Ky Tax Rebate 2024 FRANKFORT Ky September 1 2023 Each year the Kentucky Department of Revenue calculates the individual standard deduction in accordance with KRS 141 081 After adjusting for inflation the standard deduction for 2024 is 3 160 an increase of 180

When does the IRS process and refund tax returns The IRS is set to commence accepting and processing tax returns on January 29 initiating the eagerly awaited tax season Reports from the agency indicate that over 90 of refunds are issued within 21 days offering the possibility of quick refunds for prompt filers Here s when KY and IRS start accepting 2023 federal and state tax returns and how soon you can get your 2024 refund Plus tax day deadlines When does Kentucky start processing tax returns

Ky Tax Rebate 2024

Ky Tax Rebate 2024

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate-1024x576.jpg

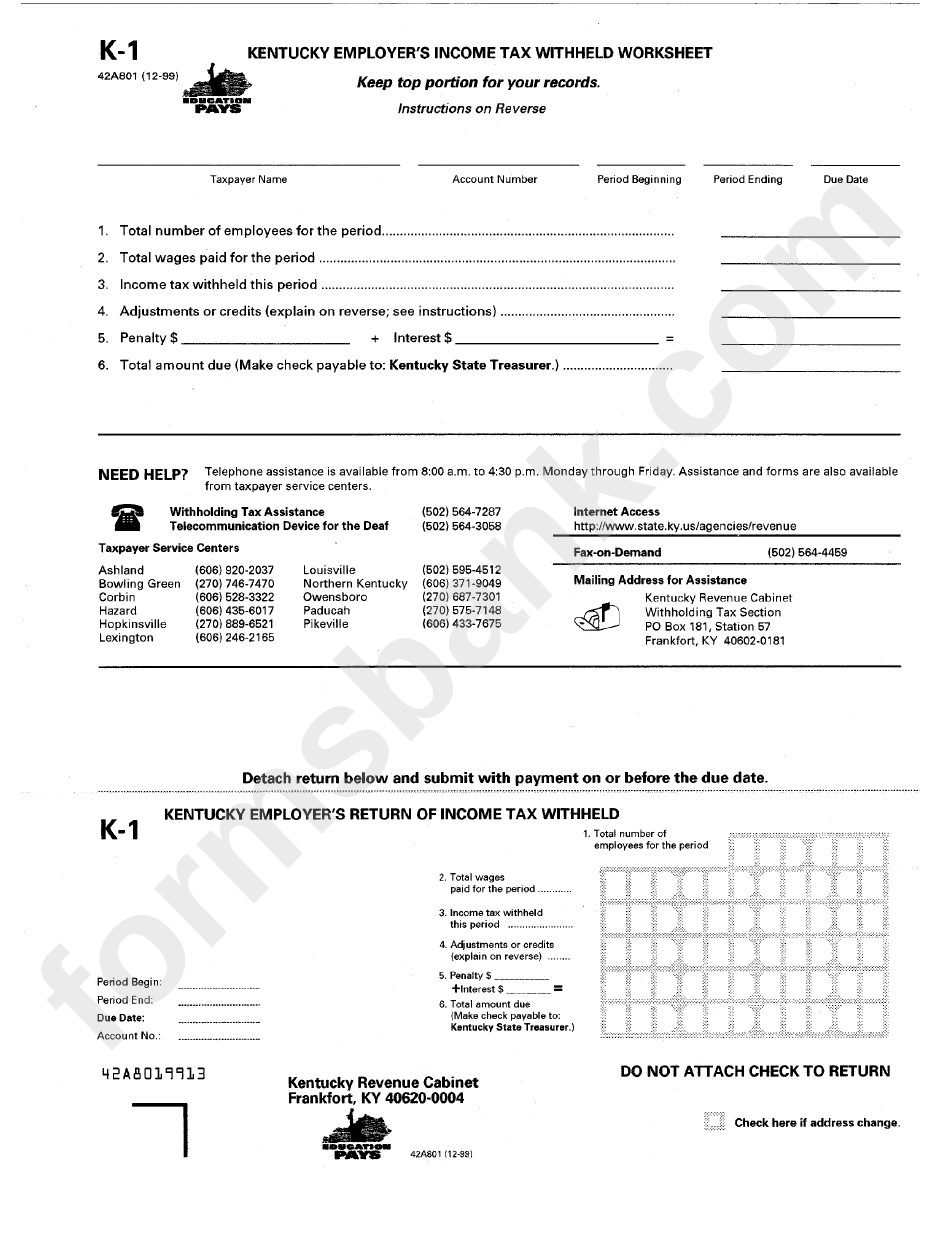

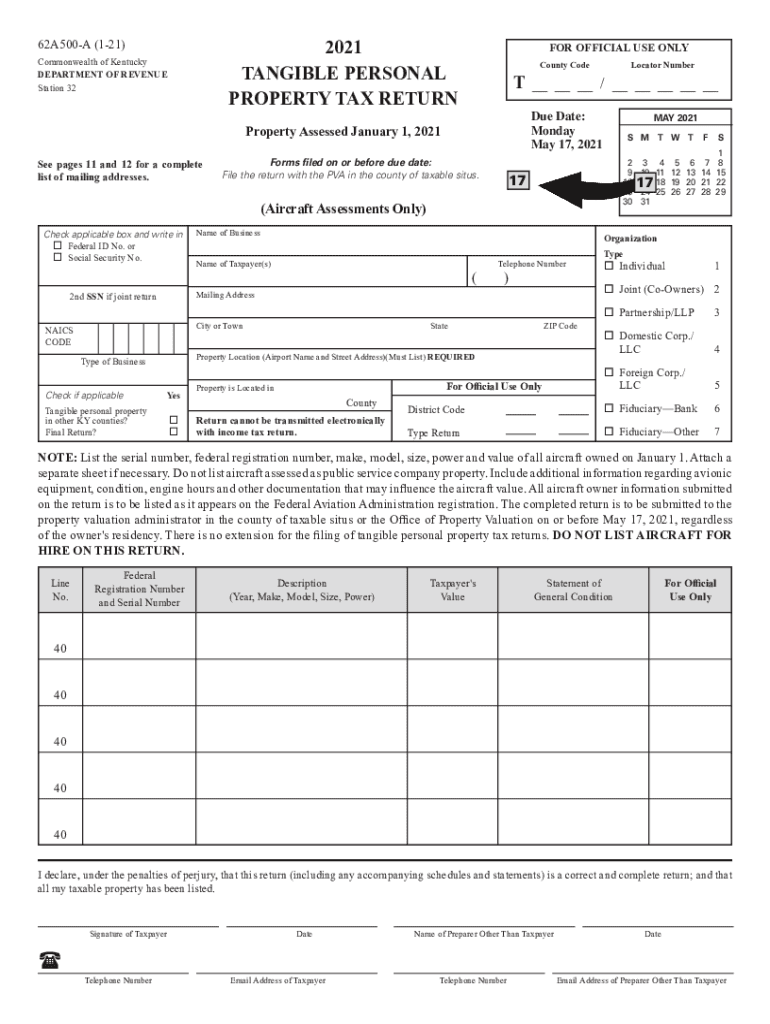

Ky Tangible Property Tax Return 2021 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/539/994/539994227/large.png

HMRC Paid My Tax Rebate Into Someone Else s Bank Account Consumer Affairs The Guardian

https://i.guim.co.uk/img/media/d6b4235d7c4d4e3715bcf9e3786605d2554b014b/575_1246_4591_2754/master/4591.jpg?width=445&quality=45&auto=format&fit=max&dpr=2&s=86afad64dcb566da22db6377996e0dcd

Welcome Department of Revenue News Press Releases Publications Tax Interest Rate Update for 1 1 24 DOR Announces Updates to Individual Income Tax for 2024 Tax Year June 2023 Sales Tax Facts with Guidance Updates Now Available Pre Register for PVA Special Examination for Franklin and Graves Counties January stimulus check 2024 update If you received one of those special state rebate payments sometimes called stimulus checks last year there s some news from the IRS that you need to

When are taxes due in Kentucky 2024 The federal deadline is April 15 The IRS expects more than 128 7 million individual tax returns to be filed by that date officials said FRANKFORT Ky AP The Kentucky Senate passed a bill Monday that would tap into the state s massive revenue surpluses to deliver more than 1 billion in income tax rebates to taxpayers The measure cleared the Senate on a 28 7 vote just days after being unveiled

Download Ky Tax Rebate 2024

More picture related to Ky Tax Rebate 2024

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A-1024x536.jpg

AlconChoice Rebate Form How To Qualify And Fill Out Printable Rebate Form

http://printablerebateform.net/wp-content/uploads/2023/01/Alcon-Rebate-Form-2023.png

