Lottery Tax Return Canada This Chapter discusses the tax treatment of various receipts such as strike pay gambling winnings and forfeited deposits which do not readily come within any of the more usual

No lottery winnings aren t taxed in Canada Whether you earn just a couple of bucks or millions of dollars from a lottery pot your earnings don t need to be reported to the Canada Revenue Agency Winnings from a Canadian lottery such as Lotto Max or 649 are considered to be windfalls and windfalls are not subject to tax Even winnings from a sweepstake

Lottery Tax Return Canada

Lottery Tax Return Canada

https://i.ytimg.com/vi/gNFejk4kJ88/maxresdefault.jpg

What Is Line 15000 Tax Return formerly Line 150 In Canada

https://thefinancekey.com/wp-content/uploads/2022/02/line-15000-tax-return-canada-768x510.jpg

How To Pay Ohio Lottery Tax After Claiming Your Winnings Explained

https://dvo14rqtr1m20.cloudfront.net/learn/wp-content/uploads/sites/4/2021/10/Screen-Shot-2021-10-26-at-2.34.41-PM.png

Lottery winnings in Canada are subject to taxation by the Canada Revenue Agency CRA The tax treatment of lottery winnings depends on several factors including the type and amount of the prize In this blog post we will delve into the tax rules surrounding prize and lottery winnings in Canada clarifying the various scenarios and exemptions By understanding

Yes lottery winnings in Canada are generally subject to taxation When an individual wins a lottery prize whether it s a lump sum payment or annuity payments the Lottery Tax Rules in Canada On the surface you do not have to pay taxes on lottery winnings in Canada and lottery winners don t have to report lotto prizes on their tax

