Tax Rebate For Medical Expenses Web 14 juin 2018 nbsp 0183 32 What is Section 80D Every individual or HUF can claim a deduction from their total income for medical insurance premiums paid in any given year under Section

Web 21 f 233 vr 2022 nbsp 0183 32 Section 80D of Income Tax Act allows deduction of up to Rs 50 000 for medical expenses incurred for senior citizens self Web 16 nov 2022 nbsp 0183 32 33 3 of the fees paid by the person to a registered medical scheme or similar qualifying foreign fund as exceeds three times the amount of the MTC to which

Tax Rebate For Medical Expenses

Tax Rebate For Medical Expenses

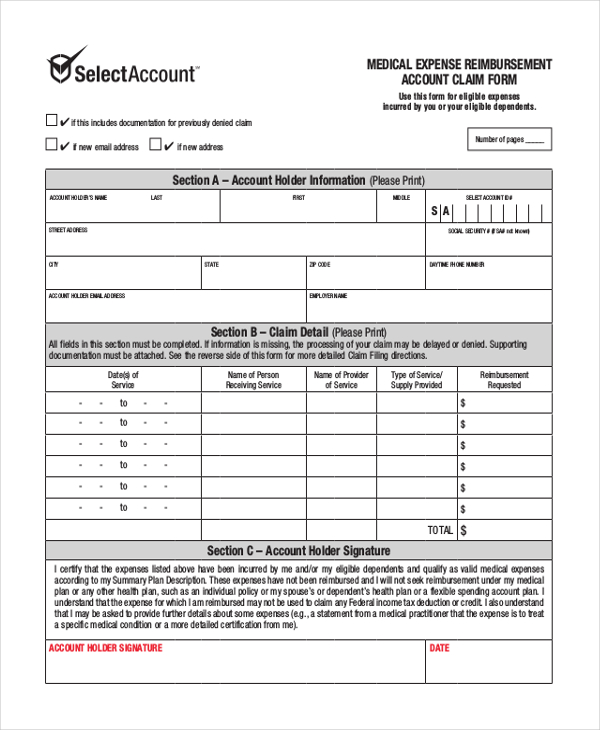

https://images.sampleforms.com/wp-content/uploads/2016/08/MEDICAL-EXPENSE-REIMBURSEMENT-ACCOUNT-CLAIM-FORM.jpg

