Married Couple Tax Rebate Web Accordingly a couple with no children are entitled to maximum tax relief of 3000 in year 1 with a cap of 7500 tax relief over five years If you do not pay income tax then a tax

Web For the 2023 to 2024 tax year it could cut your tax bill by between 163 401 and 163 1 037 50 a year Use the Married Couple s Allowance calculator to work out what you could get If Web 16 f 233 vr 2020 nbsp 0183 32 La facture peut augmenter en cas de mariage Le premier est celui du m 233 canisme dit de la d 233 cote qui permet de r 233 duire la facture

Married Couple Tax Rebate

Married Couple Tax Rebate

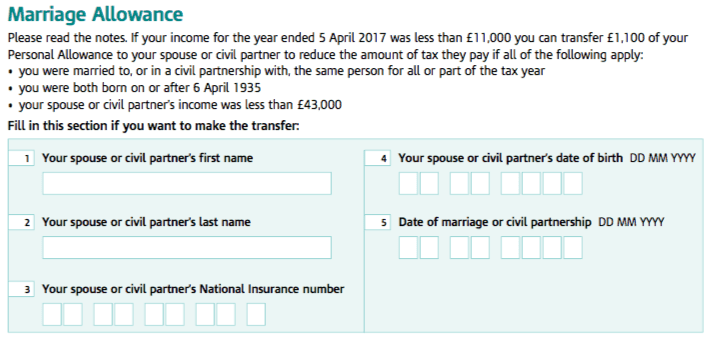

https://performanceaccountancy.co.uk/wp-content/uploads/2016/07/Marriage_allowance_details.png

ABOUT Claims Advisory Services Tax Rebate

https://www.claimsadvisoryservices.co.uk/wp-content/uploads/2023/03/AdobeStock_125640582-768x512.jpeg

Guide Tax Assessment As A Married Couple Irish Tax Rebates

https://blog.irishtaxrebates.ie/wp-content/uploads/2017/04/bride-1837148_1920-768x512.jpg

Web Kit Sproson Edited by Martin Lewis Updated 16 May 2023 If you re married or in a civil partnership and under 88 years old you may be entitled to a 163 1 260 tax break called the marriage tax allowance something Web 14 janv 2022 nbsp 0183 32 For gifting purposes for significant gifts such as property married couples or those in a Pacs relationship get an allowance currently worth 80 724

Web 11 sept 2023 nbsp 0183 32 Find out whether you re eligible to claim marriage allowance the tax break which could allow married couples to earn an extra 163 252 in 2022 23 plus other tax breaks available for married couples and civil Web Il y a 1 jour nbsp 0183 32 Car buyers also may qualify for a federal tax credit of up to 7 500 for some vehicles with income restrictions of 150 000 for individuals and 300 000 for married

Download Married Couple Tax Rebate

More picture related to Married Couple Tax Rebate

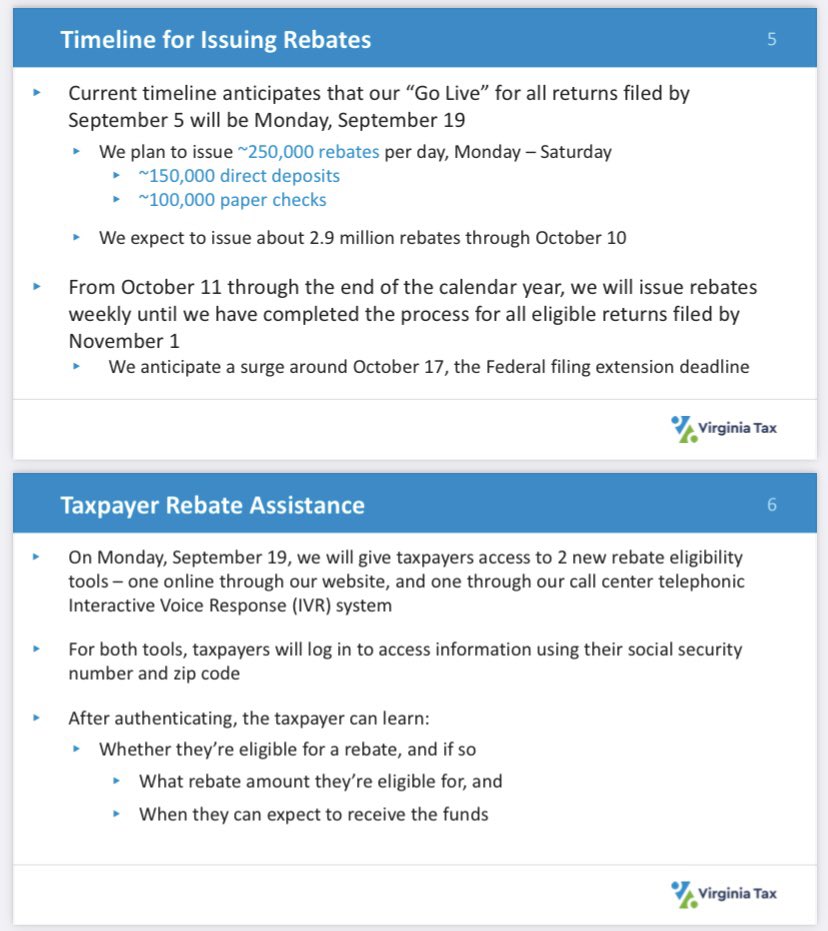

Jackie DeFusco On Twitter Virginia s Tax Commissioner Says The First

https://pbs.twimg.com/media/FciofsTWQAIsug8.jpg

7 Out Of 10 Married Couples Are Availing Their Marriage Tax Credits

https://refundyourtax.ie/wp-content/uploads/2020/09/tax-credits-married-couples-768x432.jpg

