Taxability Of State Tax Rebates Web 10 f 233 vr 2023 nbsp 0183 32 If you received a state tax rebate or payment in 2022 it s unclear whether the funds are taxable on your federal return The IRS last week told affected taxpayers to

Web 10 f 233 vr 2023 nbsp 0183 32 This means that people in the following states do not need to report these state payments on their 2022 tax return California Colorado Connecticut Delaware Web 9 f 233 vr 2023 nbsp 0183 32 The Tax Policy Center a nonprofit research group counts 18 states that sent one time income tax rebates in 2022 Arkansas California Colorado Connecticut

Taxability Of State Tax Rebates

Taxability Of State Tax Rebates

https://kstati.net/wp-content/uploads/2016/02/State_corporate_tax_rate.jpg

Tax Rates By State Map Printable Map Gambaran

https://files.taxfoundation.org/20200127173134/linkedin-In-Stream_Wide___2020-State-Corporate-Income-Tax-Rates-01.png

Relocate Out Of California To Escape High Taxes After Retirement

https://thefinancebuff.com/wordpress/wp-content/uploads/2020/10/state-tax-map-1024x863.png

Web 11 f 233 vr 2023 nbsp 0183 32 The Internal Revenue Service provided details clarifying whether special state tax payments issued by 21 states in 2022 are taxable The IRS has determined that in the interest of sound tax Web 24 juil 2023 nbsp 0183 32 Three are potentially relevant in determining the taxability of state rebate checks Qualified disaster relief payments are not taxable even if made through the

Web 10 f 233 vr 2023 nbsp 0183 32 I R S Decides Most Special State Payments Are Not Taxable The agency offered the guidance that it had asked millions of taxpayers in 21 states to wait for before filing their returns Web The IRS had encouraged Americans to wait on filing 2022 returns as it determined the federal taxability of those payments Now the IRS has clarified that certain 2022 state

Download Taxability Of State Tax Rebates

More picture related to Taxability Of State Tax Rebates

The Union Role In Our Growing Taxocracy California Policy Center

https://californiapolicycenter.org/wp-content/uploads/2017/05/Top_State_Marginal_Tax_Rates.jpg

Como Es Posible Que Eeuu Tenga El Doble Pib Per Capita Que Espa a

https://files.taxfoundation.org/20200813112019/property-taxes-by-state-2020-FV-01.png

Taxes And Sustainable Community Building One Community

https://files.taxfoundation.org/legacy/docs/Corporate Income Tax Rates.png

Web 13 f 233 vr 2023 nbsp 0183 32 Is Your State Rebate From 2022 Taxable Here Are the IRS Rules The agency has released its tax reporting guidelines for state rebates and relief payments Web 28 f 233 vr 2023 nbsp 0183 32 IRS Announces FY 2022 Federal Taxability Rules for State Issued Rebates in 2022 Weiss CPA Client Center Make A Payment Locations Glenview 2700 Patriot

Web The way a state tax credit works is that it reduces the state tax liability dollar for dollar by the amount of the credit For example suppose the state tax rate is 10 a taxpayer s Web 19 mars 2023 nbsp 0183 32 Some State Relief Payments Could Be Taxable What About Alaska The IRS considers some of Alaska s special supplemental energy relief payments to

