Loan Principal Deduction 80c Meaning The repayment of the principal of a loan taken to buy or construct a residential property is eligible for tax deductions under Section 80C This deduction is also applicable on stamp duty registration fees

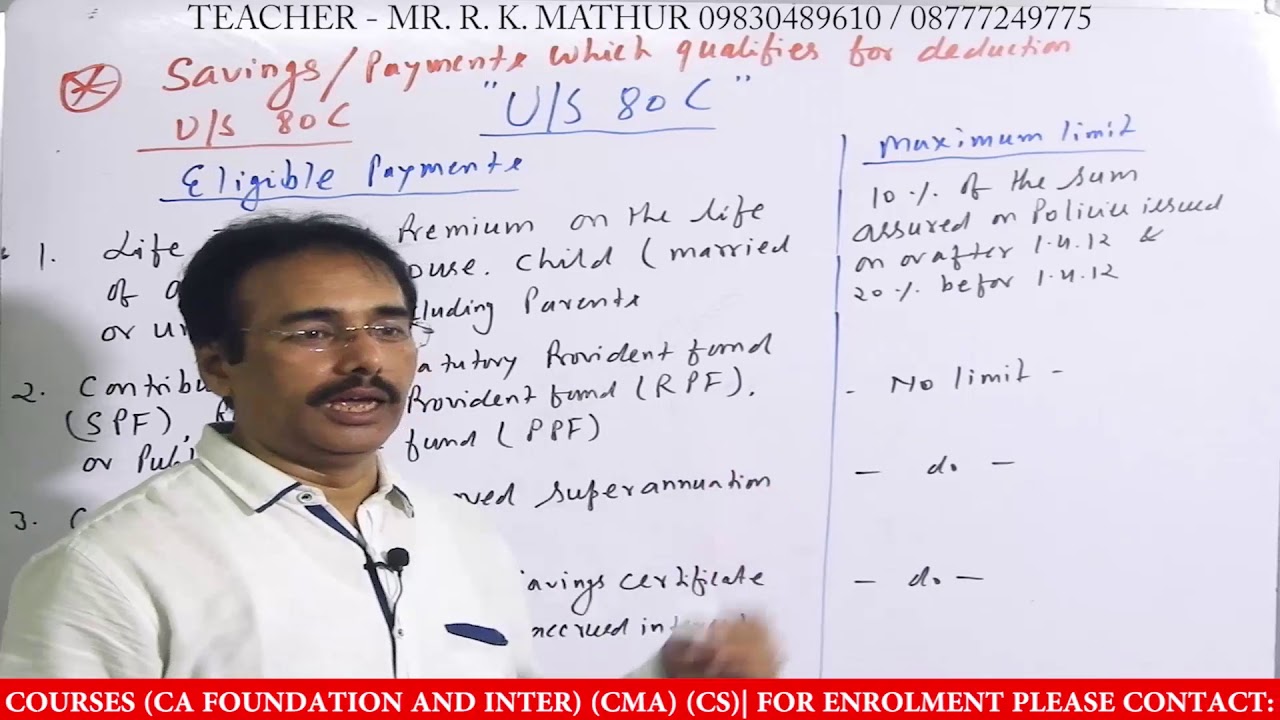

Section 80C of the Income Tax Act allows for a deduction of payment of principal component and it is allowed on the basis of actual payment made in the Tax deduction on the principal component is limited to Rs 1 50 lakhs per annum under Section 80C while rebate towards interest is capped at Rs 2 lakhs Additional tax benefits are also offered to first

Loan Principal Deduction 80c Meaning

Loan Principal Deduction 80c Meaning

https://i.ytimg.com/vi/L1AUhzT9w0Y/maxresdefault.jpg

Deductions Under Section 80C Benefits Works Myfinopedia

https://www.myfinopedia.com/wp-content/uploads/2023/01/Deductions-Under-Section-80C.jpg

Section 80C Deductions List To Save Income Tax FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2022/09/section-80C-deductions-list-to-save-income-tax-video.webp

80CCD 1 allows deductions against employees contributions to the National Pension Scheme NPS The maximum deduction under 80CCD 1 can be either of the below two whichever is Section 80C allows the deduction for the amount paid towards the principal repayment of the home loan taken from the specified financial institutions This deduction is allowed under the overall

Principal repayment towards home loan Principal repayments made for housing loans can be claimed for deduction under section 80C This deduction can be What is 80C in Income Tax and its Sub sections Section 80C permits certain investments and expenses to be tax exempted By well planning the 80C investments that are

Download Loan Principal Deduction 80c Meaning

More picture related to Loan Principal Deduction 80c Meaning

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Tax-benefits-on-Home-Loan-819x1024.jpeg

INCOME TAX DEDUCTION 80C YouTube

https://i.ytimg.com/vi/_NyxvWdjEhE/maxresdefault.jpg

Tax Benefits Of Paying Home Loan EMI HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2021/10/benefits-of-paying-home-loan-emi.png

Home Loan Principal Repayment If you re a homeowner the portion of your home loan EMI dedicated towards principal repayment is eligible for deduction For home loan principal amount payment the borrower can claim tax deductions under Section 80C of the Income Tax I T act See also 11 key facts about

Yes the principal repayment of a home loan is eligible for deduction under Section 80C subject to the overall limit of 1 50 000 However the property should not The principal repayment component in the home loan EMI is allowed as deduction under Section 80C of the Income Tax Act

Deduction US 80C Deduction Under Section 80C Everything About

https://i.ytimg.com/vi/784UGSm-7B0/maxresdefault.jpg

Important Deductions Meaning Solving Simple Problem Under Sec 80C

https://i.ytimg.com/vi/M7MnleWMWJk/maxresdefault.jpg

https://cleartax.in/s/80C-Deductions

The repayment of the principal of a loan taken to buy or construct a residential property is eligible for tax deductions under Section 80C This deduction is also applicable on stamp duty registration fees

https://taxguru.in/income-tax/tax-benefits-home...

Section 80C of the Income Tax Act allows for a deduction of payment of principal component and it is allowed on the basis of actual payment made in the

Tax Benefits On Home Loan Know More At Taxhelpdesk

Deduction US 80C Deduction Under Section 80C Everything About

Section 194IA Deduction Of Tax At Source From Payment Of Transfer Of

Dependent Deduction And Spouse Deduction In Japan Law Japan

General Loan Calculator Review Download App Of The Day

How To Claim Business Loan Tax Deductions Under Section 80C IIFL Finance

How To Claim Business Loan Tax Deductions Under Section 80C IIFL Finance

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

Here A List Of Types Of Deductions Covered Under Section 80C

Student Loan Servicer Errors Pose Risks To Borrowers And Economy CFPB

Loan Principal Deduction 80c Meaning - Principal repayment towards home loan Principal repayments made for housing loans can be claimed for deduction under section 80C This deduction can be