Taxability Of State Tax Refund Irs IR 2023 158 Aug 30 2023 The IRS today provided guidance on the federal tax status of refunds of state or local taxes and certain other payments made by state or local governments to individuals

Feb 3 2023 The IRS is aware of questions involving special tax refunds or payments made by states in 2022 we are working with state tax officials as quickly as possible to provide additional information and clarity for taxpayers Timely guidance is key to eliminating confusion and frustration for taxpayers and tax professionals earning the trust of the American people and providing quality service One example relates to the federal tax treatment of special

Taxability Of State Tax Refund Irs

Taxability Of State Tax Refund Irs

https://imageio.forbes.com/specials-images/imageserve/63eb8eaf836a97338e2ed0f6/0x0.jpg?format=jpg&width=1200

Tips To Get A Bigger Tax Refund This Year Money Savvy Living

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

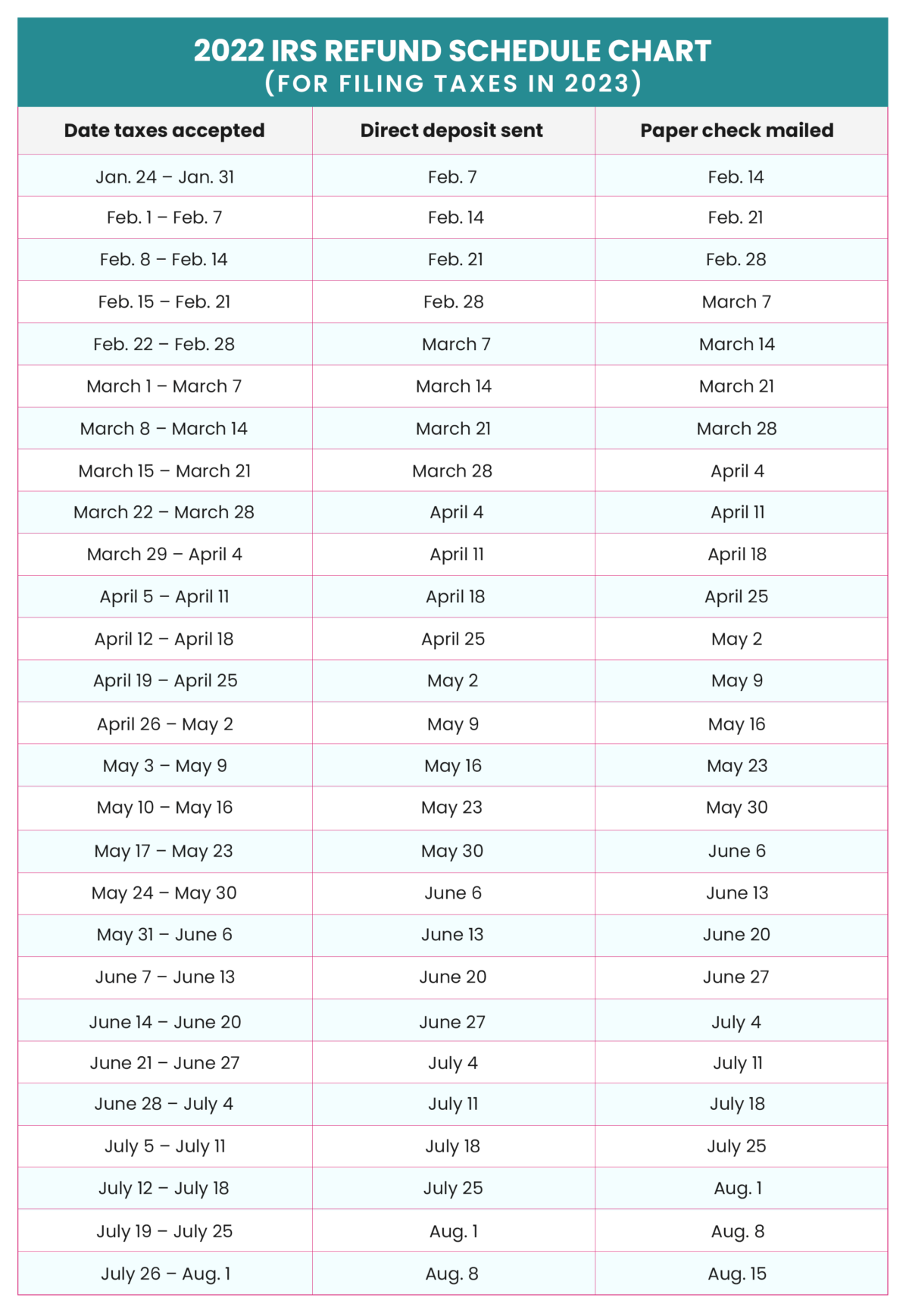

2023 Tax Refund Date Chart Printable Forms Free Online

https://www.wealthysinglemommy.com/wp-content/uploads/Edited-Chart-1-1200x1737.png

If you re one of the millions of taxpayers who received a one time tax payment from your state last year the Internal Revenue Service has some advice Hold off on filing your federal income tax IRS finally offers guidance on taxability of state refunds and payments It s mostly good news After telling millions to hold off on filing their taxes the Internal Revenue Service on

Use this worksheet to determine the portion of the taxpayer s prior year state refund that is considered taxable in the current year Use a copy of the taxpayer s previous year return to enter all amounts in the spaces provided The taxable portion will be included on the return as If you receive a refund of or credit for state or local income taxes in a year after the year in which you paid them you may have to include the refund in income in the year you receive it This includes refunds resulting from taxes that were over withheld applied from a prior year return not figured correctly or figured again because of

Download Taxability Of State Tax Refund Irs

More picture related to Taxability Of State Tax Refund Irs

State Tax Refunds Are State Tax Refunds Taxable

https://1.bp.blogspot.com/-NvJ6PoFk2lM/Xassvldoa-I/AAAAAAAAAQE/_cq70vDF1TwrGzBh1DA4eWPhjzMIlJRsQCLcBGAsYHQ/s1600/State%2BTax%2BRefunds_%2BAre%2Bstate%2Btax%2Brefunds%2Btaxable_.png

