Life Insurance Policy Income Tax Rebate Web 31 janv 2023 nbsp 0183 32 policy held for less than eight years 12 8 policy held for more than eight years 7 5 current rate at 1st January 2023 These rates may be reduced under

Web Is this the first time you are claiming the relief Login with your Singpass or Singpass Foreign user Account SFA at myTax Portal Go to Individuals gt File Income Tax Web a Self Assessment tax return a redundancy payment UK income if you live abroad interest from savings or payment protection insurance PPI income from a life or

Life Insurance Policy Income Tax Rebate

Life Insurance Policy Income Tax Rebate

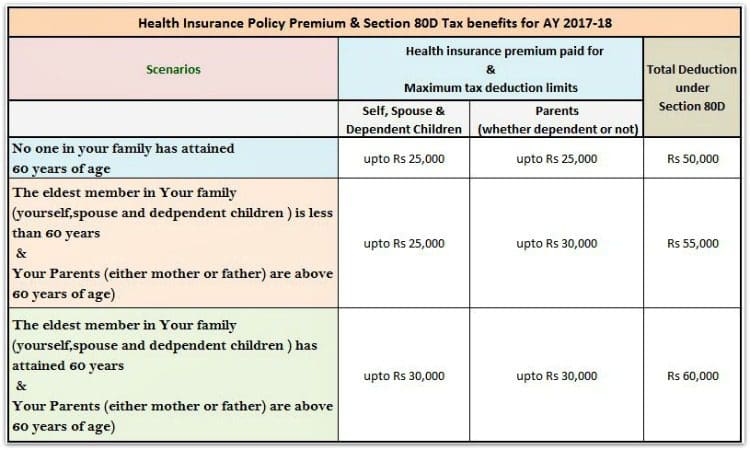

http://www.relakhs.com/wp-content/uploads/2016/03/Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2016-17-pic.jpg

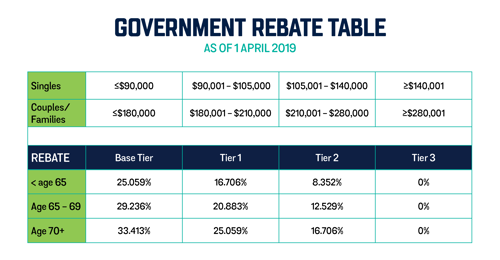

Tax Time And Private Health Insurance Teachers Health

https://www.teachershealth.com.au/media/2111/2019-govt-rebate-table2.png?width=500&height=260.4838709677419

Private Health Insurance Rebate Navy Health

https://navyhealth.com.au/wp-content/uploads/2018/03/Federal-Government-Rebate-1-APR-2019.png

