Late Filing Fee Tax Return If you file VAT excise duties or other self assessed taxes after the filing deadline you must pay a late filing penalty If you file your return late the late filing penalty is imposed even if you do

If you file your tax return after the filing deadline but before the organisation s tax assessment has been completed you may have to pay a late filing penalty The late filing penalty is 100 You The Failure to File penalty is 5 of the unpaid taxes for each month or part of a month that a tax return is late The penalty won t exceed 25 of your unpaid taxes

Late Filing Fee Tax Return

Late Filing Fee Tax Return

https://www.companyformations.ie/wp-content/uploads/2022/07/Annual-Return-Late-Fee-Calculator.jpg

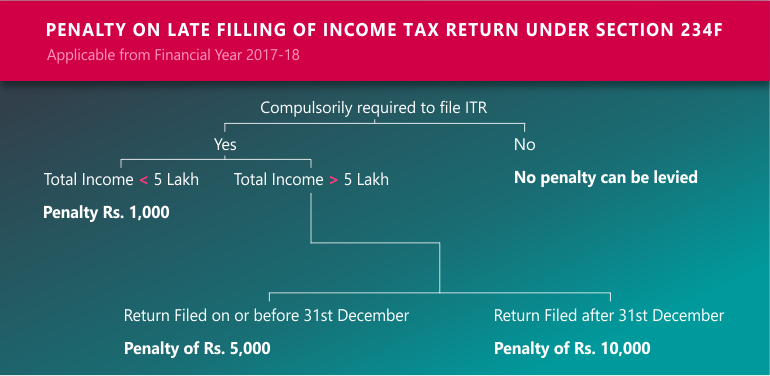

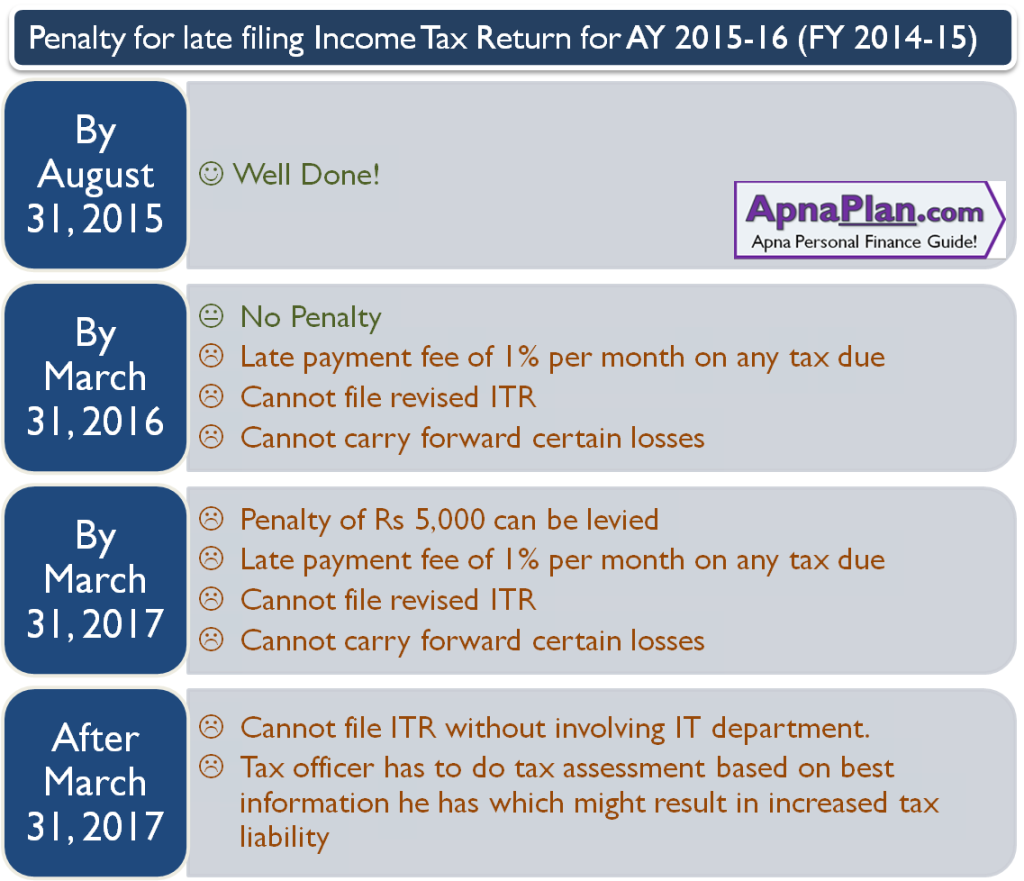

Penalty For Late Filing Of ITR Everything You Need To Know

https://www.taxhelpdesk.in/wp-content/uploads/2023/07/Penalty-for-late-filing-of-ITR.png

