Lic Rebate In Income Tax Web 5 juin 2023 nbsp 0183 32 Section 80CCC of the Income Tax Act 1961 allows deduction on the premium paid to buy an annuity policy which pays annuity pay outs throughout your

Web 17 nov 2022 nbsp 0183 32 You can efile income tax return on your income from salary house property capital gains business amp profession and income from other sources Further you can Web 1 d 233 c 2021 nbsp 0183 32 Tax benefit in respect of premium paid for life insurance policies Section 80C of the Income Tax Act allows an individual and a Hindu Undivided Family HUF to claim

Lic Rebate In Income Tax

Lic Rebate In Income Tax

https://lh3.googleusercontent.com/-_uJ-qEAh2k8/WnOT_8GaoqI/AAAAAAAALak/eGTIXMN0uhAlctSfjqBlV2ThqJyhrlBdACHMYCw/s1600/Screenshot_20180202-033638.png

Interim Budget 2019 20 The Talk Of The Town Trade Brains

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

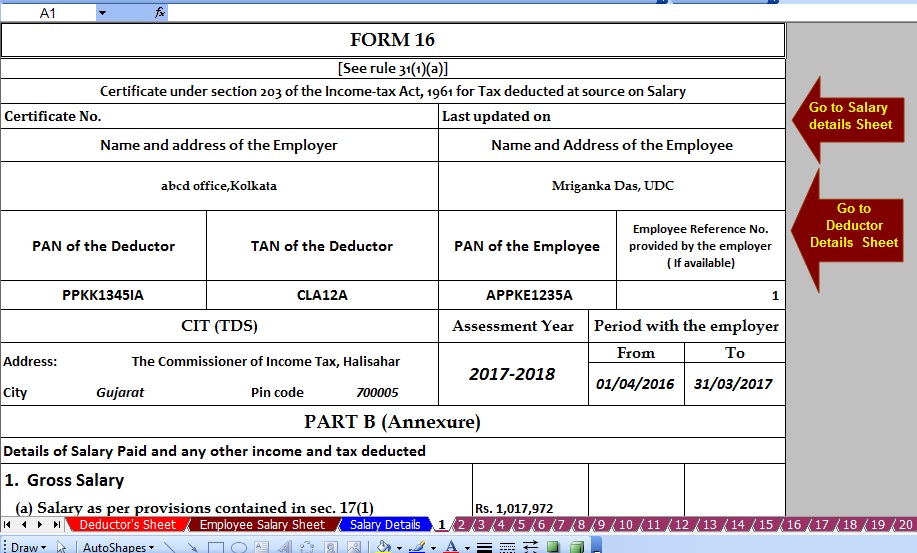

Taxexcel Income Tax Deductions And Rebate For Salaried Employees

https://2.bp.blogspot.com/-NuD7tVeysmk/WF1MXzZYhuI/AAAAAAAADuQ/JTAeSoGS2oQWf-s-FsY_6spEpXWDIDvbQCLcB/s1600/Form%2B16%2BP-B.jpg

Web Tax Benefits Under the Income Tax Act of 1961 the premium paid under LIC Jeevan Lakshya is eligible to avail rebate on annual income tax under section 80C As per Web Deduction is restricted to 20 of capital sum assured in respect of policies issued on or before 31 3 2012 and 10 in case of policies issued on or after 1 4 2012

Web 9 mai 2020 nbsp 0183 32 You can claim a deduction in FY 2019 20 only for the EMIs that are due by 31 March 2020 That means you can claim a deduction only for the interest which falls due as part of outstanding EMIs as on 31 Web How Your LIC Premiums Can Help You Save Income Tax If you want to save on taxes then there are numerous life insurance policies that provide an opportunity to save

