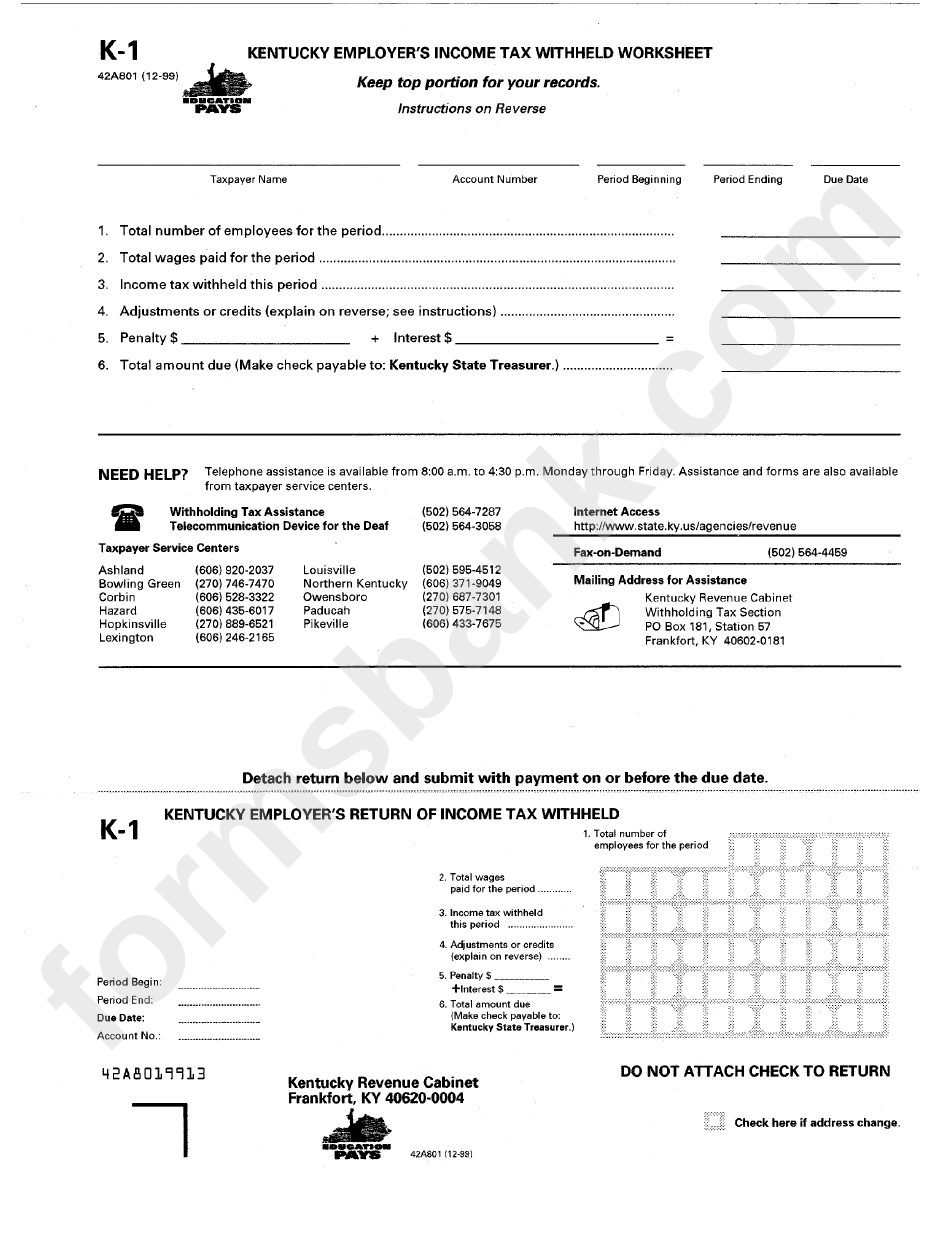

Ky State Tax Withholding Calculator DOR has created a withholding tax calculator to assist employers in computing the correct amount of Kentucky withholding tax for employees The