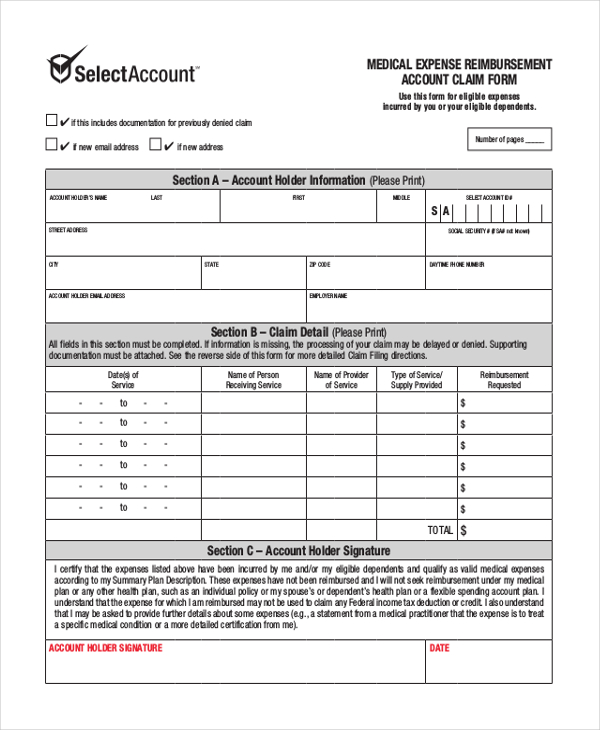

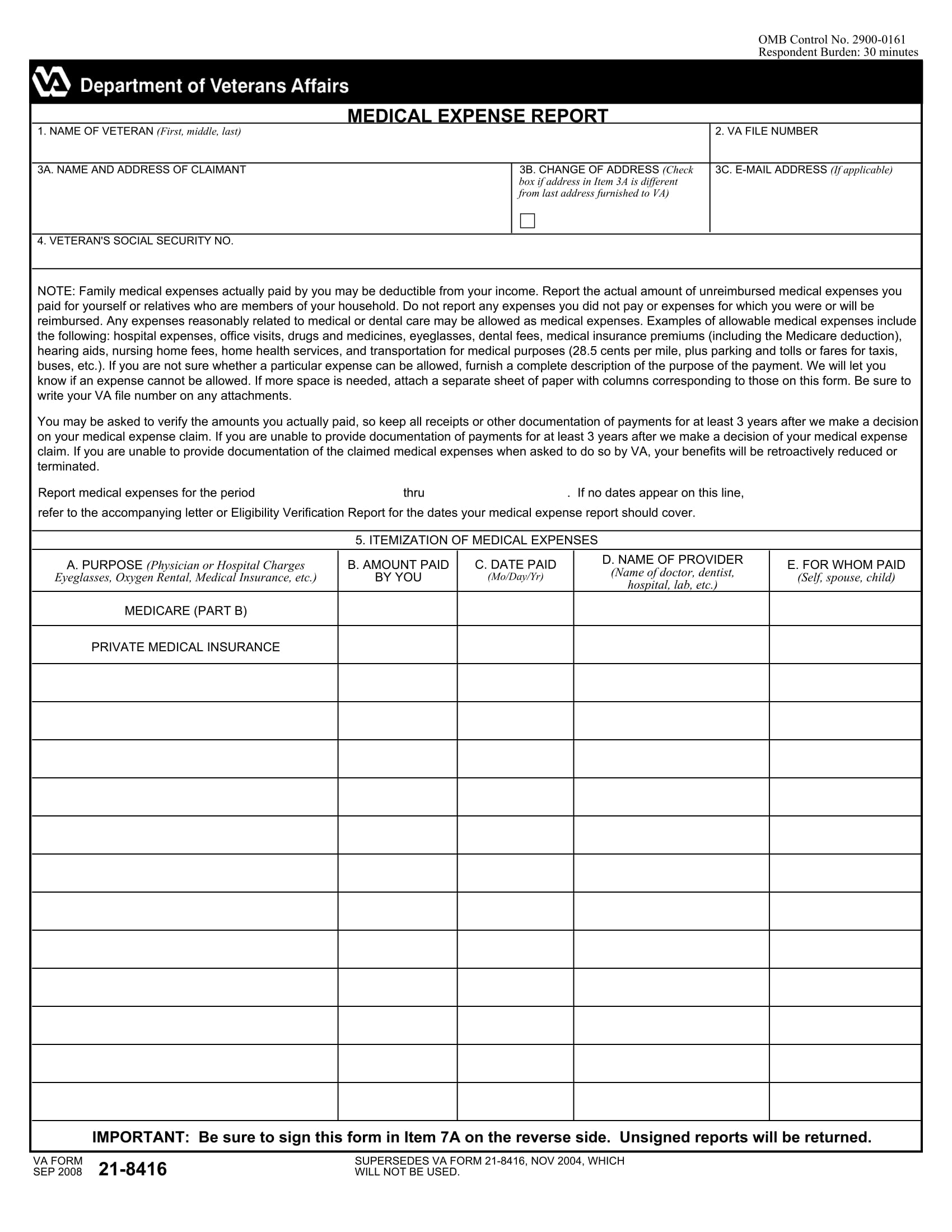

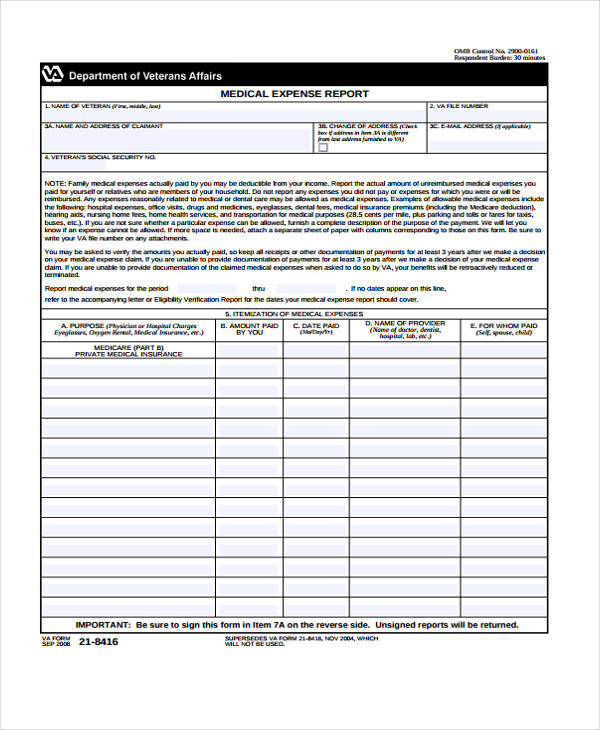

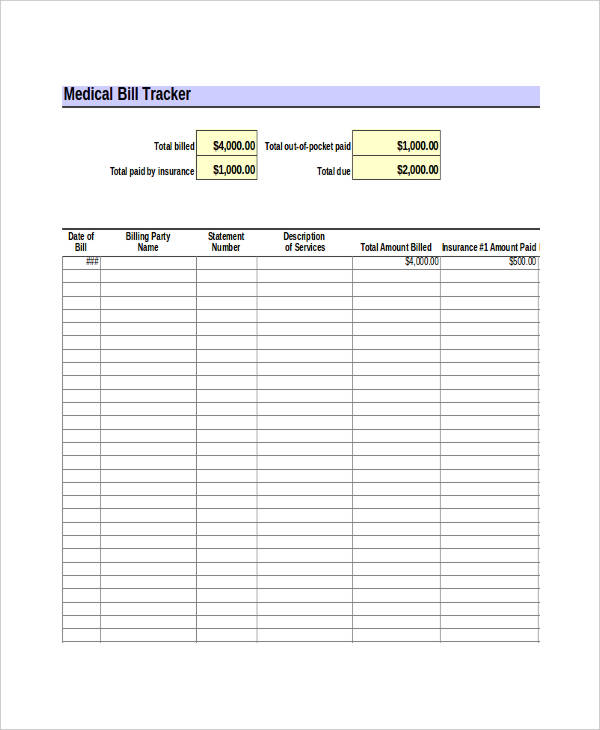

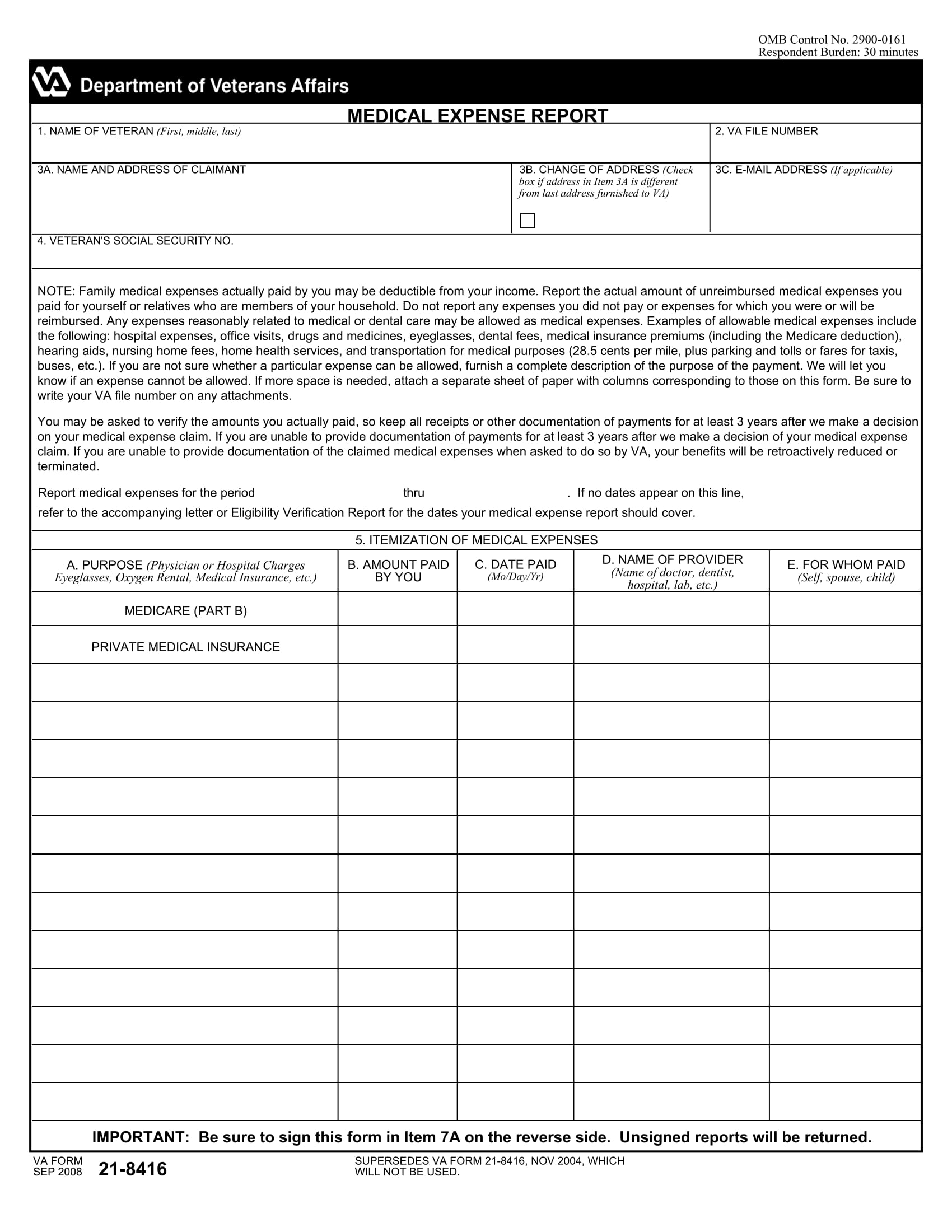