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

https://www.moneymgmnt.com/wp-content/uploads/tax-rebate-thailand-2023-1024x565.png

We estimate on a conventional basis the tax deal would be roughly revenue neutral raising about 40 million from 2024 through 2033 The revenue losses from retroactively changing bonus depreciation R D expensing the interest limitation and the child tax credit amount to 110 billion and are reflected in 2024 in the table below because that is when tax revenues would change Check Refund Status Online Current Year Original Only Enter the primary social security number on your Kentucky tax return Enter the exact refund amount shown on your Kentucky tax return in whole dollars only To obtain a previous year s refund status please call 502 564 4581 to speak to an examiner

Flexible Income Lookback Taxpayers can choose to use either current or prior year income to calculate the child tax credit in 2024 and 2025 providing flexibility in determining eligibility Inflation Adjustment Starting in 2024 the child tax credit will be adjusted for inflation to keep up with the rising cost of living Business tax relief How much is the child tax credit in 2024 The maximum tax credit available per child is 2 000 for each child under 17 on Dec 31 2023 Only a portion is refundable this year up to 1 600 per child

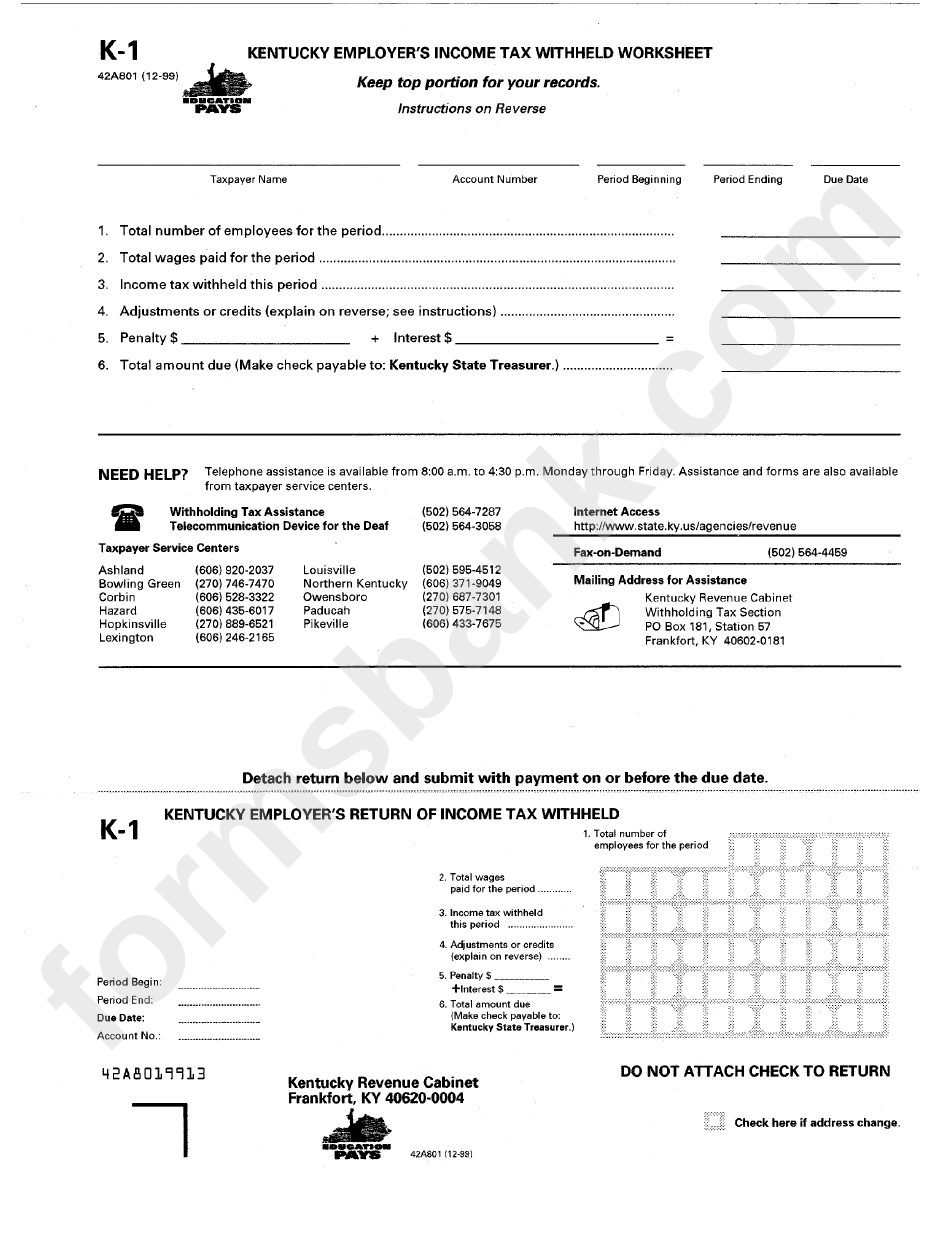

Ky State Income Tax Withholding Form WithholdingForm

https://www.withholdingform.com/wp-content/uploads/2022/10/form-k-1-kentucky-employer-s-return-of-income-tax-withheld-printable.png

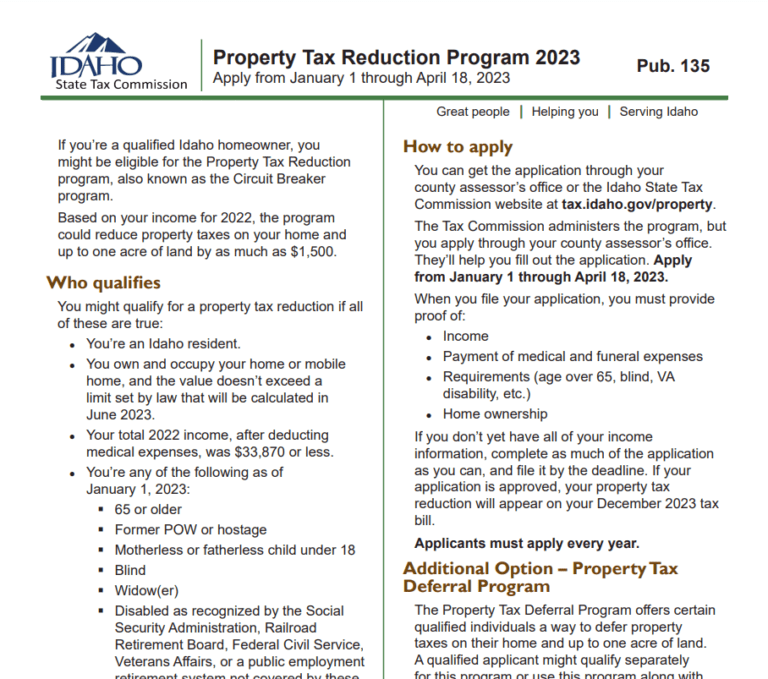

