Maryland Homestead Rebate Web The homestead credit limits the amount of assessment increase on which a homeowner will pay property taxes in that tax year on the one property actually used as the owner s

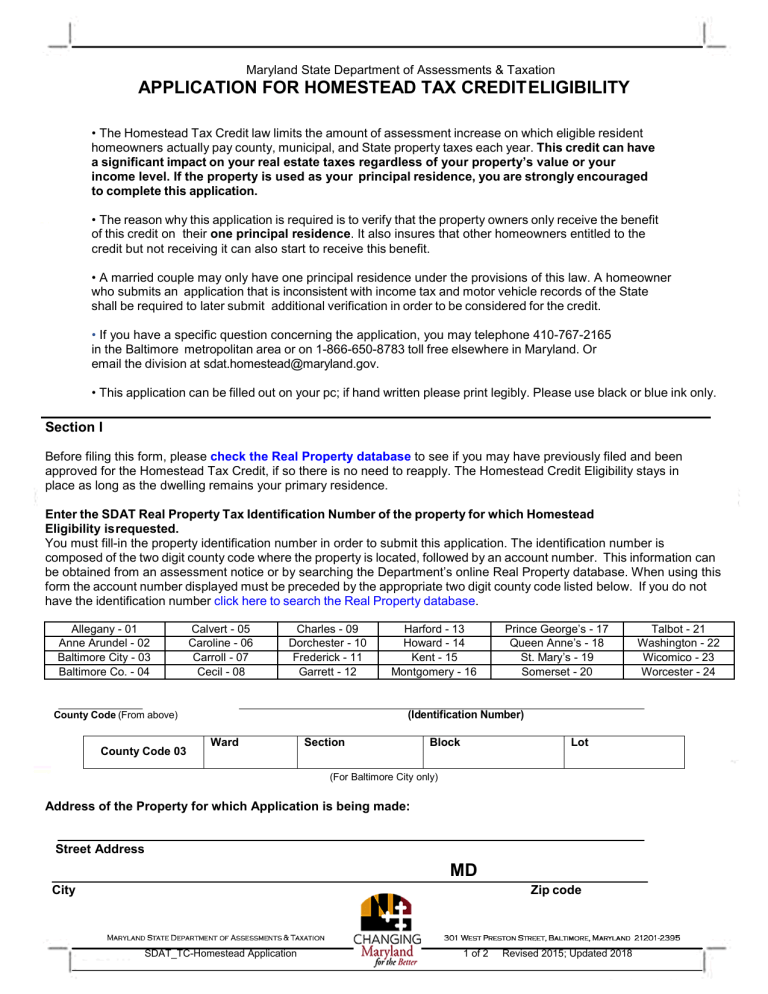

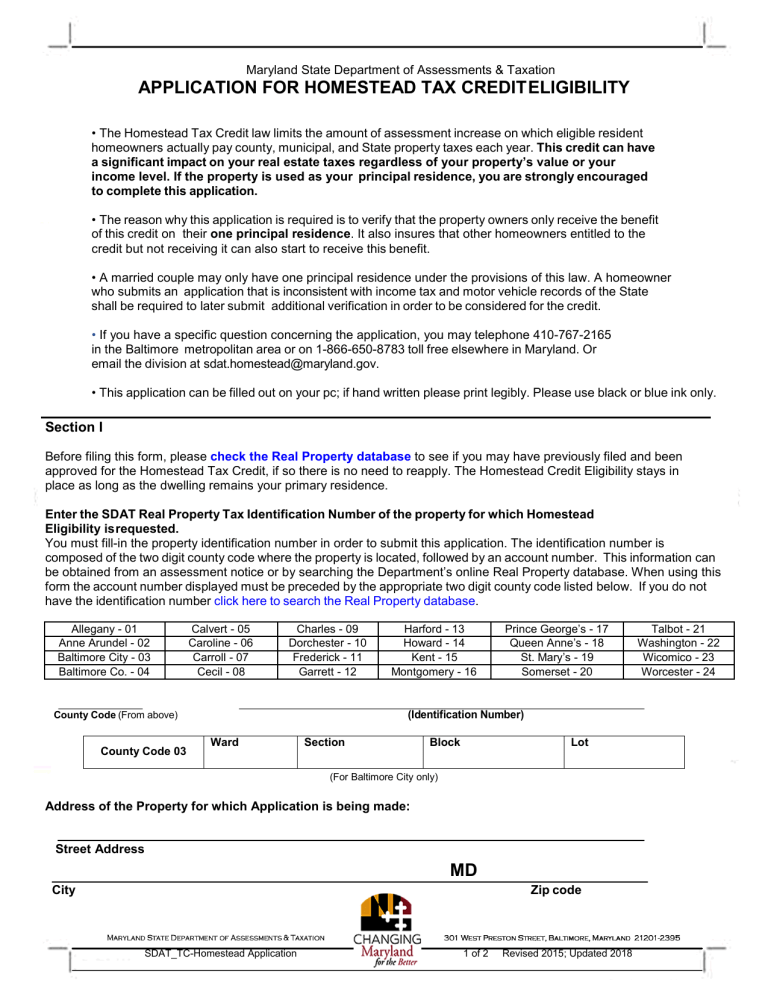

Web 7 f 233 vr 2022 nbsp 0183 32 SDAT s 2022 Homeowners and Renters Tax Credit Applications Now Available Online BALTIMORE MD The Maryland Department of Assessments and Web Maryland