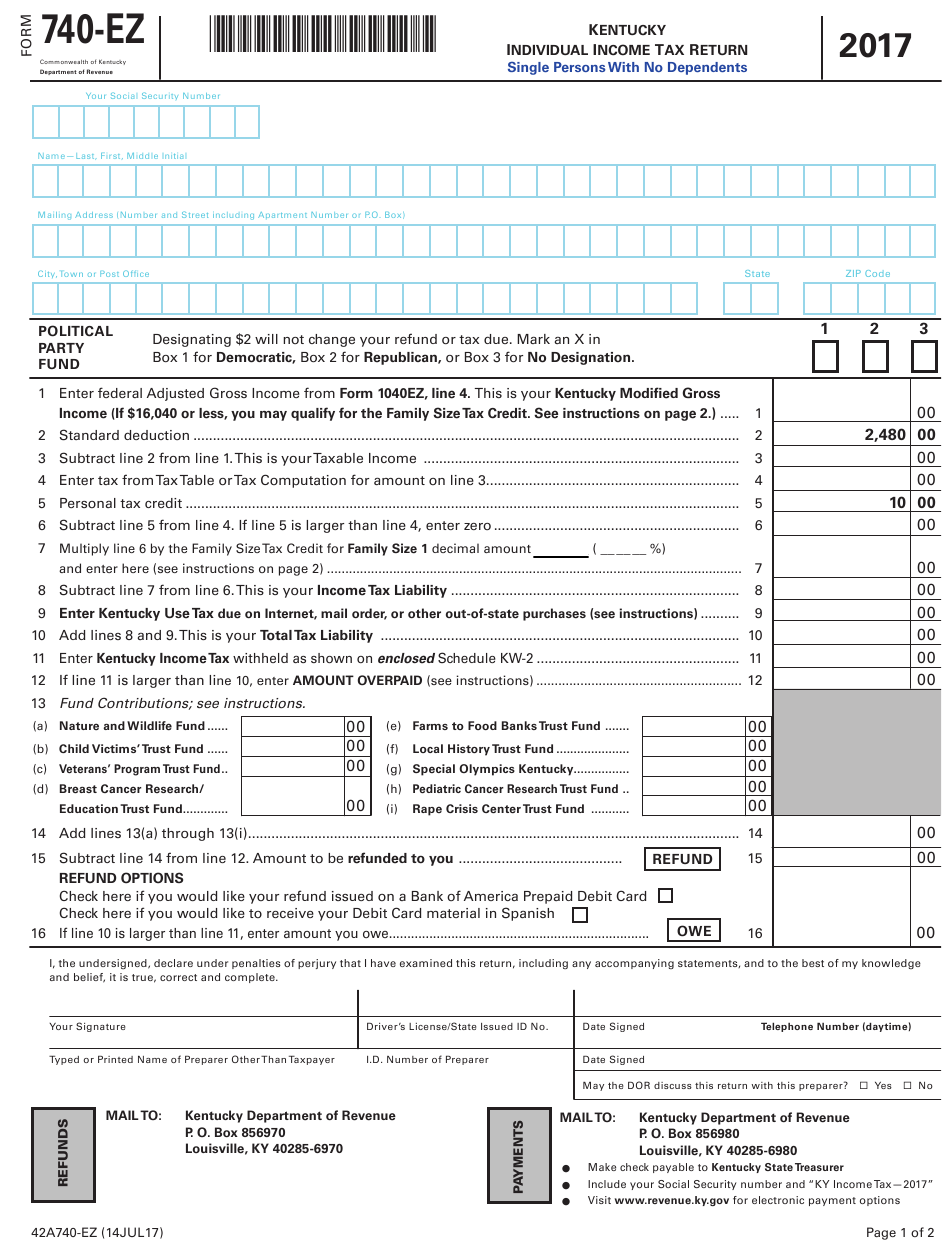

The state income tax rate is 4 5 regardless of income or filing status Prior to 2018 the state had rates ranging from 2 to 6 To calculate taxes owed Kentucky Income Tax Calculator 2023 2024 If you make 70 000 a year living in Kentucky you will be taxed 10 985 Your average tax rate is 10 94 and your

Ky State Tax Withholding Calculator

Ky State Tax Withholding Calculator

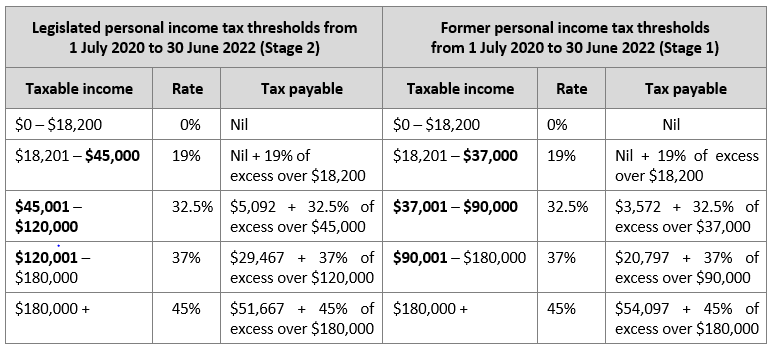

https://www.withholdingform.com/wp-content/uploads/2022/08/tax-rate-changes-starting-now-initiative-chartered-accountants.png