ITR Filing FY 2021 22 Know Last Date And Penalty If You Miss DEADLINE

https://cdn.zeebiz.com/sites/default/files/2022/07/18/190204-itr.jpg

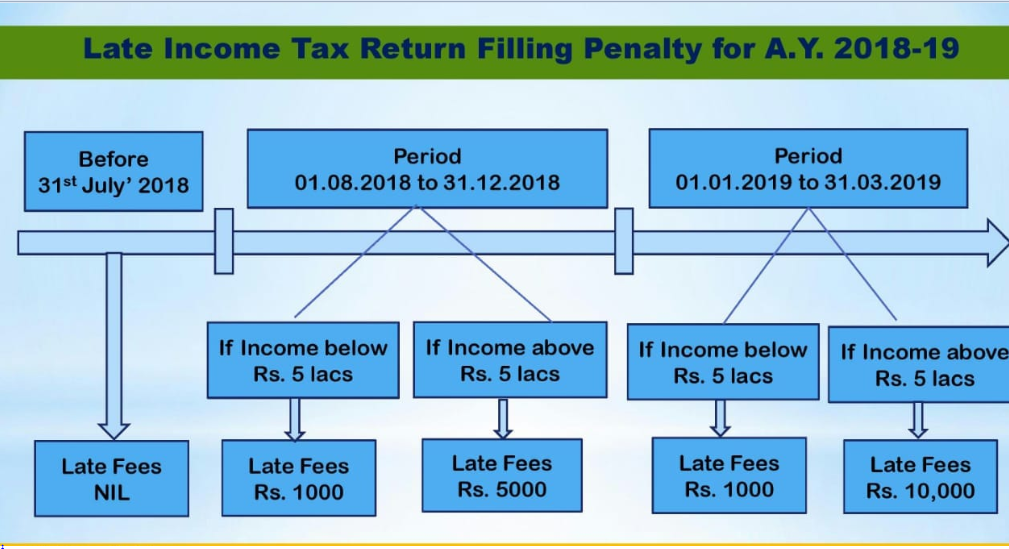

You ll pay a late filing penalty of 100 if your tax return is up to 3 months late You ll have to pay more if it s later or if you pay your tax bill late You ll be charged interest on late Taxpayers must file income tax return by due date Late filing incurs penalties Benefits of timely filing include easy loans tax refunds and proofs

Filing belated tax returns is allowed but incurs penalties Late filings have drawbacks financial penalties losses and disallowed deductions Timeline for belated filing is explained Methods for filing and consequences of missing You will be charged interest on any taxes that you owe if you pay late You will also be charged a late filing penalty if you file your tax return late and have a balance owing

Download Late Filing Fee Tax Return

More picture related to Late Filing Fee Tax Return

I T Return Filing Interest Penalties On The Cards If Failed To File

https://images.moneycontrol.com/static-mcnews/2022/07/Penalties-2-belate-returns-ITR-.jpg

Penalty On Late Filing Of Income Tax Return Section 234F TaxAdda

https://taxadda.com/wp-content/uploads/234f.png

Explained All About Belated Filing Of Income Tax Returns

https://images.moneycontrol.com/static-mcnews/2022/01/Filing-a-belated-income-tax-return.jpg

File your past due return and pay now to limit interest charges and late payment penalties You risk losing your refund if you don t file your return If you are due a refund for withholding or Use this tool to appeal a Self Assessment penalty for late filing or late payment You will be able to either Start now Find out when you can expect to receive a reply from

You ll have to pay penalties if you do not file your Company Tax Return by the deadline If your tax return is late 3 times in a row the 100 penalties are increased to 500 each If your tax What happens if you re late filing your tax return If you miss the deadline to file your self assessment tax return HMRC could automatically charge you 100 HMRC must

ITR Filing Last Date Today Late Fee Or Jail Term Or Both What Happens

https://cdn.dnaindia.com/sites/default/files/styles/full/public/2022/08/01/2526636-itr-filing.jpg

