List Of Gst Returns And Due Dates Pdf GST Return Due Dates Chart Updated Download in PDF Last updated at April 16 2024 by Teachoo GST DUE DATE CHART FOR NORMAL REGISTERED

It includes all types of sales and sales return like B2B B2C export sales exempted sales and also amendment in invoices previously uploaded Due date for Every person who is registered under GST should furnish returns as prescribed by the Act and the Rules and at the prescribed frequency Provisions related to Registration are

List Of Gst Returns And Due Dates Pdf

List Of Gst Returns And Due Dates Pdf

https://softwareauggest-blogimages.s3.ca-central-1.amazonaws.com/blog/wp-content/uploads/2022/01/19103606/Types-of-GST-Returns-Forms-Due-Dates-Penalties-1024x409.jpg

Types Of GST Returns And Their Due Dates ExcelDataPro

https://d25skit2l41vkl.cloudfront.net/wp-content/uploads/2017/07/Types-of-GST-Returns.jpg

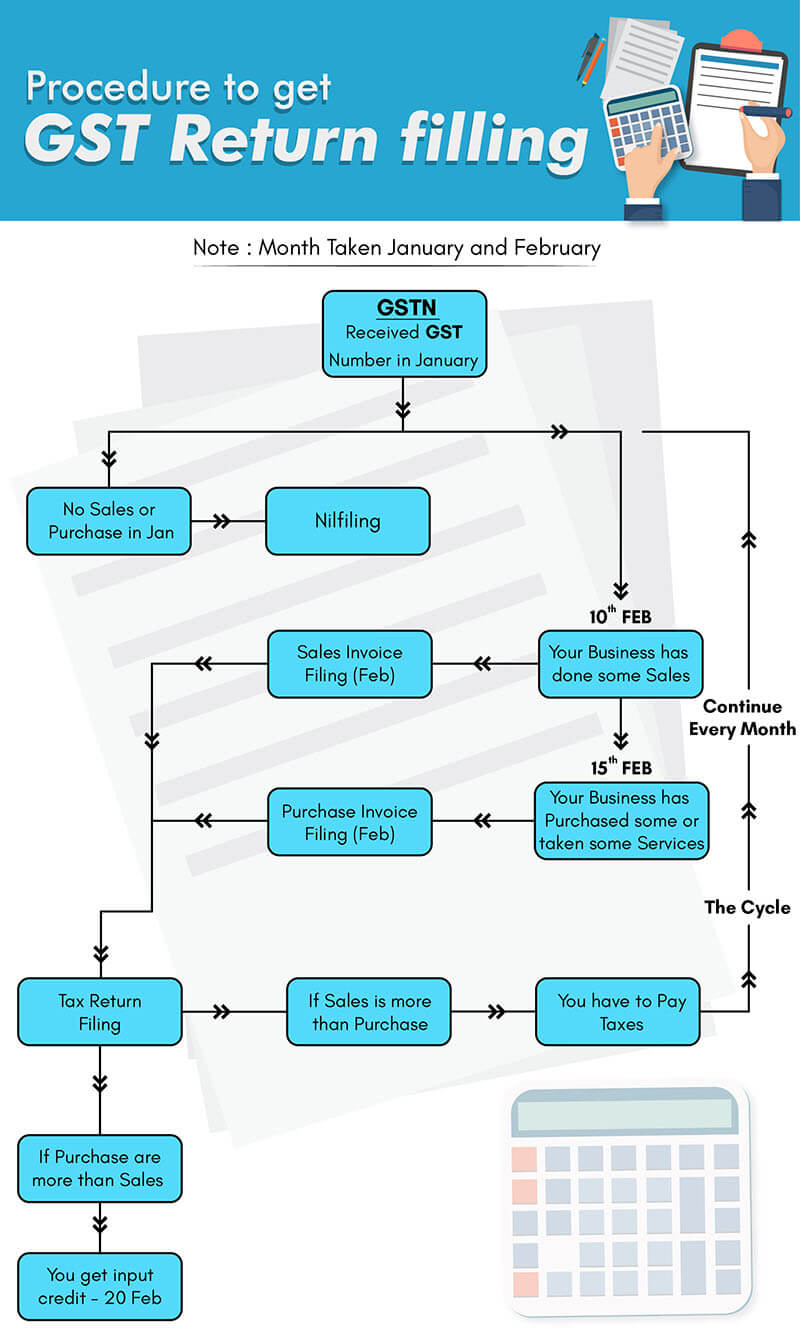

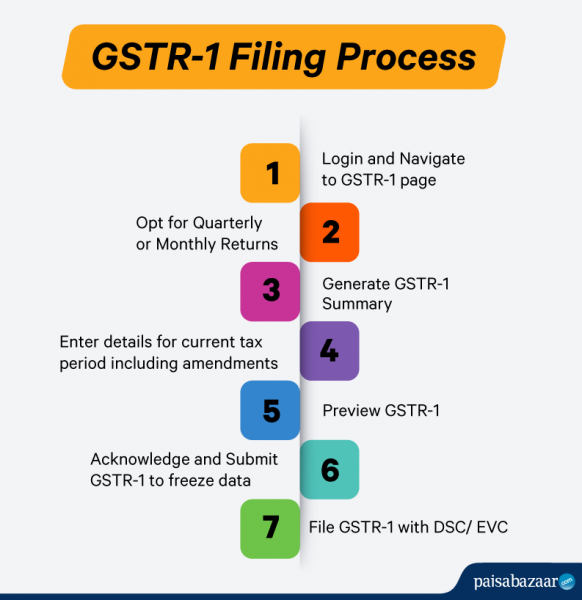

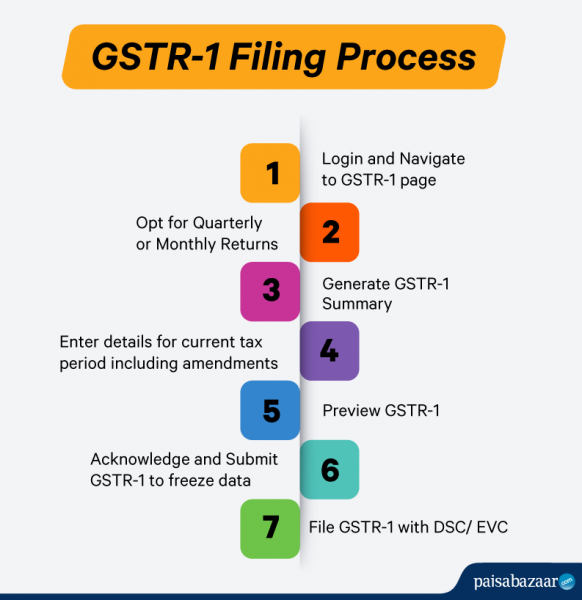