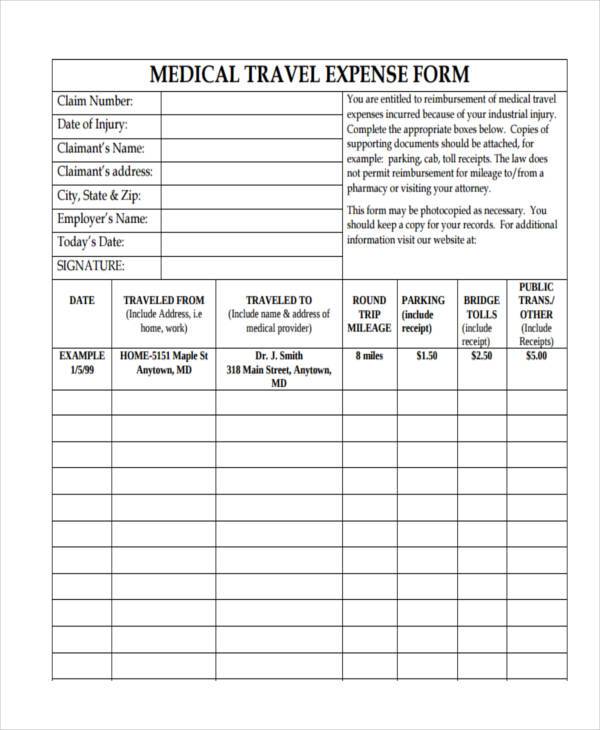

FREE 13 Expense Report Forms In MS Word PDF Excel

https://images.sampleforms.com/wp-content/uploads/2017/11/Medical-Expense-Report-Form-1.jpg

