Ma State Tax Rebate 2023 Web 16 nov 2022 nbsp 0183 32 If you missed the Oct 17 deadline but submit your state income tax return by Sept 15 2023 you should receive your rebate approximately one month after you file

Web If you have not yet filed your 2021 return you are still eligible if you file by September 15 2023 and if eligible for a refund you should receive it approximately one month after you Web 10 f 233 vr 2023 nbsp 0183 32 BOSTON After telling millions in Massachusetts and other states to hold off on filing their taxes the IRS on Friday issued new guidance addressing the tax rebates

Ma State Tax Rebate 2023

Ma State Tax Rebate 2023

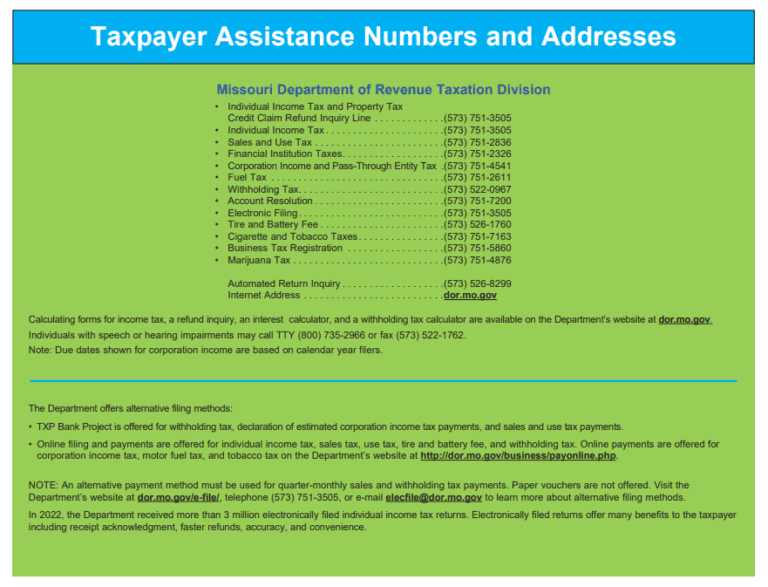

https://printablerebateform.net/wp-content/uploads/2023/04/Missouri-Tax-Rebate-2023-768x587.png