Idaho Tax Rebate 2023 Your Comprehensive Guide To Saving Money Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/03/Idaho-Tax-Rebate-2023-768x679.png

https://revenue.ky.gov/News/Pages/DOR-Announces-Updates-to-Individual-Income-Tax-for-2024-Tax-Year.aspx

FRANKFORT Ky September 1 2023 Each year the Kentucky Department of Revenue calculates the individual standard deduction in accordance with KRS 141 081 After adjusting for inflation the standard deduction for 2024 is 3 160 an increase of 180

https://omdnews.com/2024/01/26/tax-season-2024-early-filings-and-refund-expectations-for-kentucky-taxpayers/

When does the IRS process and refund tax returns The IRS is set to commence accepting and processing tax returns on January 29 initiating the eagerly awaited tax season Reports from the agency indicate that over 90 of refunds are issued within 21 days offering the possibility of quick refunds for prompt filers

Up To 1 044 Tax Rebate 2023 Arriving In Colorado Today See If You re Eligible South

Ky State Income Tax Withholding Form WithholdingForm

Property Tax Rebate Pennsylvania LatestRebate

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim PrintableRebateForm

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim PrintableRebateForm

TAX REBATE Ft The Receipts Podcast OFF THE CUFF PODCAST Listen Notes

Eight Moves To Make To Give Yourself A Larger Tax Refund Between 2 000 And 14 890 See If You

Missouri State Tax Rebate 2023 Printable Rebate Form

Ky Tax Rebate 2024 - When are taxes due in Kentucky 2024 The federal deadline is April 15 The IRS expects more than 128 7 million individual tax returns to be filed by that date officials said