Korea Vat Refund Rate Web 1 Okt 2019 nbsp 0183 32 The foreign corporation should claim a VAT refund for the purchase of goods services during the period from 1 January to 31 December by 30 June of the following year To apply for a VAT refund the amount of VAT to be refunded for 1 calendar year should be more than KRW300 000

Web Learn about South Korea VAT Compliance and Rates Get detailed VAT guidelines and rules for South Korea VAT returns VAT rates and more Web Foreign VAT Refunds Guide from South Korea The following information details the requirements needed to be eligible for a VAT refund in South Korea These include claimable expense types the South Korea VAT rates

Korea Vat Refund Rate

Korea Vat Refund Rate

https://www.icalculator.com/images/south-korea-vat-calculator.png

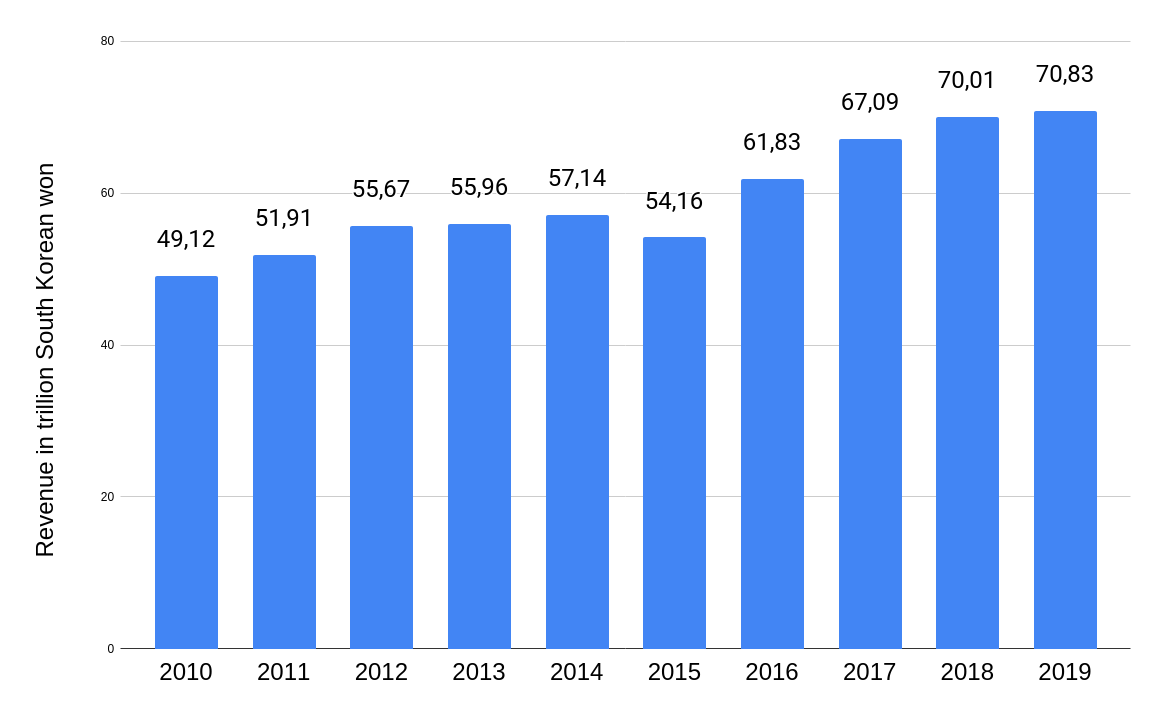

Insight Special Real time Reporting In South Korea Summitto Blog

https://blog.summitto.com/img/VAT_revenue_South_Korea.png#center

VAT Refund Samples INSATAX VAT Value Added Tax Refund Specialists

http://insatax.com/sites/default/files/carousel_images/southkorea.jpg

Web Cash VAT Refund In South Korea VAT refunds can be provided in cash Credit Card VAT Refund In South Korea VAT refunds can be processed as a credit card refund South Korea s main VAT rate is 10 with other rates including 0 that can apply to certain transactions Web 4 Sept 2023 nbsp 0183 32 Value Added Tax VAT in South Korea is an indirect tax imposed on domestic and international transactions It is levied when consumers purchase goods and services The standard VAT rate in South Korea is

