Life Insurance Rebate In Income Tax Web 5 mai 2023 nbsp 0183 32 Types of Tax Rebates in Life Insurance Section 80C This section allows the deduction of the taxable income up 1 5 Lakhs Instruments under this section 1 ELSS

Web 26 juin 2018 nbsp 0183 32 Income received from insurance policies issued on or after 1 April 2023 other than unit linked policies having a premium or aggregate of premium exceeding Web Is this the first time you are claiming the relief Login with your Singpass or Singpass Foreign user Account SFA at myTax Portal Go to Individuals gt File Income Tax

Life Insurance Rebate In Income Tax

Life Insurance Rebate In Income Tax

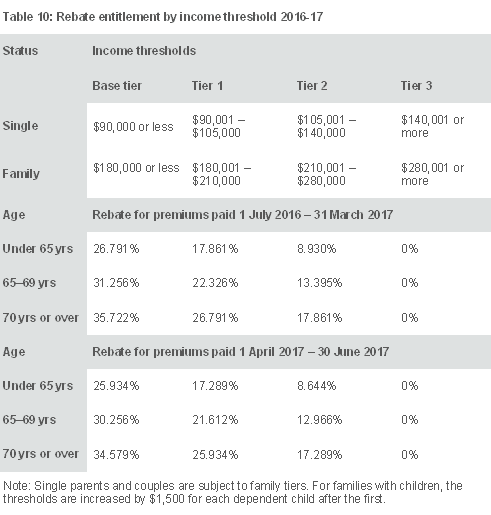

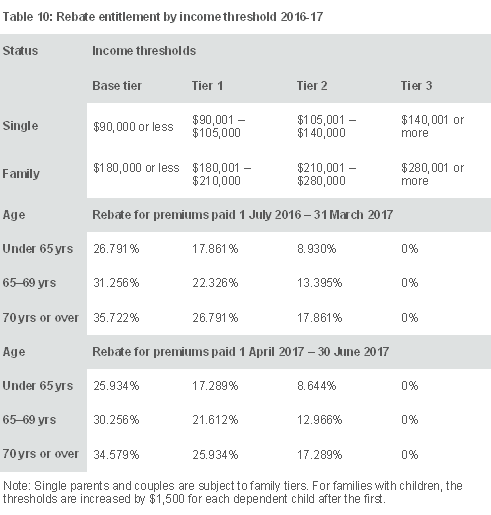

https://www.blgba.com.au/hs-fs/hubfs/Imported_Blog_Media/Table-10.png?width=609&height=639&name=Table-10.png

All About Income Tax Rules Applicable For Life Insurance Policies

https://i0.wp.com/1.bp.blogspot.com/-FD75GTJg7lg/VshB6OJ1cBI/AAAAAAAABQ0/qh4SqKNnBJI/s1600/Income_Tax_rebate_sec_80C.jpg?ssl=1