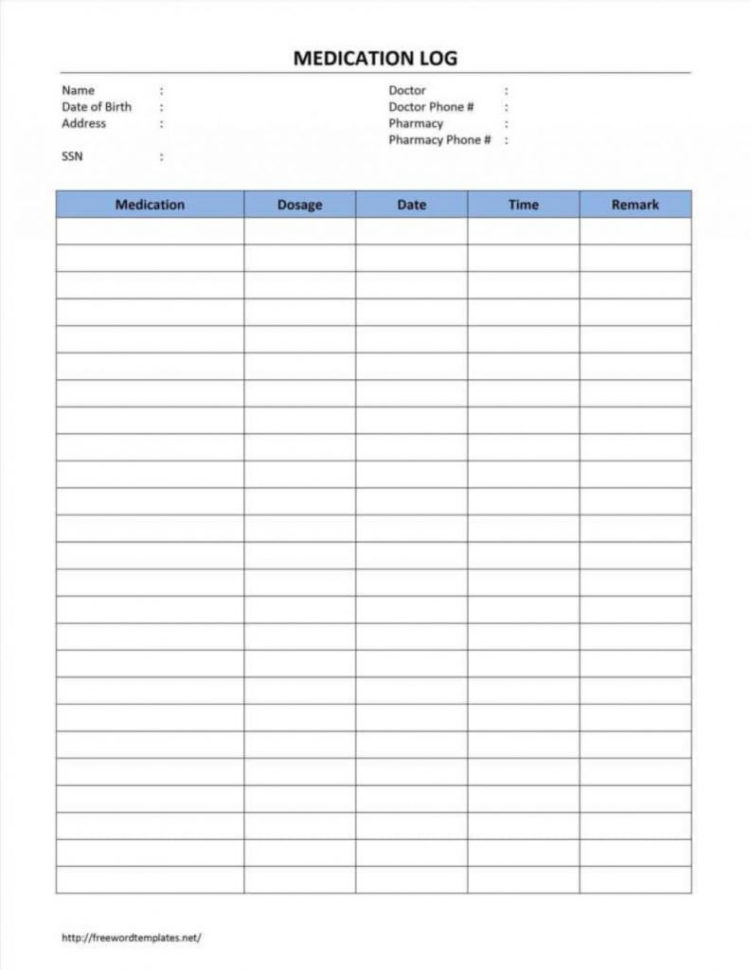

FREE 11 Medical Expense Forms In PDF MS Word

https://images.sampleforms.com/wp-content/uploads/2017/04/Medical-Expense-Report-Form.jpg