Download Lottery Tax Return Canada

More picture related to Lottery Tax Return Canada

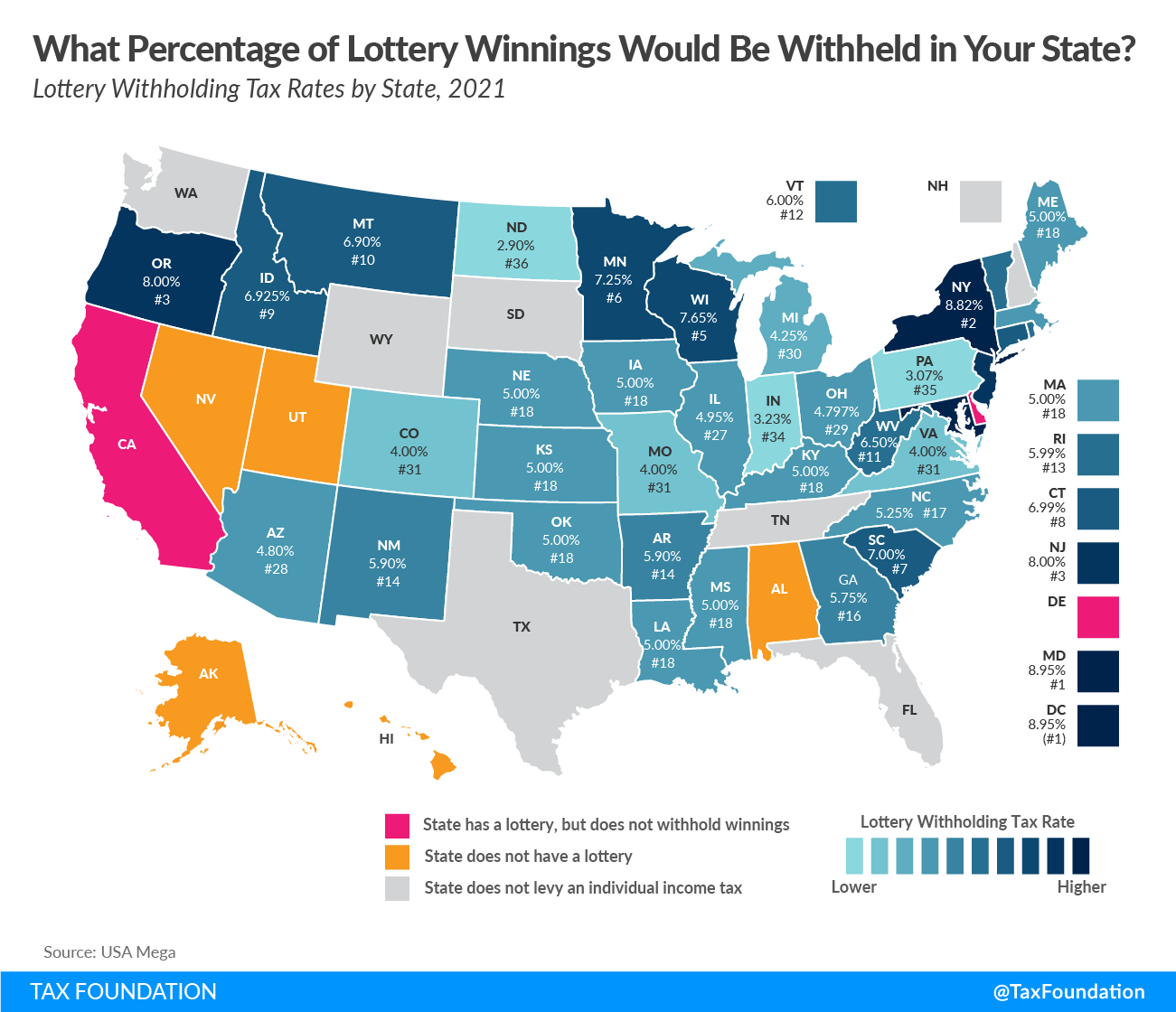

New Year Means New Taxes For Lottery Winners 10 States Adjust Levies

https://www.casino.org/news/wp-content/uploads/2023/01/1200Lotterya.jpg

Corporate Income Tax Annual Tax Return Form Excel Template And Google

https://image.slidesdocs.com/responsive-images/sheets/corporate-income-tax-annual-tax-return-form-excel-template_d9bd2fc9f4__max.jpg

Can A Tourist Win The Lottery In The United States

https://journeyz.co/wp-content/uploads/2022/02/Tax.jpg

Winnings from official lotteries are tax exempt meaning you do not need to report them as income on your tax return This exemption applies to both cash prizes File a Non Resident Tax Return 1040NR The tax return should be filed by April 15 of the year following the one in which you have earned your winnings The gambling establishment should provide you

Lottery and gambling winnings aren t taxable in Canada and don t need to be reported on tax returns However any income generated by your winnings will be subject to standard tax rates For example if you invest Even though Canadian tax law does not tax lottery winnings Canadians must still report foreign lottery winnings to the Canada Revenue Agency CRA This is

4 Smart Investments Using Your Tax Return

https://blog.usccreditunion.org/hubfs/tax-return-money.jpg

Android File FREE Income Tax Return ClearTax ITR E filing

https://images.sftcdn.net/images/t_app-cover-l,f_auto/p/7db9b7c2-9ff1-41ac-bbee-27dcf1be0514/1391937416/file-free-income-tax-return-cleartax-itr-e-filing-screenshot.png

https://www.canada.ca › en › revenue-agency › services...

This Chapter discusses the tax treatment of various receipts such as strike pay gambling winnings and forfeited deposits which do not readily come within any of the more usual

https://www.savvynewcanadians.com › ar…

No lottery winnings aren t taxed in Canada Whether you earn just a couple of bucks or millions of dollars from a lottery pot your earnings don t need to be reported to the Canada Revenue Agency

Tax Return Employment Self Employment Dividend Rental Property

4 Smart Investments Using Your Tax Return

What Is Line 15000 Tax Return formerly Line 150 In Canada

Top 6 Tax Tips For Filing A Canadian Tax Return

The Popularity Of Lottery Games In Low Income Neighborhoods

What Is Line 15000 Tax Return formerly Line 150 In Canada

What Is Line 15000 Tax Return formerly Line 150 In Canada

Tax Return Deadline Extension

Lottery Winnings Tax Rates By State Tax Foundation

Contact AAA Tax Service

Lottery Tax Return Canada - Learn about how lottery winnings are taxed in Canada and why Canadian winners don t have to worry about taxes on their windfalls Here we explore the world of lottery