Maryland Homestead Tax Credit Explained The homestead credit limits the amount of assessment increase on which a homeowner will pay property taxes in that tax year on the one property actually used as the owner s principal residence See Section 9 105 Tax Property Article of the Maryland Annotated Code

The Homestead Tax Credit caps the percentage increase that you can be taxed on the assessed value of your home While every county has its own cap the highest increase can be no more than 10 The list of each county s cap is available on the Maryland State Department of Assessment and Taxation SDAT website below County Homestead Tax Credit The Homestead Tax Credit HTC limits the increase in taxable assessment each year to a fixed percentage Every county and municipality in Maryland is required to limit taxable assessment increases to no more than 10 per year and the State also limits the taxable assessment for the State portion of the tax to 10

Maryland Homestead Tax Credit Explained

Maryland Homestead Tax Credit Explained

https://chartertitlemd.com/wp-content/uploads/2022/06/Advantage-Title-1080-×-1080-px.png

Texas Homestead Exemption Explained How To Fill Out Texas Homestead

https://i.ytimg.com/vi/1EcmMvUwEp8/maxresdefault.jpg

Harris County Homestead Exemption Form ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/harris-county-homestead-exemption-form-printable-pdf-download-3.png

All Marylanders who received a Homeowners or Renters Tax Credit in 2023 will be mailed a complimentary 2024 application to their home address To determine whether you are eligible to receive a tax credit please visit SDAT s online tax credit system To download an application please visit https dat maryland gov Pages Tax Credit Explaining the Homeowner s Tax Credit Exemptions from property taxes known as homesteads protect homeowners from paying a certain amount of money or a set percentage of the home s worth This is because homestead exemptions only apply to one s principal house and not to secondary or investment properties

Homestead Tax Credit Program A property tax relief program that provides a property tax credit for the principal residence of a property owner Upon qualification this credit is automatically applied to the tax bill when the The tax credit is based upon the amount by which the property taxes exceed a percentage of your income according to the following formula 0 of the first 8 000 of the combined household income 4 of the next 4 000 of income 6 5 of the next 4 000 of income and 9 of all income above 16 000

Download Maryland Homestead Tax Credit Explained

More picture related to Maryland Homestead Tax Credit Explained

Baltimore City Homestead Tax Credit Form Fill Out And Sign Printable

https://www.signnow.com/preview/0/291/291671/large.png

Maryland Homestead Tax Credit YouTube

https://i.ytimg.com/vi/qg3ezZxs3f0/maxresdefault.jpg

Must Know Facts About Florida Homestead Exemptions Lakeland Real Estate

https://lakelandfloridaliving.com/wp-content/uploads/2021/09/Things-To-Know-About-Florida-Homestead-Exemption-663x1024.png