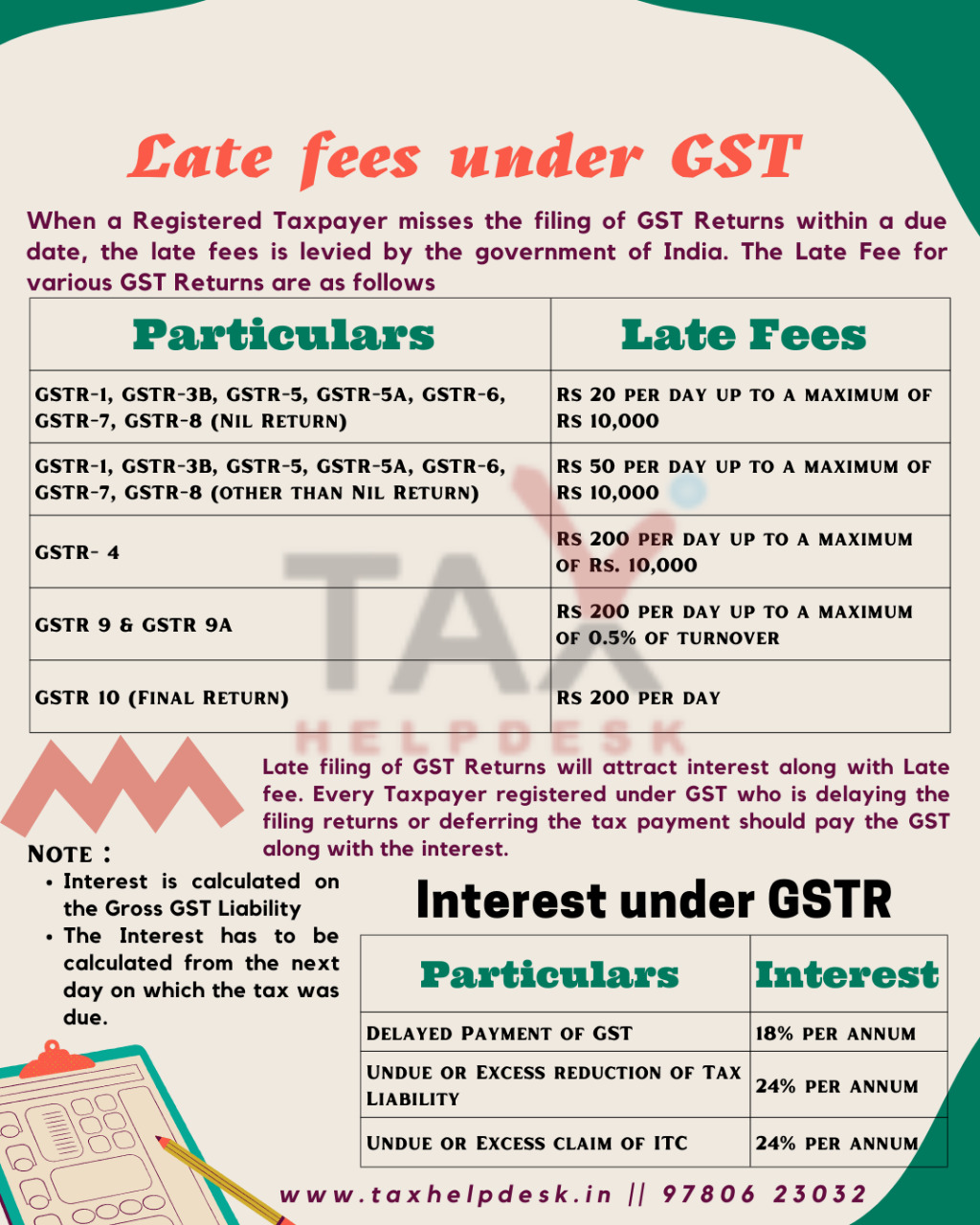

Fees For Late Filing Of Gst Returns In India Tax Heal Hot Sex Picture

https://www.taxhelpdesk.in/wp-content/uploads/2022/03/Late-fees-and-interest-under-GST-Returns.jpeg

https://www.vero.fi › ... › late-penalty-charges

If you file VAT excise duties or other self assessed taxes after the filing deadline you must pay a late filing penalty If you file your return late the late filing penalty is imposed even if you do

https://www.vero.fi › en › businesses-and-corporations › ...