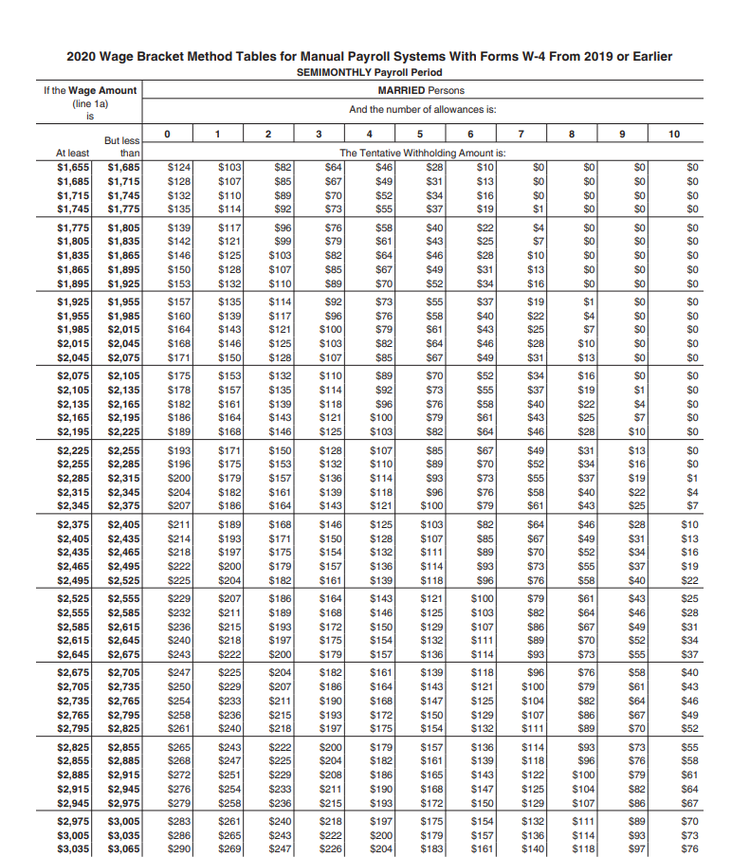

Tax Withholding Calculator 2020 MarieBryanni

https://m.foolcdn.com/media/affiliates/images/PayrollTaxes-01-IRSWithholdingTable_7CWWk0h.width-750.png

Payroll Tax Withholding Calculator 2023 SallieJersey

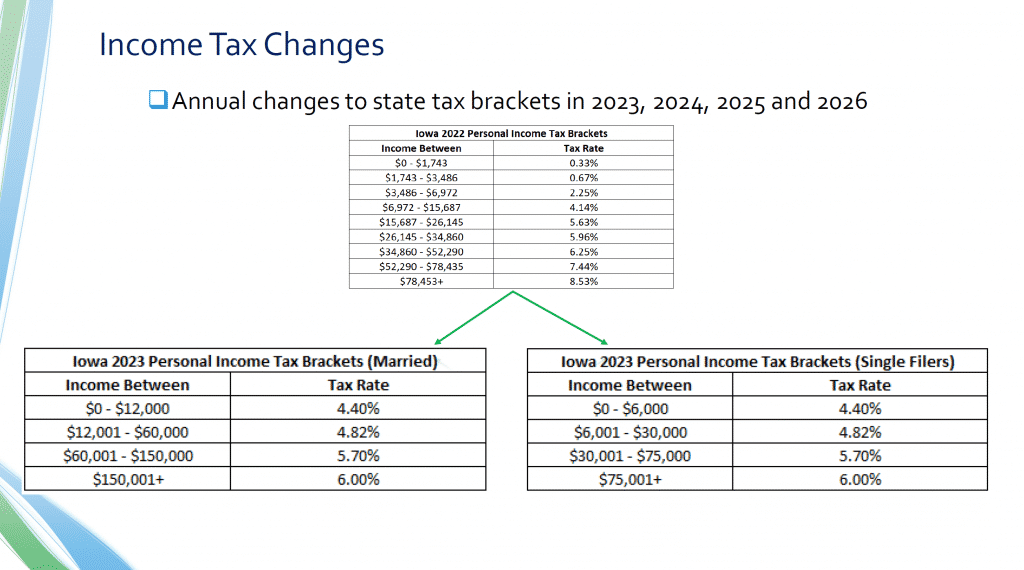

https://arnoldmotewealthmanagement.com/wp-content/uploads/2022/05/02-Iowa-2023-income-tax-bracket-1024x570.png

