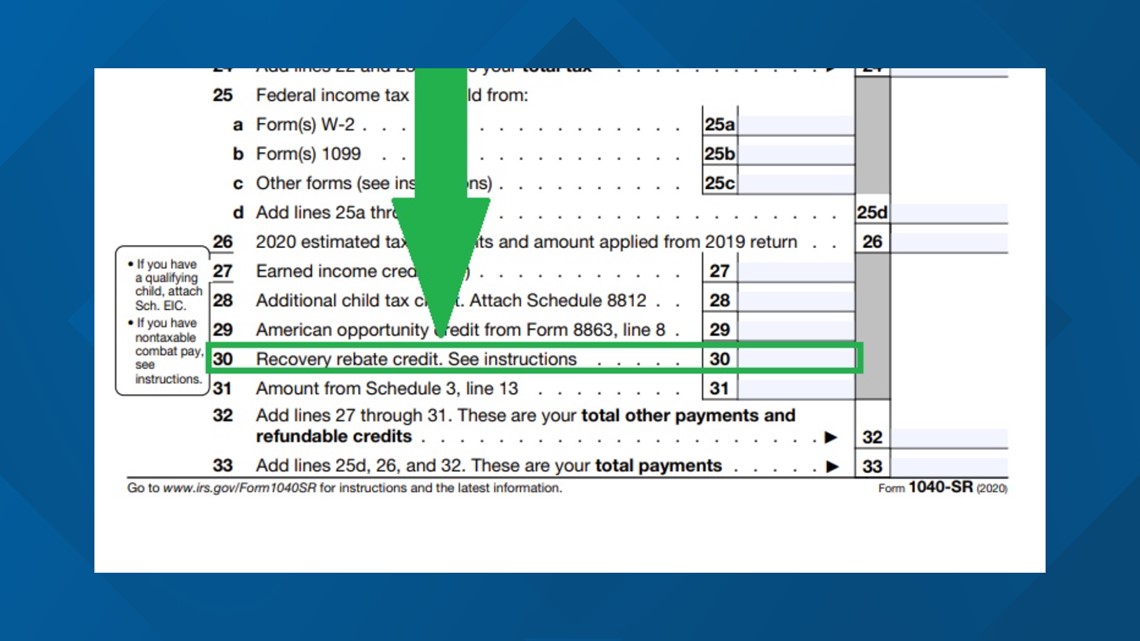

Line 30 Recovery Rebate Credit Web 10 d 233 c 2021 nbsp 0183 32 A2 If you re eligible for the Recovery Rebate Credit you ll need to file a 2020 tax return to claim the credit even if you don t usually file a tax return This credit is

Web 10 d 233 c 2021 nbsp 0183 32 To claim the 2020 Recovery Rebate Credit you will need to Compute the 2020 Recovery Rebate Credit amount using the line 30 worksheet found in 2020 Form Web 13 janv 2022 nbsp 0183 32 If you entered an amount greater than 0 on line 30 and made a mistake on the amount the IRS will calculate the correct amount of the Recovery Rebate Credit

Line 30 Recovery Rebate Credit

Line 30 Recovery Rebate Credit

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021-768x767.jpg

1040 Line 30 Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/irs-1040-form-line-30-solved-complete-the-schedule-a-form-1040-for-1.png

Recovery Rebate Credit On 2021 Tax Return Could Help Get Missed COVID

https://dontmesswithtaxes.typepad.com/.a/6a00d8345157c669e20282e140c0ca200b-800wi

Web 10 d 233 c 2021 nbsp 0183 32 If you entered an amount on line 30 of your 2020 tax return but made a mistake in calculating the amount the IRS will calculate the correct amount of the Web 1 d 233 c 2022 nbsp 0183 32 The 2020 Recovery Rebate Credit is actually a tax year 2020 tax credit The government sent payments beginning in April of 2020 and a second round beginning in late December of 2020 and into 2021 The

Web 1 janv 2021 nbsp 0183 32 To claim a recovery rebate credit taxpayers will need to reconcile their economic impact payment with any recovery rebate credit amount for which they are Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Download Line 30 Recovery Rebate Credit

More picture related to Line 30 Recovery Rebate Credit

Recovery Rebate Credit Line 30 Instructions Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2023/02/solved-recovery-rebate-credit-error-on-1040-instructions-6.png