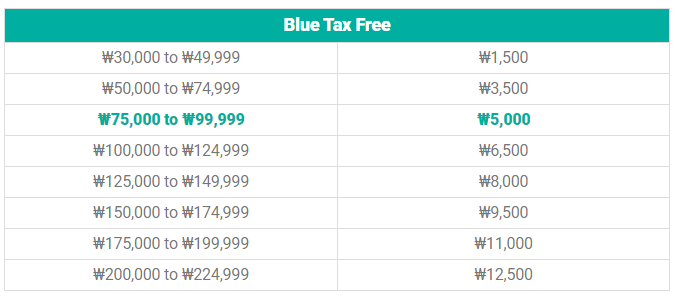

Web Claim goods when departing Immediate Tax Refund Receive an immediate tax refund when purchasing VAT included goods 183 A purchase should be under 500 000 won 183 Total amount of purchases should be under 2 500 000 won for the duration of one trip Check eligibility for Immediate tax refund Tax deducted Payment Claim Goods Mailbox Tax Web The interest rate on the refund of overpaid national taxes or customs duties and deemed rental income from rental deposit on real property is raised from 1 2 to 2 9 per annum reflecting the recent upward trend in market interest rates

Download Korea Vat Refund Rate

More picture related to Korea Vat Refund Rate

Guide To Getting VAT Tax Refunds On Your Shopping In Seoul South Korea

https://i.pinimg.com/originals/55/b4/f0/55b4f0d5355852bdb4e0df59d502c384.png

Full Service Outsourcing Of Korean VAT Invoices Payment Etc Korean

https://koreantaxexpert.com/wp-content/uploads/2019/10/Depositphotos_27464395_xl-2015-1024x595.jpg

Claiming A Tax Refund In Korea A Must Know For Savvy Travelers For

http://early-volcano.flywheelsites.com/wp-content/uploads/2015/08/img_1725.jpg

Web A VAT refund of up to 10 00 of your total expenditures may be refunded for qualifying purchases Regulations on VAT and sales tax refunds vary across countries and by region so be sure to check ahead before expecting a Korea VAT refund Korea VAT Law For Businesses and Merchants Web 01 Jan 2022 5 min read This tax guide provides an overview of the indirect tax system and rules to be aware of for doing business in South Korea Indirect tax snapshot Please click on each section to expand further What is the principal indirect tax Is there a

Web Process and Documentation A VAT refund may be applied for until the 30th of June for the preceding year with a minimum eligible VAT amount of KRW 300 000 For a successful application foreign companies must provide legally appropriate evidence for all incurred expenses in Korea Web 27 Juni 2023 nbsp 0183 32 Value added tax VAT VAT is levied at a rate of 10 on the supply of goods and services except zero rated VAT on certain supply of goods and services e g goods for exportation certain eligible services rendered to non residents earning foreign currency international transportation service by ships and aircraft and exemption on