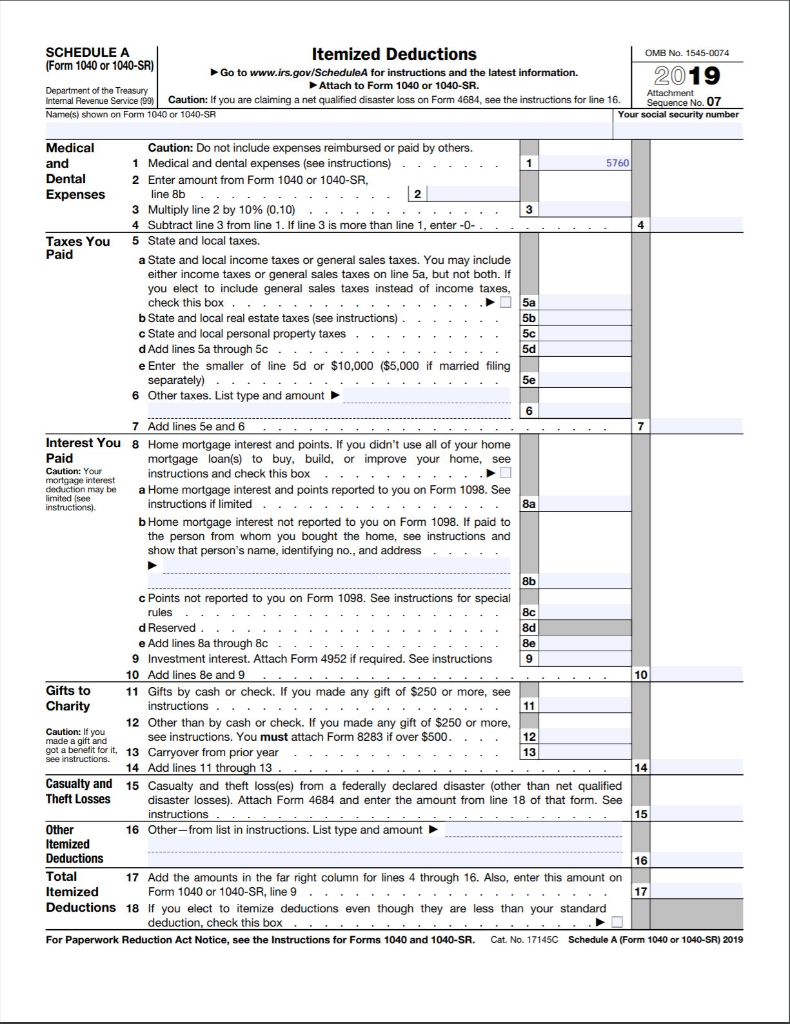

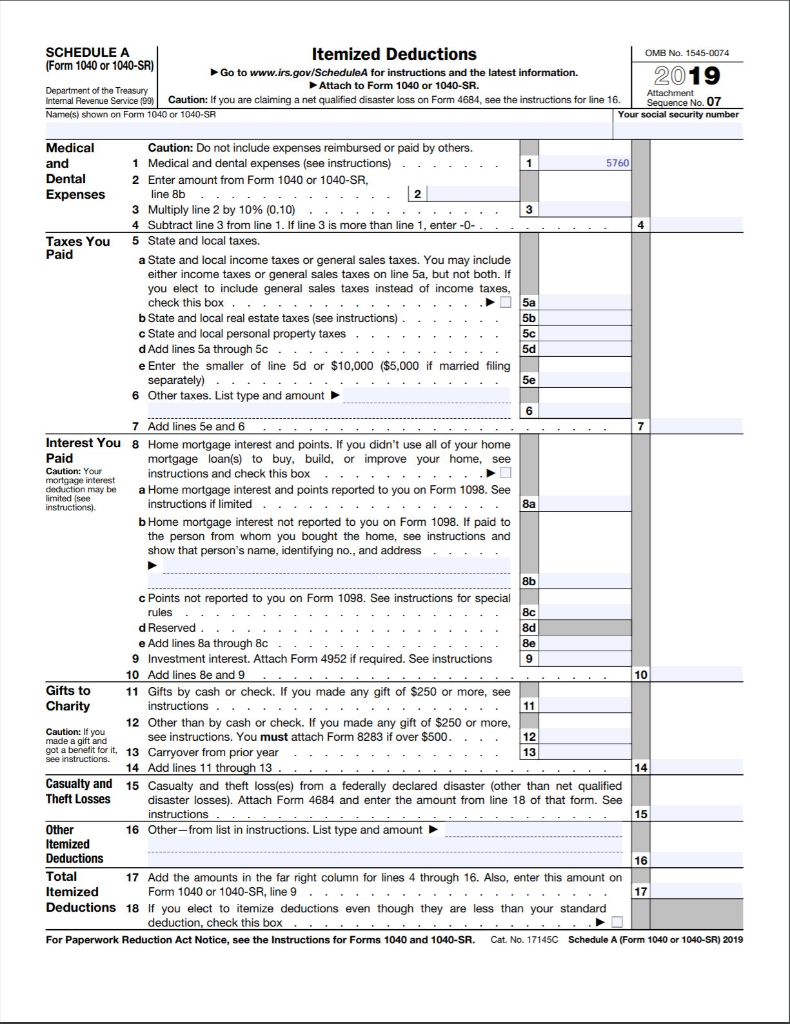

Web 12 janv 2023 nbsp 0183 32 How much medical expense is tax deductible You can deduct qualifying medical expenses that exceed 7 5 of your adjusted gross income You must itemize your deductions to be able to claim Web 15 mars 2019 nbsp 0183 32 Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You can claim this deduction if these two conditions are

Web 24 oct 2022 nbsp 0183 32 October 24 2022 Lifestyle Money Management Tax Written by Haziq Alfian Part of the struggle of doing your taxes is figuring out which expenses you can claim for Web 31 mars 2023 nbsp 0183 32 For tax returns filed in 2023 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2022 adjusted gross income So if your adjusted gross income is

Download Tax Rebate For Medical Expenses

More picture related to Tax Rebate For Medical Expenses

.png)

