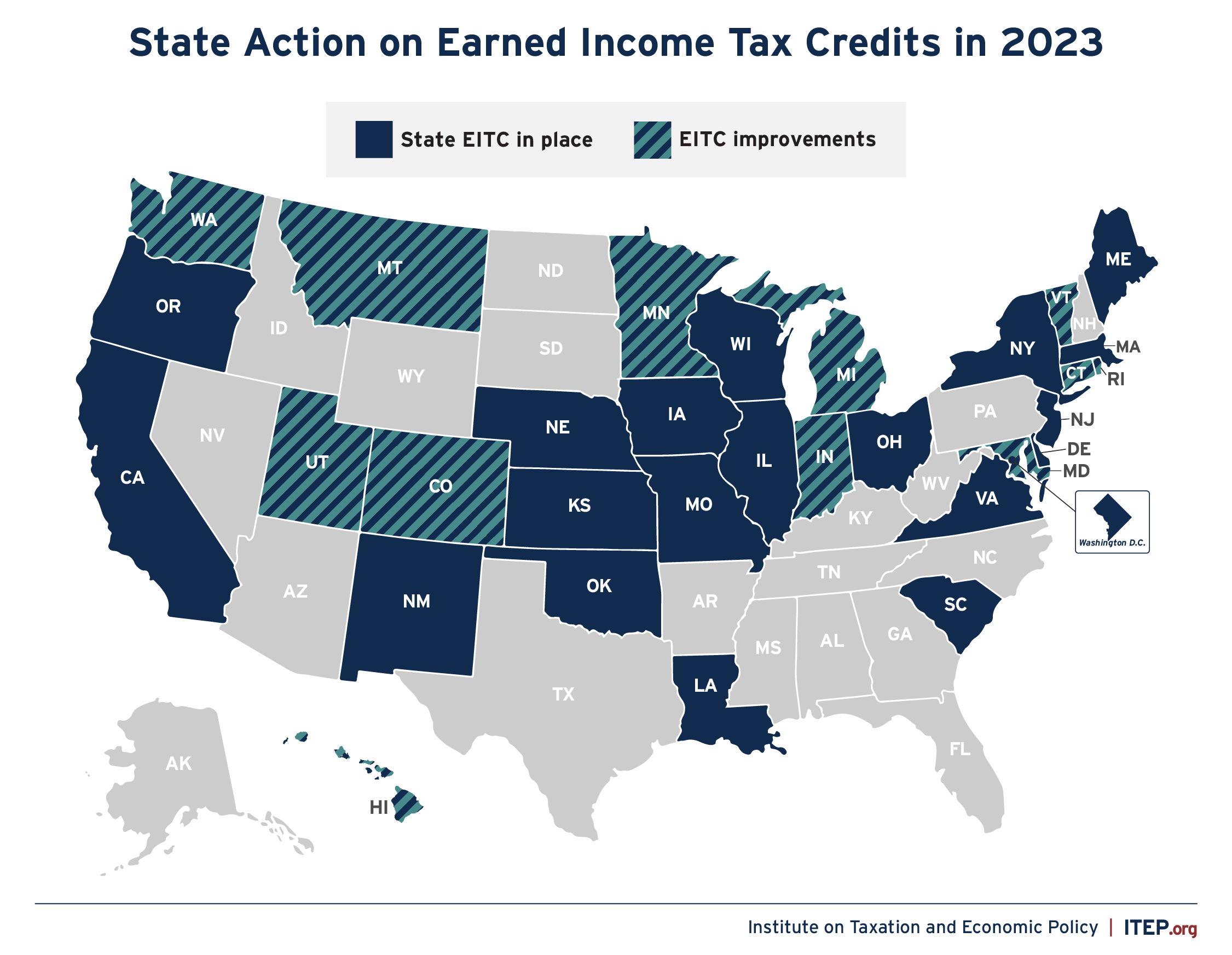

Maryland Tax Credits 2023 42 rowsThe Maryland earned income tax credit EITC will either reduce or eliminate

What is the Homeowners Property Tax Credit Program The State of Maryland has developed a program which allows credits against the homeowner s property tax bill if The Tax year 2023 instruction booklets for tax preparation Answers to your tax questions

