Maryland Inheritance Tax Exemption 2022 For decedents dying on or after October 1 2023 a surviving registered domestic partner is exempt from inheritance tax See Tax General 7 203 l 3

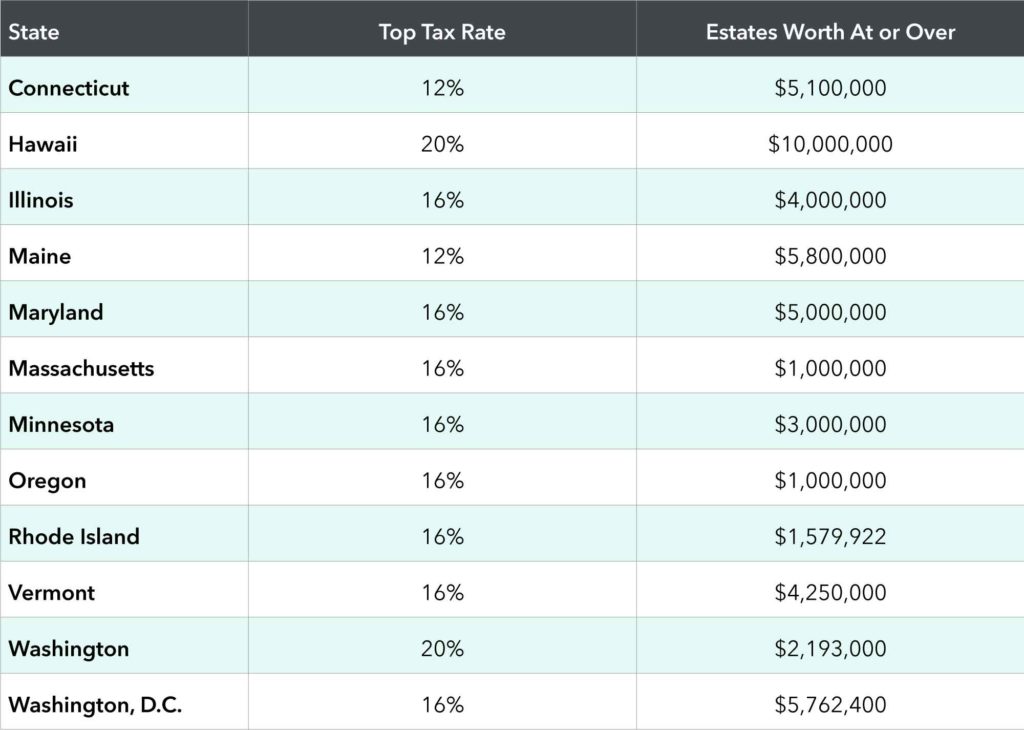

The Maryland estate tax exemption is 5 million and it also has an inheritance tax The federal government also has its own estate tax The tax is administered and collected by the Comptroller of Maryland and is due within nine 9 months after the decedent s date of death See the MET 1 Estate Tax Return and the links

