Leave Travel Allowance Exemption Limit For Ay 2022 23 The criteria for and amounts of allowances for travel expenses to be considered exempt from tax in the 2023 taxation shall be as prescribed in this decision

Certain conditions to be met for claiming Leave travel allowance as exemptions The conditions are as follows Actual Journey is must for concession Only If you have traveled from 2022 until now you can claim only twice for travel between 2022 and 2025 Also the claim can be made only for actual travel costs This

Leave Travel Allowance Exemption Limit For Ay 2022 23

Leave Travel Allowance Exemption Limit For Ay 2022 23

https://life.futuregenerali.in/media/enhiobd5/leave-travel-allowance.jpg

TDS Rate Chart AY 2023 2024 FY 2022 2023 Sensys Blog

http://www.sensystechnologies.com/blog/wp-content/uploads/2022/04/20220429_120210.jpg

How To Claim LTA Exemption While Filing Return Bharat Times

https://images.livemint.com/img/2022/11/13/original/lta_1668357086324.png

Employees get Leave Travel Allowance LTA to claim reimbursement for travel expenses incurred during a leave period LTA typically covers costs for air train The criteria for and amounts of allowances for travel expenses to be considered exempt from tax in the 2022 taxation shall be as prescribed in this decision

Leave Travel Allowance covers only the travel expense incurred during the travel How much of a Leave Travel Allowance LTA is exempt from taxes The LTA Following allowances cannot be claimed as exempt Sec 10 5 Leave Travel concession assistance Sec 10 13A Allowance to meet expenditure incurred on house

Download Leave Travel Allowance Exemption Limit For Ay 2022 23

More picture related to Leave Travel Allowance Exemption Limit For Ay 2022 23

Leave Travel Allowance LTA How To Claim Benefits Under LTA

https://static.wixstatic.com/media/7d4526_c268964da9bf42eea4d3c8632d0233ee~mv2.png/v1/fill/w_1000,h_668,al_c,q_90,usm_0.66_1.00_0.01/7d4526_c268964da9bf42eea4d3c8632d0233ee~mv2.png

Travelling Allowance To The Officials Deployed For Election Duty

https://www.staffnews.in/wp-content/uploads/2022/09/travelling-allowance-to-the-officials-deployed-for-election-duty-claim-form.jpg

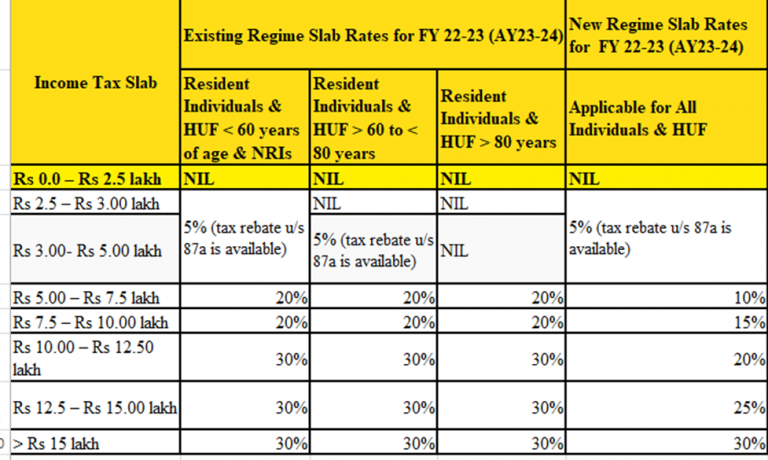

Old Tax Regime Vs New Tax Regime For The Assessment Year 2024 25

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhFzJwJHyVBIaFv0G0rI9CycAztACJH2ffDNgtSG3IRxDkB8E8neD3ScVZdjeaFsEGlRNFOqKLdxATPyE6sMa7P2WhsdLZv3UJrW1PuAJqOiUXvDtJ4GGzrXO4yvVbUK8NRVEwbATdQ9KZblStNks1dIgMF8yCHF-iAGrgmOApYakwfpsgcIG_WKP3T/s633/Tax Slab for A.Y.2024-25.jpg