Maryland Tax Credits 2023

Maryland Tax Credits 2023

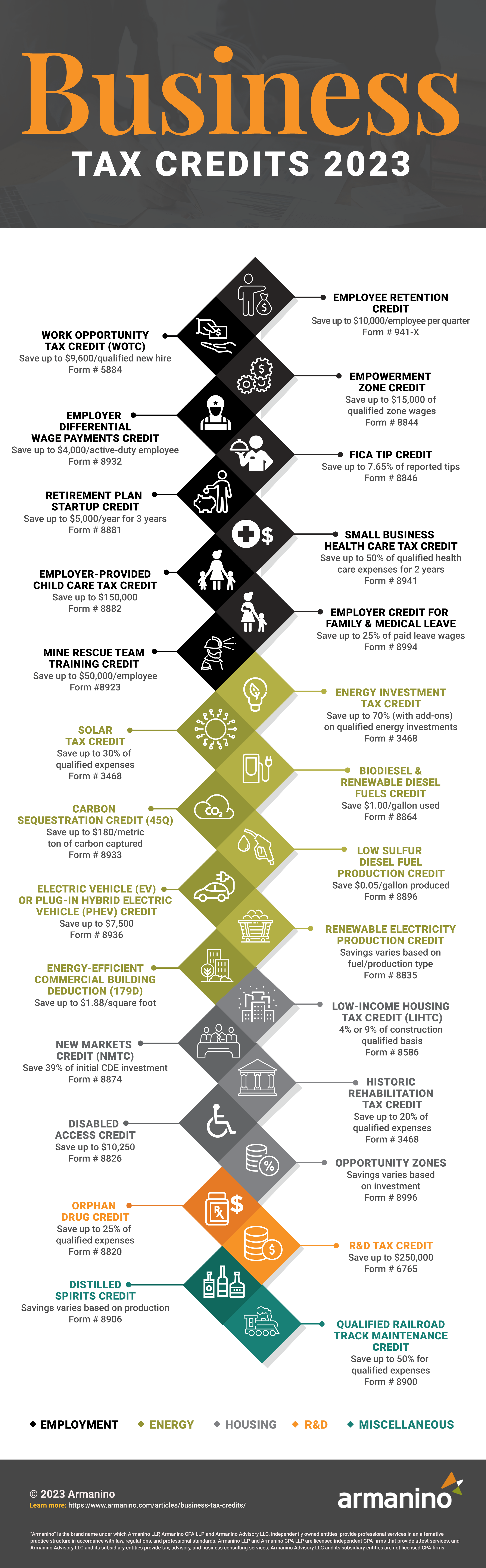

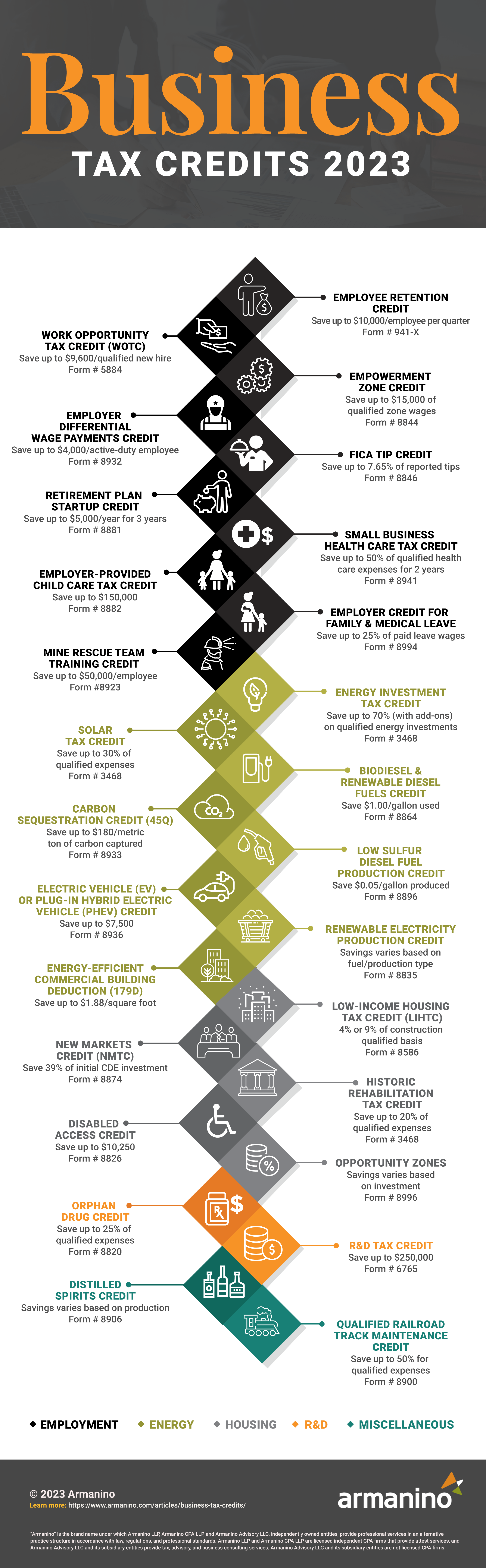

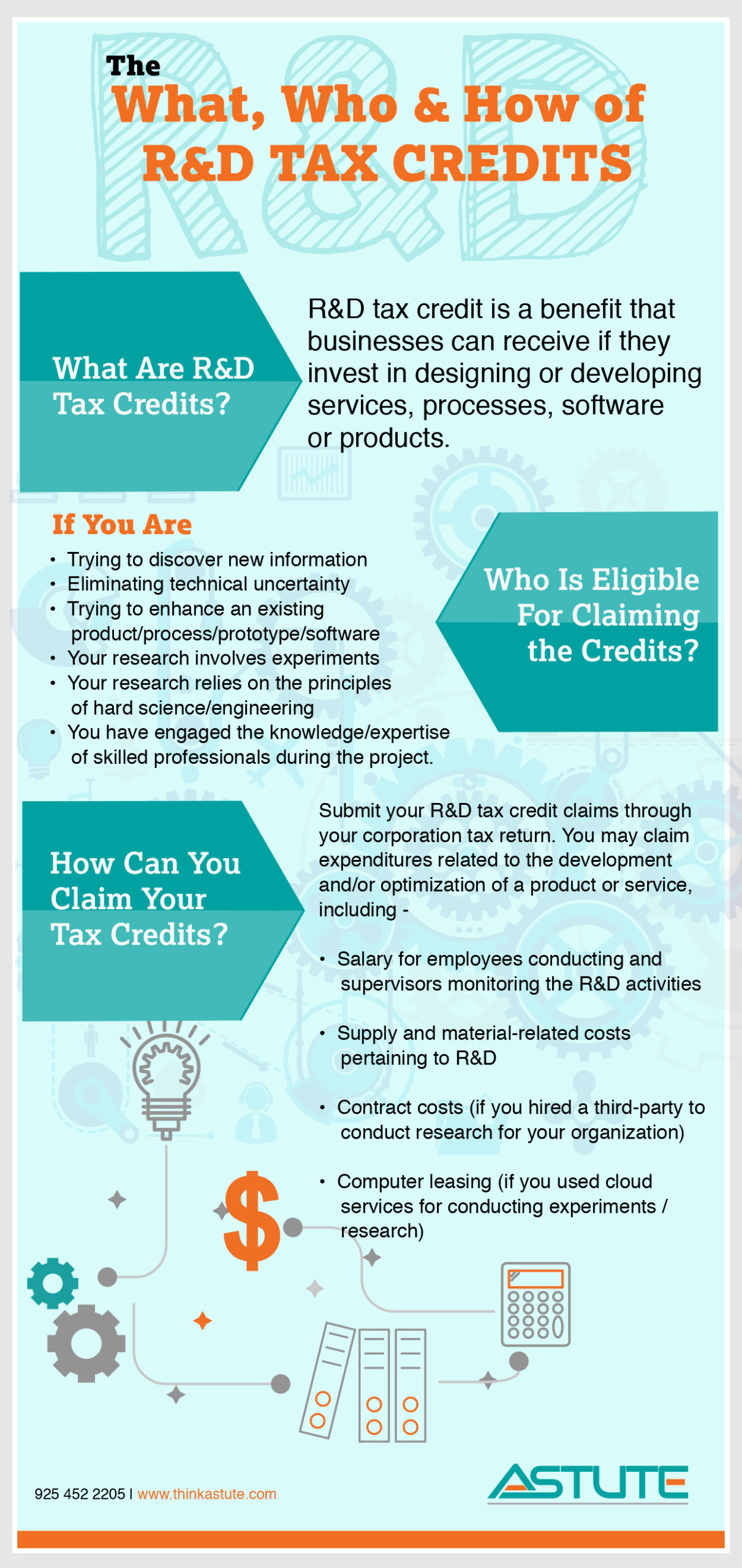

https://www.armanino.com/-/media/images/articles/business-tax-credits-2023-infographic.png

Annalee Sides

https://www.montgomerycountymd.gov/PortalImages/InfoCentral/Photo/16/2022/eitc-2022.jpg

List Of 4 Refundable Tax Credits For Tax Year 2022 2023 Internal

https://www.irstaxapp.com/wp-content/uploads/2023/01/refundable-tax-credits-1024x576.png

The Homeowners Property Tax Credit Program provides tax relief for eligible homeowners by setting a limit on the amount of property taxes owed based on their You may be eligible to claim some valuable personal income tax credits available on your Maryland tax return The following list contains general information about some of the

Can I apply for the Homeowner tax credit Answer Yes If the owner is proposing work for a portion of the interior that is exclusively the owner occupied residential portion of the The State of Maryland has developed a program which allows credits against the homeown er s property tax bill if the property taxes exceed a fixed percentage of the