Download Lic Rebate In Income Tax

More picture related to Lic Rebate In Income Tax

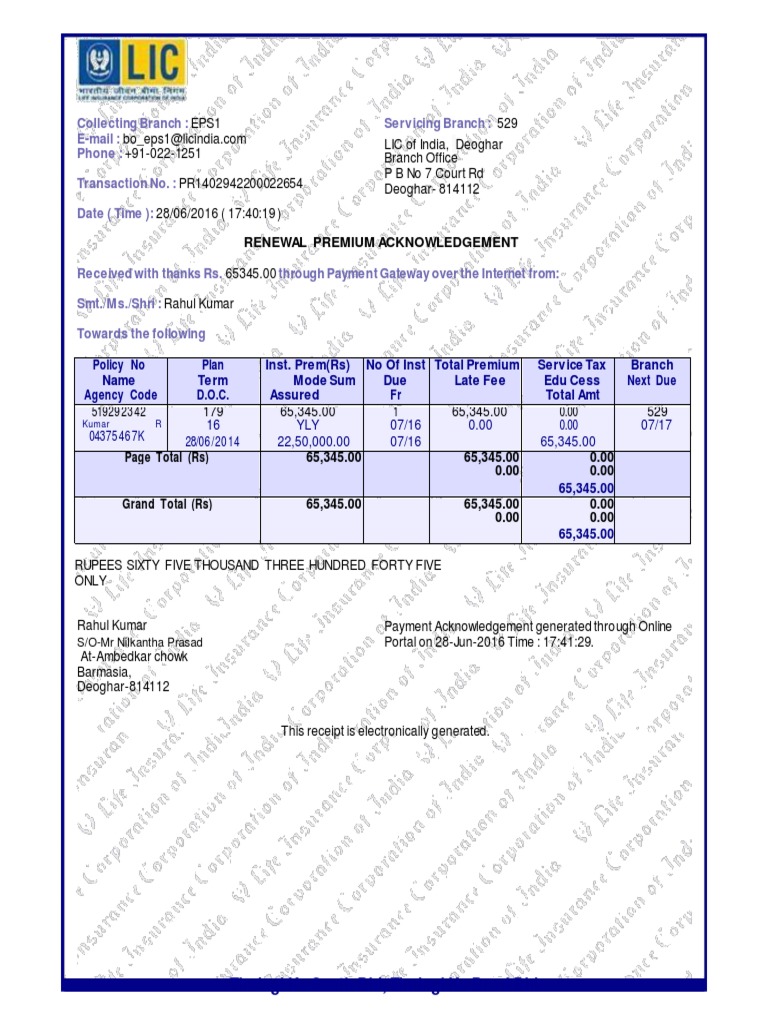

LIC Receipt pdf Payments Taxes

https://imgv2-2-f.scribdassets.com/img/document/352522811/original/fbaf481399/1583337625?v=1

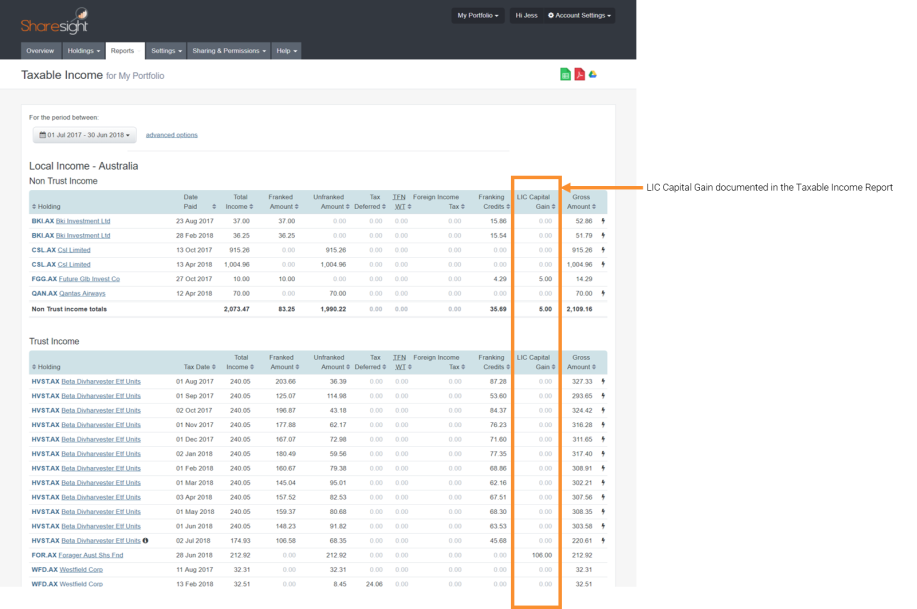

How Sharesight Helps You Handle Australian LIC Capital Gain Tax

https://images.ctfassets.net/kw7pc879iryd/Aqh7LV4rrUawCGqgy44gI/98fd6aa3f0827abebbc86c1833eac4d1/LIC_-_Taxable_Income_Report.png?w=917

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

https://i2.wp.com/arthikdisha.com/wp-content/uploads/2019/02/pdfresizer.com-pdf-crop-page-001.jpg?resize=720%2C400&ssl=1

Web Check out several tax saving life insurance policies from LIC of India and get tax benefits under 80C 80CCC 80DD and 10D of the Income Tax Act 1961 Web 14 f 233 vr 2023 nbsp 0183 32 1 Section 80C As per section 80C of the Income Tax Act 1961 there are tax benefits offered under different LIC plans Under this section the premium paid

Web The Rates for Charging Income Tax for Financial Year 2020 21 i e AY 2021 22 Other than Senior Citizen and Super Senior Citizen Senior Citizen 60 years or more but below the Web Section 80CCC Income Tax Deductions on Pension Fund Contributions Section 80CCC of the Income Tax Act of 1961 allows for annual deductions of up to Rs 1 5 lakh for

80C TO 80U DEDUCTIONS LIST PDF

https://wealthtechspeaks.in/wp-content/uploads/2017/04/Tax-Deduction-Under-Section-80C.png

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

https://www.practicaltaxplanning.com/ptp/wp-content/uploads/2022/06/7PY4cfZG8ZE.jpg

https://www.turtlemint.com/lic-premium-tax-deductions

Web 5 juin 2023 nbsp 0183 32 Section 80CCC of the Income Tax Act 1961 allows deduction on the premium paid to buy an annuity policy which pays annuity pay outs throughout your

https://cleartax.in/s/lic-policy-list

Web 17 nov 2022 nbsp 0183 32 You can efile income tax return on your income from salary house property capital gains business amp profession and income from other sources Further you can

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

80C TO 80U DEDUCTIONS LIST PDF

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

Pol cia Tis c Bal k How To Calculate Rebate Ob iansky V a ok Vlastn k

Pol cia Tis c Bal k How To Calculate Rebate Ob iansky V a ok Vlastn k

Pajak Penghasilan Untuk Keperluan Pajak Pemerintah Atas Pendapatan

Pajak Penghasilan Untuk Keperluan Pajak Pemerintah Atas Pendapatan

Va A Decidir Comedia Apellido How To Calculate Rebate Abierto Pl tano

How To Solve For Income Tax Amy Fleishman s Math Problems

Lic Income Tax Rates And Benefits 2022 2023 shorts short trending

Lic Rebate In Income Tax - Web 1 f 233 vr 2023 nbsp 0183 32 The Union Budget 2023 24 has proposed to limit the income tax exemption on the proceeds of high value life insurance policies Mooted as part of an emphasis on