Maryland Inheritance Tax Exemption 2022

Maryland Inheritance Tax Exemption 2022

https://files.taxfoundation.org/20191016110753/Estate-Inheritance-2019-fv-01.png

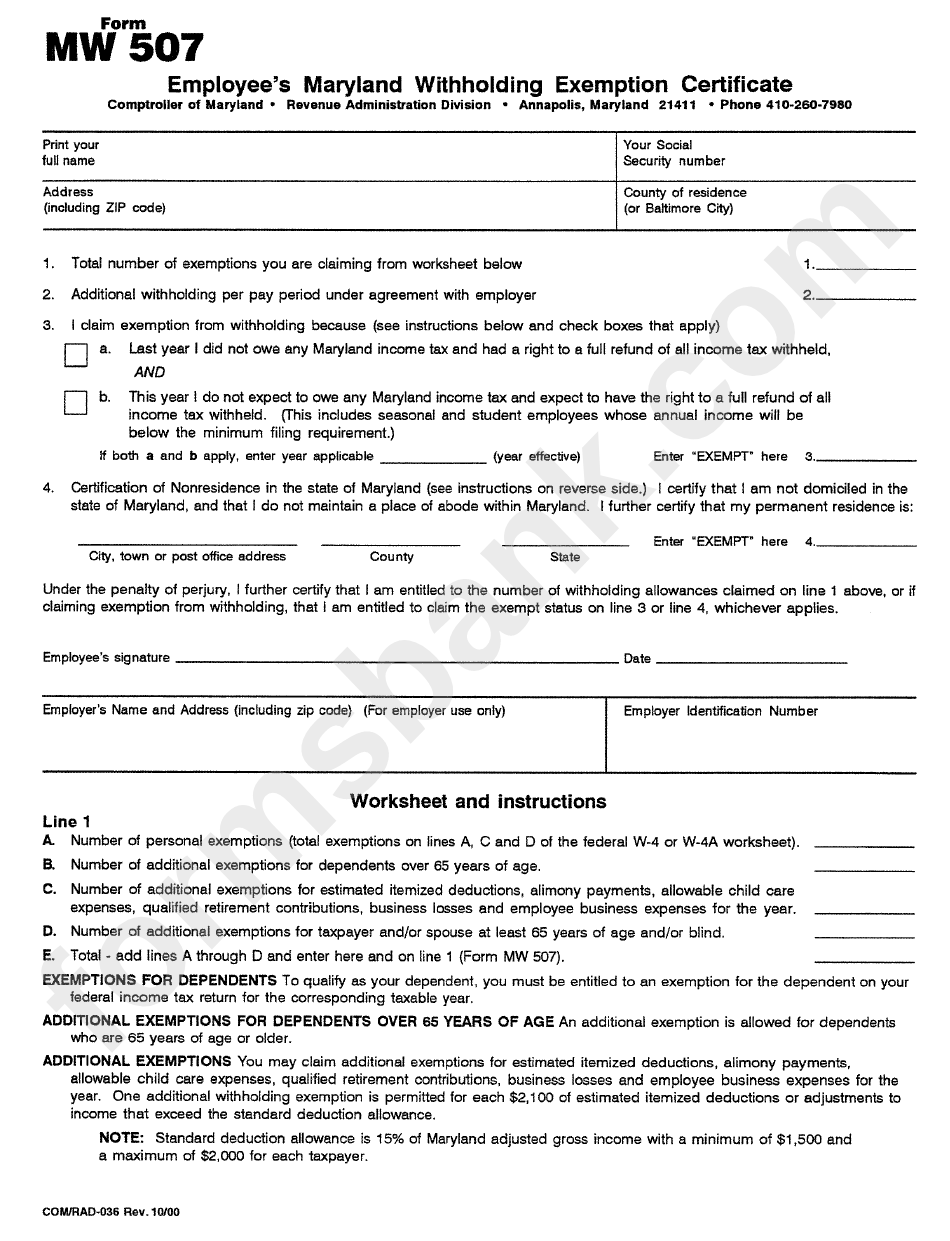

Maryland Tax Forms 2022 Printable State MD Form 502 And MD Form 502

https://www.incometaxpro.net/images/forms/2022/maryland-tax-forms.png

17 States That Charge Estate Or Inheritance Taxes Alhambra Investments

https://alhambrapartners.com/wp-content/uploads/2020/11/2.png

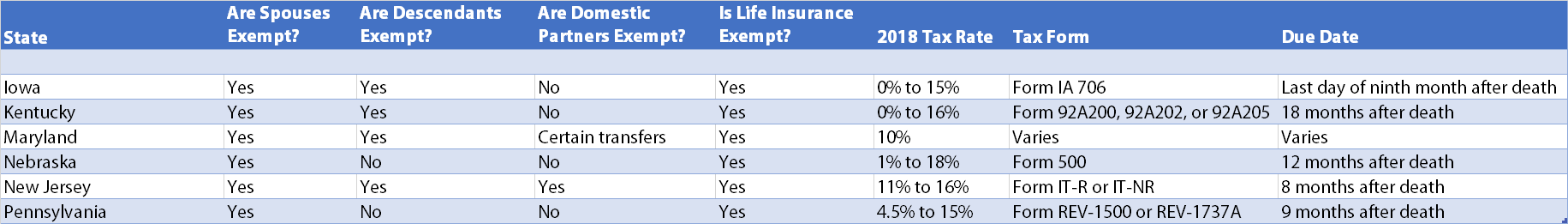

The Maryland Inheritance Tax applies to all beneficiaries unless they have a specific exemption from the tax A decedent s spouse child stepchild grandchild step grandchild parent grandparent or sibling are Maryland Inheritance Tax Exemptions There are many exemptions to Maryland s inheritance tax The inheritance tax doesn t apply when property is inherited by the deceased