PROCESS FOR GST RETURN FILING SERVICES ONLINE CA CS ADV Service PUNE

https://legaldocs.co.in/img/gst-filling/gst-return-filling.jpg

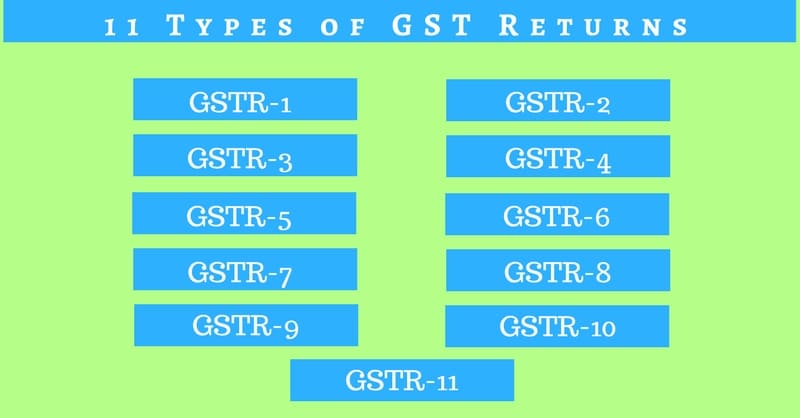

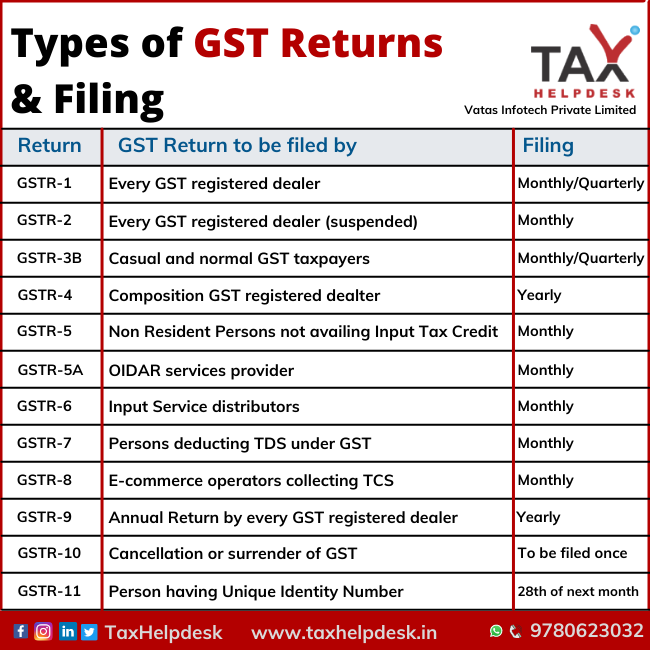

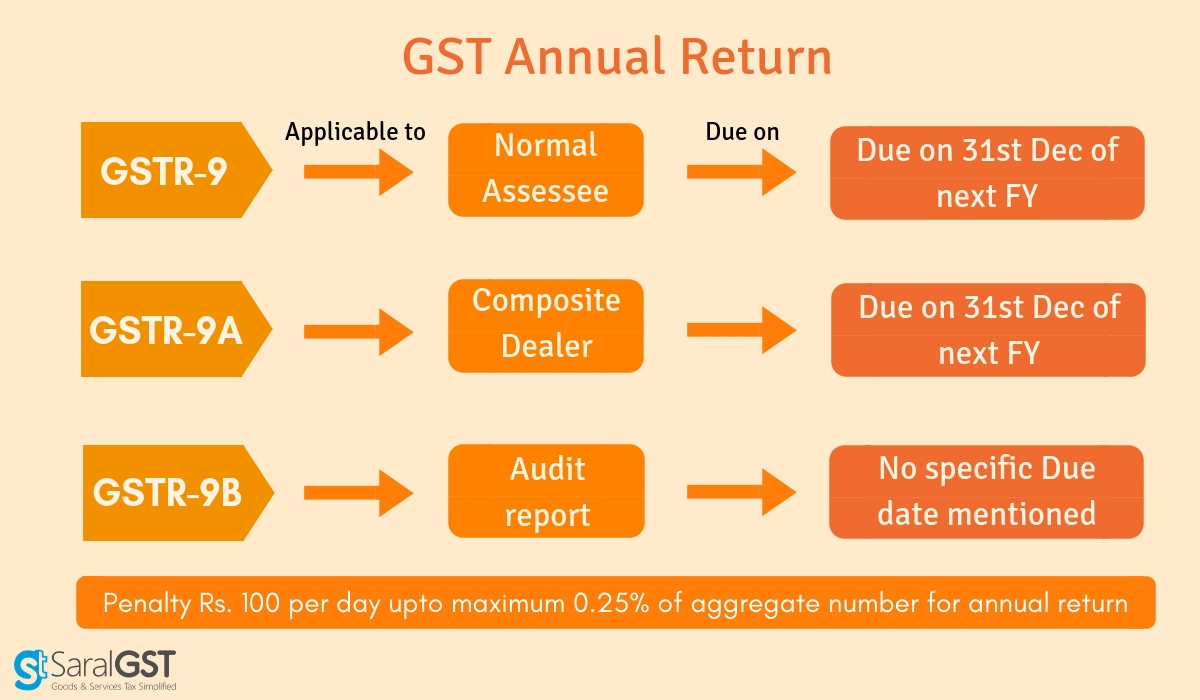

Following table lists the various types of returns under GST Law annual return There are separate returns for a taxpayer registered under the composition scheme non resident Goods and Services GST Returns Calendar with Due Dates against every GST Return explaining who to file such returns including all returns applicability

12 rowsIf you are registered under GST you need to file monthly returns Every month a single monthly return with summary of outward supply and inward supply This in depth article explains various types of GST Returns format of GST returns process of filing GST returns and important due dates Check out now

Download List Of Gst Returns And Due Dates Pdf

More picture related to List Of Gst Returns And Due Dates Pdf

GST Return When To File GST Due Dates Other Important Dates

https://okcredit-blog-images-prod.storage.googleapis.com/2020/11/gst123.jpg

Types Of GST Returns And Due Dates Accoxi Income Tax Income Tax

https://i.pinimg.com/736x/a0/3c/08/a03c0847d15a36d960b01c6c19ba373d.jpg

Types Of GST Returns Filing Period And Due Dates

https://www.taxhelpdesk.in/wp-content/uploads/2021/02/Types-of-GST-Returns-Filing.png

In this comprehensive guide we will explore the various aspects of GST returns including the information required to be furnished the importance of filing returns the From July 2017 to December 2019 the due date was 20th of next month Now this due date has been broken into 3 dates i e 20th 22nd and 24 th of following

In this article we look at the different types of GST returns and the due dates The following describes the types of GST returns articles as per the GST Act There are 4 types of GST levied namely Integrated Goods and Services Tax IGST State Goods and Services Tax SGST Central Goods and Services Tax CGST and Union