Life Insurance Telemarketing Life Insurance Rebate In Income Tax

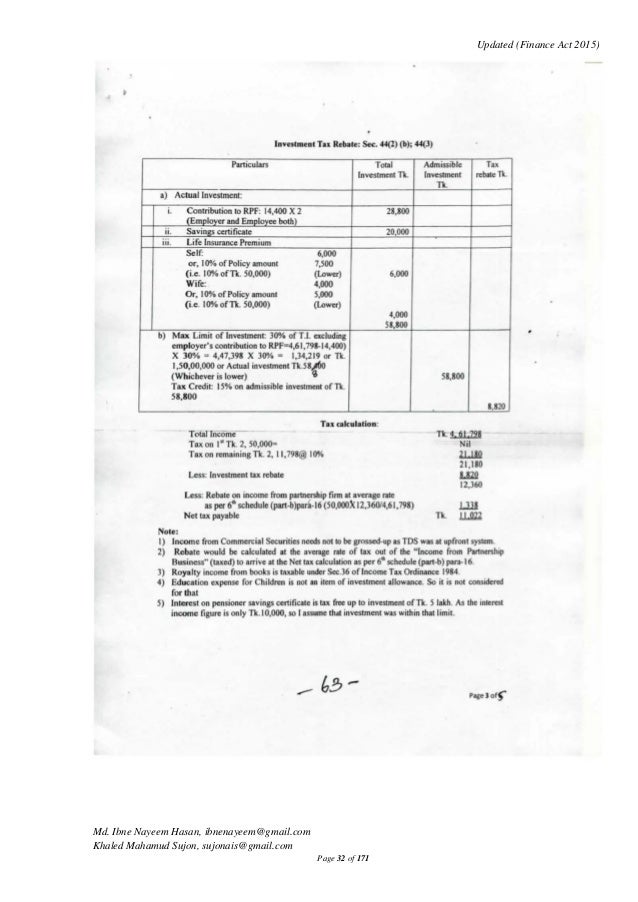

https://image.slidesharecdn.com/ranjansirlecturedetailsupdatedinlightoffa2015-151127002113-lva1-app6891/95/bangladesh-income-tax-hand-noteranjan-sir-lecture-details-updated-in-light-of-finance-act-2015-bangladesh-tax-hand-note-for-icab-icmab-32-638.jpg?cb=1451275293

Web 21 sept 2020 nbsp 0183 32 Up to 20 of sum assured Maximum 150 000 covering all the investment made under Sec 80C along with deduction u s 80CCC amp 80CCD From 01 04 2012 to 31 03 2013 Up to 10 of sum assured Up Web 19 avr 2022 nbsp 0183 32 No most life insurance premiums are not tax deductible The IRS considers premiums for an individual policy a personal expense

Web 27 sept 2021 nbsp 0183 32 Advisor Insight Life insurance offers desirable tax advantages though it is not exactly tax free Here are ways your life insurance benefits could be taxed Web 15 ao 251 t 2023 nbsp 0183 32 The life insurance death benefit is completely income tax free to beneficiaries No matter how big the death benefit is 50 000 or 50 million your

Download Life Insurance Rebate In Income Tax

More picture related to Life Insurance Rebate In Income Tax

Notice Regarding Rebate On Late Fee Of Renewal Premium Mahalaxmi Life

https://mahalaxmilife.com.np/wp-content/uploads/2020/09/Rebate-on-Renewal-scaled.jpg

Tax Time And Private Health Insurance Teachers Health

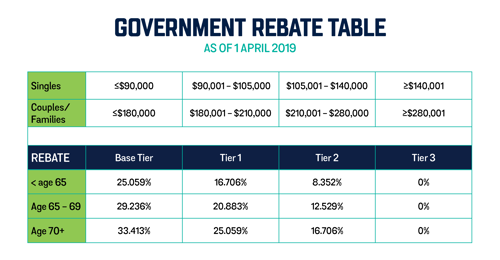

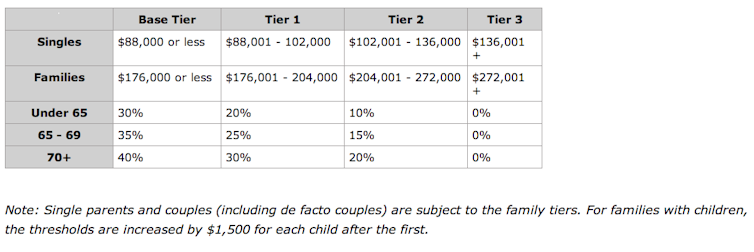

https://www.teachershealth.com.au/media/2111/2019-govt-rebate-table2.png?width=500&height=260.4838709677419

