Married Couple Benefit Allowance You can use this calculator to work out if you qualify for Married Couple s Allowance and how much you might get You need to be married or in a civil partnership to claim

Tax relief for the Married Couple s Allowance is 10 The benefit has upper and lower limits for both the amount of tax that can be claimed and how much that can be earned For You can claim married couple s allowance by completing the relevant section of your tax return if you are within self assessment If you do not complete a tax

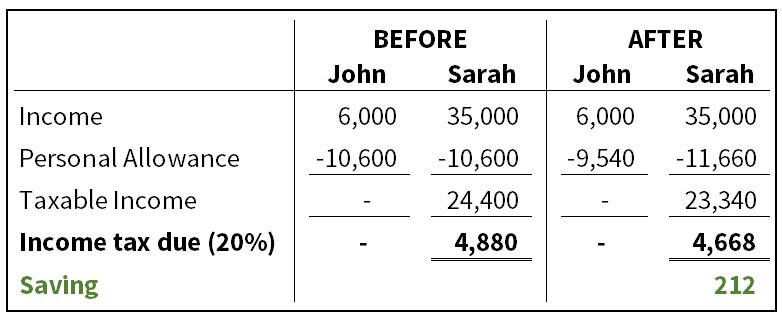

Married Couple Benefit Allowance

Married Couple Benefit Allowance

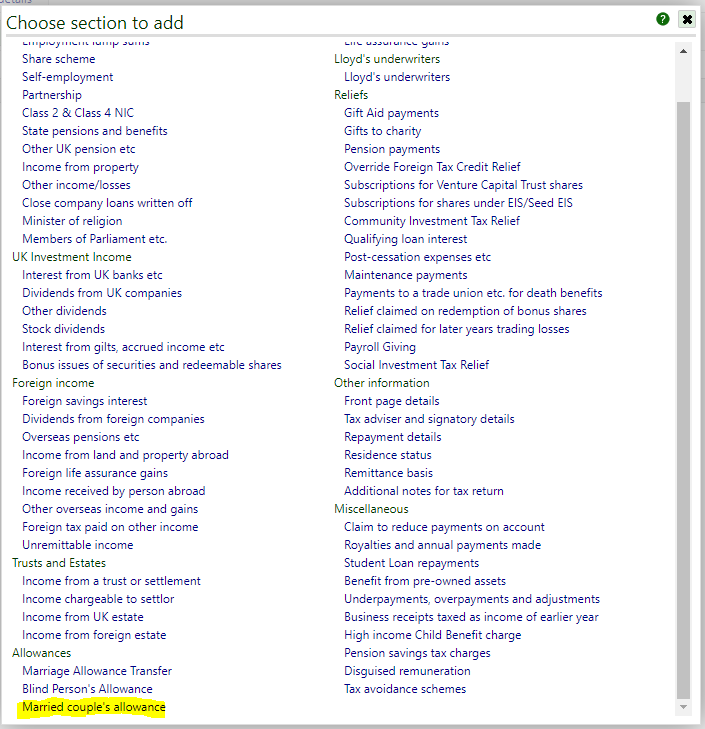

https://moneystepper.com/wp-content/uploads/2015/11/Marriage-Allowance-Example.jpg

Married Couple s Allowance And Marriage Allowance In The UK

https://chacc.co.uk/wp-content/uploads/2022/07/Married-couples-allowance-and-marriage-allowance-in-the-UK-2048x1229.jpg