Exempt from taxation under Section 501 c 3 of the IRS Code or to which transfers are deductible under Section 2055 of the IRS Code if it is incorporated under laws of Maryland conducts a In Maryland residents pay a 10 inheritance tax on assets passing to beneficiaries who are not exempt from the tax This tax is an important consideration for anyone planning

Download Maryland Inheritance Tax Exemption 2022

More picture related to Maryland Inheritance Tax Exemption 2022

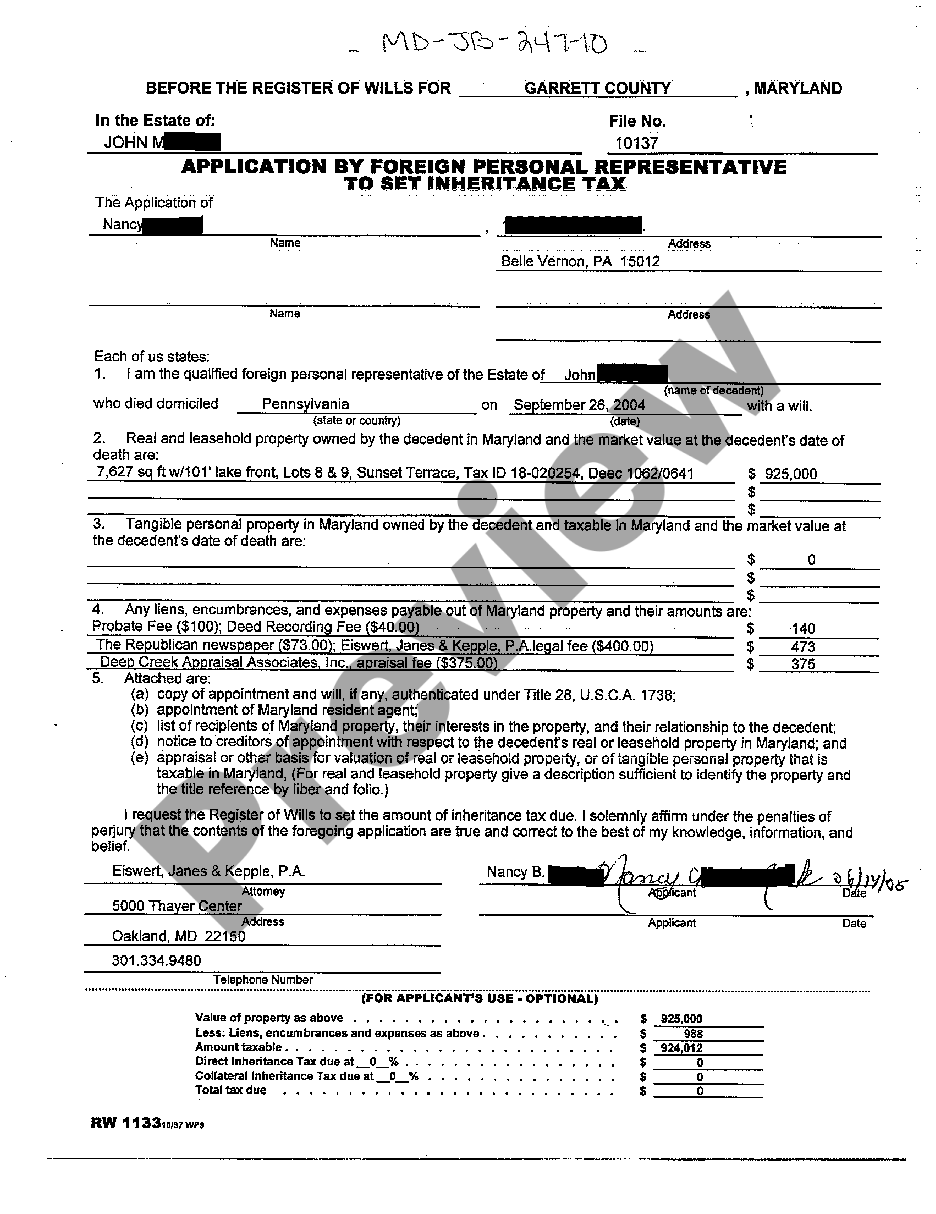

Inheritance Tax Waiver Form Maryland For Domicile US Legal Forms

https://cdn.uslegal.com/uslegal-preview/MD/MD-JB-247-10/1.png

Maryland Inheritance Tax Calculator Probate

https://assets-global.website-files.com/5daf3d101c624dca765b5fcc/5dd6c168d6128e2baaf984ac_Inheritance Tax by State.png

