Married Couples Tax Allowance Rebate Web Married Couple s Allowance could reduce your tax bill each year if you re married or in a civil partnership For the 2023 to 2024 tax year it could cut your tax bill by between 163 401

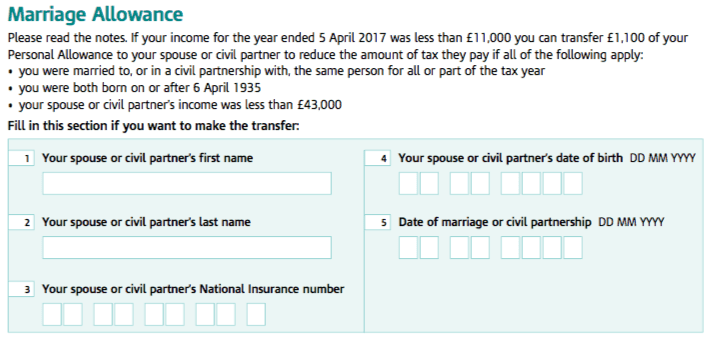

Web Get a tax break worth up to 163 1 250 If you re married or in a civil partnership and under 88 years old you may be entitled to a 163 1 260 tax break called Web 6 avr 2023 nbsp 0183 32 The marriage allowance allows an individual to give up 10 of their personal allowance 163 12 570 in 2023 24 so the amount is 163 1 260 to their spouse or civil partner 20 of this allowance is then given as a

Married Couples Tax Allowance Rebate

Married Couples Tax Allowance Rebate

https://goselfemployed.co/wp-content/uploads/2018/07/marriage-allowance-self-employed.png

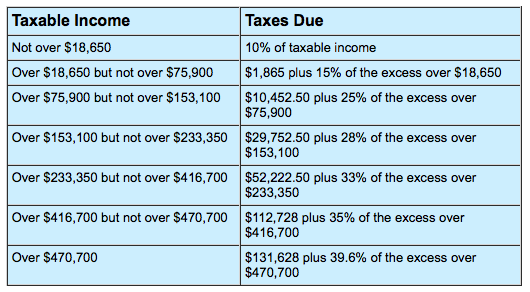

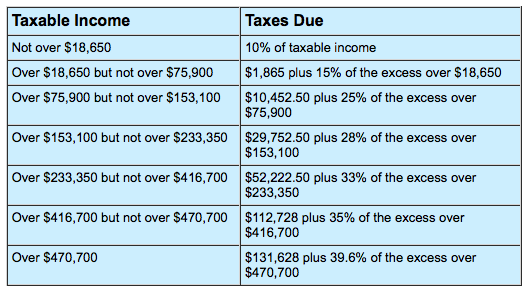

Tax Brackets Married Couple Lang Allan Company CPA PC

https://langallancpa.com/wp-content/uploads/2017/12/tax-brackets-married-couple.png