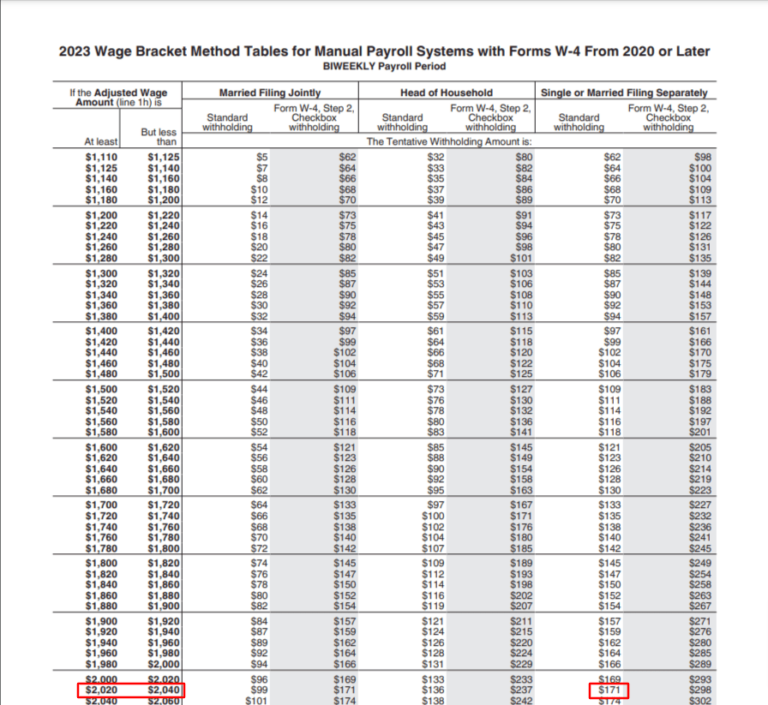

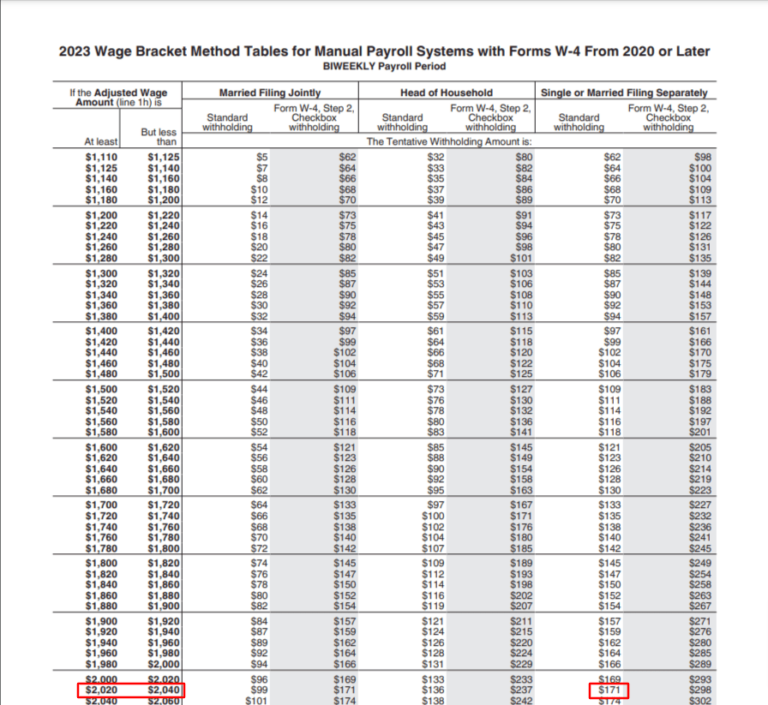

Kentucky Paycheck Calculator For Salary Hourly Payment 2023 Curious to know how much taxes and other deductions will reduce your paycheck Use our paycheck tax Calculate Any Pre Tax Withholdings If your employees contribute to HSA 401 k or other pre tax withholdings deduct the appropriate amount from their gross

Use ADP s Kentucky Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees Just enter the wages tax withholdings and other Check out PaycheckCity for Kentucky paycheck calculators withholding calculators tax calculators payroll information and more Free for personal use

Download Ky State Tax Withholding Calculator

More picture related to Ky State Tax Withholding Calculator

2022 Ga Tax Withholding Form WithholdingForm

https://i0.wp.com/www.withholdingform.com/wp-content/uploads/2022/08/tax-calculator-atotaxrates-info.jpg