Are State Tax Refunds And Rebates Federally Taxable It Depends

https://davidjccutler.com/wp-content/uploads/2023/02/0x0-930x620.jpg

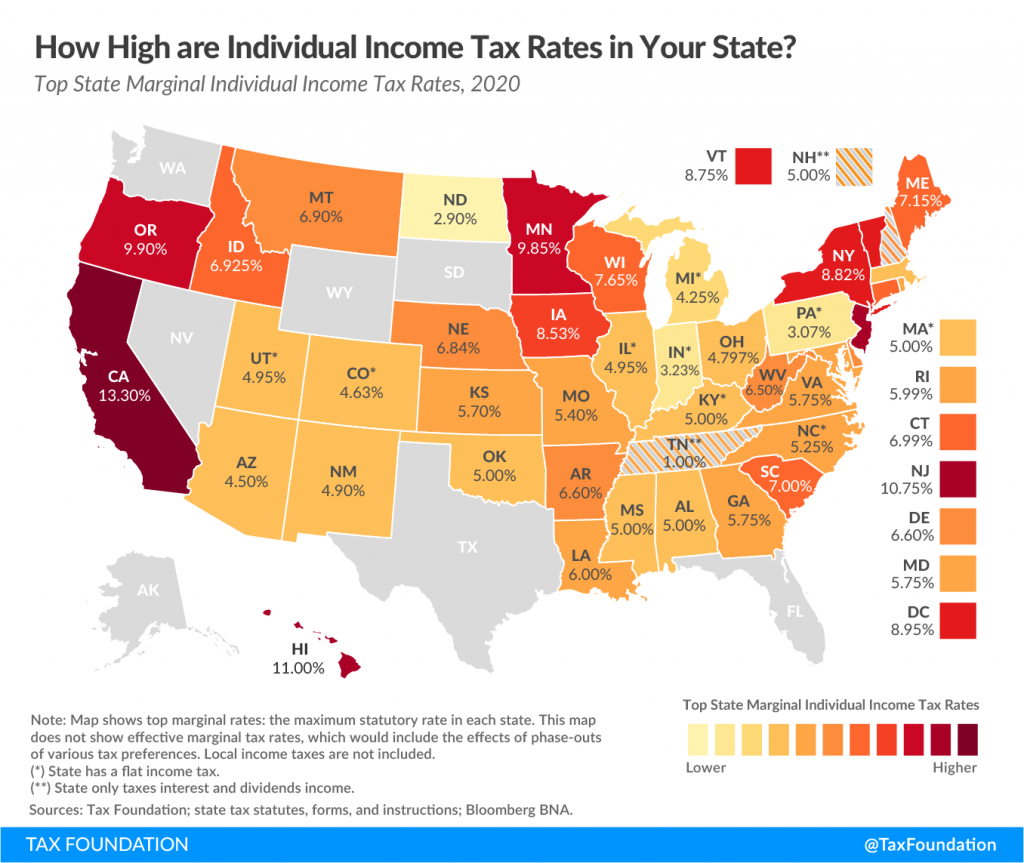

Map Top State Income Tax Rates Tax Foundation

http://taxfoundation.org/sites/taxfoundation.org/files/UserFiles/Image/maps/top_income_tax_rates_display.jpg

https://www.cnbc.com/2023/02/10/tax-pros-await-irs-guidance-on-state...

Web 10 f 233 vr 2023 nbsp 0183 32 If you received a state tax rebate or payment in 2022 it s unclear whether the funds are taxable on your federal return The IRS last week told affected taxpayers to

https://www.irs.gov/newsroom/irs-issues-guidance-on-state-tax-payments...

Web 10 f 233 vr 2023 nbsp 0183 32 This means that people in the following states do not need to report these state payments on their 2022 tax return California Colorado Connecticut Delaware

Daily Infographic State Tax Rates For Retail Gasoline And Diesel

Are State Tax Refunds And Rebates Federally Taxable It Depends

Nh Property Tax Rates By Town 2022

IRS Says California Most State Tax Rebates Aren t Considered Taxable

Gaming Hardware Discussion Hardware Sales Thread Page 73

How State Taxes Are Paid Matters Stevens And Sweet Financial

How State Taxes Are Paid Matters Stevens And Sweet Financial

Breaking Down The Rebate Will The IRS Make People Pay Taxes On State

2022 Tax Brackets

Will The IRS Tax South Carolina State Rebates Likely Not Wltx

Taxability Of State Tax Rebates - Web 1 d 233 c 2022 nbsp 0183 32 The eligibility requirements for tax rebates vary widely but generally taxpayers do not have to wait until they file next year s tax return to receive payment In