Which States Have Inheritance Tax Mercer Advisors

https://www.merceradvisors.com/wp-content/uploads/2020/08/Tax-Rate-Table-1024x730.jpg

Explore Maryland s inheritance tax exemptions including criteria types and filing rules to ensure compliance and optimize estate planning The federal government s estate tax exemption is 12 92 million in 2023 In 2022 the exemption was 12 06 million The exemption is increased each year based on inflation

Estates under 5 million per person are exempt from Maryland estate tax Using portability married couples can shield up to 10 million from estate taxes The proposal seeks If your net estate exceeds the exemption amount during the year of death your estate will owe a Maryland estate tax The exemption in 2024 is five million dollars 5 0M

Estate And Inheritance Taxes Urban Institute

https://www.urban.org/sites/default/files/inline-images/tile-map.png

5 Things To Understand About Maryland s Inheritance Tax

https://www.marylandworkerscompensationlaw.com/wp-content/assets/images/attorneys/david-galinis.jpg

http://registers.maryland.gov › main › taxes…

For decedents dying on or after October 1 2023 a surviving registered domestic partner is exempt from inheritance tax See Tax General 7 203 l 3

https://smartasset.com › ... › maryland-esta…

The Maryland estate tax exemption is 5 million and it also has an inheritance tax The federal government also has its own estate tax

