Plug In Rebate Tax Form Web 10 janv 2023 nbsp 0183 32 Use Form 8936 to figure your credit for qualified plug in electric drive motor vehicles you placed in service during your tax year Also use Form 8936 to figure your

Web 26 juin 2023 nbsp 0183 32 If you purchased a qualifying plug in EV or clean vehicle during the required timeframes either after December 31 2009 through December 31 2022 or January 1 Web 25 f 233 vr 2023 nbsp 0183 32 Form 8936 is an IRS form for claiming the Qualified Plug in Electric Drive Motor Vehicle Credit on an individual s tax return Taxpayers may use Form 8936

Plug In Rebate Tax Form

Plug In Rebate Tax Form

https://www.pdffiller.com/preview/101/482/101482549/large.png

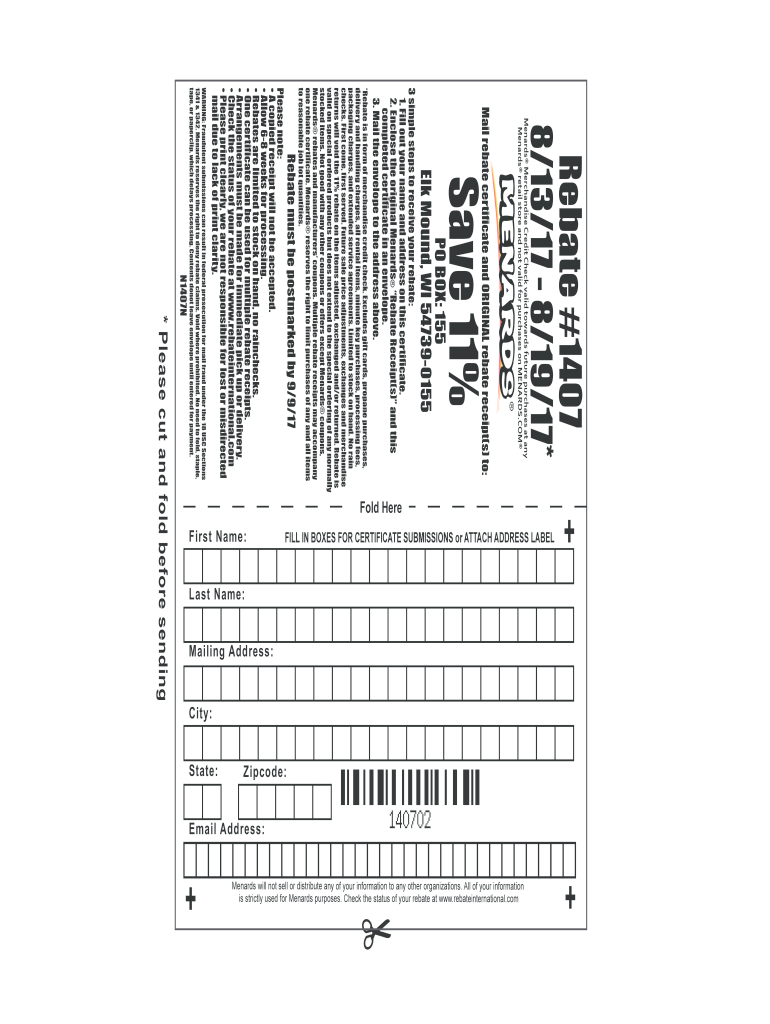

Property Tax Rebate Application Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/140/1407/140793/page_1_bg.png

Tulsa Sales Tax Rebate Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/27/773/27773189/large.png

Web Instructions for Form 8936 Department of the Treasury Internal Revenue Service Rev January 2023 Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

Web Federal Tax Credits for Plug in Electric and Fuel Cell Electric Vehicles Purchased in 2023 or After Federal Tax Credit Up To 7 500 All electric plug in hybrid and fuel cell electric Web If you place in service a new plug in electric vehicle EV or fuel cell vehicle FCV in 2023 or after you may qualify for a clean vehicle tax credit Find information on credits for used

Download Plug In Rebate Tax Form

More picture related to Plug In Rebate Tax Form

How Do I Claim The Recovery Rebate Credit On My Ta

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/e3d7f0ce-2b70-4164-b921-f7ef2ca8a52f.default.png

Working From Home Tax Rebate Form 2022 Printable Rebate Form

https://www.printablerebateform.com/wp-content/uploads/2021/07/Work-from-Home-Tax-Rebate-Form-2021.jpg

P G And E Ev Rebate Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/08/PG-Rebate-Form-2021.jpg