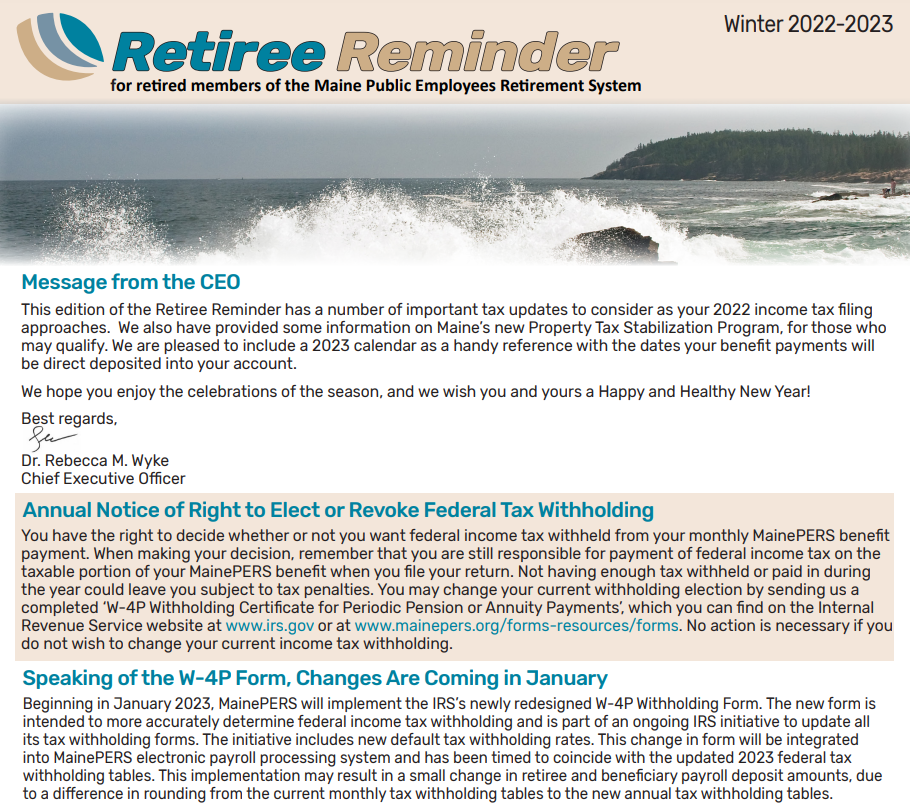

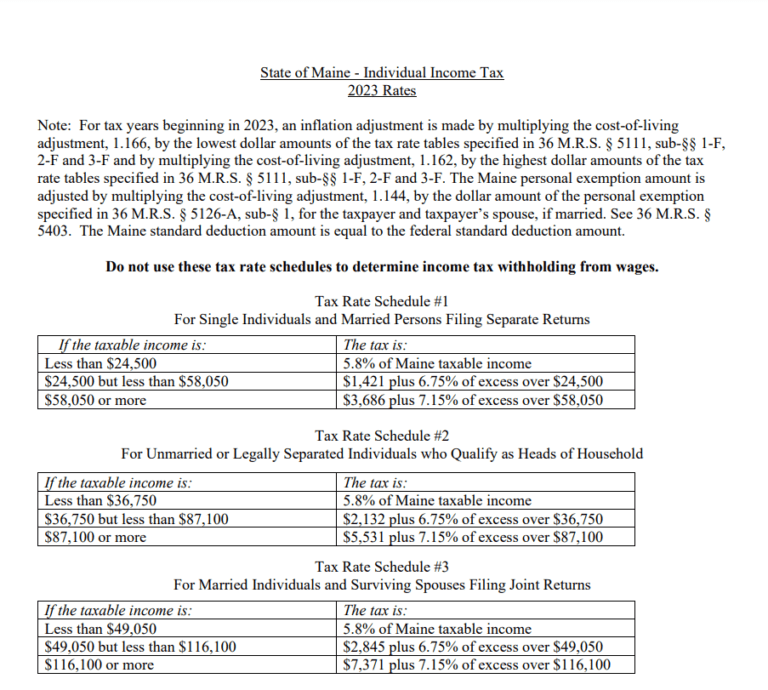

Maine Tax Relief 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Maine-Tax-Rebate-2023-768x690.png

Minnesota Tax Rebate 2023 Your Comprehensive Guide Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Minnesota-Tax-Rebate-2023-768x679.png

Web 2 nov 2022 nbsp 0183 32 In order to be qualified for the rebate state tax returns must have been filed by October 17 2022 Any unpaid taxes child support or other types of debt may impact the amount of the return Any money Web 12 oct 2022 nbsp 0183 32 Massachusetts plans to send millions of residents some parts of 2 9 billion in surplus tax revenue thanks to a 1986 law But the only

Web 18 mai 2023 nbsp 0183 32 To maximize your Massachusetts State Tax Rebate in 2023 it s essential to take advantage of all eligible deductions and credits Deductions reduce your taxable Web 8 avr 2023 nbsp 0183 32 To claim the Massachusetts Tax Rebate in 2023 taxpayers must follow these steps Check their eligibility for the program by reviewing the eligibility criteria Collect

Download Ma State Tax Rebate 2023

More picture related to Ma State Tax Rebate 2023

Tax Rebate 2023 Massachusetts Maximizing Tax Rebate Opportunities

https://www.tax-rebate.net/wp-content/uploads/2023/05/Tax-Rebate-2023-Massachusetts.jpg

Electric Car Rebates Washington State 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2023/05/ma-tax-rebates-electric-cars-2022-carrebate-2.jpg?w=358&h=537&ssl=1

State Of Maine Renters Rebate Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/Maine-Renters-Rebate-2023.png

Web 23 avr 2023 nbsp 0183 32 Important dates for Mass Tax Rebate 2023 Here are the important dates to keep in mind for Mass Tax Rebate 2023 Mid July 2023 The Massachusetts Web 4 mai 2023 nbsp 0183 32 How to Apply Here s how you can apply for the MA Tax Rebate 2023 Gather the required documents You will need a copy of your state income tax return for the tax year 2022 Visit the

Web 8 ao 251 t 2023 nbsp 0183 32 Program regulations for MOR EV went into effect on August 8 2023 225 CMR 26 00 Note For retroactive MOR EV Used and MOR EV rebates for eligible Web 10 f 233 vr 2023 nbsp 0183 32 The Senate voted 32 6 Thursday to lift its eight year term limit on the position State House News Service has more on the reasoning for the move as well as