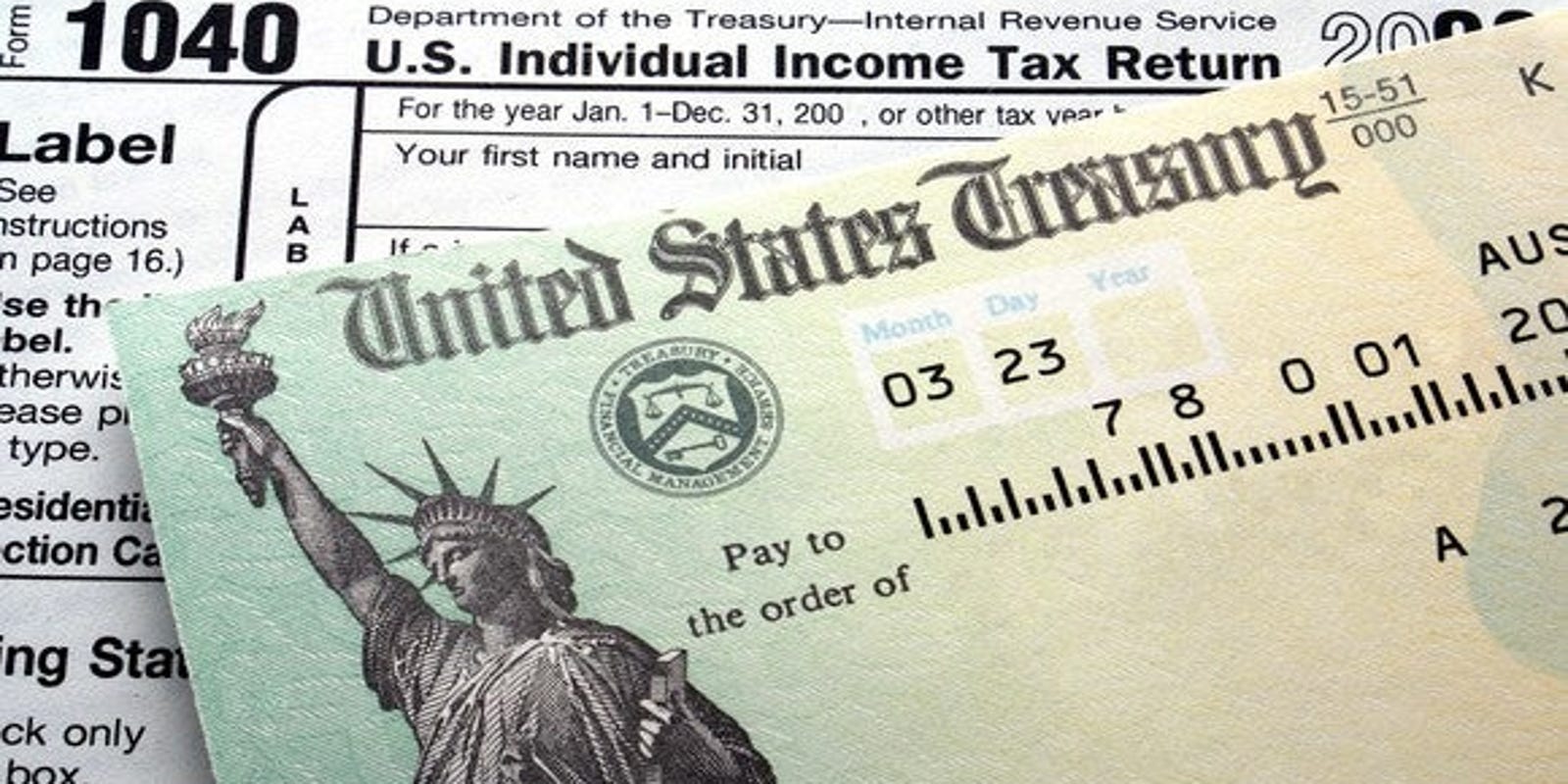

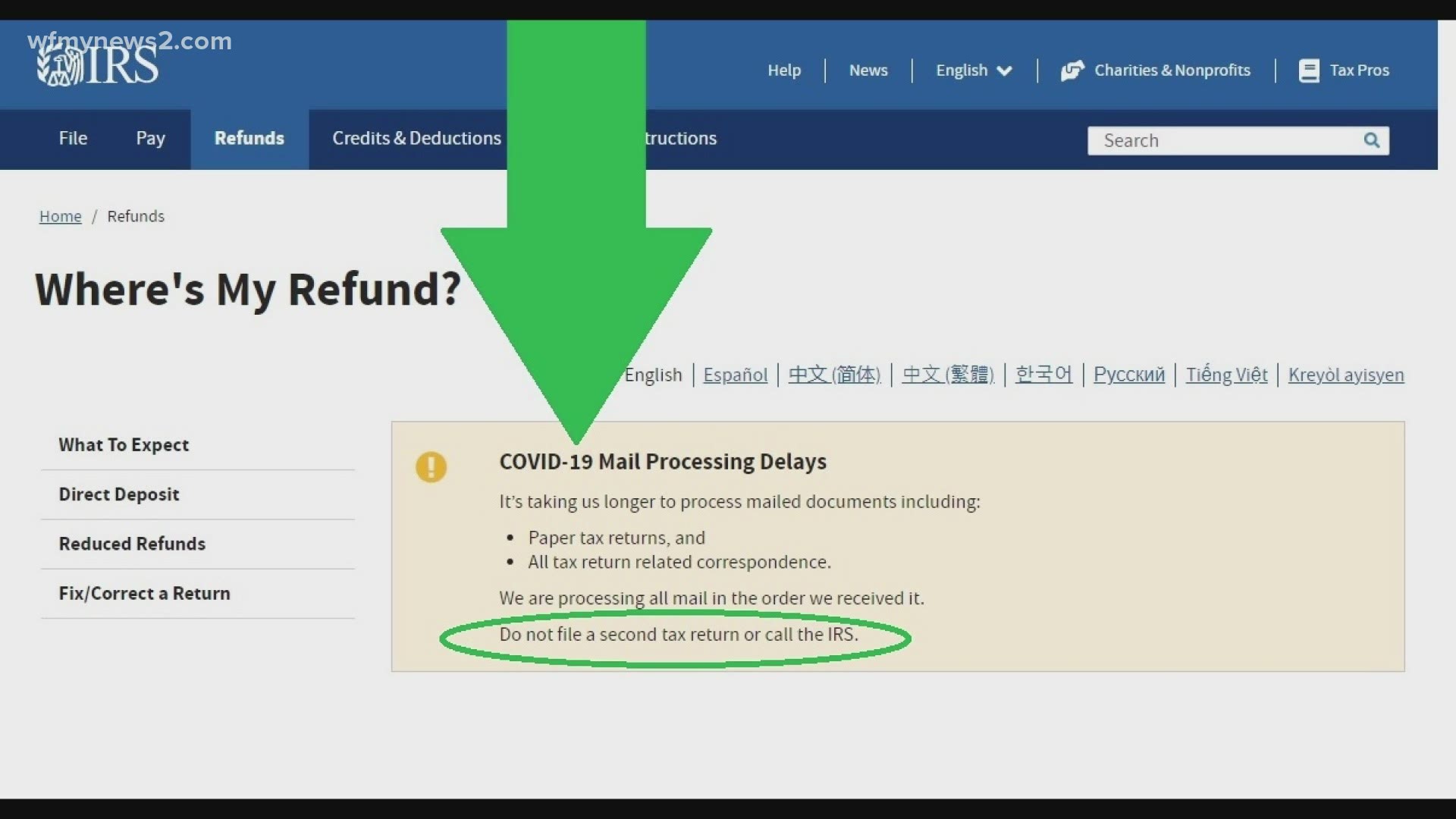

Avoid The Rush Track Tax Refunds Using Tool At IRS gov

https://www.gannett-cdn.com/-mm-/ea52bcfb29090d759296e5630a82a776c9e821ef/c=0-31-580-357/local/-/media/2020/02/08/USATODAY/usatsports/income-tax-refund-check-irs-getty.jpg?width=1600&height=800&fit=crop

Check IRS Where s My Refund IRS Refund Status 2023

https://nufo.org/wp-content/uploads/2022/04/Where-Is-My-Tax-Refund-1-768x627.png

State income tax refunds can sometimes be considered taxable income according to the IRS You must report them on Schedule A of Form 1040 if you claimed a deduction for state and local taxes the year before In Rev Rul 2019 11 issued Friday the IRS addressed how the long standing tax benefit rule interacts with the new 10 000 limit on deductions of state and local taxes to determine the portion of any state or local tax refund that must be included on the taxpayer s federal income tax return