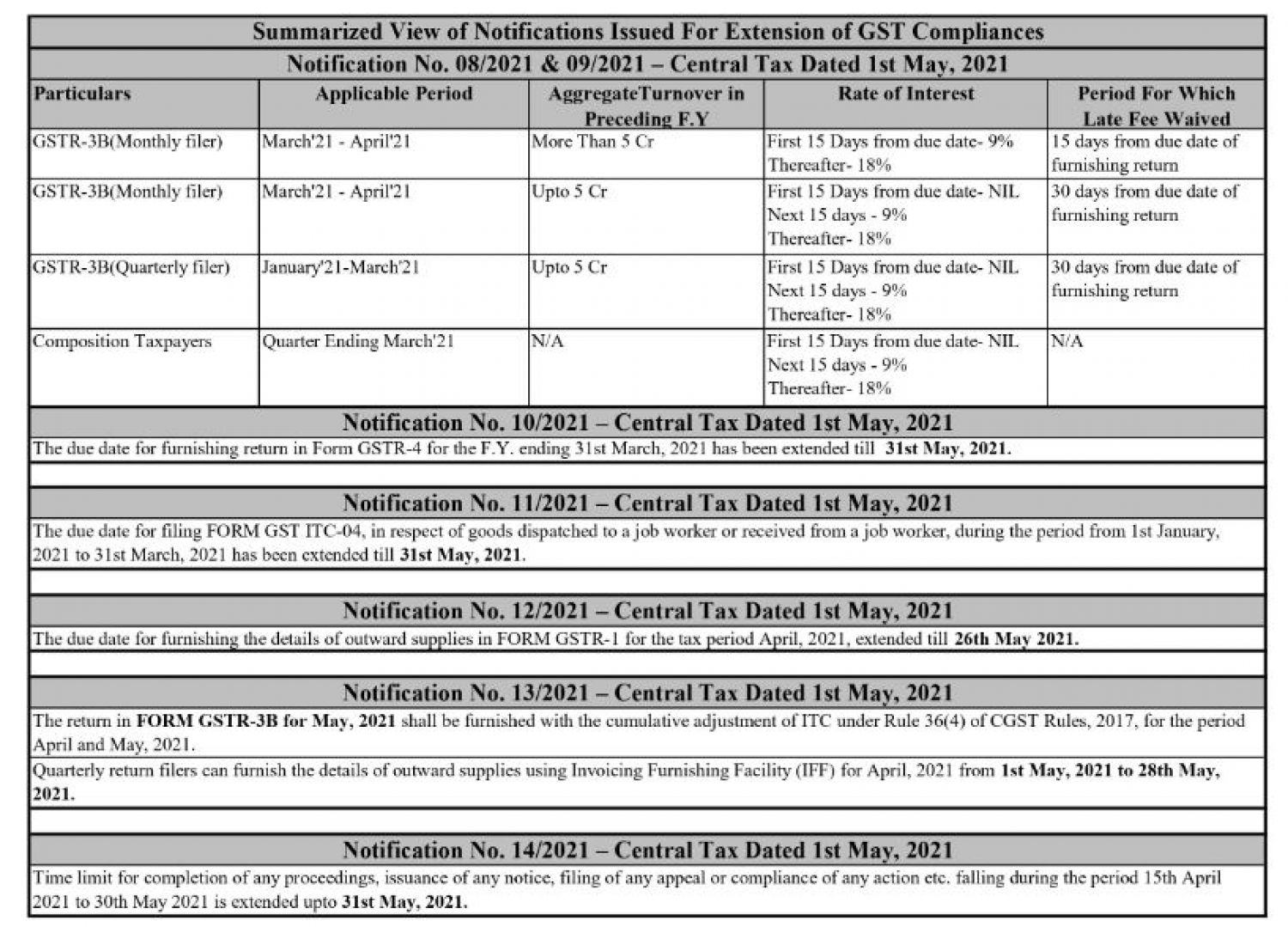

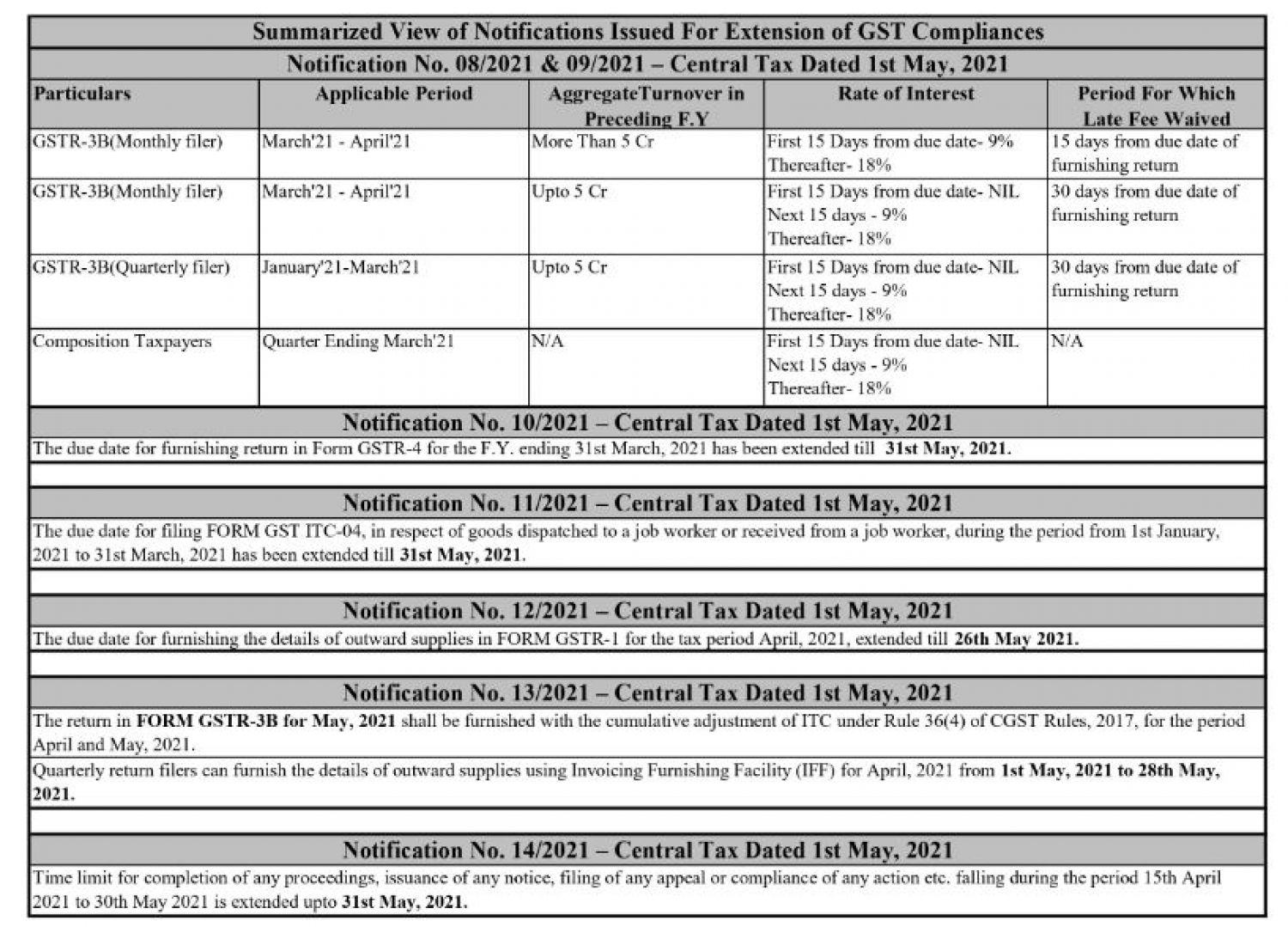

Due Dates Of Various GST Return Falling In Month Of April

https://carajput.com/art_imgs/extension-of-the-due-dates-for-different-gst-returns-in-april2021.jpg

GST Return Due Date For FY 2023 24

https://www.taxmani.in/wp-content/uploads/2022/04/GST-Return-Due-Date-for-FY-2022-23.png

https://www.teachoo.com/6739/1948/GST-Return-Due...

GST Return Due Dates Chart Updated Download in PDF Last updated at April 16 2024 by Teachoo GST DUE DATE CHART FOR NORMAL REGISTERED

https://taxadda.com/gst-returns

It includes all types of sales and sales return like B2B B2C export sales exempted sales and also amendment in invoices previously uploaded Due date for

GST Return Who Should File Due Dates Types Of GST Returns

Due Dates Of Various GST Return Falling In Month Of April

Types Of GST Returns And Their Due Dates Enterslice

GST Returns Types Forms Due Dates Penalties Certicom

Gst returns Certicom

GST Return Forms Types Due Dates And Late Filing Penalties

GST Return Forms Types Due Dates And Late Filing Penalties

Types Of GST Returns Format How To File Due Dates

GSTR 9 Meaning Due Date And Details In GST Annual Return

GST Returns enterslice Enterslice

List Of Gst Returns And Due Dates Pdf - This in depth article explains various types of GST Returns format of GST returns process of filing GST returns and important due dates Check out now