Texas Has Third Highest Insurance Rebates For Individual Market D

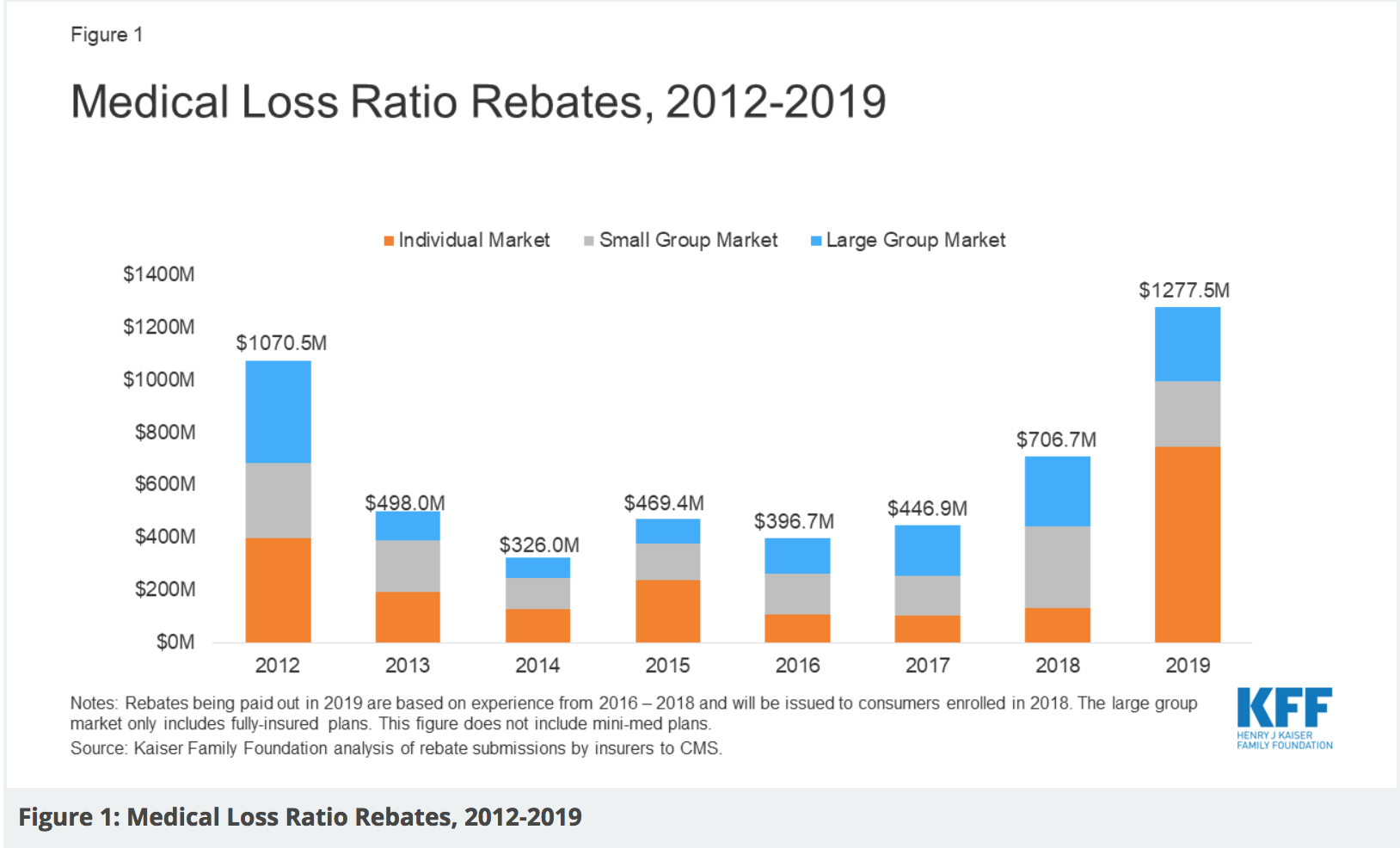

https://assets.dmagstatic.com/wp-content/uploads/2019/09/Screen-Shot-2019-09-13-at-2.11.29-PM.png

Web 15 juin 2023 nbsp 0183 32 At Aflac we issue thousands of life insurance policies every year We know all the common questions about life insurance including how life insurance premiums Web 4 nov 2016 nbsp 0183 32 Tax rebate depends on your taxable income Under section 87A claimable rebate is up to Rs 12 500 The important thing here is that taxable income is calculated

Web 30 oct 2018 nbsp 0183 32 Under section 80C premiums that you pay towards a life insurance policy qualify for a deduction up to 1 5 lakh while Section 10 10D makes income on Web 1 f 233 vr 2023 nbsp 0183 32 The Union Budget 2023 24 has proposed to limit the income tax exemption on the proceeds of high value life insurance policies Mooted as part of an emphasis on

Private Health Insurance Rebate Navy Health

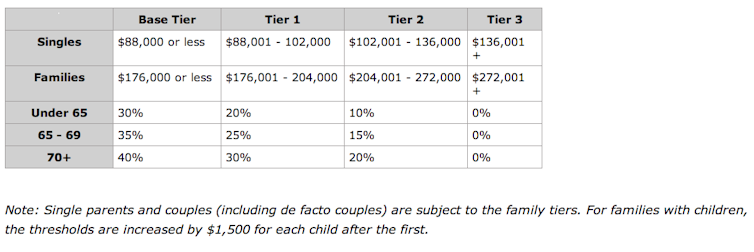

https://navyhealth.com.au/wp-content/uploads/2018/03/Federal-Government-Rebate-1-APR-2019.png