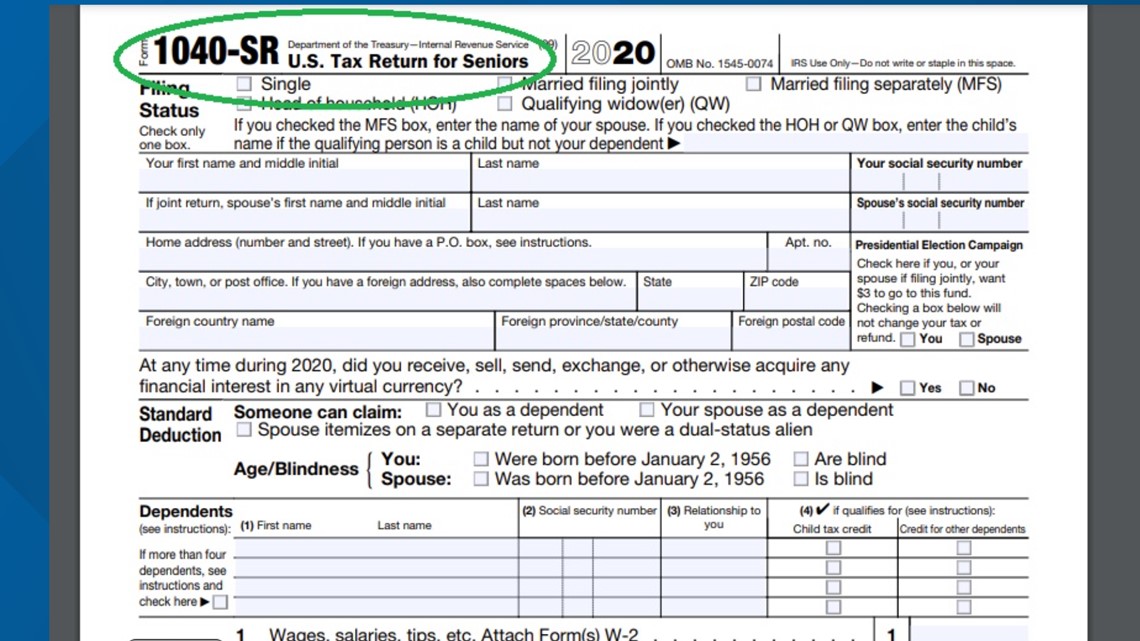

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return

https://images.dailykos.com/images/912448/large/line30.PNG?1612073698

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return

https://images.dailykos.com/images/912447/story_image/1040.PNG?1612073472

Web 9 f 233 vr 2021 nbsp 0183 32 Stimulus and your taxes FAQ Look for Line 30 on your 1040 tax form Tax bill Call the IRS first if you owe and can t pay your tax bill File online File early File for free Web 12 oct 2022 nbsp 0183 32 As a result after subtracting the amount of their third stimulus payment the recovery rebate credit they report on Line 30 of their 2021 tax return is equal to 840

Web If the amount entered as received differs from the amount of credit available which is based on the filing status and number of dependents claimed on the return the program Web In this video I discuss how to fill out the Recovery Rebate Credit worksheet The Recovery Rebate Credit is a tax credit that is calculated based on any 2021

Line 30 Recovery Rebate Credit 2022 Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/tax-implications-of-covid-19-passport-software-inc.png

How To Fill Out The Recovery Rebate Credit Line 30 Form 1040 Otosection

https://i0.wp.com/kb.erosupport.com/assets/img_5ffe30e292b09.png?resize=650,400

https://www.irs.gov/newsroom/2020-recovery-rebate-credit-topic-d...

Web 10 d 233 c 2021 nbsp 0183 32 A2 If you re eligible for the Recovery Rebate Credit you ll need to file a 2020 tax return to claim the credit even if you don t usually file a tax return This credit is

https://www.irs.gov/newsroom/2020-recovery-rebate-credit-topic-a...

Web 10 d 233 c 2021 nbsp 0183 32 To claim the 2020 Recovery Rebate Credit you will need to Compute the 2020 Recovery Rebate Credit amount using the line 30 worksheet found in 2020 Form

How To Claim Recovery Rebate Credit Turbotax Romainedesign Recovery

Line 30 Recovery Rebate Credit 2022 Recovery Rebate

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

How To Claim The Stimulus Money On Your Tax Return Wltx

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

How To Claim The Stimulus Money On Your Tax Return 13newsnow

30 Recovery Rebate Worksheet Worksheets Decoomo

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Line 30 Recovery Rebate Credit - Web 5 d 233 c 2022 nbsp 0183 32 The Recovery Rebate Credit amount is figured just like the third economic impact stimulus payment except that it uses your client s tax year 2021 information to