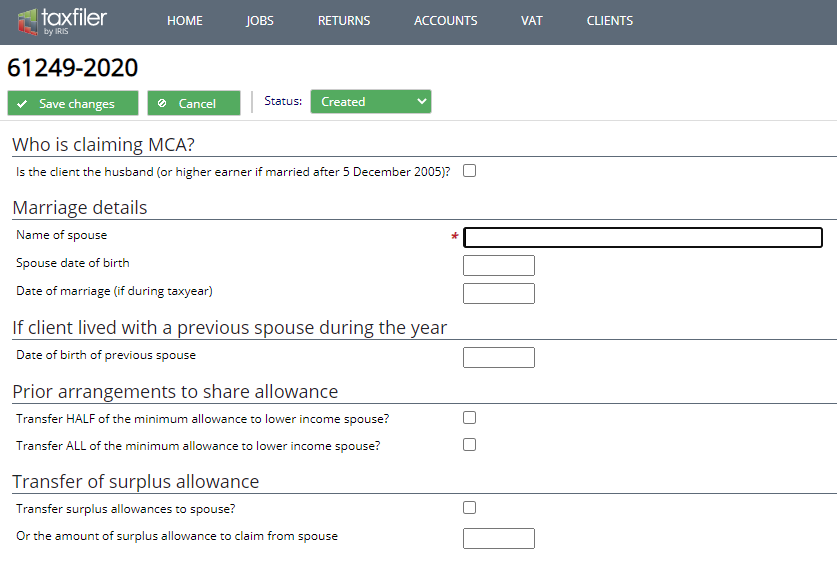

Married Couple s Allowance Support Taxfiler

https://taxfiler.b-cdn.net/wp-content/uploads/2020/05/MCA3-1020.png

The Married Couple s Allowance is a tax perk for qualifying couples where one partner is over the qualifying age MCA is a restricted allowance that could cut 10 off your Discover the benefits of the Married Couple s Allowance in the UK Learn who qualifies how to claim it and how much it can reduce your tax bill

Get a tax break worth up to 1 250 If you re married or in a civil partnership and under 89 years old you may be entitled to a 1 260 tax break called the marriage tax allowance something around 2 1 Marriage allowance is a tax perk worth up to 252 in 2024 25 available to couples who are married or in a civil partnership where one low earner can transfer 1 260 of their personal allowance to their partner

Download Married Couple Benefit Allowance

More picture related to Married Couple Benefit Allowance

Marriage Allowance And Married Couple s Allowance

https://www.ridgefieldconsulting.co.uk/wp-content/uploads/2019/08/Marriage-Allowance-1280x853.jpg

Married Couple s Allowance Support Taxfiler

https://taxfiler.b-cdn.net/wp-content/uploads/2019/06/MCA2-1.png

Why Every Couple Should Have An Allowance Quicken Loans Couples

https://i.pinimg.com/originals/08/bb/58/08bb5853fd5a8e75edc1255eed981956.jpg

Marriage allowance saves couples money by allowing the lower or non earner to reduce the amount of tax their partner pays by transferring up to 1 260 or For the 2024 to 2025 tax year it could cut your tax bill by between 427 and 1 108 a year Use the Married Couple s Allowance calculator to work out what you could get

Marriage allowance allows you to transfer 1 260 of your tax free personal allowance to your partner if they earn more than you do This could reduce their tax bill by up to 252 You can claim Married Couple s Allowance if all the following apply you re married or in a civil partnership you re living with your spouse or civil partner one of you was born

Marriage Allowance And Married Couple s Allowance

https://www.wizzaccounting.co.uk/blog/wp-content/uploads/2020/06/marriage-allowance.jpg

Marriage Allowance How Does Marriage Allowance Work Personal

https://cdn.images.express.co.uk/img/dynamic/23/590x/secondary/Marriage-Allowance-UK-Marriage-tax-Allowance-HMRC-Marriage-tax-Allowance-UK-2674766.jpg?r=1600581954146

https://www.gov.uk/calculate-married-couples-allowance

You can use this calculator to work out if you qualify for Married Couple s Allowance and how much you might get You need to be married or in a civil partnership to claim

https://www.moneyhelper.org.uk/en/work/employment/...

Tax relief for the Married Couple s Allowance is 10 The benefit has upper and lower limits for both the amount of tax that can be claimed and how much that can be earned For

The Marriage Allowance Transfer Personal Tax Centre

Marriage Allowance And Married Couple s Allowance

Married Couples Allowance What Is Married Couple s Allowance

Communicating Expectations To Your Husband How To Enjoy The Holidays

7 Social Security Spousal Benefit Rules Every Married Couple Should Know

Married Couple s Allowance Flop Stonehouse Accountants

Married Couple s Allowance Flop Stonehouse Accountants

Married Couples Allowance What Is Married Couple s Allowance

What Are Married Couples Allowance Accotax

Married Couples Allowance 2022 2023 In 2022 Married Couple Couples

Married Couple Benefit Allowance - If you re married or in a civil partnership you can take advantage of the Married Couple Allowance and reduce your tax bills by allowing one partner to get an