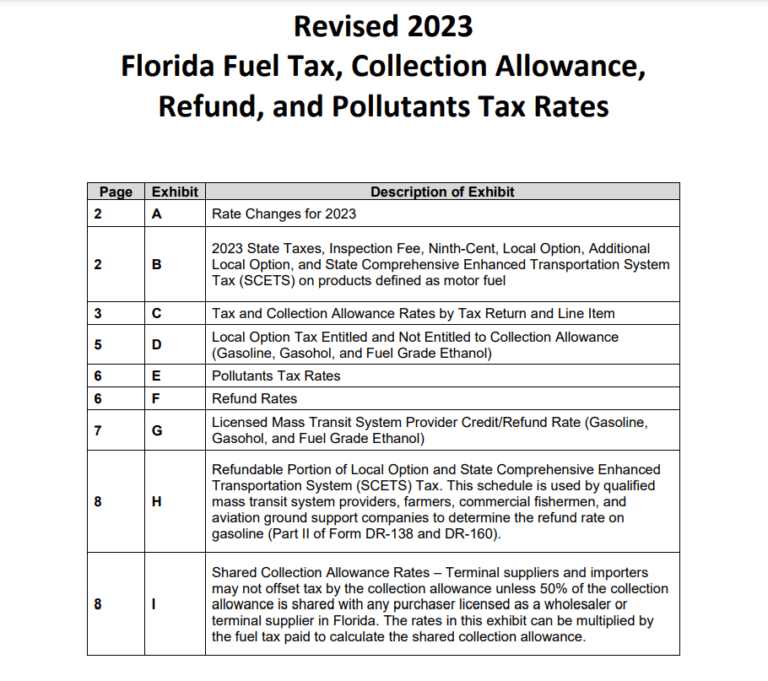

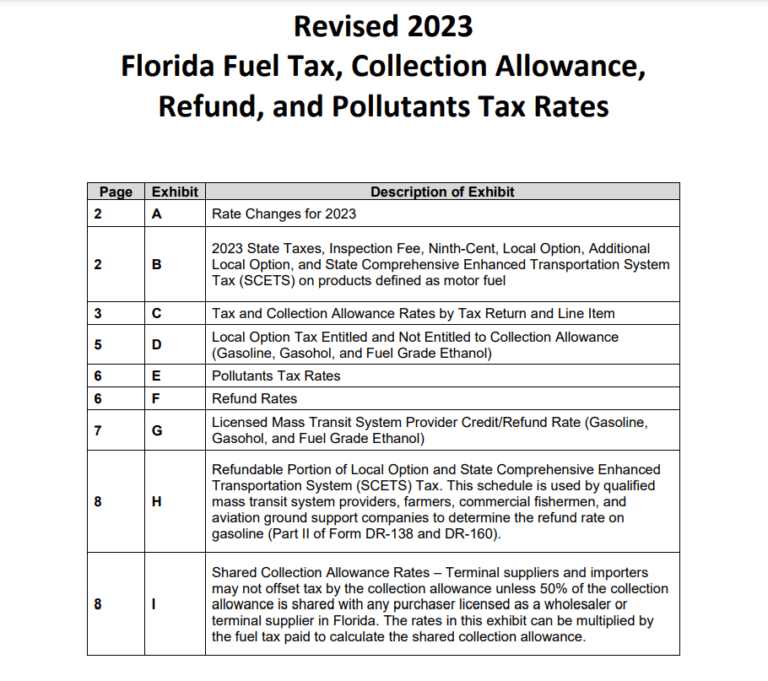

Florida Tax Rebate 2023 Get Tax Relief And Boost Economic Growth

https://printablerebateform.net/wp-content/uploads/2023/03/Florida-Tax-Rebate-2023-768x681.png

Ma Tax Rebate 2023 Calculator Tax Rebate

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/Ma-Tax-Rebate-2023-Calculator.jpg?w=1046&h=651&ssl=1

https://www.cnet.com/personal-finance/massachusetts-has-started-giving...

Web 16 nov 2022 nbsp 0183 32 If you missed the Oct 17 deadline but submit your state income tax return by Sept 15 2023 you should receive your rebate approximately one month after you file

https://www.mass.gov/info-details/chapter-62f-taxpayer-refunds

Web If you have not yet filed your 2021 return you are still eligible if you file by September 15 2023 and if eligible for a refund you should receive it approximately one month after you