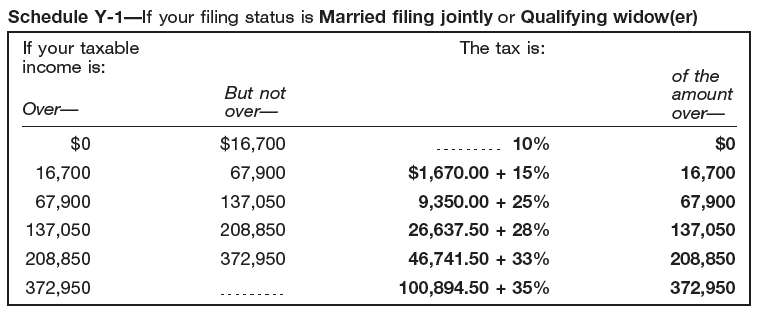

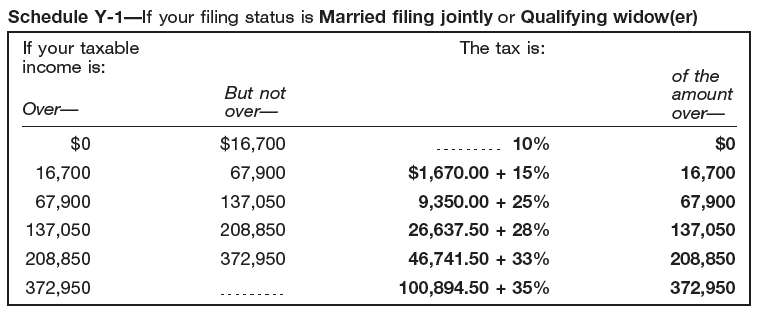

2008 Tax Rates For A Married Couple Filing Jointly Download Table

https://www.researchgate.net/profile/Ashraf-Zaman-5/publication/255582055/figure/download/tbl1/AS:669458582470684@1536622772503/2008-Tax-Rates-for-a-Married-Couple-Filing-Jointly.png

Web As of 2023 preowned plug in electric and fuel cell EVs qualify for a credit of up to 30 of their purchase price maxing out at 4 000 The used EV tax credit can only be claimed Web Marriage Allowance lets you transfer 163 1 260 of your Personal Allowance to your husband wife or civil partner This reduces their tax by up to 163 252 in the tax year 6 April to 5 April

Web 14 juil 2023 nbsp 0183 32 If you are married or in a civil partnership under the marriage allowance you can transfer up to 163 1 260 of your personal tax allowance to your spouse or civil partner Web 24 mars 2021 nbsp 0183 32 MARTIN Lewis is urging married couples to claim a tax break refund worth up to 163 1 188 by April 5 or miss out on 163 220 The tax perk known as the marriage

Average Tax Rates For Married Couple With Two Incomes 2009

http://visualeconsite.s3.amazonaws.com/wp-content/uploads/Marriedfilingjointly_schedule_2009.png

Tax Rates Heemer Klein Company PLLC

https://hkglcpa.com/wp-content/uploads/2022/10/2022-Tax-Brackets-for-Single-Filers-and-Married-Couples-Filing-Jointly.png

https://www.french-property.com/.../calculation-tax-liability/allowances

Web Accordingly a couple with no children are entitled to maximum tax relief of 3000 in year 1 with a cap of 7500 tax relief over five years If you do not pay income tax then a tax

https://www.gov.uk/married-couples-allowance/what-youll-get

Web For the 2023 to 2024 tax year it could cut your tax bill by between 163 401 and 163 1 037 50 a year Use the Married Couple s Allowance calculator to work out what you could get If

Married Couples Eligible For Tax Rebate Being Warned To Watch Out For

Average Tax Rates For Married Couple With Two Incomes 2009

Marriage Tax Allowance Explained Goselfemployed co

Married Couples Filing Separate Tax Returns Why Would They Do It Hogan

Are There Tax Benefits For Married Couples In Canada Koinly

Average Tax Return For Married Couple With One Child Tax Walls

Average Tax Return For Married Couple With One Child Tax Walls

The Best Married Couples Tax Tips Shared Economy Tax

How Many Allowances To Claim If Married Filing Jointly 3pointsdesign

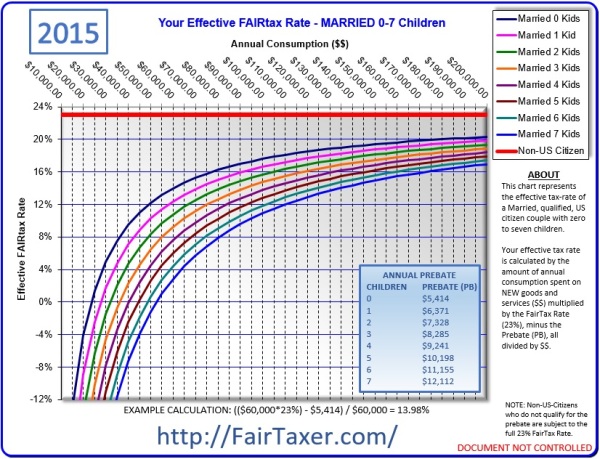

2015 Prebate Schedule For Single Or Married Couples FairTaxer

Married Couple Tax Rebate - Web 14 janv 2022 nbsp 0183 32 For gifting purposes for significant gifts such as property married couples or those in a Pacs relationship get an allowance currently worth 80 724