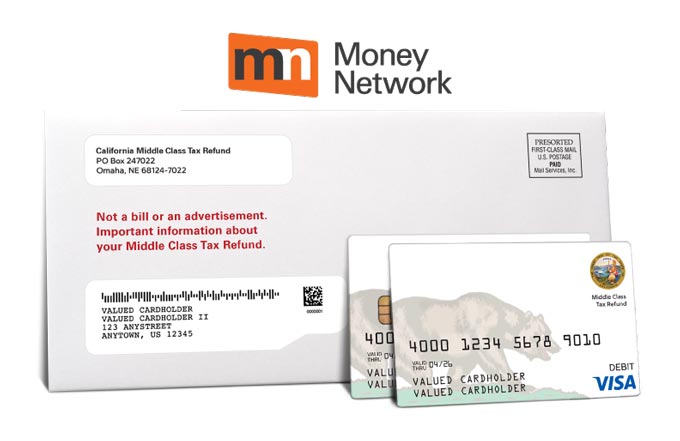

WASHINGTON The Internal Revenue Service said today that taxpayers who filed their federal income taxes early in this year s filing season and reported certain state 2022 tax refunds as taxable income should consider filing an amended return The IRS is aware of questions involving special tax refunds or payments made by certain states related to the pandemic and its associated consequences in 2022 A variety of state programs distributed these payments in 2022 and the rules surrounding their treatment for federal income tax purposes are complex

Here s The Average IRS Tax Refund Amount By State GOBankingRates

https://cdn.gobankingrates.com/wp-content/uploads/2020/05/IRS-Tax-Refund-check-shutterstock_1640116444.jpg

Average Tax Refund In Every U S State Vivid Maps

https://vividmaps.com/wp-content/uploads/2019/02/Taxes.jpg

https://www.irs.gov/newsroom/irs-issues-guidance...

IR 2023 158 Aug 30 2023 The IRS today provided guidance on the federal tax status of refunds of state or local taxes and certain other payments made by state or local governments to individuals

https://www.irs.gov/newsroom/irs-statement...

Feb 3 2023 The IRS is aware of questions involving special tax refunds or payments made by states in 2022 we are working with state tax officials as quickly as possible to provide additional information and clarity for taxpayers