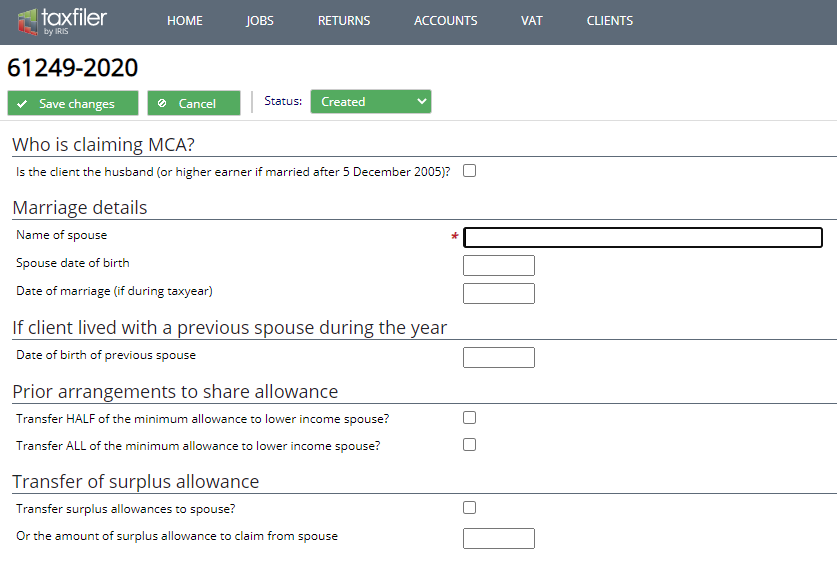

Married Couple s Allowance Taxfiler

https://taxfiler.co.uk/wp-content/uploads/2019/06/MCA2-1.png

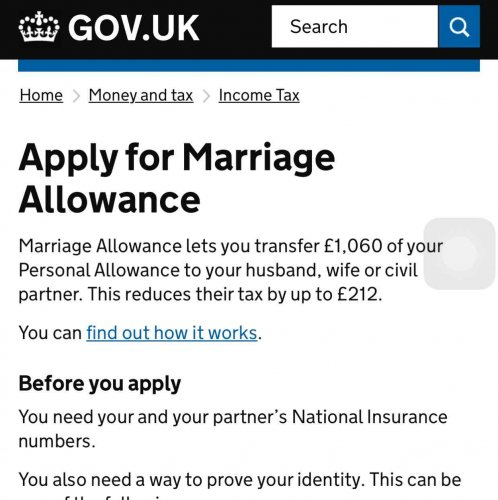

Web Marriage Allowance lets you transfer 163 1 260 of your Personal Allowance to your husband wife or civil partner It s free to apply for Marriage Allowance This can reduce their tax Web 14 juil 2023 nbsp 0183 32 If you are married or in a civil partnership under the marriage allowance you can transfer up to 163 1 260 of your personal tax allowance to your spouse or civil partner if you both meet

Web 11 f 233 vr 2022 nbsp 0183 32 Marriage Allowance is 10 of an individual s tax free Personal Allowance The maximum amount that can be transferred to their husband wife or civil partner is Web Tax relief for the Married Couple s Allowance is 10 The benefit has upper and lower limits for both the amount of tax that can be claimed and how much that can be earned

Download Married Couples Tax Allowance Rebate

More picture related to Married Couples Tax Allowance Rebate

Marriage Allowance Tax Advantages For Married Couples

https://moneystepper.com/wp-content/uploads/2015/11/Marriage-Allowance-Example.jpg

Irs 2017 Tax Tables Married Filing Jointly Brokeasshome

https://i2.wp.com/clarkandcassid.wpengine.com/wp-content/uploads/2016/11/MFJ_2017.jpg?resize=618%2C268