Premium Calculator Of State Life Insurance Savings Tax rebate

https://i.pinimg.com/originals/1b/f7/1f/1bf71f3892b43d8202305bb537e6baa5.png

https://www.myinsuranceclub.com/articles/tax-rebates-in-life-insurance...

Web 5 mai 2023 nbsp 0183 32 Types of Tax Rebates in Life Insurance Section 80C This section allows the deduction of the taxable income up 1 5 Lakhs Instruments under this section 1 ELSS

https://cleartax.in/s/life-insurance-taxability

Web 26 juin 2018 nbsp 0183 32 Income received from insurance policies issued on or after 1 April 2023 other than unit linked policies having a premium or aggregate of premium exceeding

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

Private Health Insurance Rebate Navy Health

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Rebating Meaning In Insurance What Is Insurance Rebating The

How Does Private Health Insurance Affect My Tax Return Compare Club

FactCheck Could Private Lifetime Health Cover Changes Cost 1000 More

FactCheck Could Private Lifetime Health Cover Changes Cost 1000 More

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

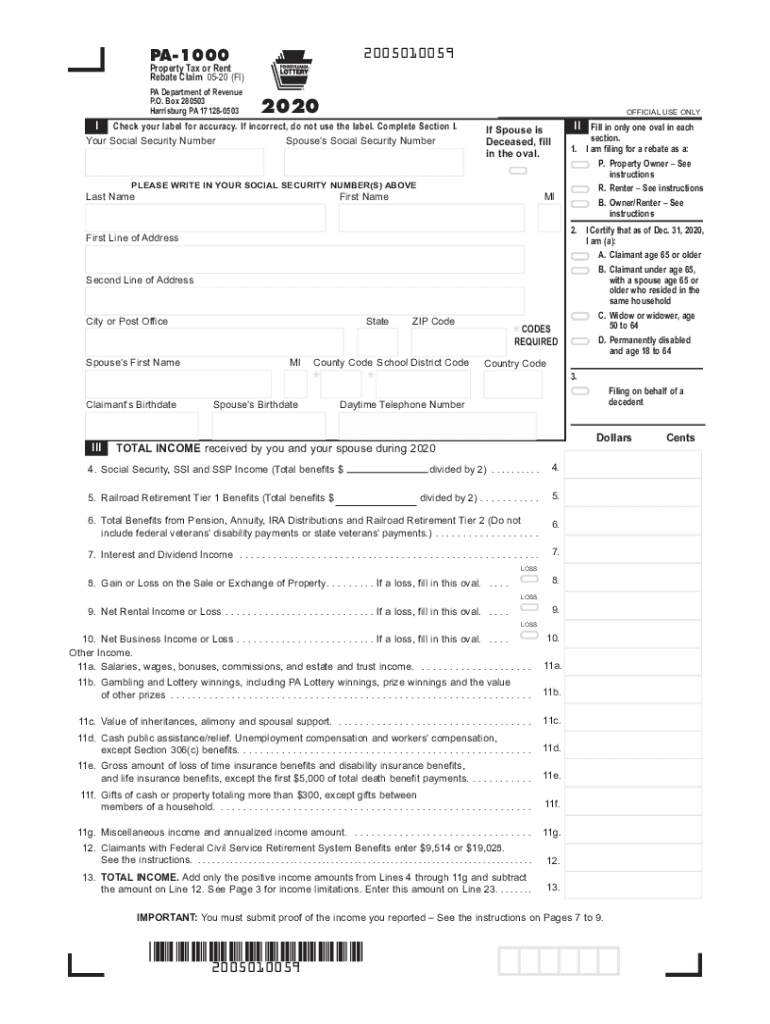

2020 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Life Insurance Rebate In Income Tax - Web 27 sept 2021 nbsp 0183 32 Advisor Insight Life insurance offers desirable tax advantages though it is not exactly tax free Here are ways your life insurance benefits could be taxed