Web 1 janv 2023 nbsp 0183 32 Pre owned all electric plug in hybrid and fuel cell electric vehicles purchased after December 31 2022 may be eligible for a federal tax credit of up to 4 000 Save Web 17 ao 251 t 2022 nbsp 0183 32 All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount

Web The bill would have turned the tax credit into a rebate worth up to US 7 500 for plug in electric vehicles and also would have provided businesses with a tax credit for Web As of 2023 preowned plug in electric and fuel cell EVs qualify for a credit of up to 30 of their purchase price maxing out at 4 000 The used EV tax credit can only be claimed

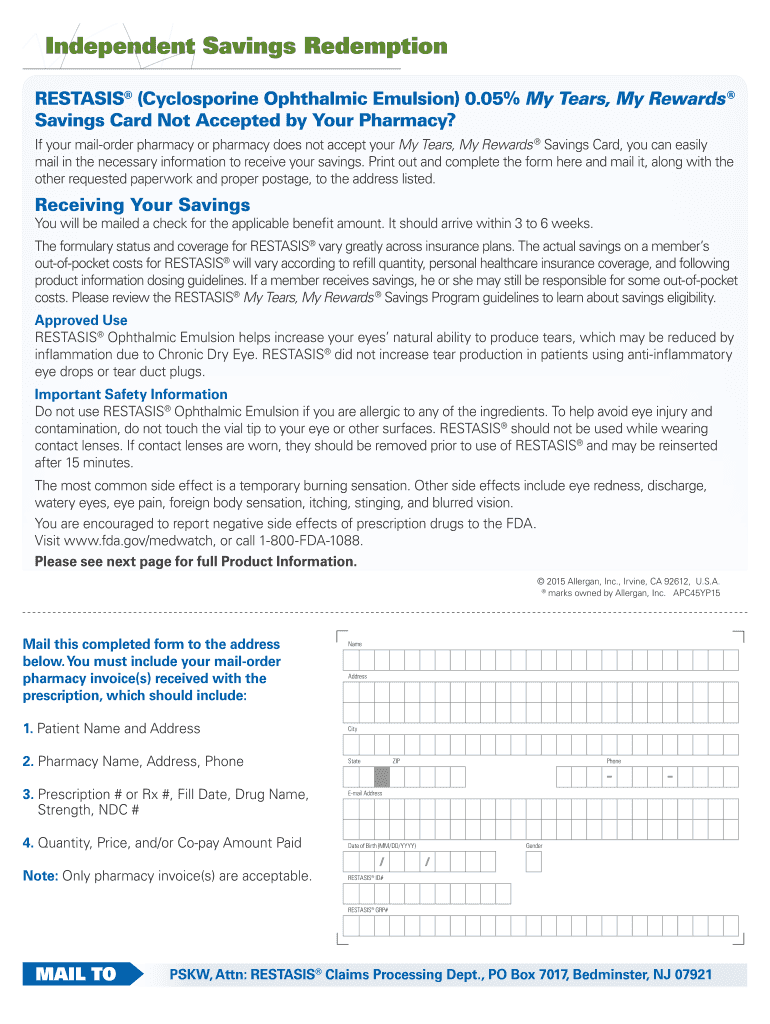

Mo Crp Form 2018 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/536/237/536237227/large.png

Recovery Rebate Credit Line 30 Form 1040 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021-768x767.jpg

https://www.irs.gov/forms-pubs/about-form-8936

Web 10 janv 2023 nbsp 0183 32 Use Form 8936 to figure your credit for qualified plug in electric drive motor vehicles you placed in service during your tax year Also use Form 8936 to figure your

https://turbotax.intuit.com/tax-tips/going-green/filing-tax-form-8936...

Web 26 juin 2023 nbsp 0183 32 If you purchased a qualifying plug in EV or clean vehicle during the required timeframes either after December 31 2009 through December 31 2022 or January 1