Get An Extra 212 By Using Govt s Marriage Allowance Scheme HotUKDeals

https://images.hotukdeals.com/threads/thread_full_screen/default/2318988_1.jpg

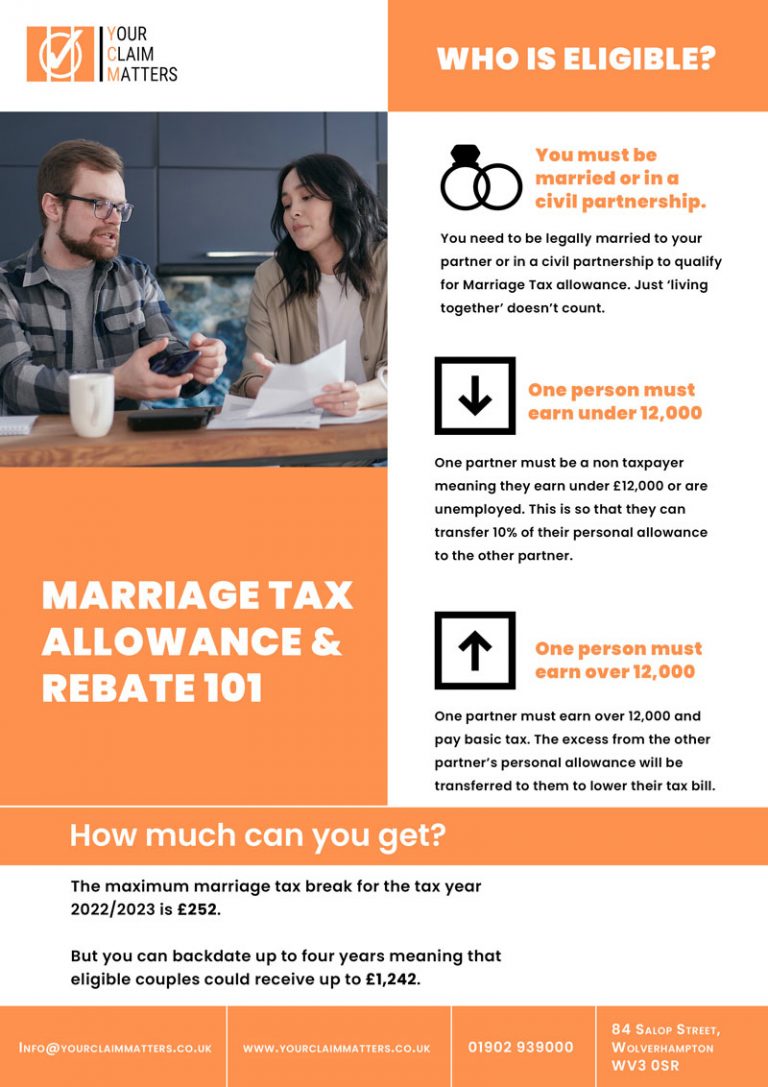

Web 11 sept 2023 nbsp 0183 32 Marriage allowance is a tax perk available to couples who are married or in a civil partnership where one low earner can transfer 163 1 260 of their personal allowance to their partner Web 14 f 233 vr 2023 nbsp 0183 32 How Much Can You Claim The marriage allowance reclaim for the tax year 2022 23 is 163 252 This can be increased to a tax rebate amount of 163 1 241 This is

Web Payments to a former spouse in cash or kind within the first twelve months of the divorce settlement open access to an allowance of 25 against a maximum eligible payment of Web 14 mars 2022 nbsp 0183 32 Martin Lewis Three must dos by 5 April 1 Tax code rebate 2 Marriage tax allowance 3 PPI tax back James Flanders News Reporter 14 March 2022 The tax

How Many Allowances To Claim If Married Filing Jointly 3pointsdesign

https://dochub.com/musiccityprotection/8YZWO9NV82Qkk2ZRzEAy30/employee-withholding-certificate-w4.jpg?dt=jon-ekUza2rfsC6sjaxM

Marriage Tax Allowance Claims What Do You Need To Know Gowing Law

https://i.ibb.co/Tmffpxh/marriage.png

https://www.gov.uk/married-couples-allowance/what-youll-get

Web Married Couple s Allowance could reduce your tax bill each year if you re married or in a civil partnership For the 2023 to 2024 tax year it could cut your tax bill by between 163 401

https://www.moneysavingexpert.com/family/m…

Web Get a tax break worth up to 163 1 250 If you re married or in a civil partnership and under 88 years old you may be entitled to a 163 1 260 tax break called

Married Couple s Allowance Support Taxfiler

How Many Allowances To Claim If Married Filing Jointly 3pointsdesign

Marriage Tax Allowance Rebate My Tax Ltd

Draw Your Signature Marriage Tax Allowance Rebate

Grassroots Welcome IDS Recommendations With One Notable Exception

Marriage Tax Allowance Tax Rebate Online

Marriage Tax Allowance Tax Rebate Online

The 101 Marriage Tax Allowance Rebate And Claim Guide

FBA

Married Couples Tax Allowance Claim Form Blank Template Imgflip

Married Couples Tax Allowance Rebate - Web Marriage Allowance lets you transfer 163 1 260 of your Personal Allowance to your husband wife or civil partner It s free to apply for Marriage Allowance This can reduce their tax