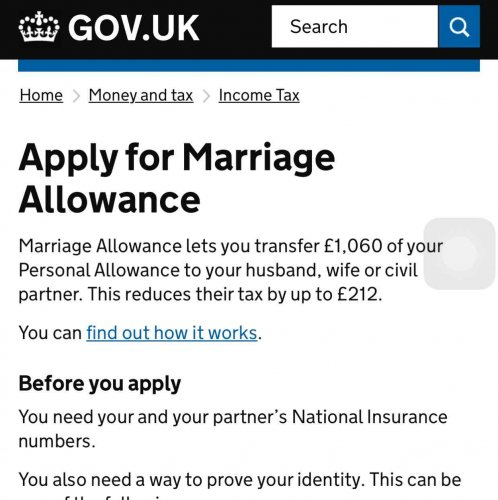

Marriage Tax Rebate Uk Web The quickest way to apply for Marriage Allowance is online You ll get an email confirming your application within 24 hours Other ways to apply If you cannot apply online you can

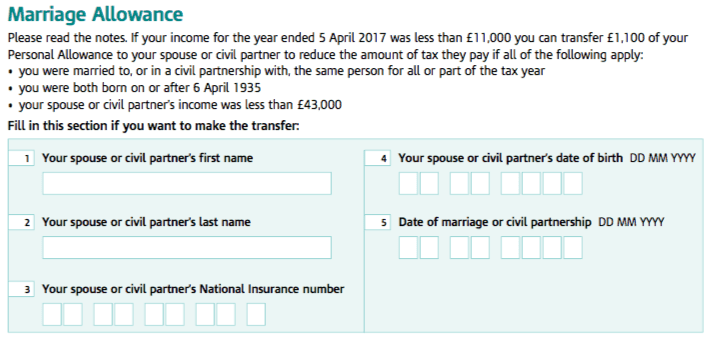

Web Updated 16 May 2023 If you re married or in a civil partnership and under 88 years old you may be entitled to a 163 1 260 tax break called the Web Claim by completing the Married Couple s Allowance section of the tax return If you do not fill in a Self Assessment tax return each year Contact HM Revenue amp Customs HMRC

Marriage Tax Rebate Uk

Marriage Tax Rebate Uk

https://performanceaccountancy.co.uk/wp-content/uploads/2016/07/Marriage_allowance_details.png