If you file your tax return after the filing deadline but before the organisation s tax assessment has been completed you may have to pay a late filing penalty The late filing penalty is 100 You

Get Aware For Penalty Of Section 234f For Late Filing Of ITR

ITR Filing Last Date Today Late Fee Or Jail Term Or Both What Happens

Gratis Apology Letter For Late Payment Of Tax

A Person Holding A Pencil And Writing On A Piece Of Paper With The

Penalties On Late Filing Of Income Tax Returns ITR After Due Date

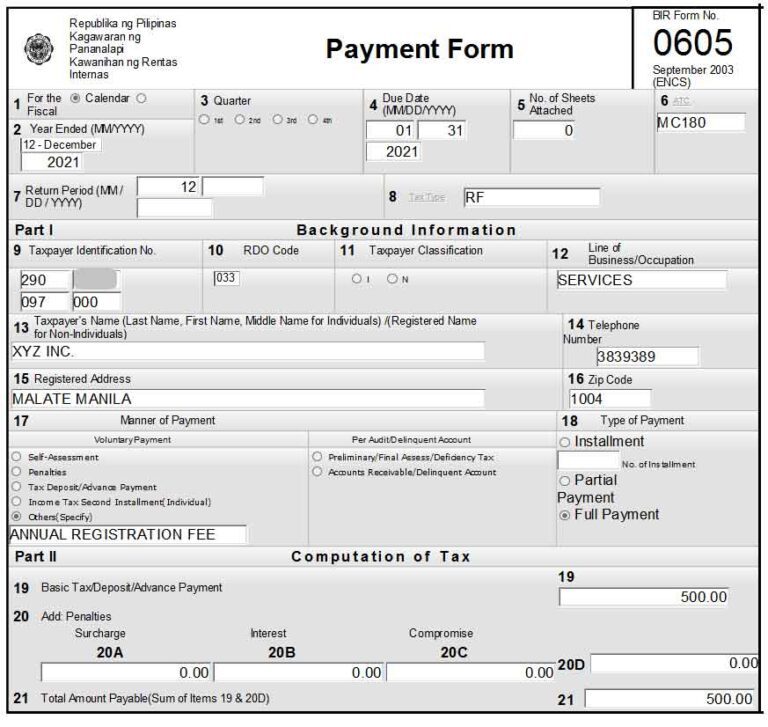

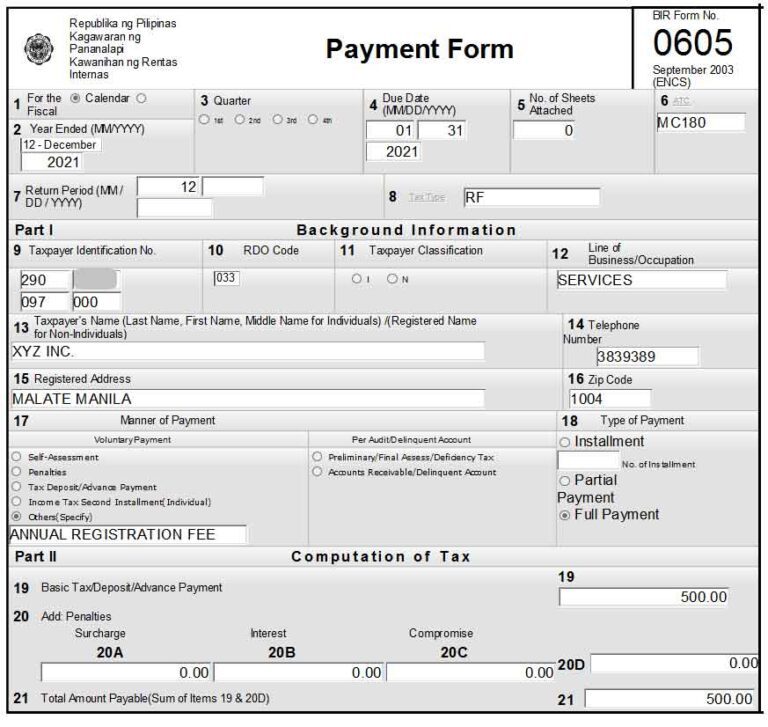

BIR Form 0605 Annual Registration Fee

BIR Form 0605 Annual Registration Fee

Penalty For Late Filing Of Income Tax Return

Tax Extension Form Extend Tax Due Date If You Need Form Example Download

Tax Dept Shows FY22 ITR Filing Data Assessee Requesting Date Extension

Late Filing Fee Tax Return - Taxpayers must file income tax return by due date Late filing incurs penalties Benefits of timely filing include easy loans tax refunds and proofs