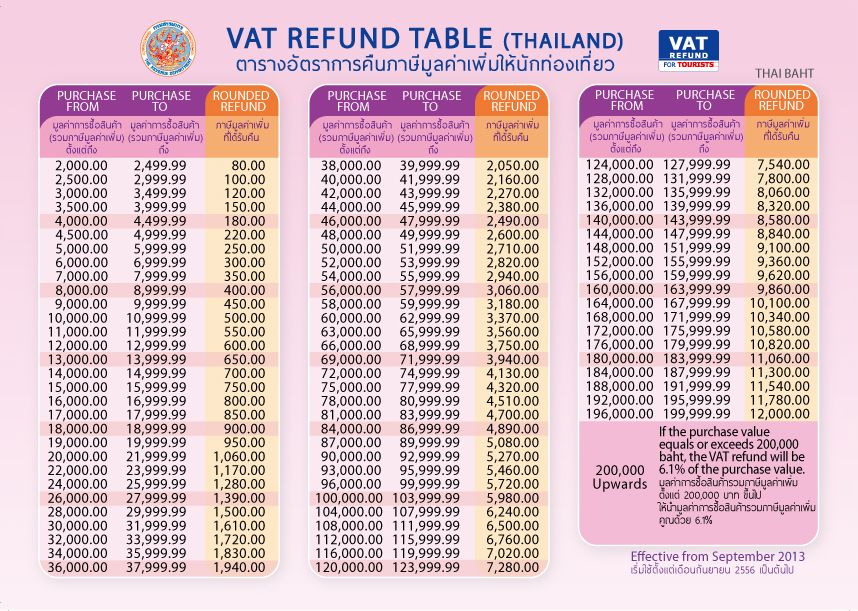

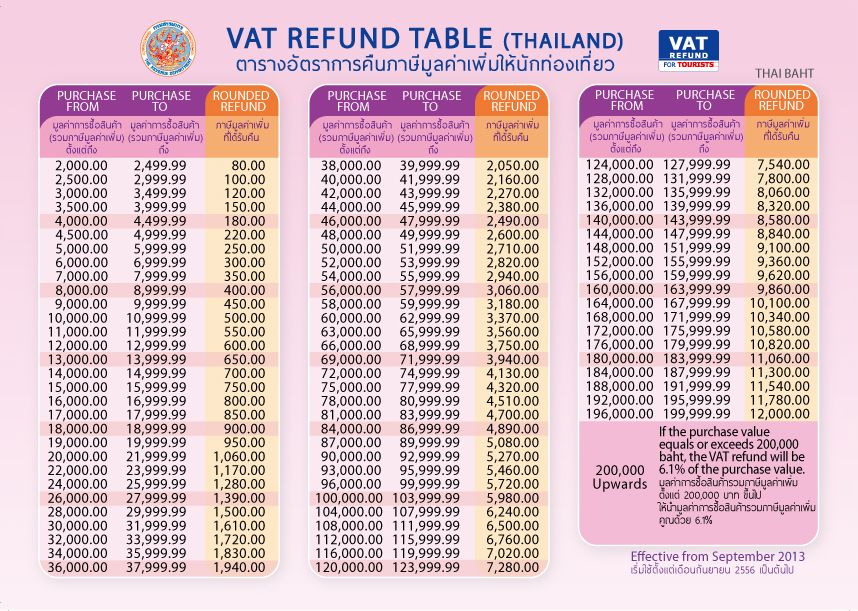

Vat Refund Calculator StormTallulah

https://www.rd.go.th/fileadmin/user_upload/kortor/images/Vat-Refund-Sheet1.jpg

Catatan I Am Nieta Cara Claim Tax VAT Di Korea Selatan Refund

https://4.bp.blogspot.com/-yYQT4gm5b2w/WoYjn5aDPMI/AAAAAAAAb3E/Rj7wA1dY3qkDUEeXgomrmm40rUxJUhlYwCLcBGAs/s1600/IMG_9063.JPG

https://kpmg.com/xx/en/home/insights/2019/10/korea-republic-of...

Web 1 Okt 2019 nbsp 0183 32 The foreign corporation should claim a VAT refund for the purchase of goods services during the period from 1 January to 31 December by 30 June of the following year To apply for a VAT refund the amount of VAT to be refunded for 1 calendar year should be more than KRW300 000

https://www.avalara.com/.../south-korea-vat-compliance-and-rates.…

Web Learn about South Korea VAT Compliance and Rates Get detailed VAT guidelines and rules for South Korea VAT returns VAT rates and more

