Marriage Allowance Tax Rebate Web Marriage Allowance lets you transfer 163 1 260 of your Personal Allowance to your husband wife or civil partner It s free to apply for Marriage Allowance This can reduce their tax

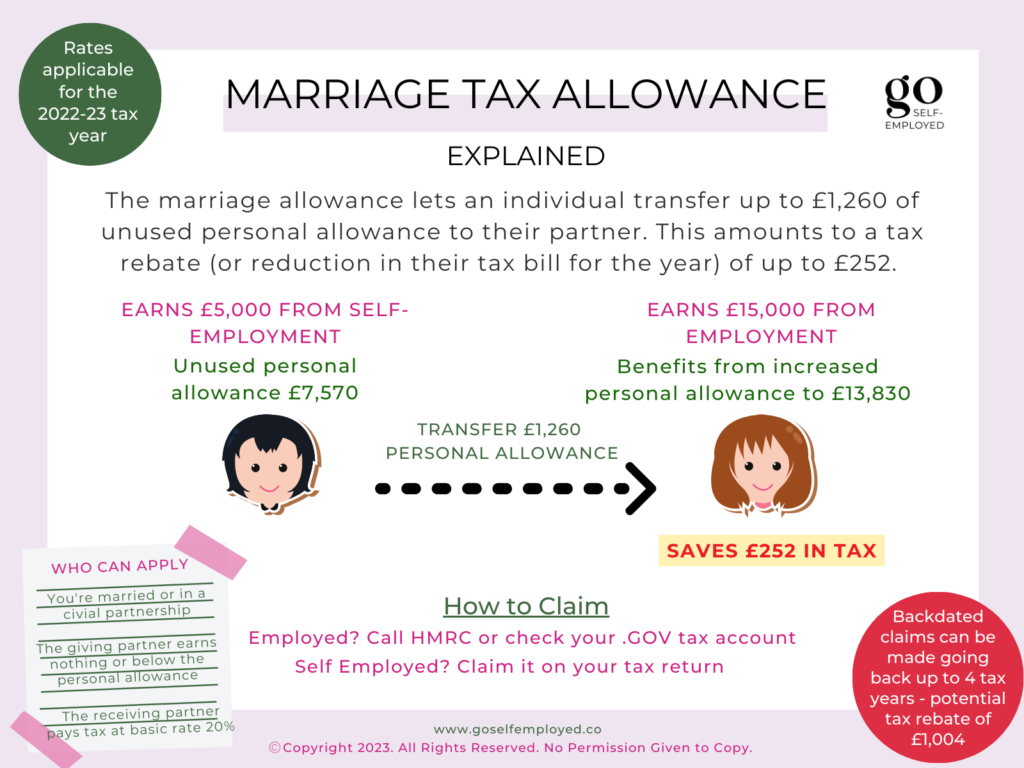

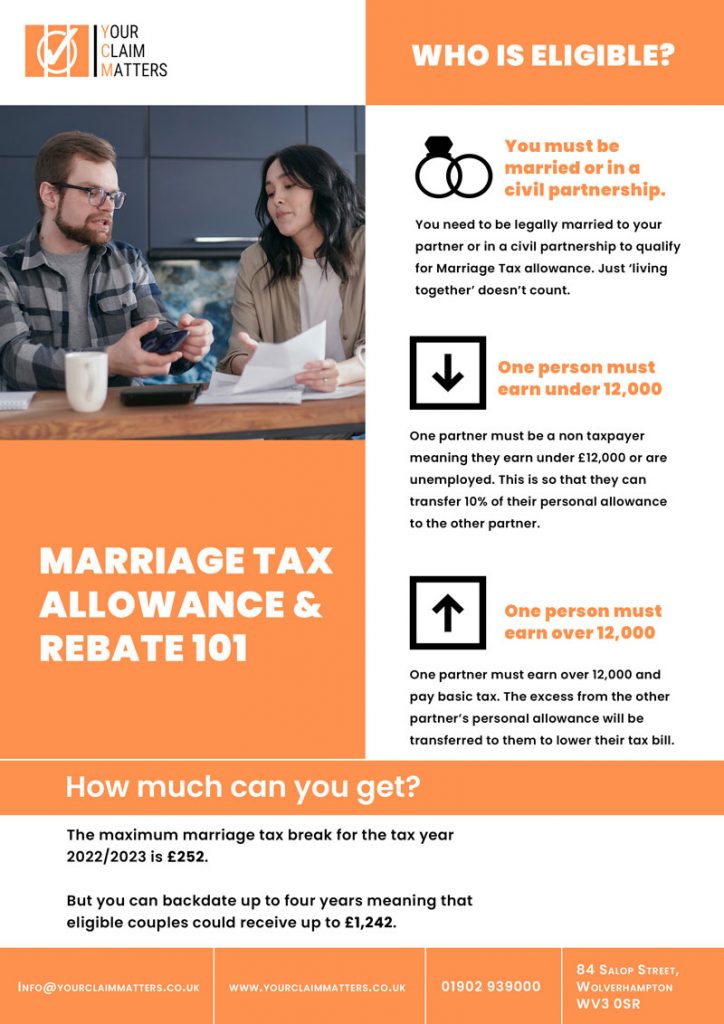

Web Marriage tax allowance for the 2023 24 tax year is worth up to 163 252 If you re eligible and apply successfully you ll also automatically get the Web 11 f 233 vr 2022 nbsp 0183 32 Marriage Allowance is 10 of an individual s tax free Personal Allowance The maximum amount that can be transferred to their husband wife or civil partner is