Medical Expense Deduction 2020 Ruxoler

https://uploads-ssl.webflow.com/5e57eb33765372f7d30e19f9/5e60276cf755ee1ecad92ae8_How%2520to%2520Calculate%2520Your%2520Adjusted%2520Gross%2520Income%2520(AGI).png

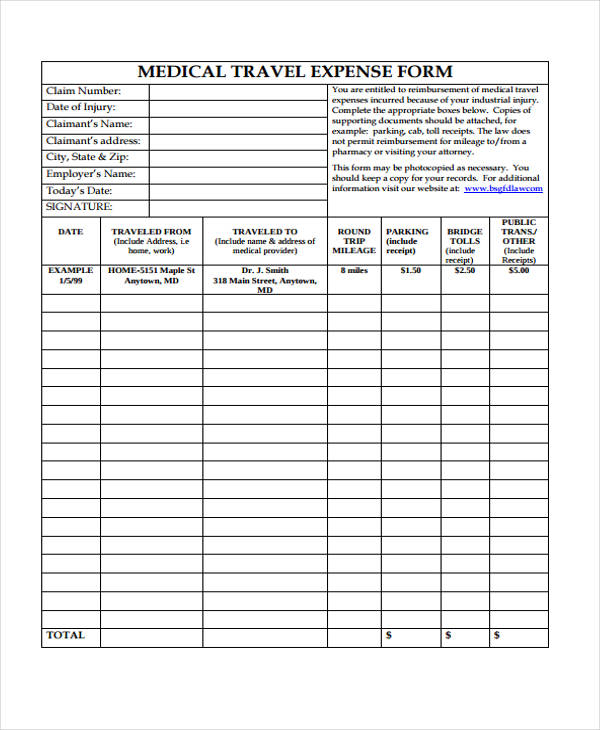

FREE 11 Medical Expense Forms In PDF MS Word

https://images.sampleforms.com/wp-content/uploads/2017/04/Medical-Travel-Expense-Form.jpg