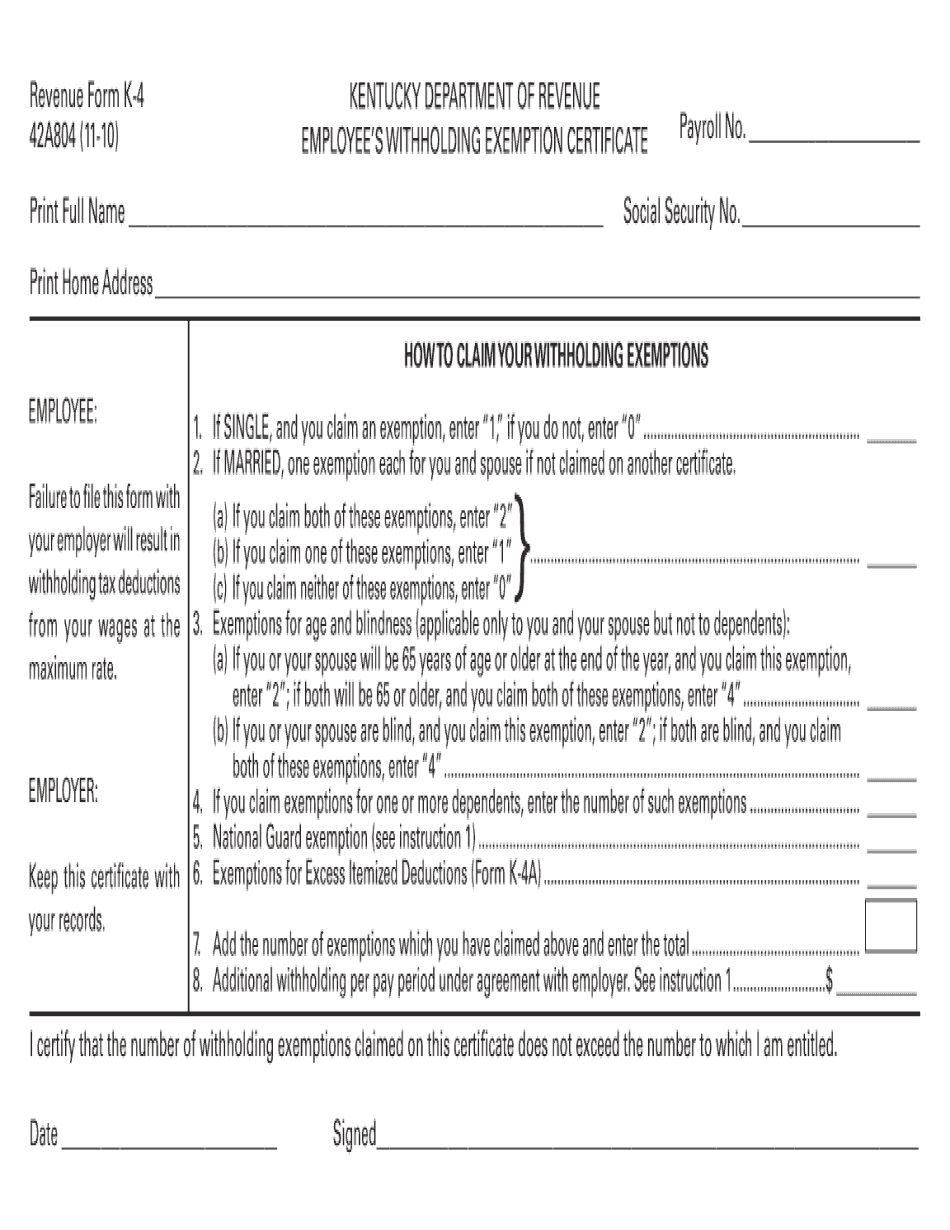

Ky State Income Tax Withholding Form WithholdingForm

https://www.withholdingform.com/wp-content/uploads/2022/10/form-k-1-kentucky-employer-s-return-of-income-tax-withheld-printable.png

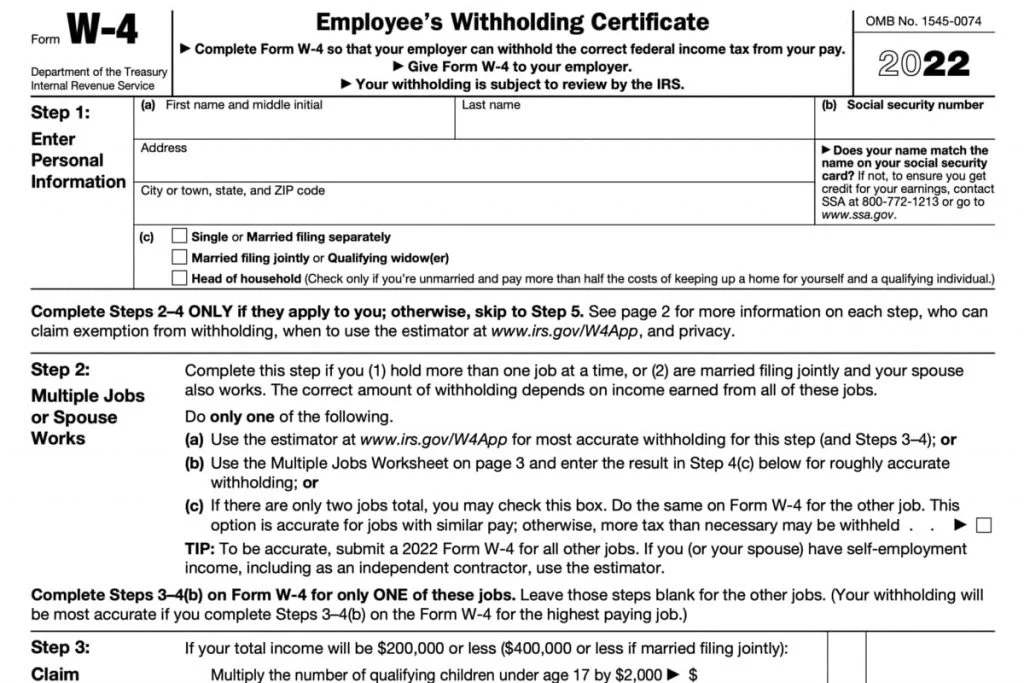

W4 Form 2024 Withholding Adjustment W 4 Forms TaxUni

https://www.taxuni.com/wp-content/uploads/2022/04/W4-Form-2022-Withholding-Tax-Adjustment-1024x683.jpg