IRS To Provide Update On California Middle Class Tax Refund Federal

Here s The Average IRS Tax Refund Amount By State GOBankingRates

IRSnews On Twitter Taxpayers In Many Places Will Not Need To Report

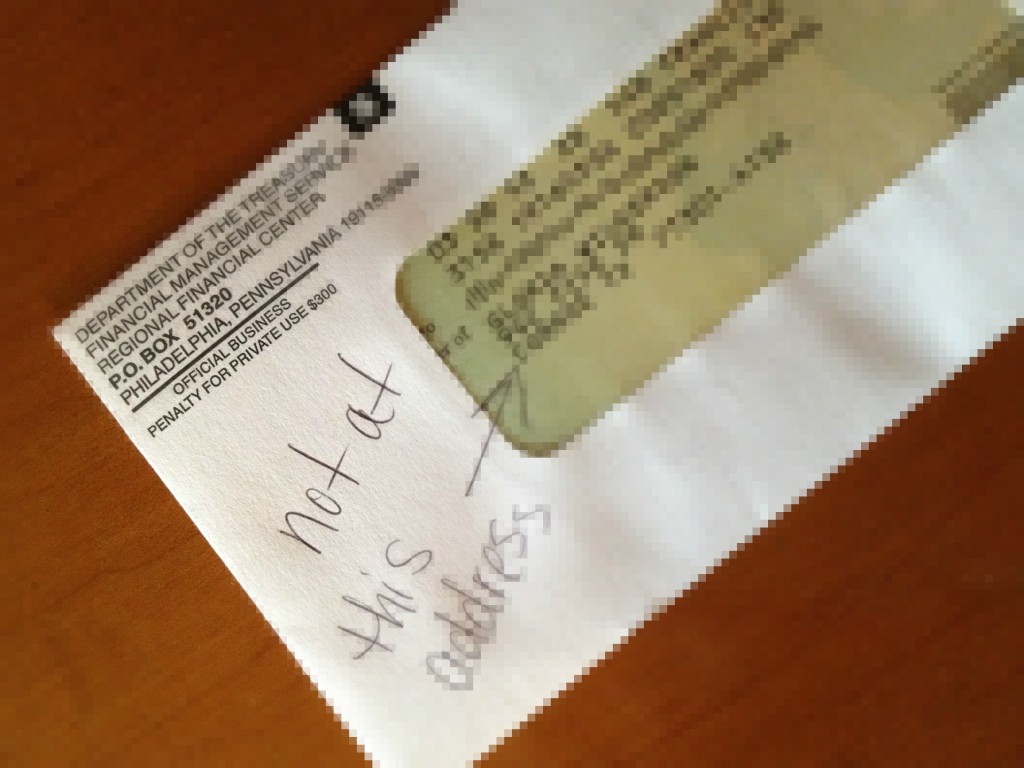

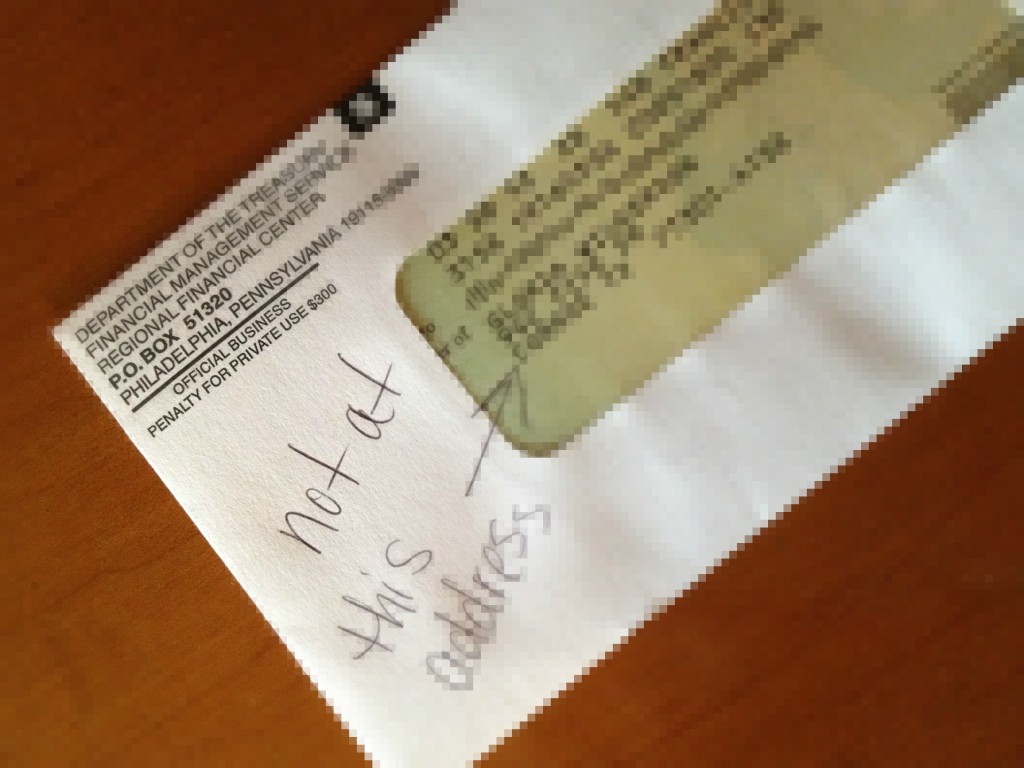

Get Gephardt Provo Couple Fights 2 Years For Tax Refund After A

Where Is Your IRS Refund Millions Of Tax Returns Are Waiting

Tax Season Is A Gold Mine For Identity Thieves Simply Being Mommy

Tax Season Is A Gold Mine For Identity Thieves Simply Being Mommy

Taxes What To Do If You Really Need Your Tax Refund Fast

Everything You Know About Getting A Tax Refund Is Wrong AOL Finance

How To Check On Irs Refund Gradecontext26

Taxability Of State Tax Refund Irs - Use this worksheet to determine the portion of the taxpayer s prior year state refund that is considered taxable in the current year Use a copy of the taxpayer s previous year return to enter all amounts in the spaces provided The taxable portion will be included on the return as