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim

Florida Tax Rebate 2023 Get Tax Relief And Boost Economic Growth

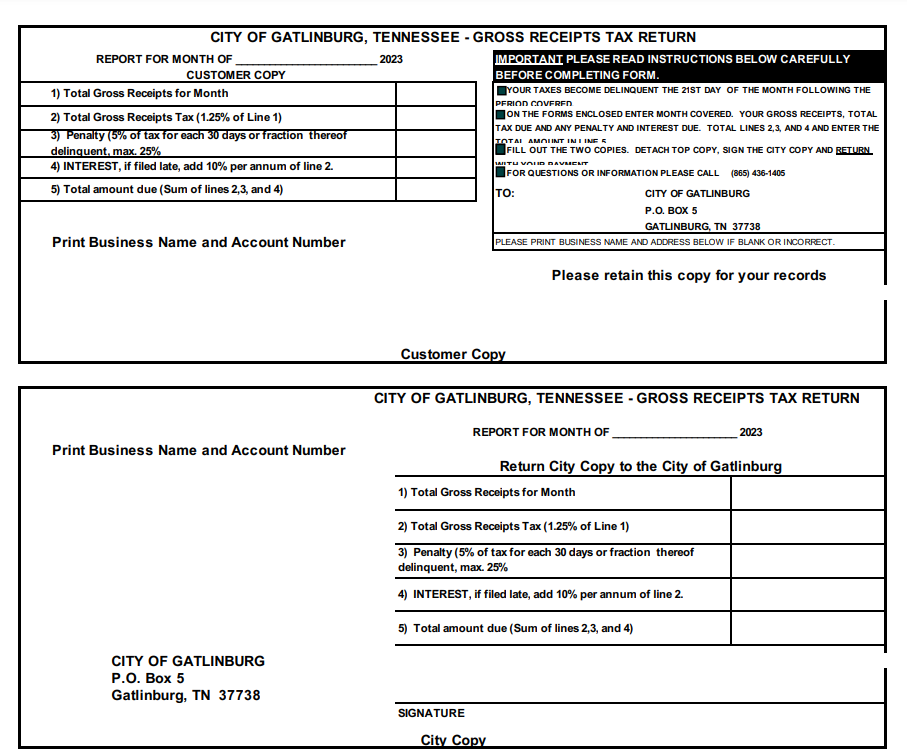

Tennessee Tax Rebate 2023 A Comprehensive Guide Printable Rebate Form

Ohio Tax Rebate 2023 Maximize Your Tax Savings Printable Rebate Form

This Is An Attachment Of 2023 LG Rebates Printable Rebate Form From

Federal Tax Rebate 2023 Maximize Your Savings And Boost Your Finances

Federal Tax Rebate 2023 Maximize Your Savings And Boost Your Finances

Goodyear Drive Card Rebate Spring 2023 Car X

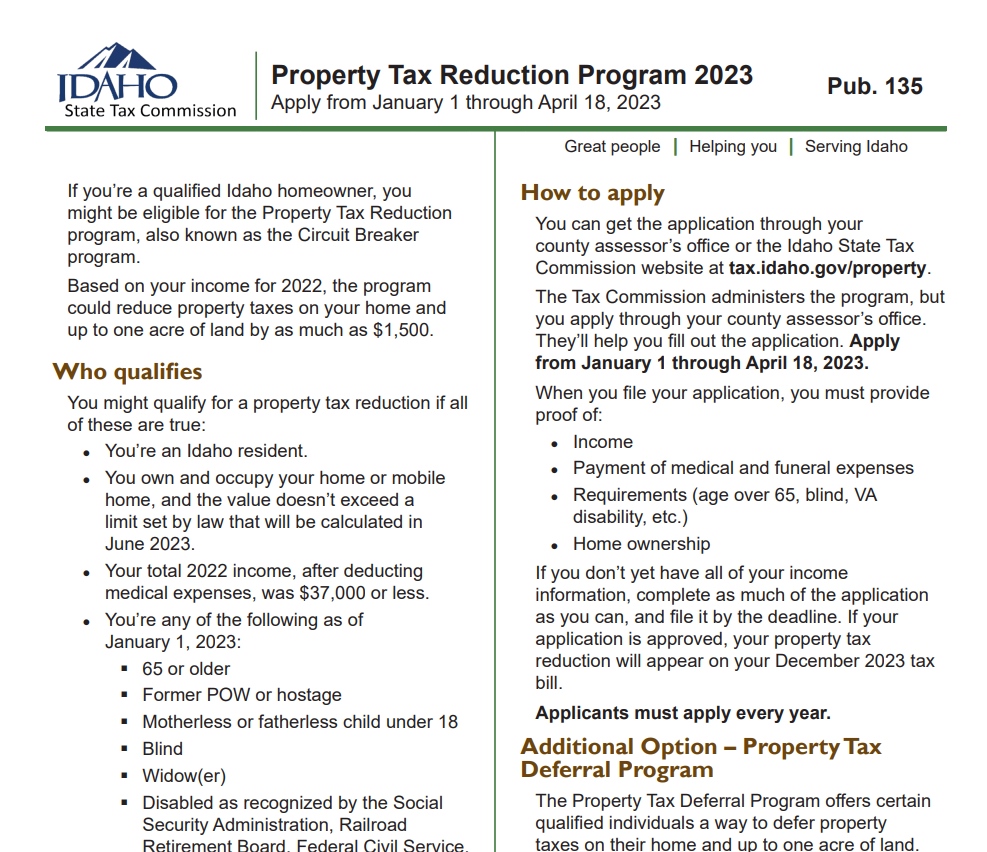

Idaho State Tax Rebate 2023 Tax Rebate

New Mexico Tax Rebate 2023 Eligibility How To Claim And Deadlines

Ma State Tax Rebate 2023 - Web 17 nov 2022 nbsp 0183 32 NBC Universal Inc Beginning Tuesday Massachusetts residents are getting money back from the state The first checks and direct deposits from 3 billion in excess