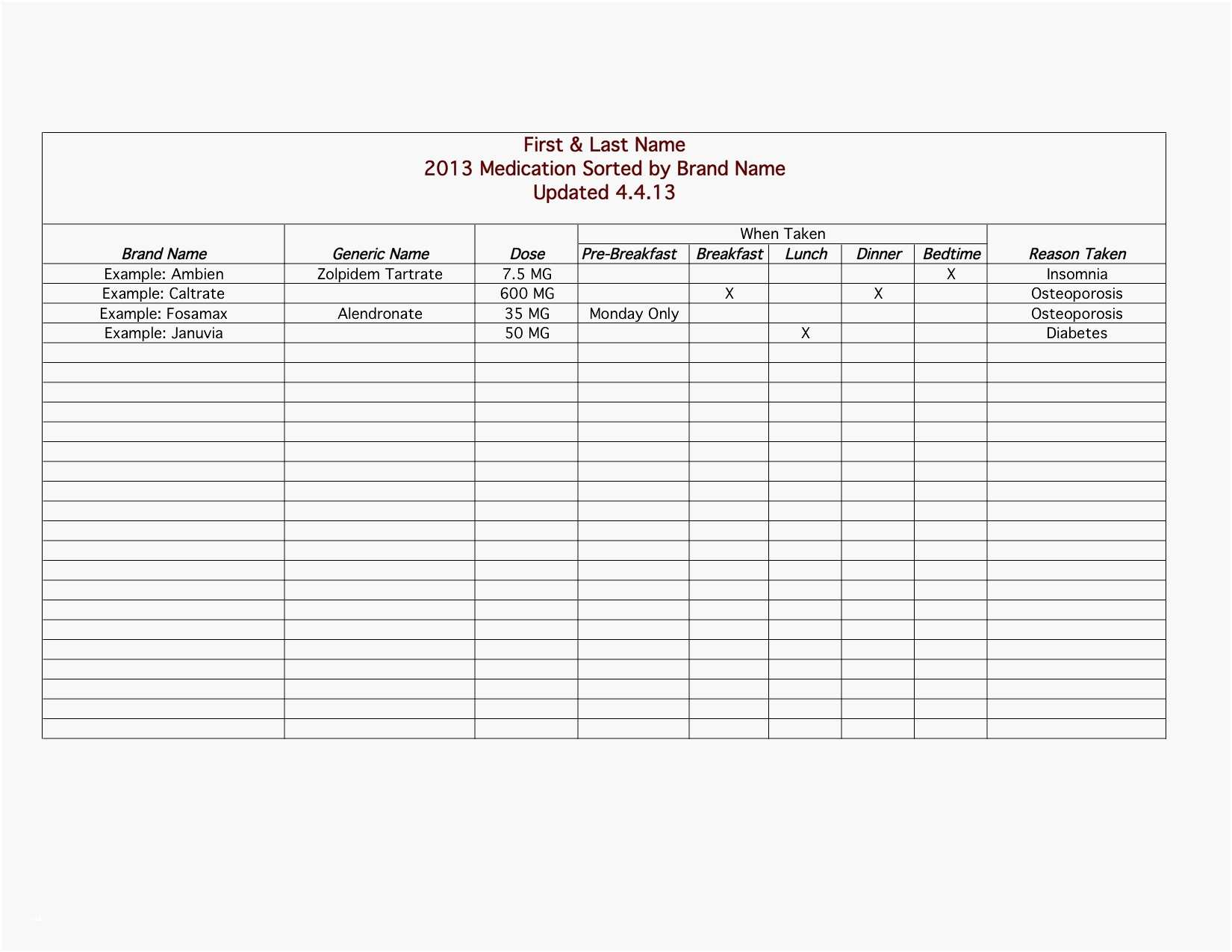

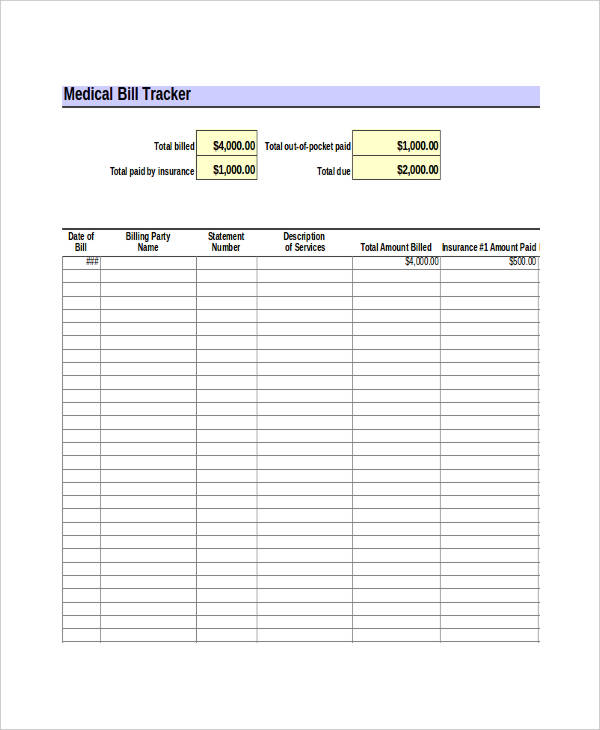

Medical Expense Spreadsheet Templates Google Spreadshee Medical Expense

https://db-excel.com/wp-content/uploads/2019/01/medical-expense-spreadsheet-templates-within-medical-expense-spreadsheet-templates-awesome-excel-spreadsheet.jpg

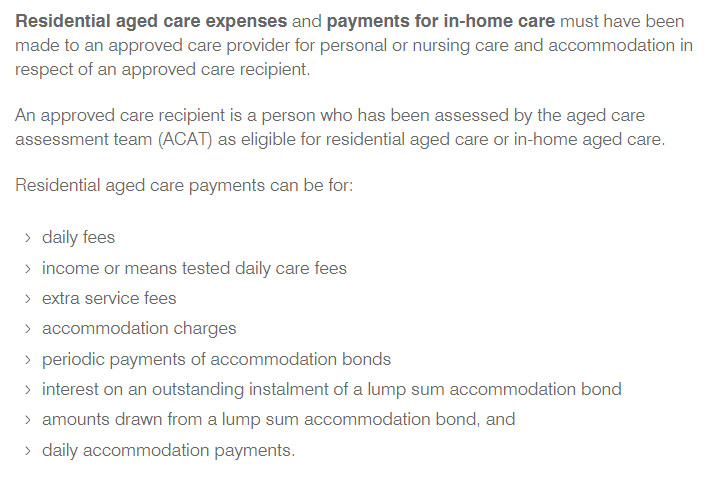

Web 22 f 233 vr 2023 nbsp 0183 32 A Medical Scheme Fees Tax Credit also known as an MTC is a rebate which in itself is non refundable but which is used to reduce the normal tax a person Web 1 8 In 2012 13 the offset was 20 per cent of net medical expenses over 2 120 for single taxpayers with adjusted taxable income for rebates of 84 000 or less and families with

Web 12 f 233 vr 2023 nbsp 0183 32 This leaves you with a medical expense deduction of 2 100 5 475 minus 3 375 This amount can be included on your Schedule A Itemized Deductions As a result of the Tax Cuts and Jobs Web 13 f 233 vr 2020 nbsp 0183 32 Income Tax Deduction for Medical Expenses Last updated February 13th 2020 05 46 pm This article provides a list of all income tax deductions and other

33 Expense Sheet Templates

https://images.template.net/wp-content/uploads/2017/06/Excel-Medical-Expense-Sheet.jpg