Marriage Allowance Tax Rebate

Marriage Allowance Tax Rebate

https://goselfemployed.co/wp-content/uploads/2018/07/marriage-allowance-self-employed.png

Marriage Allowance Tax Rebate YouTube

https://i.ytimg.com/vi/mag2FK0B478/maxresdefault.jpg

Get An Extra 212 By Using Govt s Marriage Allowance Scheme HotUKDeals

https://images.hotukdeals.com/threads/thread_full_screen/default/2318988_1.jpg

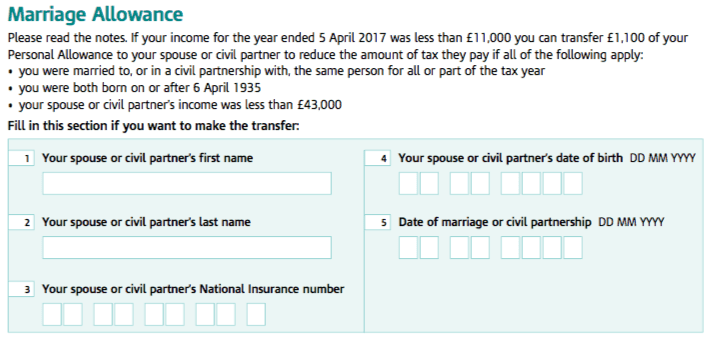

Web 6 avr 2023 nbsp 0183 32 The marriage allowance allows an individual to give up 10 of their personal allowance 163 12 570 in 2023 24 so the amount is 163 1 260 to their spouse or civil partner 20 of this allowance is then given as a Web Marriage Allowance allows you to transfer some of your Personal Allowance to your husband wife or civil partner what you get and how to apply for free

Web 14 juil 2023 nbsp 0183 32 If you are married or in a civil partnership under the marriage allowance you can transfer up to 163 1 260 of your personal tax allowance to your spouse or civil Web How to claim If you fill in a Self Assessment tax return each year Claim by completing the Married Couple s Allowance section of the tax return If you do not fill in a Self

Download Marriage Allowance Tax Rebate

More picture related to Marriage Allowance Tax Rebate

Marriage Tax Allowance Explained Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2018/07/Marriage-Tax-Allowance-1024x768.png

Marriage Allowance Tax Advantages For Married Couples

https://moneystepper.com/wp-content/uploads/2015/11/Marriage-Allowance-Example.jpg

Marriage Allowance Claim Your 252 Tax Rebate

https://www.pattersonhallaccountants.co.uk/wp-content/uploads/2023/02/Marriage-Allowance-1024x576.jpg

Web If you re married or in a civil partnership you may be entitled to a 163 1 250 tax break called marriage tax allowance something 2 4 million qualifying couples miss out on Check Web How much can Marriage Tax Allowance save you The marriage allowance will allow you to save a maximum of 163 252 in tax in the 21 22 tax year As shown in the above example it will vary from couple to couple

Web 14 mars 2022 nbsp 0183 32 There are just weeks left to submit claims potentially worth 163 100s on everything from incorrect tax codes to uniform tax rebates Martin Lewis Three must Web 8 juin 2020 nbsp 0183 32 Which hears from marriage allowance claimants who thought they d dealt with HMRC but instead had signed away almost half of their tax refund to a different

Draw Your Signature Marriage Tax Allowance Rebate

https://phillipsonhardwickadvisory.co.uk/wp-content/uploads/2022/08/Captured.png

Marriage Allowance Transfers Bradley Accounting

https://bradleyaccountingplus.co.uk/wp-content/uploads/2021/09/Marriage-Allowance-768x644.jpg

https://www.gov.uk/apply-marriage-allowance

Web Marriage Allowance lets you transfer 163 1 260 of your Personal Allowance to your husband wife or civil partner It s free to apply for Marriage Allowance This can reduce their tax

https://www.moneysavingexpert.com/family/m…

Web Marriage tax allowance for the 2023 24 tax year is worth up to 163 252 If you re eligible and apply successfully you ll also automatically get the

Kingofcr Marriage Allowance Tax Rebate

Draw Your Signature Marriage Tax Allowance Rebate

How To Take Advantage Of The Marriage Allowance Tax Rebates

Marriage Allowances You Can Claim

Marriage Allowance Tax Rebate In UK EmployeeTax

Marriage Tax Allowance Rebate My Tax Ltd

Marriage Tax Allowance Rebate My Tax Ltd

The 101 Marriage Tax Allowance Rebate And Claim Guide

Eligible Couples Urged To Apply For Tax Reduction Franks Accountants

Marriage Tax Allowance Tax Rebate Online

Marriage Allowance Tax Rebate - Web Home Money and tax Income Tax Calculate your Married Couple s Allowance You can use this calculator to work out if you qualify for Married Couple s Allowance and how