Kentucky Salary Tax Calculator for the Tax Year 2023 24 You are able to use our Kentucky State Tax Calculator to calculate your total tax costs in the tax year Use Gusto s hourly paycheck calculator to determine withholdings and calculate take home pay for your hourly employees in Kentucky Simply enter their federal and state

To pay these taxes you ll log into these accounts For state withholding payments are due either twice monthly or monthly depending on the amount withheld This will result in less federal income tax withheld from your paycheck In Kentucky the income tax is a flat rate of 5 There is no state payroll tax or local

Arkansas Withholding Tax Formula 2023 Printable Forms Free Online

https://www.patriotsoftware.com/wp-content/uploads/2022/12/2023-Publication-15-T-1-768x705.png

Ca Withholding Tax Tables 2017 Awesome Home

https://i1.wp.com/calchamberalert.com/wp-content/uploads/114.jpg?resize=665%2C521

https://revenue.ky.gov/Business/Pages/Employer...

DOR has created a withholding tax calculator to assist employers in computing the correct amount of Kentucky withholding tax for employees The

https://smartasset.com/taxes/kentucky-tax-calculator

The state income tax rate is 4 5 regardless of income or filing status Prior to 2018 the state had rates ranging from 2 to 6 To calculate taxes owed

Printable Income Tax Forms Printable Forms Free Online

Arkansas Withholding Tax Formula 2023 Printable Forms Free Online

Printable Kentucky State Tax Forms Printable World Holiday