Download Maryland Tax Credits 2023

More picture related to Maryland Tax Credits 2023

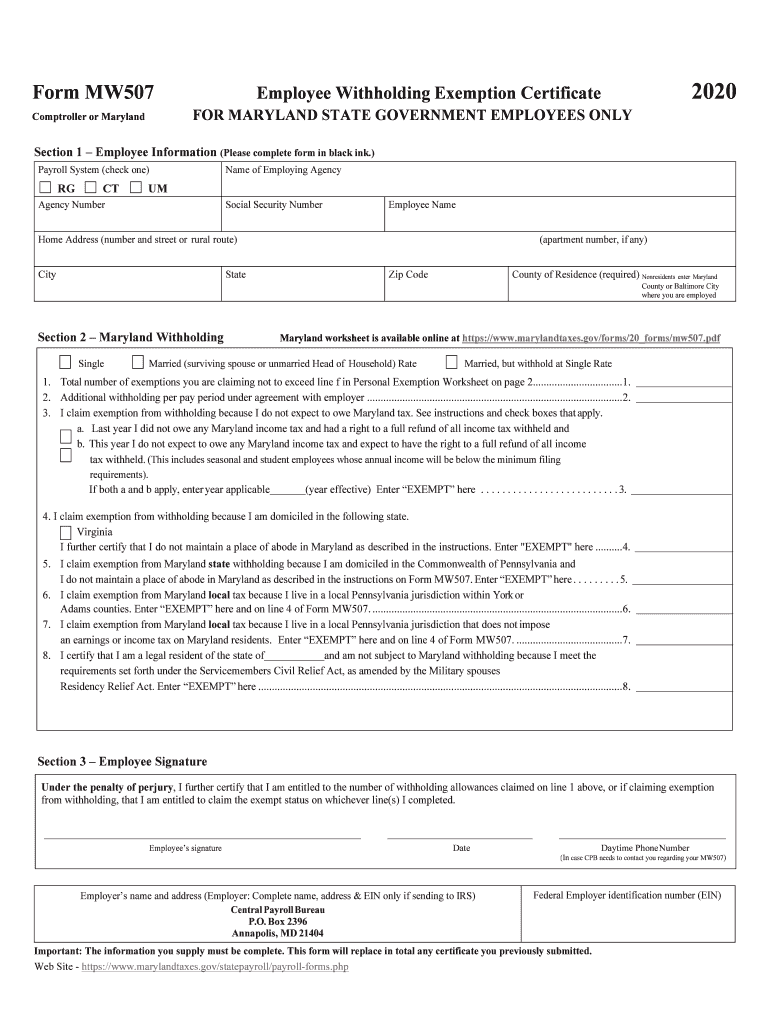

Maryland State Tax Withholding Form 2023 Printable Forms Free Online

https://www.pdffiller.com/preview/491/475/491475654/large.png

Tax Credits Save You More Than Deductions Here Are The Best Ones

https://www.gannett-cdn.com/-mm-/14ee05d59f10019b9af859e1b8044dff44c16b5c/c=0-64-2118-1261&r=x1683&c=3200x1680/local/-/media/2017/03/28/USATODAY/USATODAY/636262972570306279-tax-credits.jpg

Maryland Makes 9M In Additional Tax Credits Available For Student Loan

https://cdn.s3-media.wbal.com/Media/2016/03/09/2b359bd9-aa7b-4e1f-ae87-70a1c547d5ae/original.png

The IRA contains several new tax credits and rebates for 2023 to help households pay for energy efficiency upgrades electric vehicles electric heating and cooling systems and BALTIMORE The Maryland Department of Assessments and Taxation recently announced applications for the 2023 Homeowners and Renters Tax Credit

Homeowners Property Tax Credit The State of Maryland developed a program which allows credits against the homeowner s property tax bill if the property taxes exceed a fixed percentage of the person s gross The State of Maryland provides a credit for the real property tax bill for homeowners of all ages who qualify on the basis of gross household income