Medical Expense Spreadsheet Templates Google Spreadshee Medical Expense

http://db-excel.com/wp-content/uploads/2019/01/medical-expense-spreadsheet-templates-within-doctor-office-invoice-template-and-fake-medical-bills-format-la-751x970.jpg

https://cleartax.in/s/medical-insurance

Web 14 juin 2018 nbsp 0183 32 What is Section 80D Every individual or HUF can claim a deduction from their total income for medical insurance premiums paid in any given year under Section

https://www.newindianexpress.com/business/…

Web 21 f 233 vr 2022 nbsp 0183 32 Section 80D of Income Tax Act allows deduction of up to Rs 50 000 for medical expenses incurred for senior citizens self

FREE 44 Expense Forms In PDF MS Word Excel

33 Expense Sheet Templates

Http www anchor tax service financial tools deductions medical

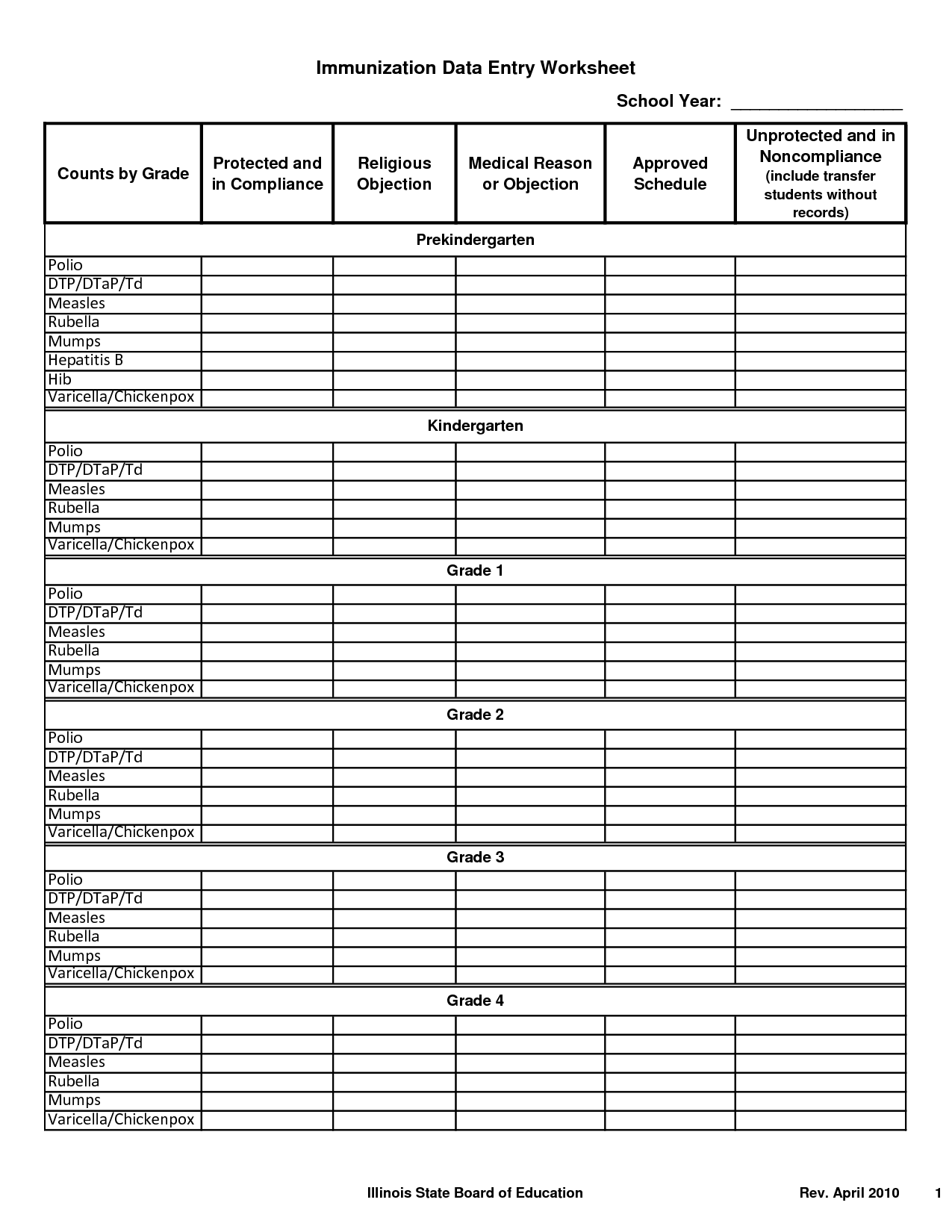

47 MEDICAL FORM CHECKLIST MedicalForm

Claiming The Medical Offset Tax Rebate

Solved How To Complete The Medical And Dental Expenses Chegg

Solved How To Complete The Medical And Dental Expenses Chegg

Medical Expense Spreadsheet Template For Your Needs Bank2home

Medical Mileage Expense Form PDFSimpli

Tracking Medical Expenses Spreadsheet Spreadsheet Downloa Tracking

Tax Rebate For Medical Expenses - Web 9 mars 2023 nbsp 0183 32 You generally receive tax relief for health expenses at your standard rate of tax 20 Nursing home expenses are given at your highest rate of tax up to 40