Land Transfer Tax Rebate Requirements An application for refund and all supporting documents including documents showing proof of payment of tax or amounts remitted must be received by the Ministry of Finance within four years from the date the tax was paid

To apply for a refund of land transfer tax you must submit a written request setting out the reasons for the refund There is no standard application form To apply for a refund or rebate of Non Resident Speculation Tax you can use the Ministry of Finance s simple and secure online services portal No user login or password is required If you qualify land transfer tax rebates are available to first time home buyers in the provinces of Ontario British Columbia and Prince Edward Island There is also a land transfer tax rebate available for first time home buyers in the city of Toronto

Land Transfer Tax Rebate Requirements

Land Transfer Tax Rebate Requirements

https://newcondocentre.com/wp-content/uploads/2021/09/Screenshot_2021-09-13-Bronte-and-Britannia-Trinity-Point-834x600.jpg

Save Thousands Land Transfer Tax Rebate For First Time Buyers

https://www.danagain.com/userfiles/images/Rebate for article.jpg

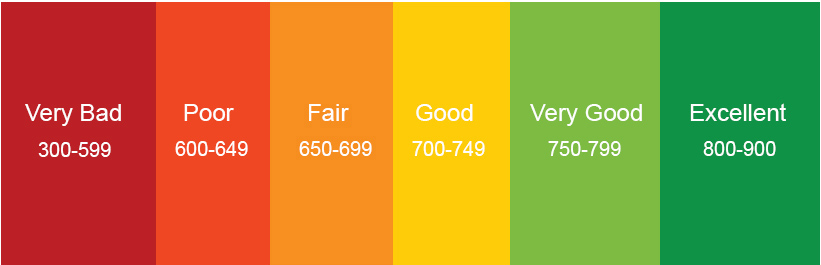

Creditworthiness Calculator Tips To Boost Your Credit Score

https://www.ratetrade.ca/bundles/assets/img/credit-pic.jpg

Fortunately if you re a first time home buyer in Ontario you may be eligible for substantial rebates on both the provincial and Toronto Land Transfer Taxes This guide will walk you through everything you need to know about these rebates making it easy to understand and share with others There is a land transfer tax rebate in Ontario of up to 4 000 that is available to first time home buyers Eligible buyers will have their entire land transfer tax bill up to 4 000 refunded to them If the land transfer tax bill is higher than 4 000 the buyer must make up the difference

The land transfer tax rebate offsets all the land transfer taxes on homes valued up to 227 500 In other words a home valued at 227 500 will be subject to 2 000 in taxes But if you qualify for the LTT rebate your net payable taxes will be zero When you buy a flat apartment or house you must pay transfertax varainsiirtovero verl telseskatt It is collected on the purchase price If you have a home loan you may deduct the interest from your taxes

Download Land Transfer Tax Rebate Requirements

More picture related to Land Transfer Tax Rebate Requirements

Land Transfer Tax What Are Your Land Transfer Taxes

http://landtransfer.tax/wp-content/uploads/2015/04/JLevy-Bus-Add-Square2.png

First time Buyer Land Transfer Tax Rebate Increasing To 4 000

https://cdn-0.newinhomes.com/127ce902-bdef-40b2-8076-380e006d3b22/l/contract-.jpg

First Time Home Buyer Land Transfer Tax And Rebate Insurdinary

https://www.insurdinary.ca/wp-content/uploads/2022/09/land-transfer-tax-and-rebate.jpg

The PEI transfer tax exemption waives the property transfer tax for first time home buyers You must have resided in PEI for 183 consecutive days before purchasing your home or have occupied your newly purchased home for at least 183 consecutive days Land Transfer Tax Rebates are available for first time home buyers in three provinces and one municipality Eligible first time home buyers are eligible for a refund of all or part of the Land Transfer Tax paid when purchasing a property Find out the requirements for claiming a Land Transfer Tax Rebate and whether you re eligible in your

Going one step at a time the Land Transfer Tax rebate from Ontario requires you to be a Canadian citizen or a permanent resident over the age of 18 If you have a partner they cannot own a home for the time they have been your partner or you may only be eligible for a In this article I will guide you through the process of qualifying for an Ontario Land Transfer Tax Refund and maximizing your refund potential What is the Ontario Land Transfer Tax The Ontario Land Transfer Tax is a provincial tax imposed on the purchase of real estate in Ontario

First Time Home Buyer Land Transfer Tax Rebates Across Canada Nesto ca

https://keycdn.nesto.ca/wp-content/uploads/2020/09/first-time-homebuyers-land-transfer-tax-rebate.jpg

Ontario Land Transfer Tax Who Pays Calculator Exemptions Rebates

https://i.pinimg.com/originals/23/b6/58/23b6585db4bc5d7b91ce03aea11a6445.jpg

https://www.ontario.ca › document › land-transfer-tax › ...

An application for refund and all supporting documents including documents showing proof of payment of tax or amounts remitted must be received by the Ministry of Finance within four years from the date the tax was paid

https://www.ontario.ca › document › land-transfer-tax › ...

To apply for a refund of land transfer tax you must submit a written request setting out the reasons for the refund There is no standard application form To apply for a refund or rebate of Non Resident Speculation Tax you can use the Ministry of Finance s simple and secure online services portal No user login or password is required

Unlock The Ontario First Time Home Buyer Land Transfer Tax Rebate

First Time Home Buyer Land Transfer Tax Rebates Across Canada Nesto ca

Toronto s Land Transfer Tax 4 Things You NEED To Know

How Much Mortgage Interest Rate Will Increase In 2022 Rate Trade ca

Ontario s Land Transfer Tax Rebate Grows But Wealthy Will Pay More

Closing Costs When Buying A House In Canada RateTrade ca

Closing Costs When Buying A House In Canada RateTrade ca

What Is The Minimum Salary To Get A Mortgage RateTrade ca

How Ontario Land Transfer Tax Works How To Qualify For Land Transfer

What Is The Land Transfer Tax Rebate And How Does It Work Ratehub ca

Land Transfer Tax Rebate Requirements - First time homebuyers may be eligible for a refund of up to 4 000 of the Ontario Land Transfer Tax To qualify you must and be a Canadian citizen or permanent resident