requires all homeowners to submit a one time application to establish eligibility for the Homestead Tax Credit The Homestead Tax Credit Eligibility

Maryland Homestead Rebate

Maryland Homestead Rebate

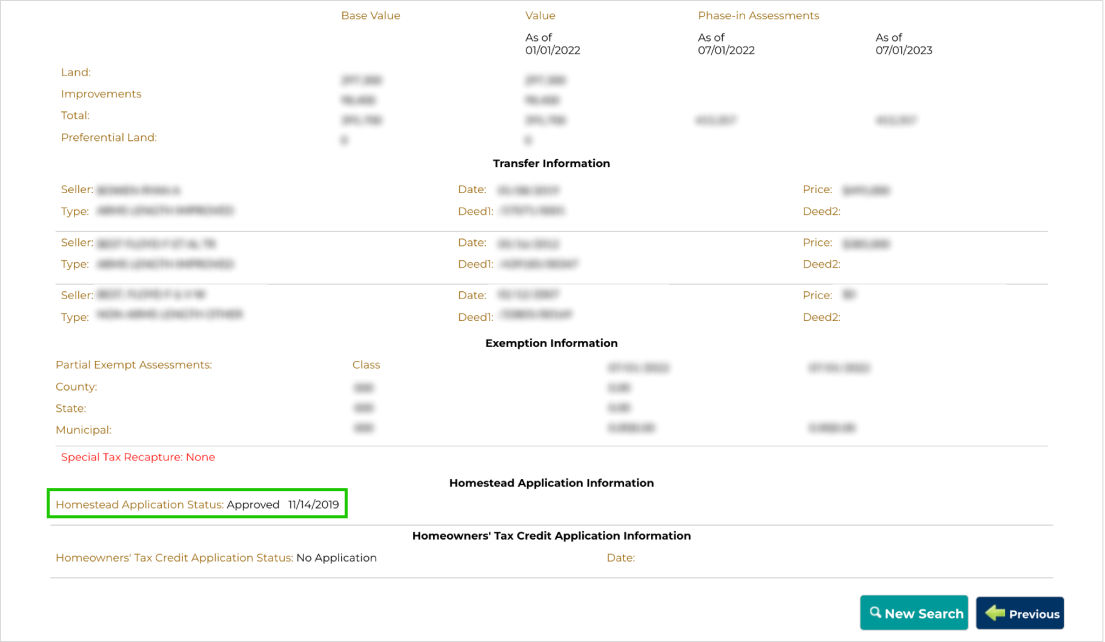

https://dat.maryland.gov/realproperty/PublishingImages/HomesteadApplicationStatus2023Approved.png

Maryland Homestead Application

https://s3.studylib.net/store/data/025350787_1-2f7b606b4e9b0deb035d196486810514-768x994.png