January 2022 Inheritance Tax Changes All You Need To Know Key

Estate And Inheritance Taxes Urban Institute

Inheritance Tax Receipts Reach 4 1Billion In The Months From April To

Maryland Inheritance Tax Calculator Probate

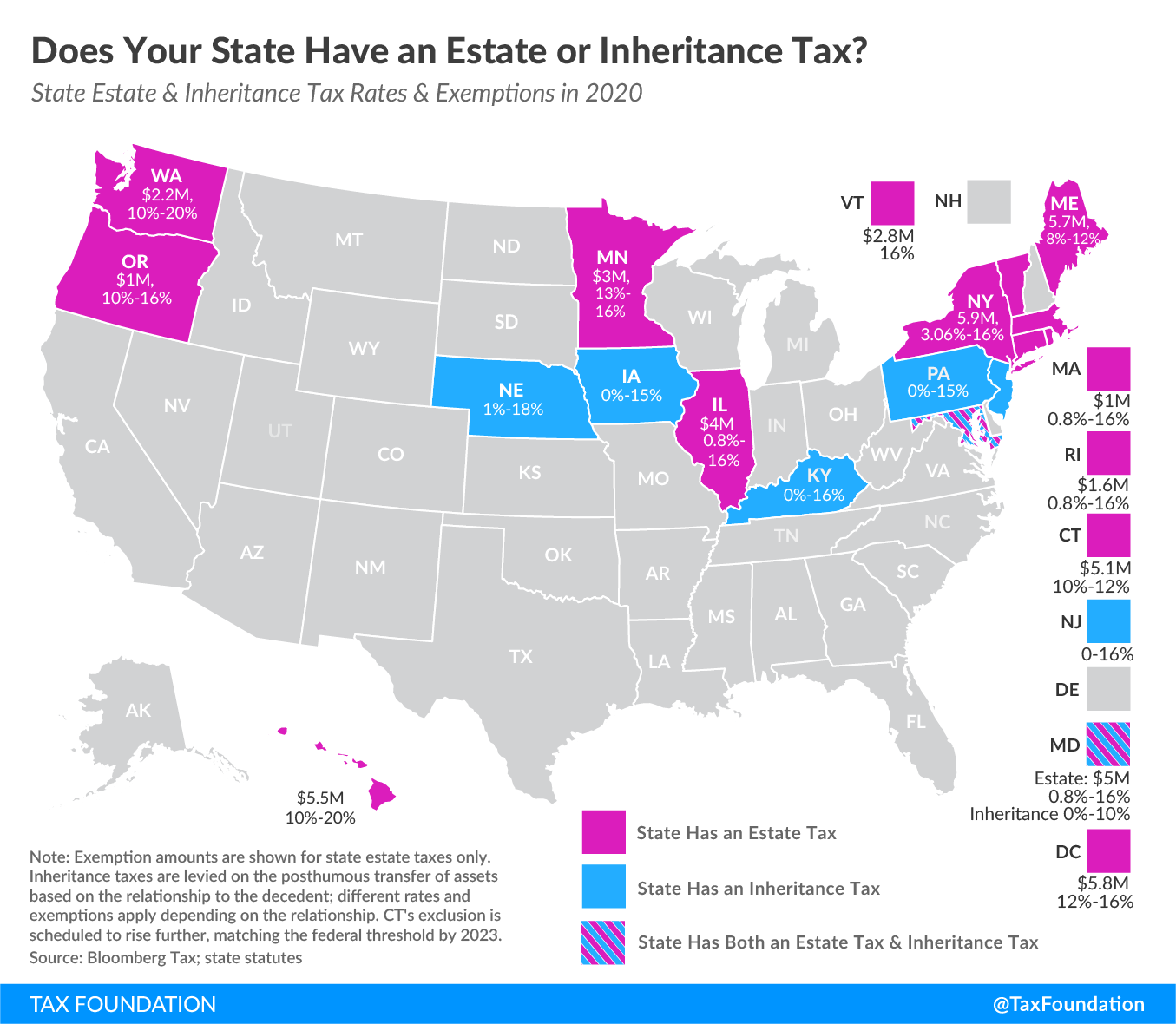

Does Your State Have An Estate Tax Or Inheritance Tax Tax Foundation

Does Your State Have An Estate Or Inheritance Tax Tax Foundation

Does Your State Have An Estate Or Inheritance Tax Tax Foundation

Maryland State Withholding Tax Form 2022 WithholdingForm

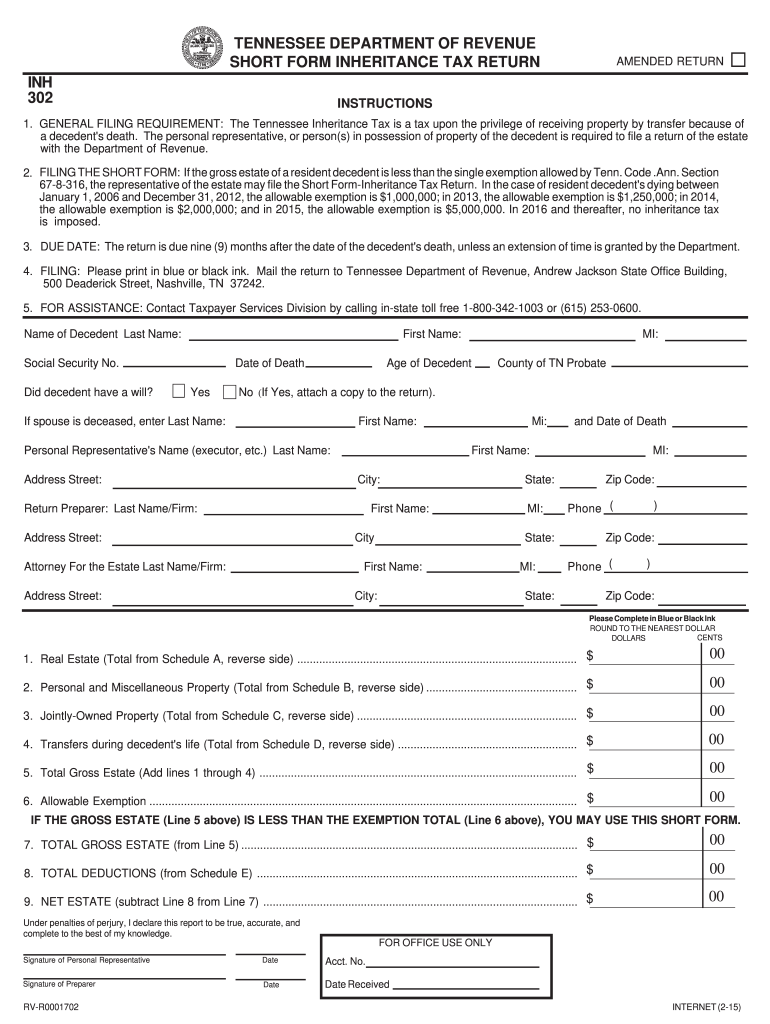

Inheritance Tax 2015 2023 Form Fill Out And Sign Printable PDF

Maryland Form 502d Fill Out Sign Online DocHub

Maryland Inheritance Tax Exemption 2022 - The inheritance tax rate in Maryland is set at 10 as outlined in Maryland Tax General Article 7 204 This flat rate applies uniformly to all non exempt beneficiaries and is