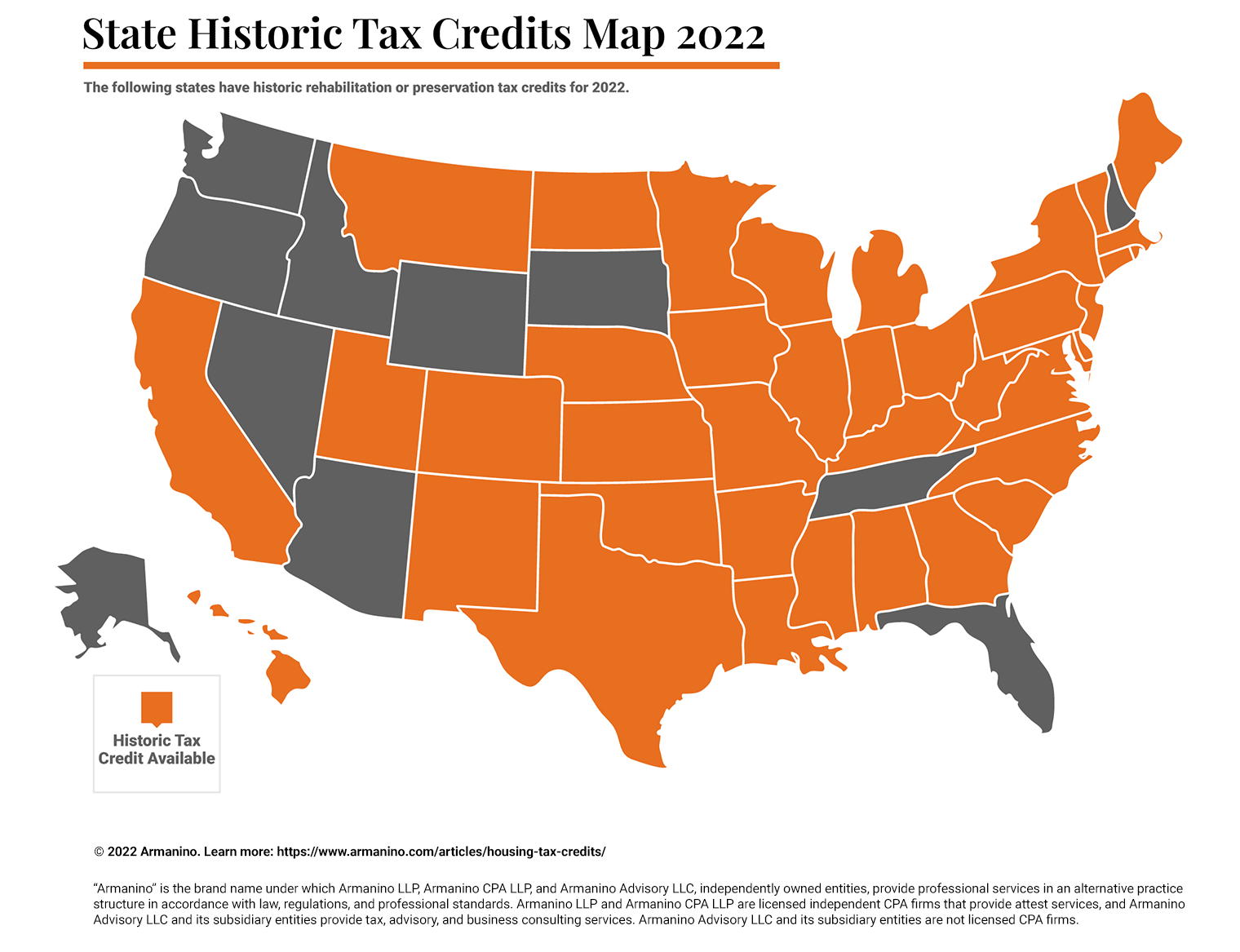

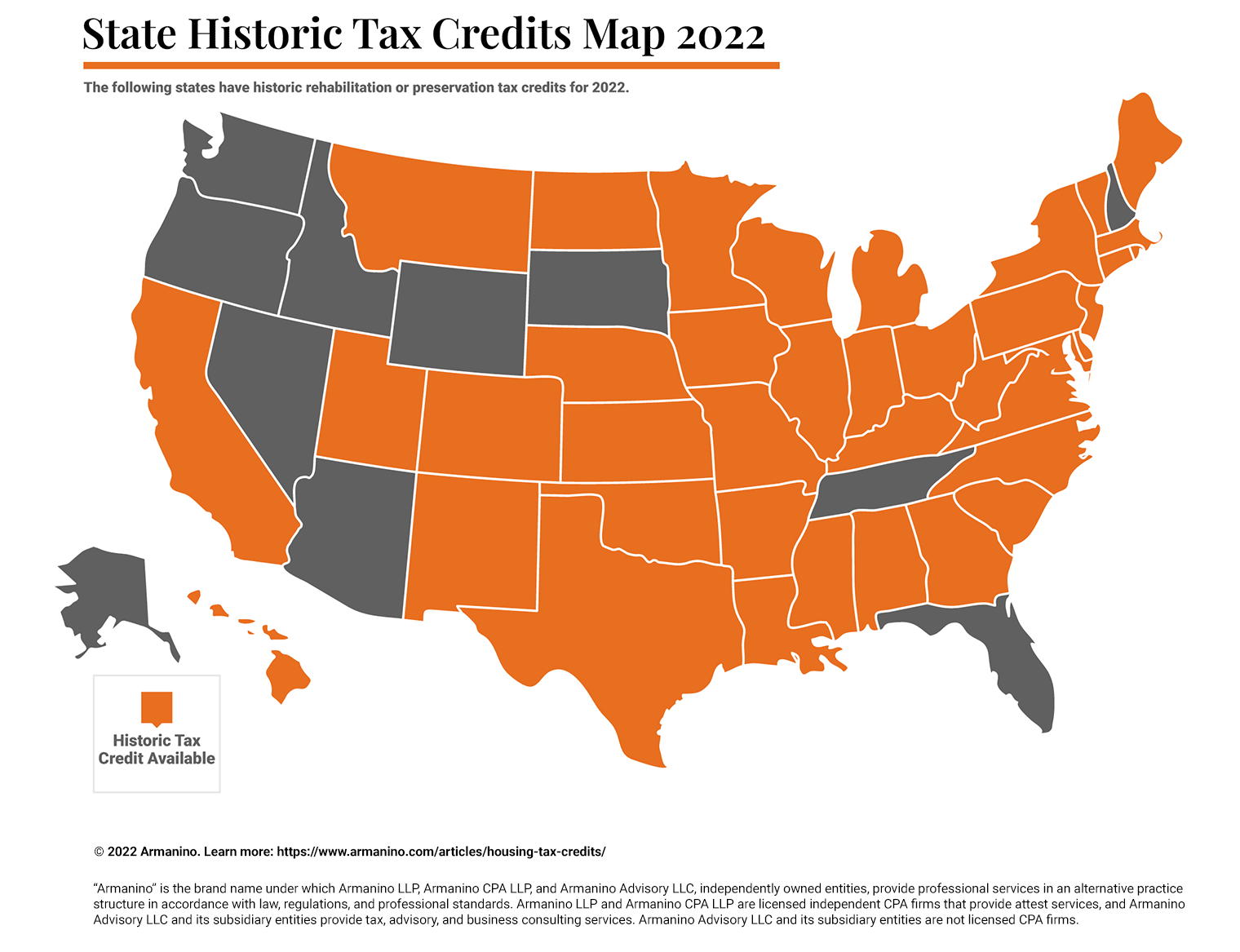

Housing Tax Credits Armanino

https://www.armanino.com/-/media/images/articles/housing-state-tax-credits.png

Tax Credits Vs Tax Deductions What s The Difference And Why It Matters

https://lirp.cdn-website.com/95f09d77/dms3rep/multi/opt/Tax+Credits-1920w.png

https://www.marylandtaxes.gov/individual/credits-deductions/index.php

42 rowsThe Maryland earned income tax credit EITC will either reduce or eliminate

https://dat.maryland.gov/realproperty/Pages/...

What is the Homeowners Property Tax Credit Program The State of Maryland has developed a program which allows credits against the homeowner s property tax bill if