The Newsfeed September 19 2022

https://files.constantcontact.com/3491ae57101/2c80b365-a2bf-4c23-89dc-8b61718fe0b6.jpg?rdr=true

Web The Homestead Tax Credit law limits the amount of assessment increase on which eligible resident homeowners actually pay county municipal and State property taxes each Web APPLICATION FOR HOMESTEAD TAX CREDITELIGIBILITY If you plan to live in this home as your principal residence you may qualify for the Homestead Property Tax

Web County Homestead Tax Credit The Homestead Tax Credit HTC limits the increase in taxable assessment each year to a fixed percentage Every county and municipality in Maryland is required to limit taxable Web The State of Maryland provides a credit for the real property tax bill for homeowners of all ages who qualify on the basis of gross household income For more information please

Download Maryland Homestead Rebate

More picture related to Maryland Homestead Rebate

Can I File An Appeal For The Homestead Rebate NJMoneyHelp

http://njmoneyhelp.com/wp-content/uploads/2018/07/house-961401_1920-968x643.jpg

Nj Homestead Rebate 2023 Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2022/08/homestead-rebate-not-received-this-year-hackettstown-nj.png

What Happens To The Homestead Rebate And My Tax Return NJMoneyHelp

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/what-happens-to-the-homestead-rebate-and-my-tax-return-njmoneyhelp.jpg?w=740&ssl=1

Web As Maryland s state energy office the Maryland Energy Administration MEA will be the applicant for two of the residential focused IRA rebate programs the HOMES Residential Energy Efficiency Rebate Program Web The tax credit is based upon the amount by which the property taxes exceed a percentage of your income according to the following formula 0 of the first 8 000 of the

Web 7 f 233 vr 2023 nbsp 0183 32 The State of Maryland provides a credit for the real property tax bill for homeowners of all ages who qualify on the basis of gross household income A new Web website https dat maryland gov realproperty Pages Maryland Homestead Tax Credit aspx You may also want to look into the Homeowners Property Tax Credit

N J s New ANCHOR Property Tax Program Your Questions Answered Nj

https://www.nj.com/resizer/mG8HoEC03Z_laQKwr9yycp9fj8o=/800x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/OCDIN5URIBBRVLQX5ZOGNBVHZI.jpg

What New Yorkers Should Know About Property Taxes Tax Credits Tax

https://i.pinimg.com/originals/f8/8b/a3/f88ba3c1c57f09d77c2c2f705ade11f0.png

https://dat.maryland.gov/realproperty/Pages/FAQ-Homestead-Tax-Credi…

Web The homestead credit limits the amount of assessment increase on which a homeowner will pay property taxes in that tax year on the one property actually used as the owner s

https://dat.maryland.gov/newsroom/Pages/2022-02-07-TaxCreditApps...

Web 7 f 233 vr 2022 nbsp 0183 32 SDAT s 2022 Homeowners and Renters Tax Credit Applications Now Available Online BALTIMORE MD The Maryland Department of Assessments and

Maryland Renters Rebate 2023 Printable Rebate Form

N J s New ANCHOR Property Tax Program Your Questions Answered Nj

I ve Never Applied For The Homestead Rebate Can I NJMoneyHelp

Do I Need To Apply For The Homestead Rebate Every Year NJMoneyHelp

What s The Deal With The Homestead Rebate NJMoneyHelp

/arc-anglerfish-arc2-prod-pmn.s3.amazonaws.com/public/BCQCTG4LZJENNM23AN5NVSUEFM.jpg)

N J Help Line Drawing More Calls

/arc-anglerfish-arc2-prod-pmn.s3.amazonaws.com/public/BCQCTG4LZJENNM23AN5NVSUEFM.jpg)

N J Help Line Drawing More Calls

The Montgomery County Homestead Credit Ozark

Can I Still File For The Homestead Rebate NJMoneyHelp

Aging In Place Property Taxes Homestead Exemptions Rebates And

Maryland Homestead Rebate - Web The State of Maryland provides a credit for the real property tax bill for homeowners of all ages who qualify on the basis of gross household income For more information please