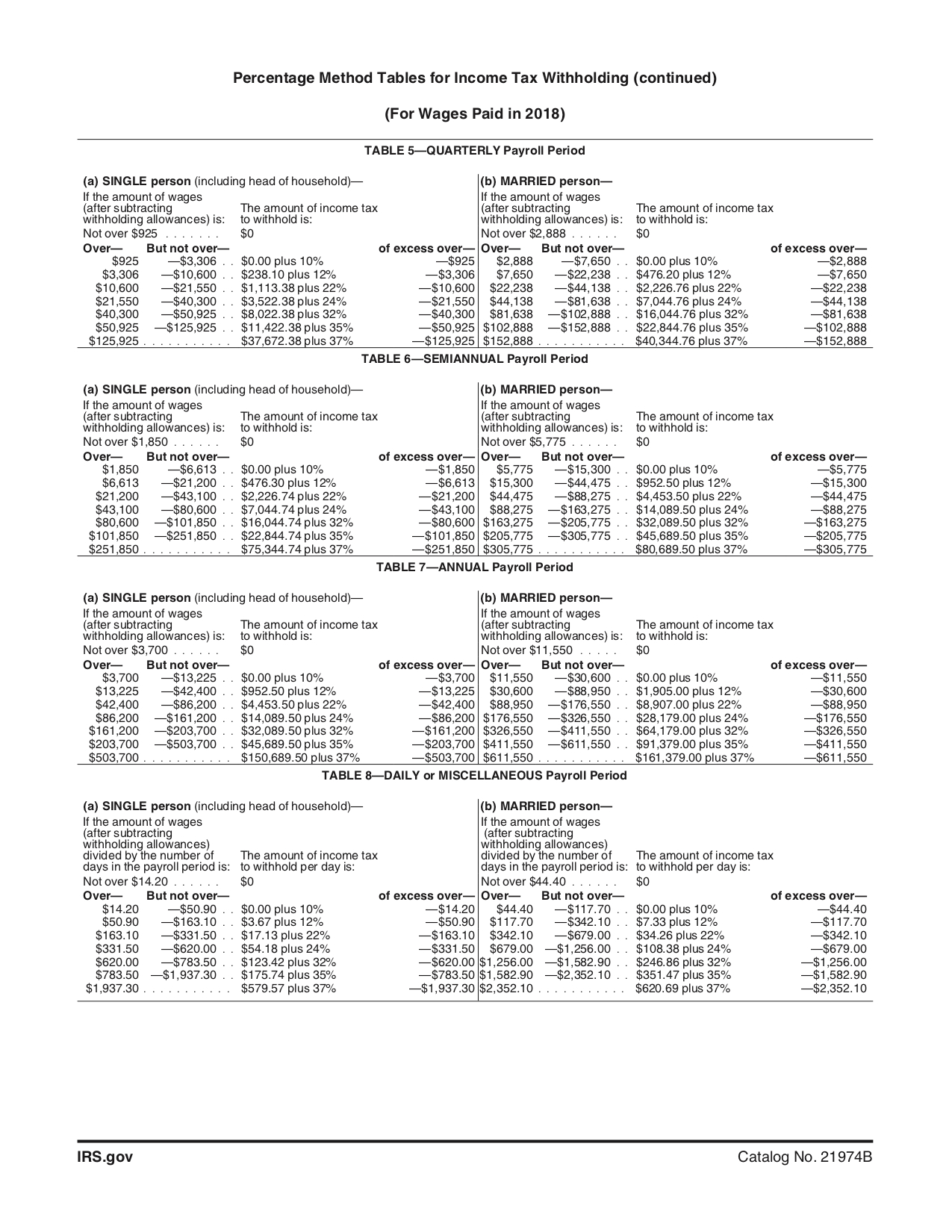

Income Tax Withholding Tables Federal Withholding Tables 2021

Income Tax Withholding Tables Federal Withholding Tables 2021

Kentucky Tax Form 2023 Printable Forms Free Online

2022 Tax Brackets PersiaKiylah

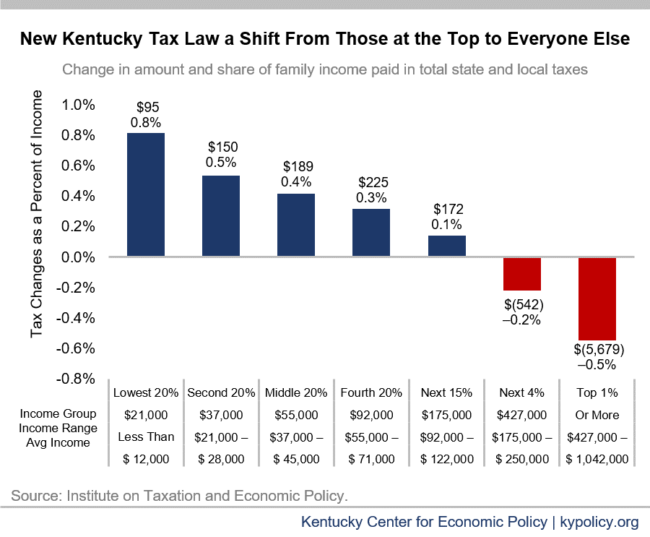

New Report Wealthiest Kentuckians Pay The Lowest Tax Rate And The

Kentucky State Income Tax Reduction - In Kentucky however lawmakers enacted permanent cuts in the individual income tax first in 2022 and again in 2023 The state budget director s report attributes the largest reduction in the revenue forecast to tax credits due