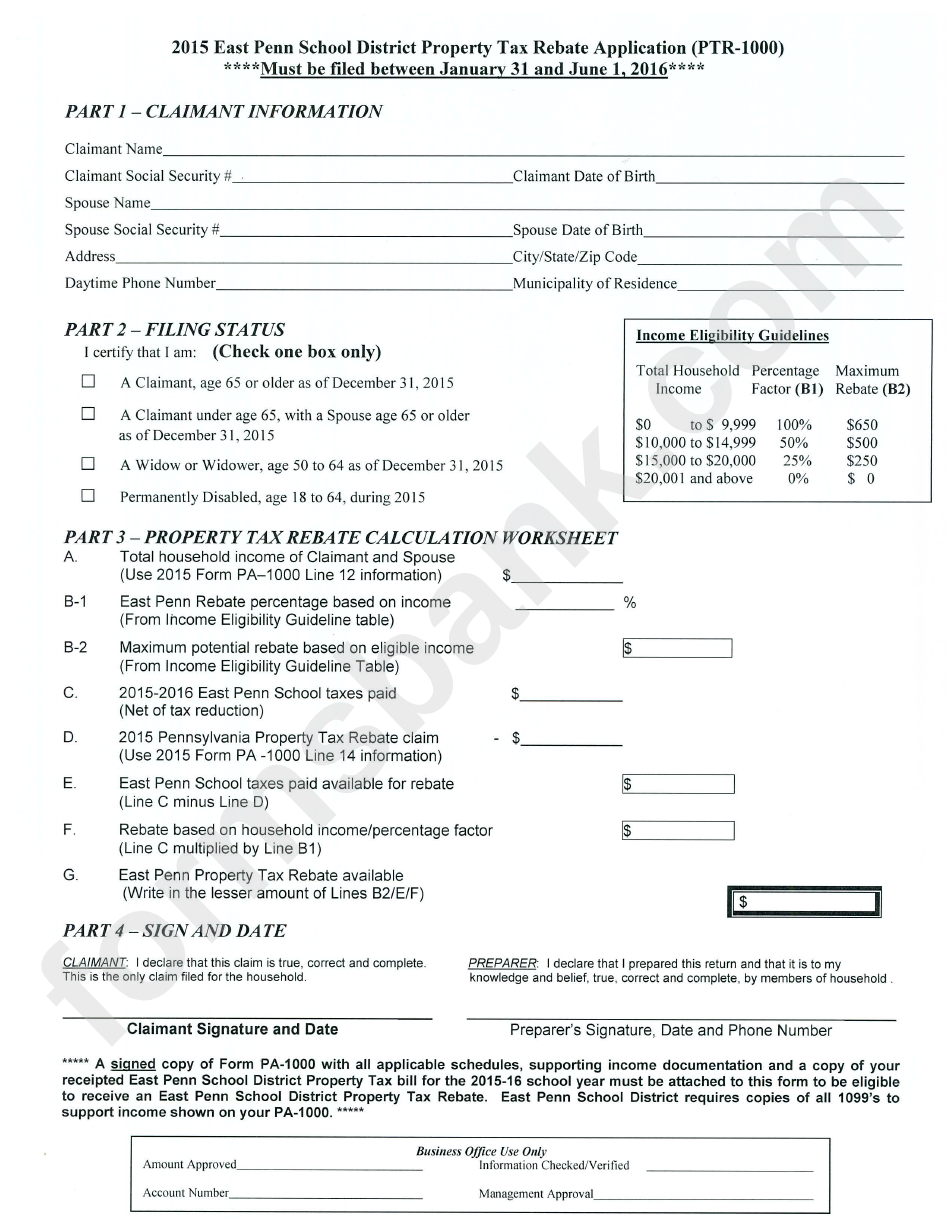

Ouc Rebates Pdf Fill And Sign Printable Template Online US Legal Forms

Mo Crp Form 2018 Fill Out Sign Online DocHub

What Is The Recovery Rebate Credit CD Tax Financial

Rebate Form Fill And Sign Printable Template Online US Legal Forms

Government Rebate Program Fill Out Sign Online DocHub

Top Mass Save Rebate Form Templates Free To Download In PDF Format

Top Mass Save Rebate Form Templates Free To Download In PDF Format