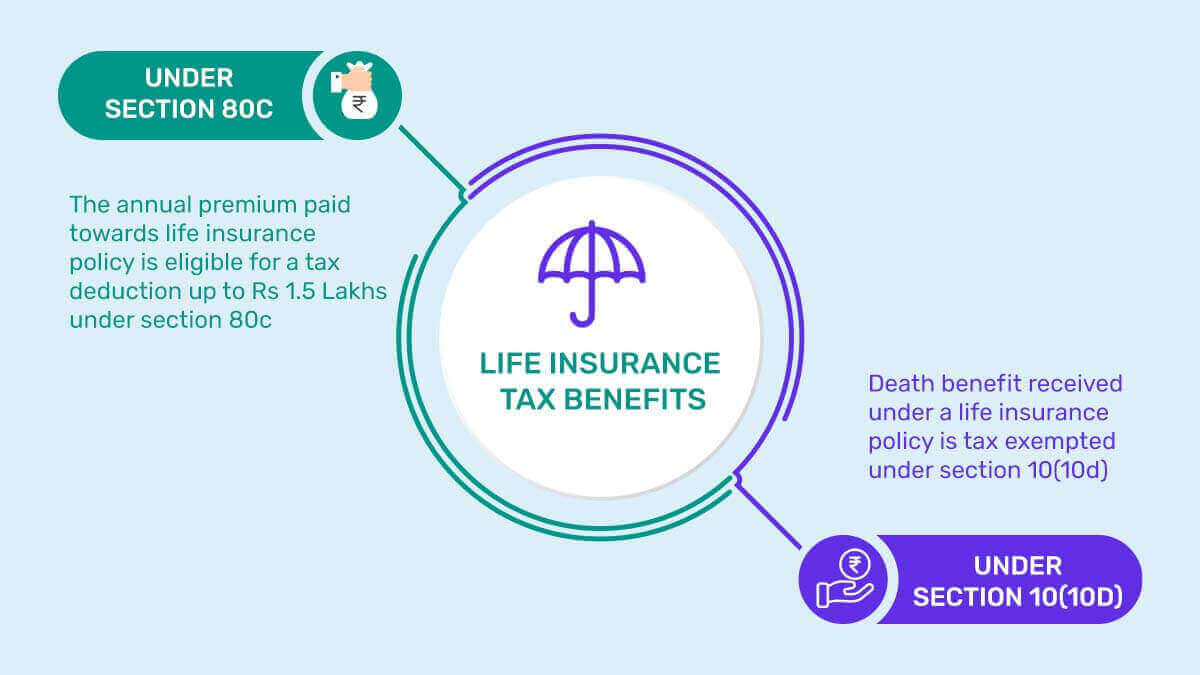

Web 4 ao 251 t 2023 nbsp 0183 32 Find out how you should enter chargeable event gains from UK life insurance policies on your Self Assessment tax return From HM Revenue amp Customs Published Web You can get tax benefits on premiums paid up to 1 50 000 towards pension retirement policies However if you surrender the plan the pension annuity received will be taxed

Web 7 juin 2022 nbsp 0183 32 Life insurance premiums under most circumstances are not taxed i e no sales tax is added or charged These premiums are also not tax deductible If an employer pays life insurance premiums Web Title Tax Leaflet Final CTP Created Date 10 12 2021 6 00 42 PM

Download Life Insurance Policy Income Tax Rebate

More picture related to Life Insurance Policy Income Tax Rebate

Conclusion Of Life Insurance Policy Keijupolypuoti

https://www.policybazaar.com/images/IncomeTax/section-80d-income-tax-act.jpg

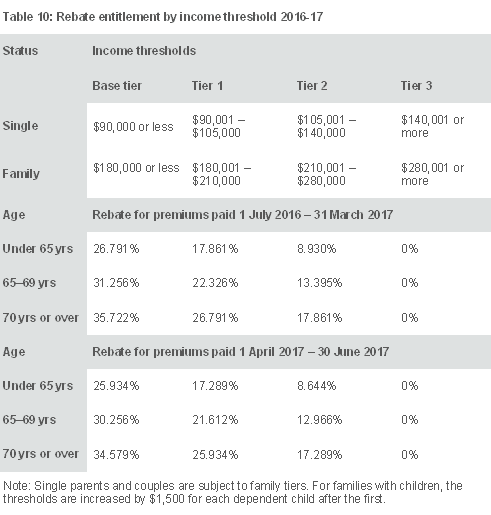

Medicare Levy Surcharge Private Health Insurance What s The Link

https://www.blgba.com.au/hs-fs/hubfs/Imported_Blog_Media/Table-10.png?width=609&height=639&name=Table-10.png

2007 Tax Rebate Tax Deduction Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

Web 4 janv 2023 nbsp 0183 32 Life insurance payouts are made tax free to beneficiaries But there are times when money from a policy is taxable Find out how it works Web 5 mai 2023 nbsp 0183 32 So under Section 80C of Income Tax his taxable income will become 6 5 lakhs Types of Tax Rebates in Life Insurance Section 80C This section allows the

Web You can get a tax deduction of up to 1 5 lakhs under Section 80C for the premiums you pay towards your term insurance plan This Section offers a deduction for all the listed Web Income Tax Tax Exemption on Insurance Premiums Salaried employees and businessmen can invest in life insurance or medical insurance in order to consider themselves

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

https://i.pinimg.com/originals/2d/3d/8c/2d3d8c83aee5a3115e206b0fac97c875.jpg

Rebating Meaning In Insurance What Is Insurance Rebating The

https://economictimes.indiatimes.com/img/60155156/Master.jpg

https://www.impots.gouv.fr/international-particulier/questions/...

Web 31 janv 2023 nbsp 0183 32 policy held for less than eight years 12 8 policy held for more than eight years 7 5 current rate at 1st January 2023 These rates may be reduced under

https://www.iras.gov.sg/.../tax-reliefs/life-insurance-relief

Web Is this the first time you are claiming the relief Login with your Singpass or Singpass Foreign user Account SFA at myTax Portal Go to Individuals gt File Income Tax

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

Life Insurance Tax Benefits In India PolicyBachat

Life Insurance Tax Benefit Ideas Oprekmania News Information

Tax Rebate Under Section 87A Investor Guruji Tax Planning

P55 Tax Rebate Form By State Printable Rebate Form

P55 Tax Rebate Form By State Printable Rebate Form

Tax Rebate For Individual It Is The Refund Which An Individual Can

INCOME TAX REBATES FOR FY 22 23 FINANCIAL PLANNING FOR PROSPERITY

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

Life Insurance Policy Income Tax Rebate - Web Title Tax Leaflet Final CTP Created Date 10 12 2021 6 00 42 PM