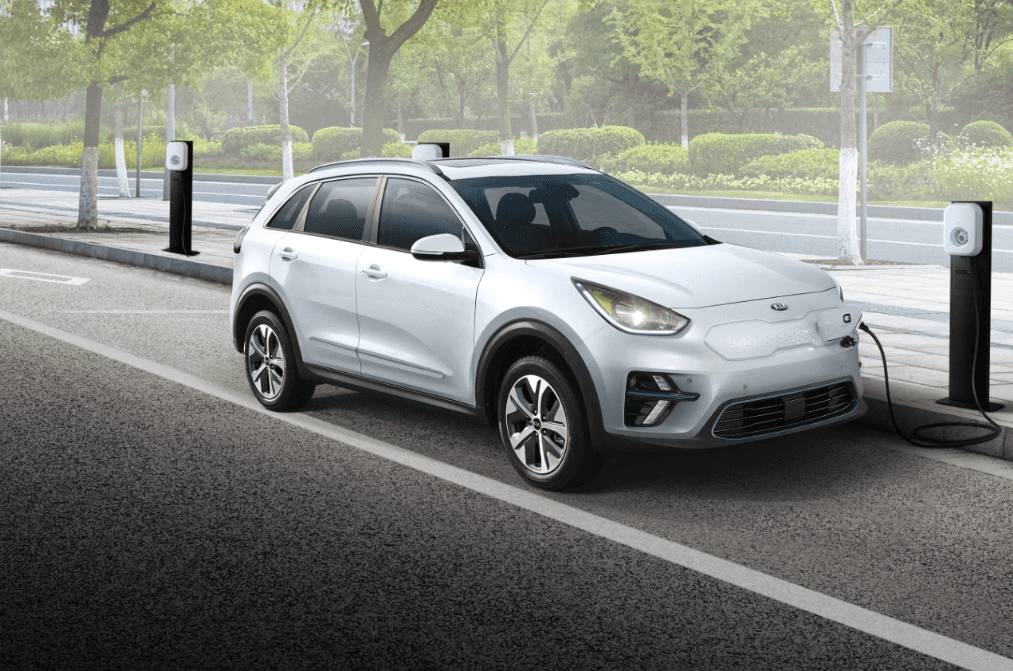

Kia Niro Ev Eligible For Federal Tax Credit We ve gathered every new EV that s currently eligible to earn either the partial 3750 or the full 7500 federal tax credit

If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Internal Revenue Unlike the first generation the new electric Niro isn t eligible for the 7500 federal EV tax credit due to new government legislation Joining the base level Wind

Kia Niro Ev Eligible For Federal Tax Credit

Kia Niro Ev Eligible For Federal Tax Credit

https://unifleet.se/wp-content/uploads/2022/05/kia-niro-ev-Aurora-Black-Pearl-1.png

Kia America Announces 2022 Niro EV

https://preview.thenewsmarket.com/Previews/KIA/StillAssets/1920x1080/592987_v2.jpg

Kia Announces Pricing Specs For 22 Niro BEV PHEV WardsAuto

https://www.wardsauto.com/sites/wardsauto.com/files/styles/article_featured_retina/public/kia-niro-ev 22.jpg?itok=BgZRHCW9

Consumer Reports details the list of 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the You can now check if the EV you desire is eligible for a sizable federal tax credit The Internal Revenue Service IRS has released its list of vehicles that qualify for a clean vehicle tax

All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500 Keeping track of which EVs are eligible for the full 7 500 tax credit or the 3 750 half credit can feel like a full time job Federal battery requirements as well as automakers supply

Download Kia Niro Ev Eligible For Federal Tax Credit

More picture related to Kia Niro Ev Eligible For Federal Tax Credit

Kia Niro Ev Towing Capacity Marylin seim

https://thedriveradviser.com/wp-content/uploads/2021/08/red-kia-niro-1-scaled.jpg

Kia Niro Fast Charging Lupon gov ph

https://file.kelleybluebookimages.com/kbb/base/evox/CP/14406/2020-Kia-Niro Plug-in Hybrid-front_14406_032_1867x864_4SS_cropped.png

Kia Niro EV Priced At A Premium GearOpen

https://gearopen.com/wp-content/uploads/2021/05/kia-niro-ev-sport.jpg

The electric vehicle tax credit has spurred concern that Kia and Hyundai EVs won t qualify without some flexibility Which EVs and PHEVs Are Eligible for a Federal Tax Credit The tightened rules for 2024 cut the number of new EVs and PHEVs that qualify for the credit by more than half on Jan 1 and more

Beginning January 1 2023 if you buy a qualified previously owned electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you As of January 1 2023 qualifying used EVs priced below 25 000 can qualify for up to 4 000 in federal tax credits There are some terms to note however Used

New Car Review Kia Niro EV The AA

https://www.theaa.ie/wp-content/uploads/2022/11/Kia_Niro_EV_Web_1.jpg

Kia Niro EV Has Finally Arrived Steve Freeman

https://www.stevefreemanonline.com/wp-content/uploads/2022/10/niro-ev4-768x768.jpg

https://www.caranddriver.com/news/g43675128/cars...

We ve gathered every new EV that s currently eligible to earn either the partial 3750 or the full 7500 federal tax credit

https://www.irs.gov/credits-deductions/...

If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Internal Revenue

New Kia Niro EV Offers The Best Range For Your Money CarBuzz

New Car Review Kia Niro EV The AA

How To Calculate Electric Car Tax Credit OsVehicle

Kia Niro EV F retagsleasing Operationell Leasing Unifleet

Does The Kia Niro EV Qualify For Tax Credit Electric Vehicle

Auto Abonnement Kia Niro EV 598 Shortlease

Auto Abonnement Kia Niro EV 598 Shortlease

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Wall Mounted Chargers Tagged Kia Niro EV Mid Range EV OneStop

Best Tires For Kia Niro Rupert kreitlow

Kia Niro Ev Eligible For Federal Tax Credit - All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500