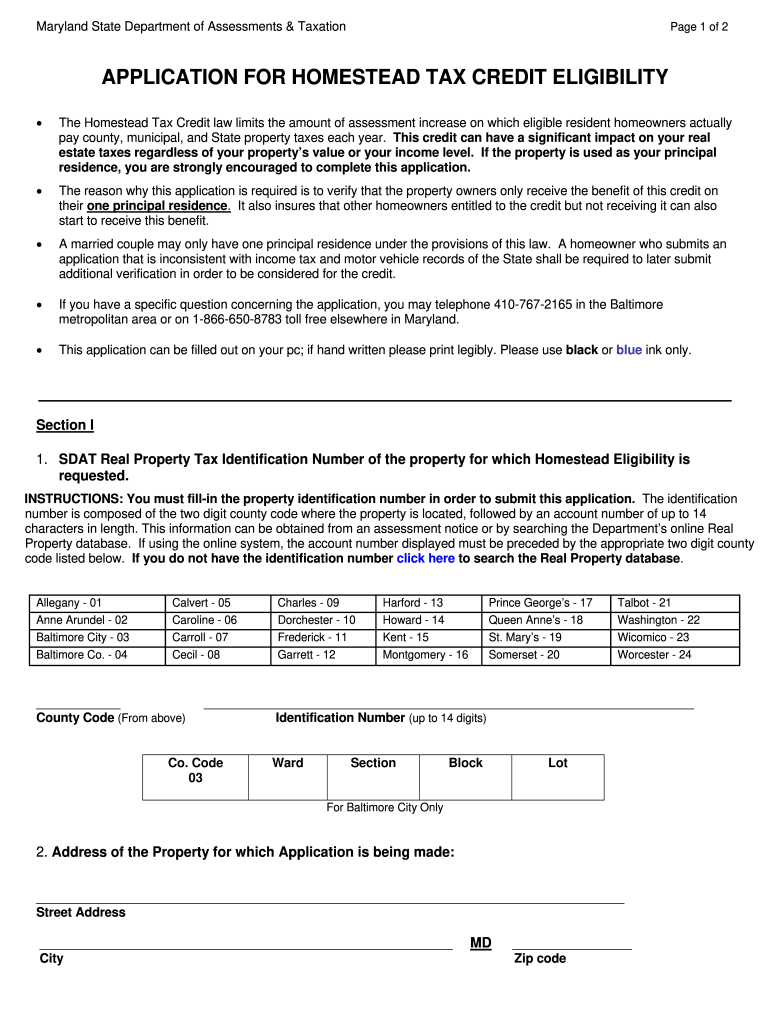

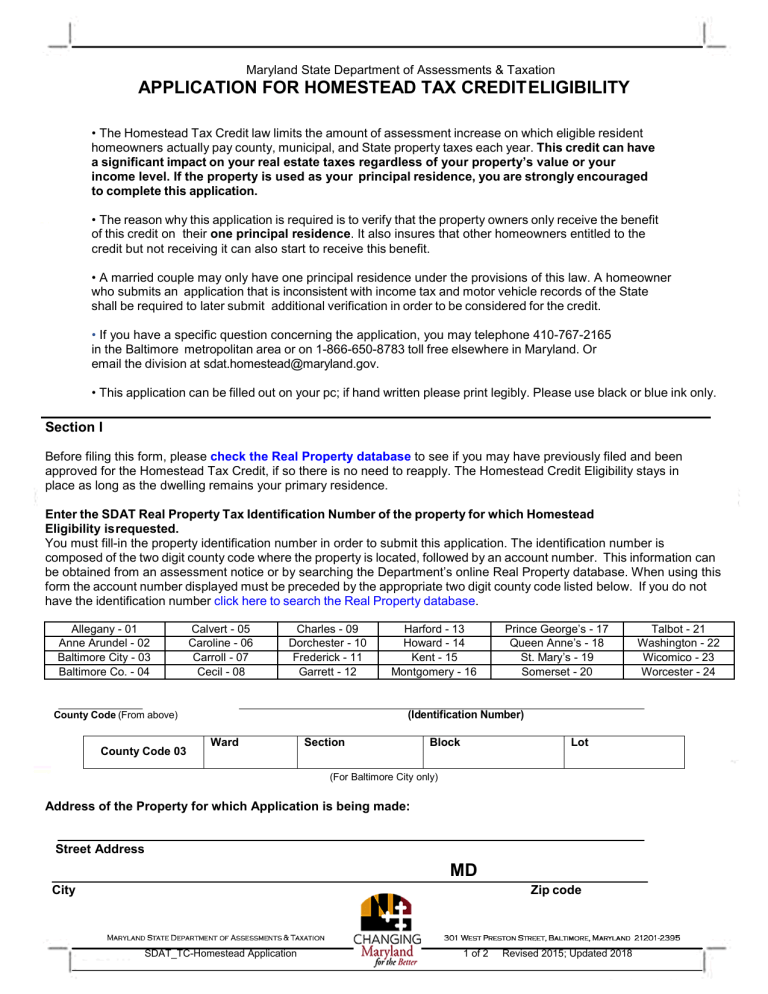

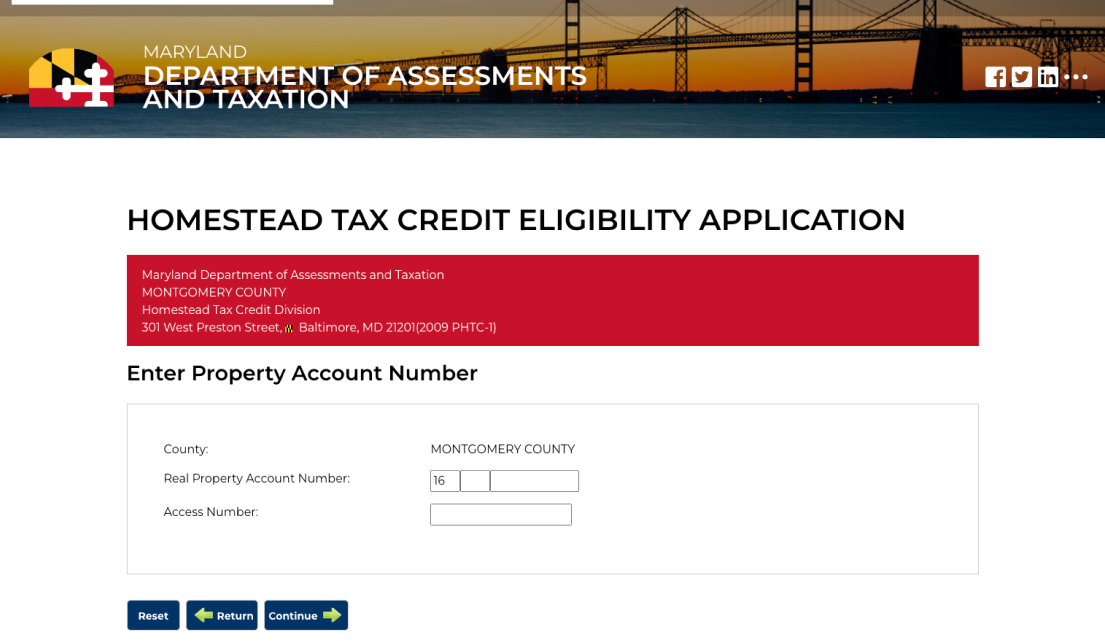

Maryland requires all homeowners to submit a one time application to establish eligibility for the Homestead Tax Credit The Homestead Tax Credit Eligibility Application is needed to ensure that homeowners receive the Homestead credit only on their principal residence The Homestead Property Tax Credit is a statutory limit on the amount an assessment increase may affect a taxpayer s tax burden This is important for owner occupied dwellings as a provision of a property tax credit against large assessment increases that functions much the same as a cap

In Maryland if you meet the requirements and file an application you may receive a discount on your real property taxes In this article I will discuss the minimum requirements to qualify for the Maryland Homestead Tax Credit how to fill out an application and why the Tax Credit is such a great deal for Maryland homeowners The Homestead Property Tax Credit may significantly reduce the amount of property taxes you owe The Homestead Tax Credit limits the amount of assessment increase on which eligible homeowners actually pay county municipal and state property taxes each year regardless of your property s value or your income level

What New Yorkers Should Know About Property Taxes Tax Credits Tax

https://i.pinimg.com/736x/f8/8b/a3/f88ba3c1c57f09d77c2c2f705ade11f0.jpg

Maryland Homestead Tax Credit Application YouTube

https://i.ytimg.com/vi/I118DvkbhSk/maxresdefault.jpg