Leave Travel Exemption Eligibility The LTA exemption is available only on the actual travel costs Expenses such as sightseeing hotel accommodation food etc How Much Leave Travel Allowance Exemption Will You Get There is a limit on how much LTA an employer may provide as an exemption For instance if Rs

How many trips must be undertaken to claim tax exemption on LTA To claim tax exemption on leave travel allowance LTA an employee must undertake two An LTA is the remuneration paid by an employer for Employee s travel in the country when he is on leave with the family or alone LTA amount is tax free Section

Income Tax FY 2022 23 AY 2023 24 Income Tax Act IT FY 2022 23 New And

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiuBLR2sr4zdq6frnOvYmY4TMuEbMynEFSiCiVO9-h9YlyZVcz20Rnk1V34S46-X5dWuSxwpF5eEVHb9f_Y-PWQSvT6D5tOGCeOjc5Ffmu9hxfpK9DcrJcDq3faqy3aR4w7eexxY8DMrm13bqa9-CohjejrV7vWzHLgplcUb6NtDbK0V_2k8wdyiQ9e/s1600/Income Tax FY 2022-23 AY 2023-24 Income Tax Act - IT Slab Rates Income Tax Official Circular.png

Leave Travel Allowance LTA Rules Claim Exemption Benefits

https://www.bajajallianz.com/blog/wp-content/uploads/2023/02/leave-travel-allowance.png

https://www.vero.fi/en/detailed-guidance/decisions/...

The criteria for and amounts of allowances for travel expenses to be considered exempt from tax in the 2023 taxation shall be as prescribed in this decision

https://taxguru.in/income-tax/leave-travel...

Certain conditions to be met for claiming Leave travel allowance as exemptions The conditions are as follows Actual Journey is must for concession Only

Leave Travel Allowance LTA Rules Claim Eligibility Exemption

Income Tax FY 2022 23 AY 2023 24 Income Tax Act IT FY 2022 23 New And

LTA Rules Exclusions Tax Exemption

Exemption On Leave Travel Allowance

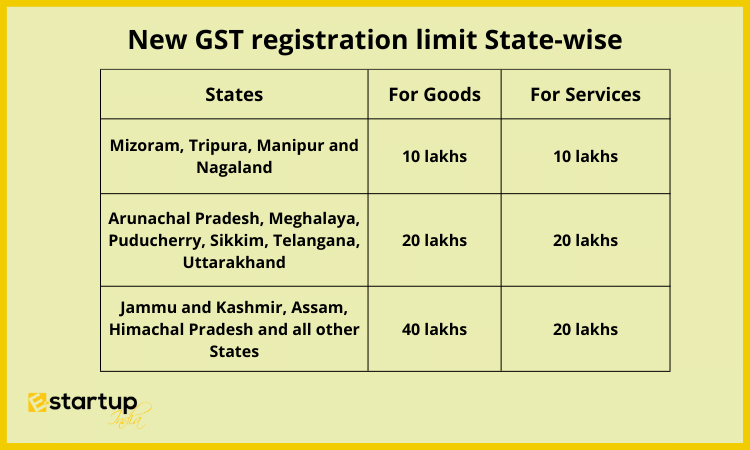

Gst Registration On Limit For Services In FY 2022 23

LTA Tax Exemption Leave Travel Allowance MoneyFrog Financial

LTA Tax Exemption Leave Travel Allowance MoneyFrog Financial

Leave Travel Allowance Exemption Guide Save Taxes On Your Vacation

.png)

Income Tax Return Who Is Required Which Form Due Dates Fy 2022 23 Ay

Income Tax Slabs New Old Tax Rates FY 2022 23 AY 2023 24 Janani

Leave Travel Allowance Exemption Limit For Ay 2022 23 - Following allowances cannot be claimed as exempt Sec 10 5 Leave Travel concession assistance Sec 10 13A Allowance to meet expenditure incurred on house