2023 Payroll Withholding Calculator LesleyMehek

Texas Withholding Tables Federal Withholding Tables 2021

Federal Income Tax Withholding Calculator Tax Withholding Estimator

Federal Income Tax Withholding Calculator Tax Withholding Estimator

State Of Arizona Withholding Calculator TheMarketatdelval

Test Your Knowledge Of The IRS Tax Withholding Estimator BDS

IRS RELEASES NEW FORM W 4 AND ONLINE WITHHOLDING CALCULATOR Personal

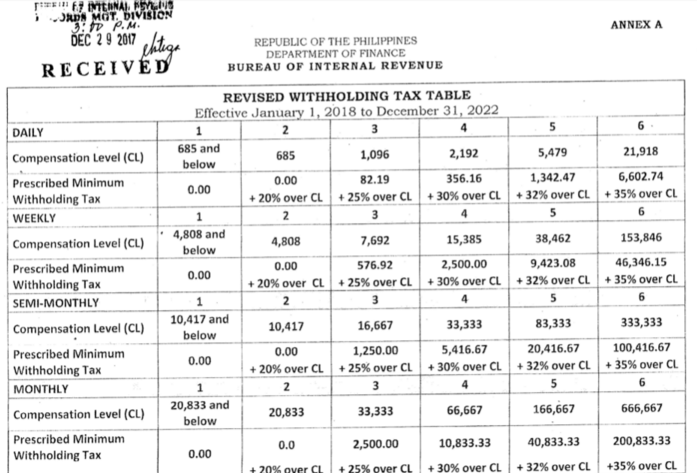

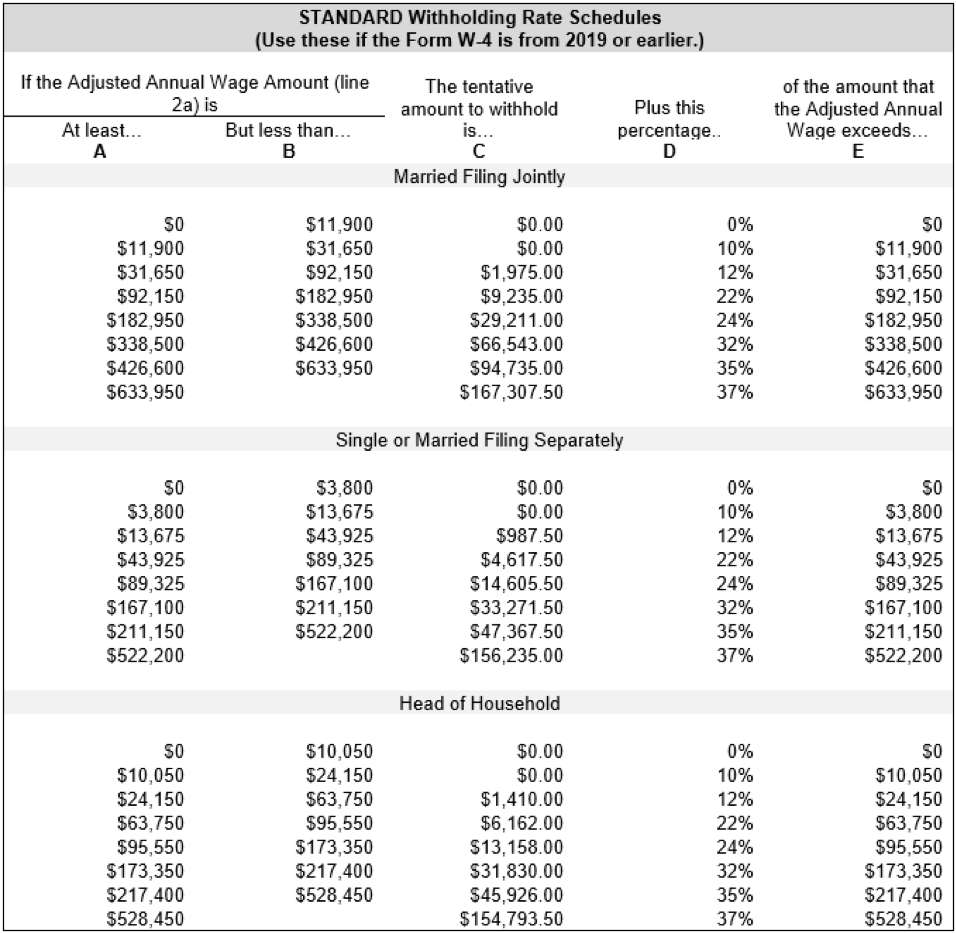

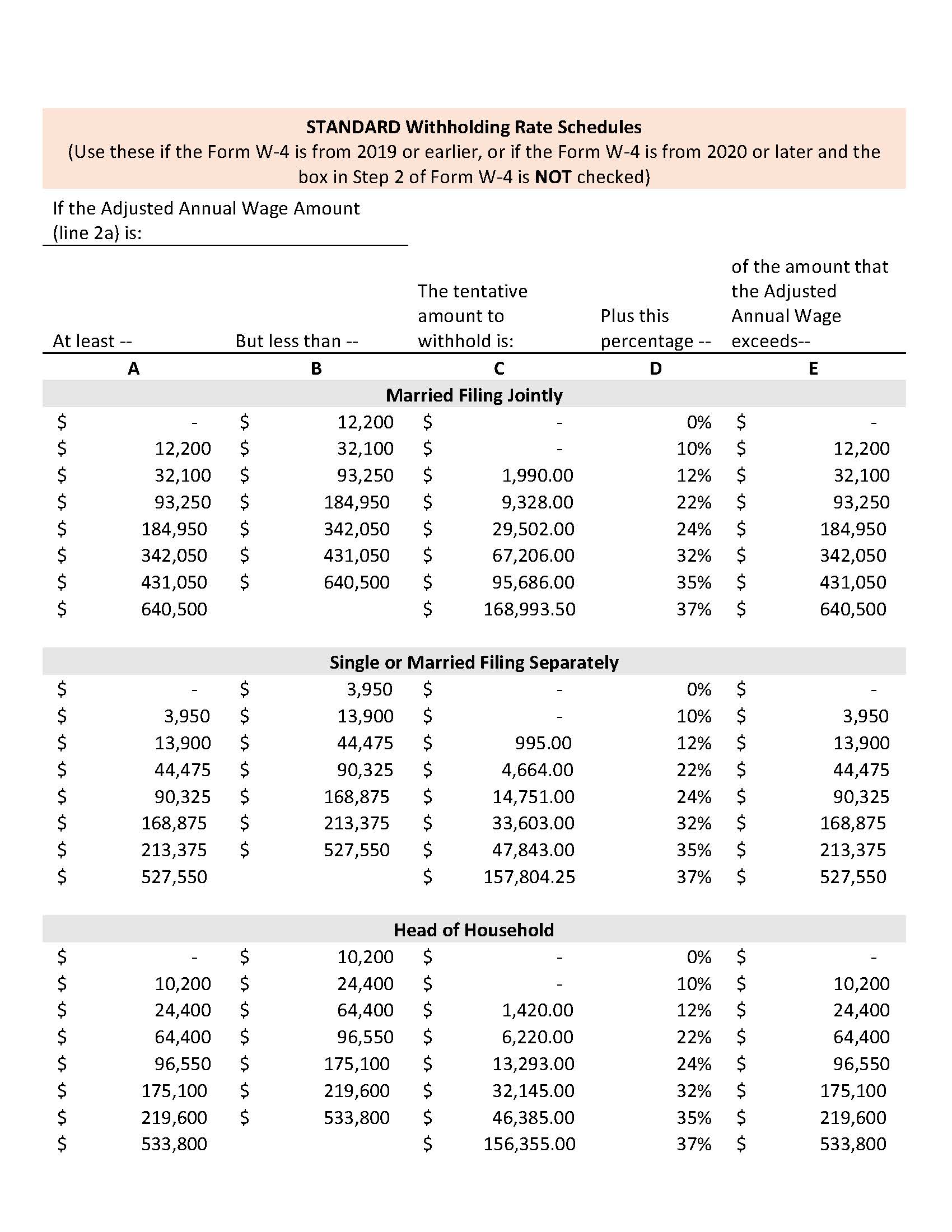

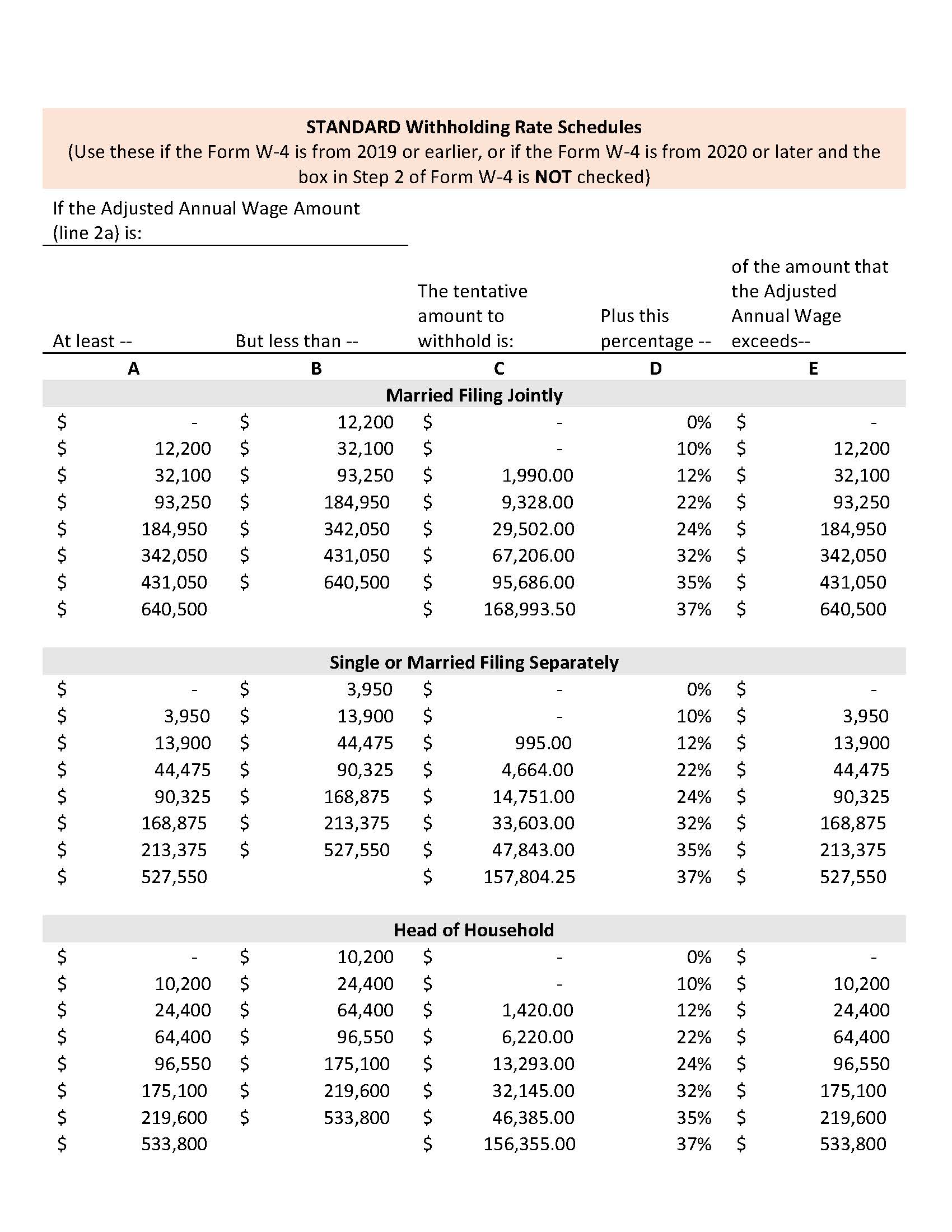

Ky State Tax Withholding Calculator - The state income tax rate in Kentucky is 5 while federal income tax rates range from 10 to 37 depending on your income This paycheck calculator can help