https://dat.maryland.gov/realproperty/Pages/FAQ...

The homestead credit limits the amount of assessment increase on which a homeowner will pay property taxes in that tax year on the one property actually used as the owner s principal residence See Section 9 105 Tax Property Article of the Maryland Annotated Code

https://mvlslaw.org/wp-content/uploads/2023/04/...

The Homestead Tax Credit caps the percentage increase that you can be taxed on the assessed value of your home While every county has its own cap the highest increase can be no more than 10 The list of each county s cap is available on the Maryland State Department of Assessment and Taxation SDAT website below

How To Apply For The Maryland Homestead Tax Credit YouTube

What New Yorkers Should Know About Property Taxes Tax Credits Tax

Important Information About The Maryland Homestead Tax Credit County

York County Sc Residential Tax Forms Homestead Exemption CountyForms

Credit Versus Exemption In Homestead Property Tax Relief ITR Foundation

Is Your Maryland Home Your Declared Primary Residence

Is Your Maryland Home Your Declared Primary Residence

Maryland Homestead Tax Credit

Maryland Homestead Application

Homestead Tax Credit

Maryland Homestead Tax Credit Explained - All Marylanders who received a Homeowners or Renters Tax Credit in 2023 will be mailed a complimentary 2024 application to their home address To determine whether you are eligible to receive a tax credit please visit SDAT s online tax credit system To download an application please visit https dat maryland gov Pages Tax Credit