Issuing Tax Invoice In Korea

Vat Refund Calculator StormTallulah

Small Saving How To Get Tax Refund Is South Korea

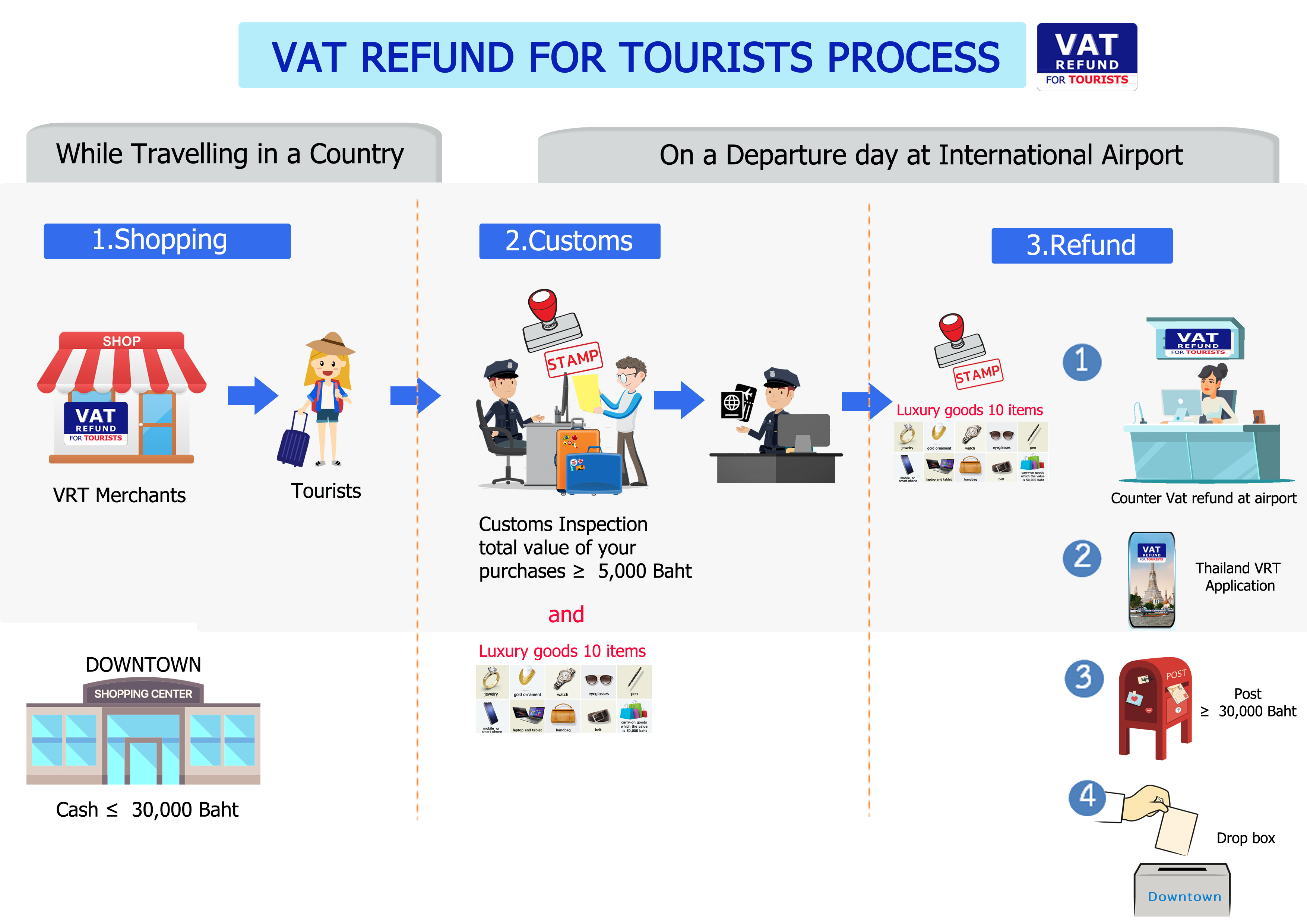

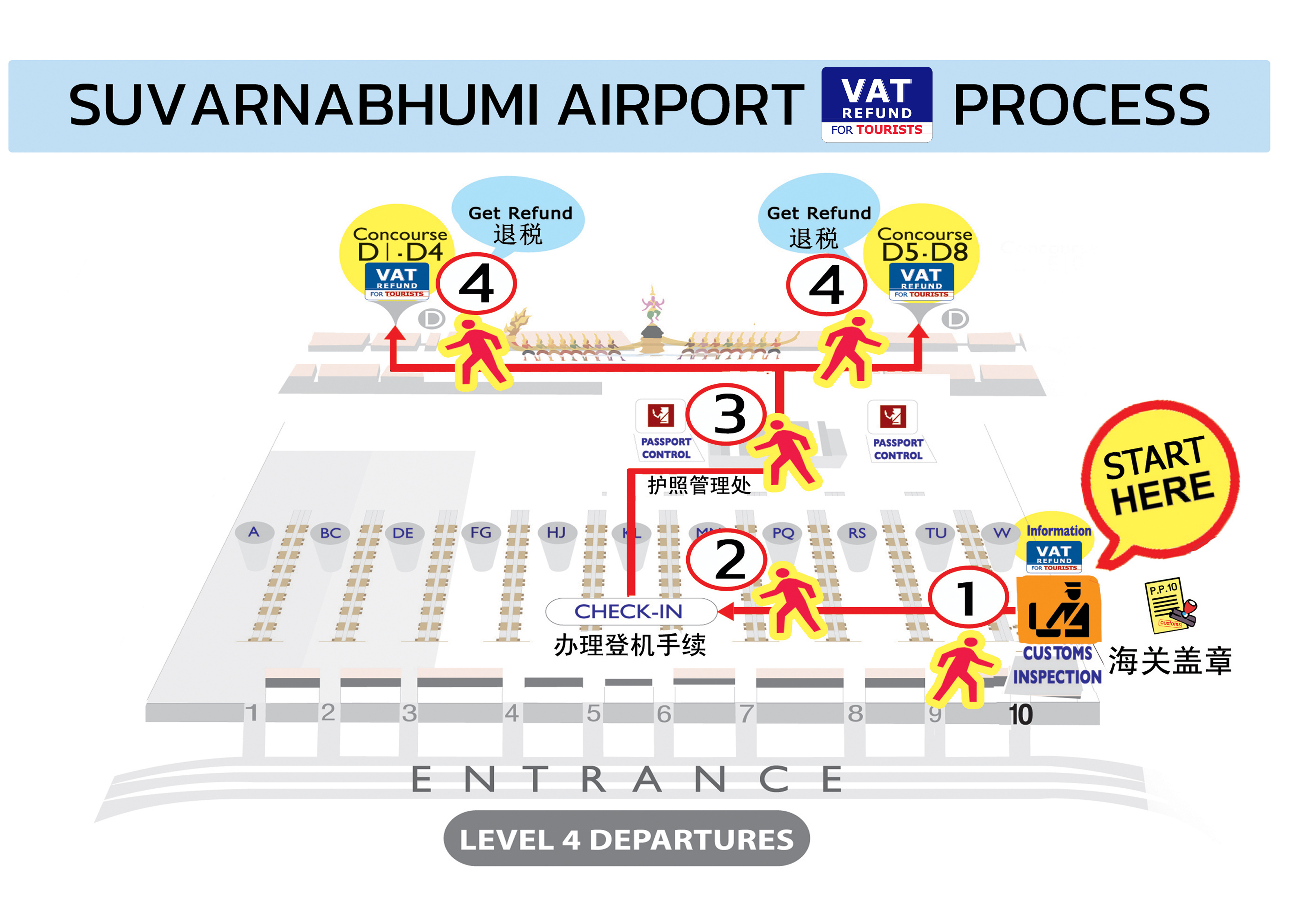

VAT Refund For Tourists Process

Korea VAT Number Archives Company Formation Korea

South Korea VAT On Non resident Digital Services Vatcalc

South Korea VAT On Non resident Digital Services Vatcalc