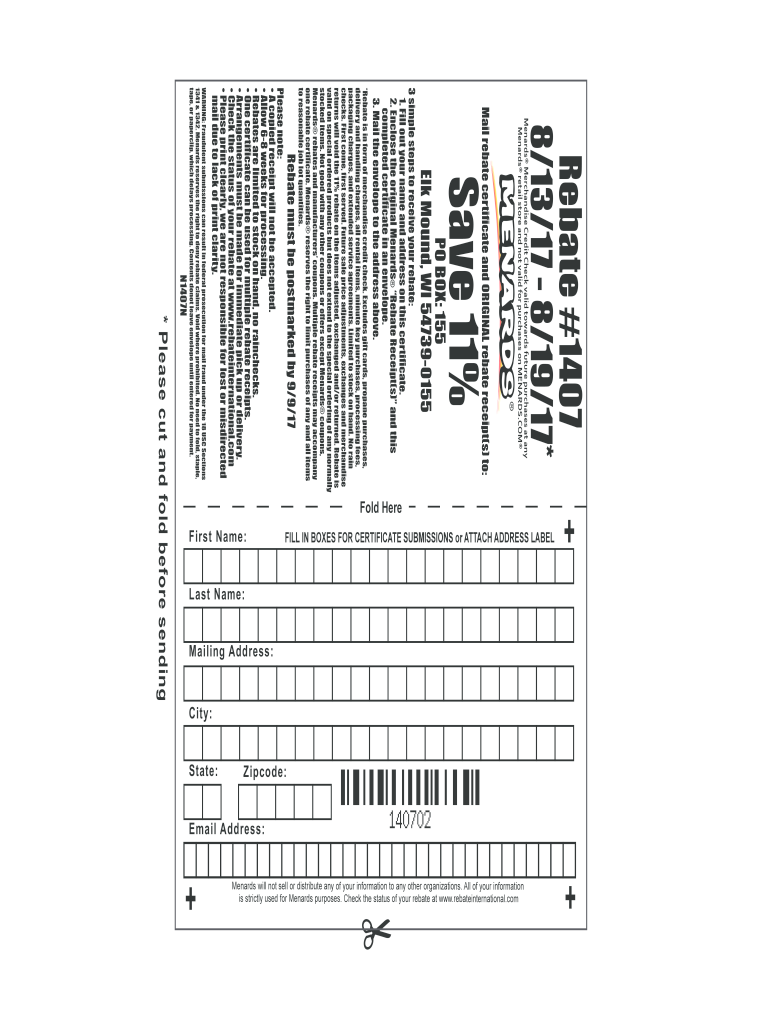

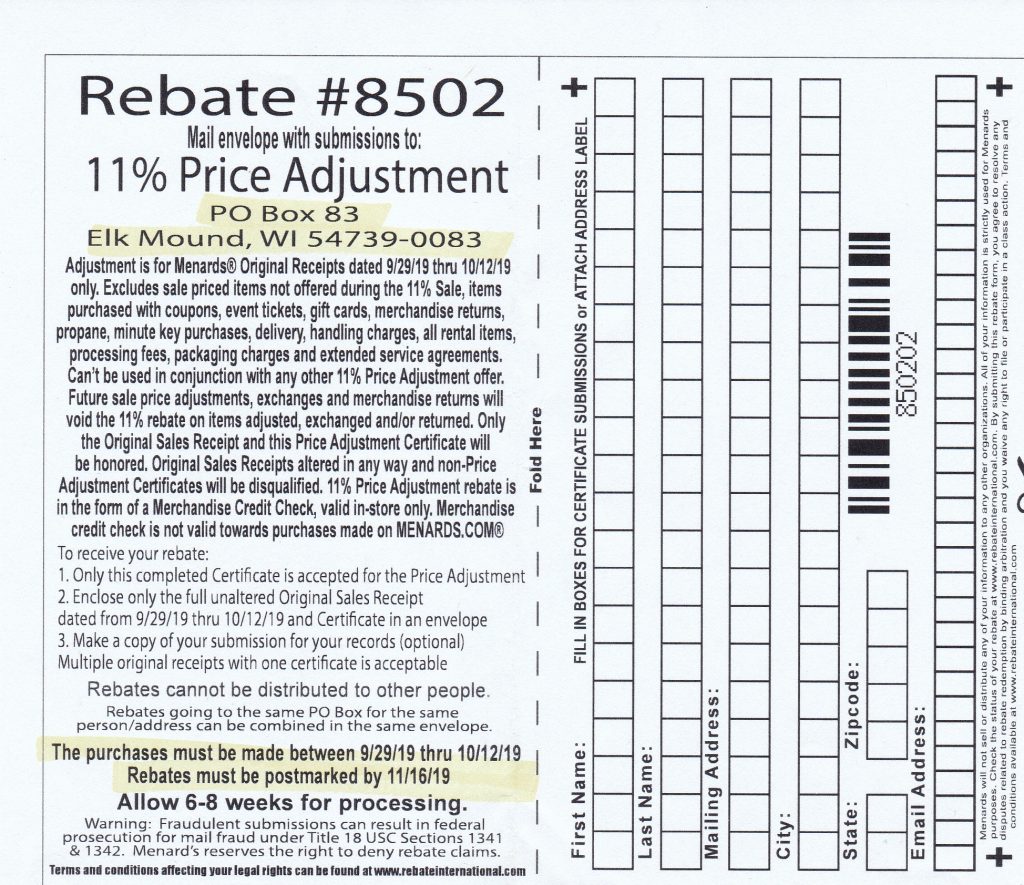

Menards 11 Price Adjustment Rebate 8502 Purchases 9 29 19 10 12 19

Printable Old Style Rebate Form Printable Forms Free Online

Ptr Tax Rebate Libracha

Plug In Rebate Tax Form - Web 17 avr 2023 nbsp 0183 32 The Inflation Reduction Act of 2022 changed which new fully electric and plug in hybrid vehicles were eligible for federal tax credits starting on April 18 2023