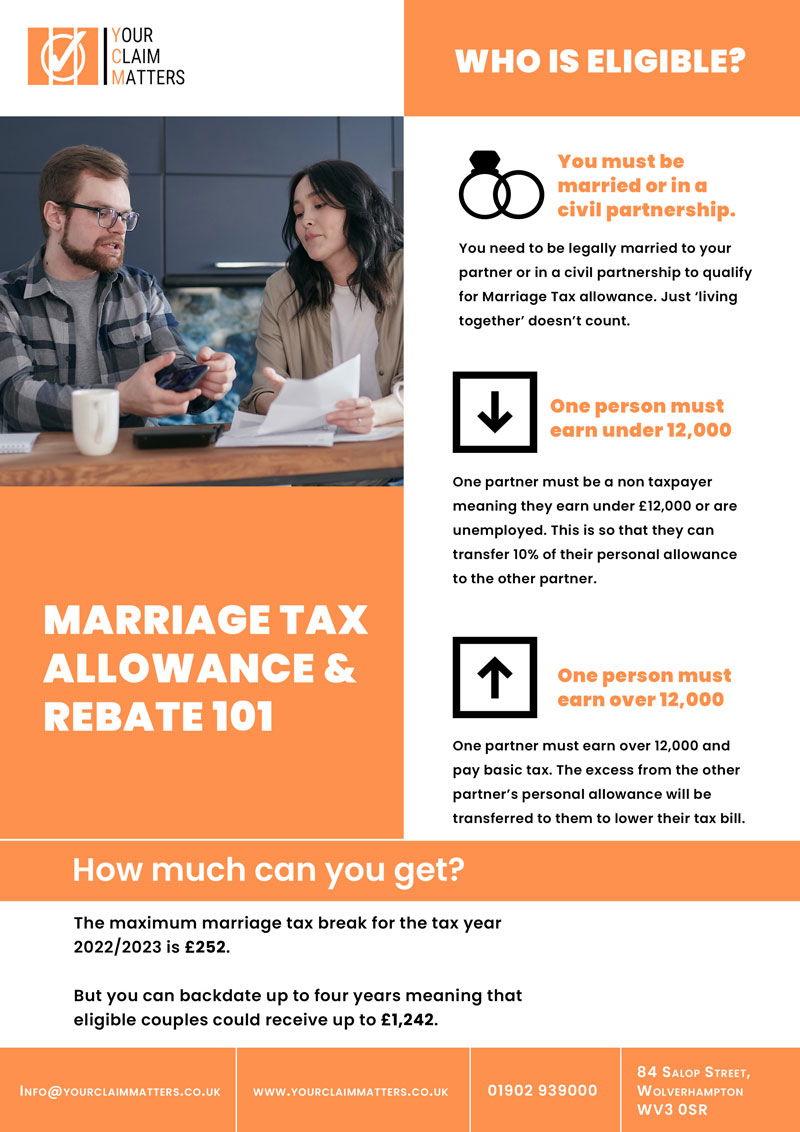

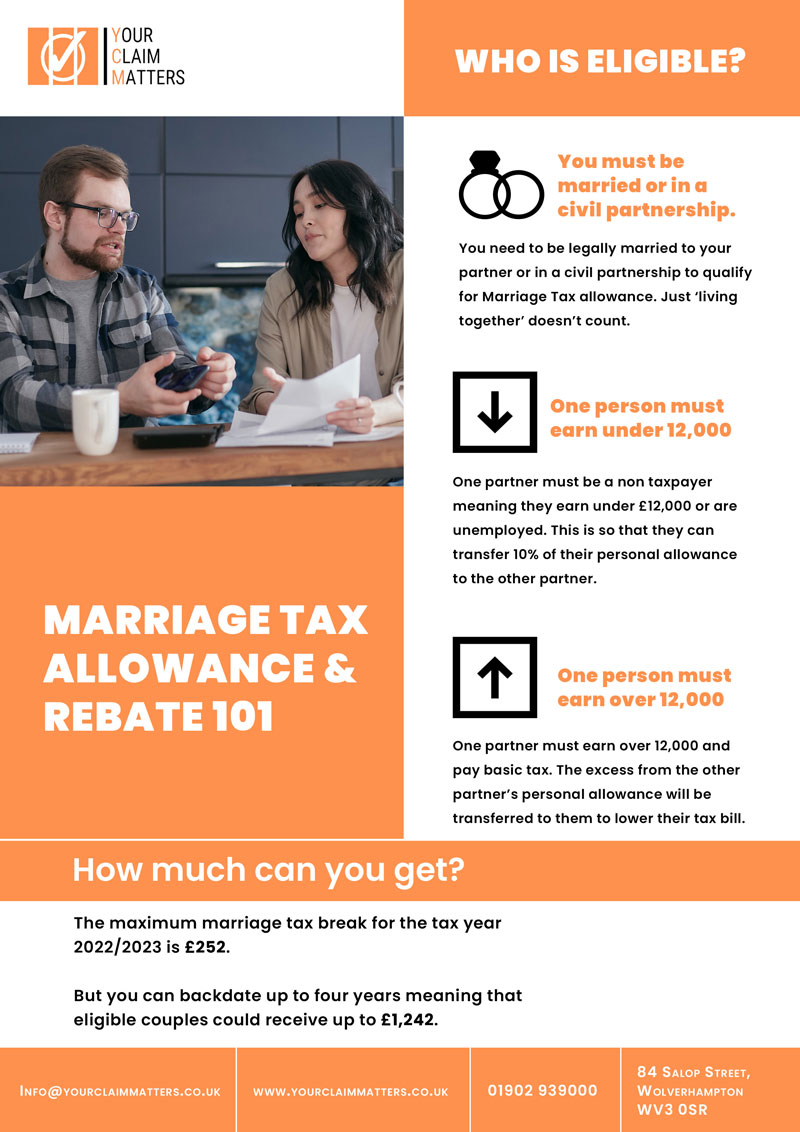

The 101 Marriage Tax Allowance Rebate And Claim Guide

https://www.yourclaimmatters.co.uk/wp-content/uploads/2022/12/marriage-tax-allowance.jpg