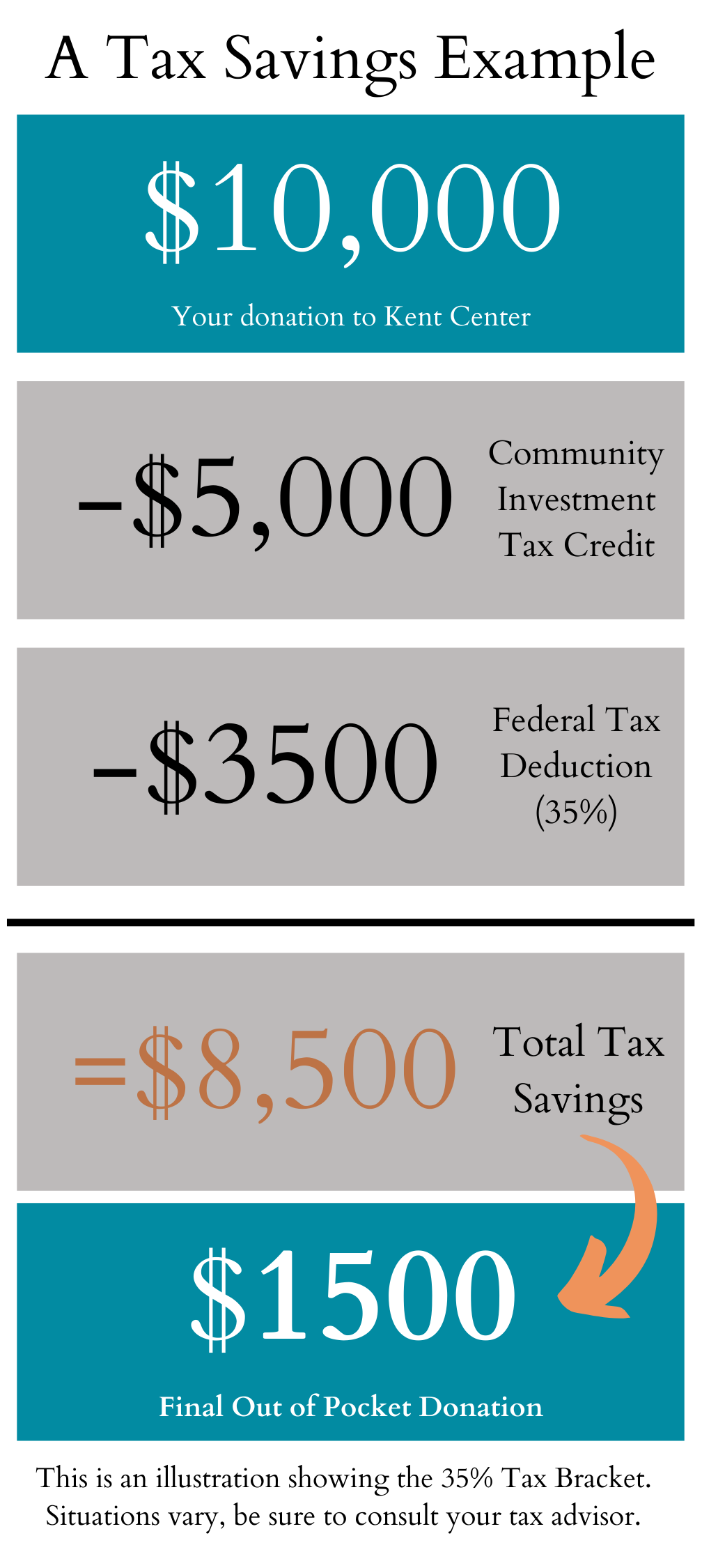

Community Investment Tax Credits Kent Center Maryland

Housing Tax Credits Armanino

Are You Eligible For R D Tax Credit Find Out Using This Infographic

Refundable Credits A Winning Policy Choice Again In 2023 ITEP

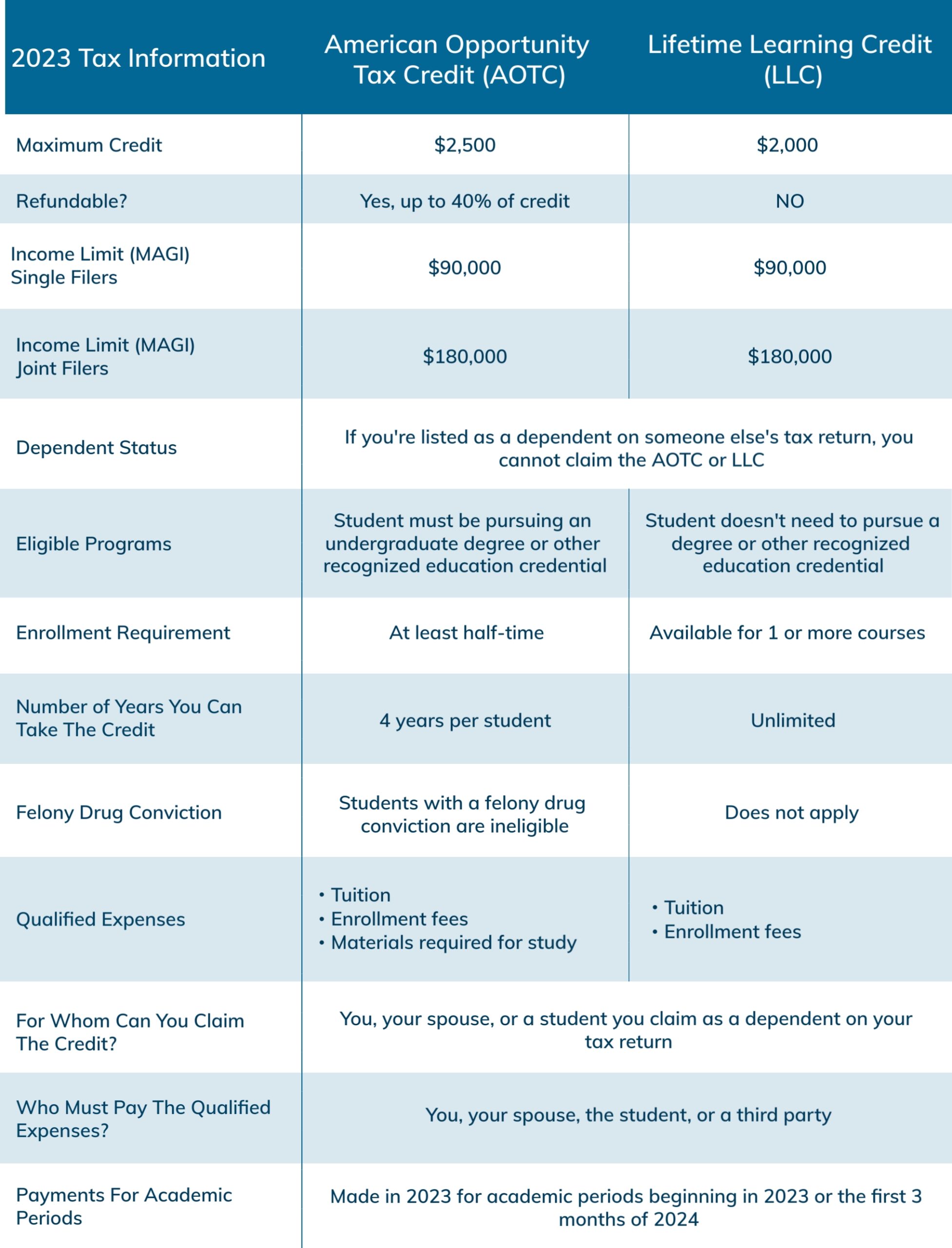

2023 Education Tax Credits Are You Eligible

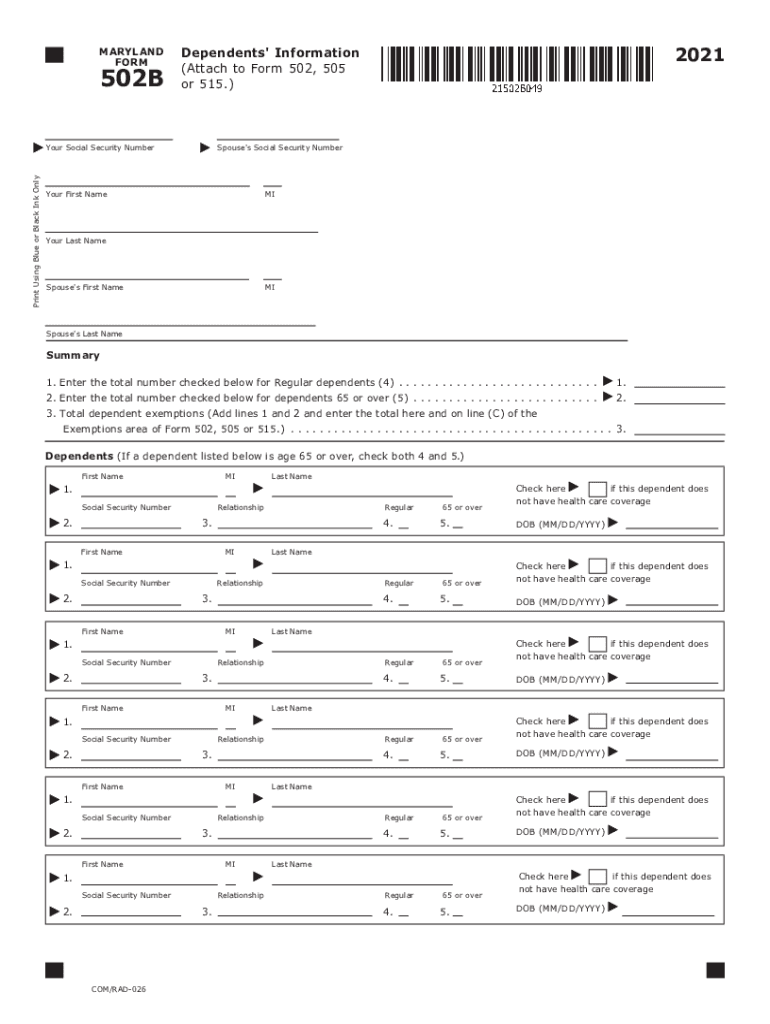

Maryland 502 Booklet 2021 2024 Form Fill Out And Sign Printable PDF

Maryland 502 Booklet 2021 2024 Form Fill Out And Sign Printable PDF

Charles County Maryland Tax Incentives Credits Charles County

Lots Of Plans To Boost Tax Credits Which Is Best Brookings

502 Maryland Tax Forms And Instructions

Maryland Tax Credits 2023 - You may be eligible to claim some valuable personal income tax credits available on your Maryland tax return The following list contains general information about some of the