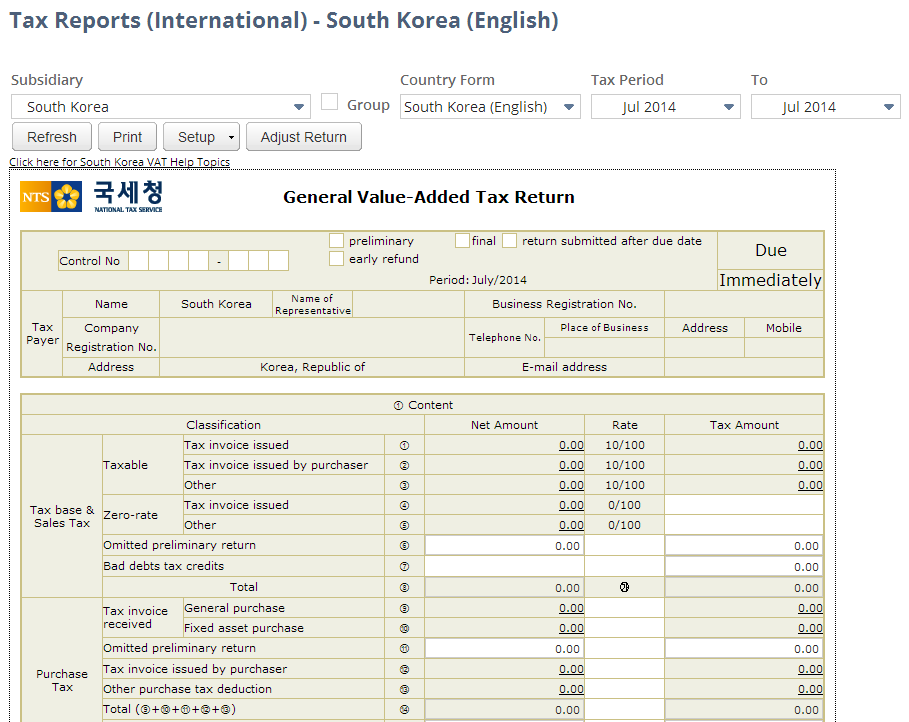

NetSuite Applications Suite South Korea VAT Report

VAT Refund For Tourists Process

VAT Taxback Visa

Korea Vat Refund Rate - Web 4 Sept 2023 nbsp 0183 32 Value Added Tax VAT in South Korea is an indirect tax imposed on domestic and international transactions It is levied when consumers purchase goods and services The standard VAT rate in South Korea is