Home Tax Rebate Online

https://tax-rebate.online/wp-content/uploads/2020/08/marriage-header.jpeg

Web Eligibility How to claim Further information What you ll get Married Couple s Allowance could reduce your tax bill each year if you re married or in a civil partnership For the Web 11 f 233 vr 2022 nbsp 0183 32 Eligible couples can transfer 10 of their tax free allowance to their partner which is 163 1 260 in the 2021 to 2022 tax year It means couples can reduce the tax they

Web How to apply You can apply for Marriage Allowance online It s free to apply If both of you have no income other than your wages then the person who earns the least should Web 6 avr 2023 nbsp 0183 32 What are the time limits What is the marriage allowance The marriage allowance allows an individual to give up 10 of their personal allowance 163 12 570 in 2023 24 so the amount is 163 1 260 to

Download Marriage Tax Rebate Uk

More picture related to Marriage Tax Rebate Uk

Get An Extra 212 By Using Govt s Marriage Allowance Scheme HotUKDeals

https://images.hotukdeals.com/threads/thread_full_screen/default/2318988_1.jpg

Easy Tax Rebates 4u Just Another WordPress Site

https://easytaxrebates4u.co.uk/wp-content/uploads/2020/10/Marriage-Tax-allowance-5.jpg

Tax Rebates

https://www.fosb.co.uk/_webedit/cached-images/129.jpg

Web 11 sept 2023 nbsp 0183 32 Find out whether you re eligible to claim marriage allowance the tax break which could allow married couples to earn an extra 163 252 in 2022 23 plus other tax breaks available for married couples and civil Web Your partner transferred 163 1 260 to your Personal Allowance making their allowance 163 11 310 and yours 163 13 830 After their death your Personal Allowance stays at 163 13 830

Web Tax relief for the Married Couple s Allowance is 10 The benefit has upper and lower limits for both the amount of tax that can be claimed and how much that can be earned For Web 14 juil 2023 nbsp 0183 32 If you are a non taxpayer i e you earn under the personal allowance and your spouse or civil partner is a basic rate taxpayer you can transfer up to 10 or

How To Take Advantage Of The Marriage Allowance Tax Rebates

https://www.taxrebates.co.uk/wp-content/uploads/Marriage_Allowance-768x402.jpeg

Draw Your Signature Marriage Tax Allowance Rebate

https://phillipsonhardwickadvisory.co.uk/wp-content/uploads/2022/08/Captured.png

https://www.gov.uk/apply-marriage-allowance

Web The quickest way to apply for Marriage Allowance is online You ll get an email confirming your application within 24 hours Other ways to apply If you cannot apply online you can

https://www.moneysavingexpert.com/family/m…

Web Updated 16 May 2023 If you re married or in a civil partnership and under 88 years old you may be entitled to a 163 1 260 tax break called the

Marriage Tax Allowance Rebate My Tax Ltd

How To Take Advantage Of The Marriage Allowance Tax Rebates

My Tax Rebate Claim Your Uniform Tax Rebate Marriage Allowance

Marriage Tax Allowance Explained Goselfemployed co

Tax Shock How Unmarried Couples Are Losing 1150 To The Taxman

Marriage Tax Allowance Tax Rebate Online

Marriage Tax Allowance Tax Rebate Online

Tax Shock How Unmarried Couples Are Losing 1150 To The Taxman

Marriage Tax

Uniform Tax Rebate My Tax Rebate

Marriage Tax Rebate Uk - Web Eligibility How to claim Further information What you ll get Married Couple s Allowance could reduce your tax bill each year if you re married or in a civil partnership For the