Maryland Tax Rebate 2024 MW506R Application for Tentative Refund of Withholding on 2024 Sales of Real Property by Nonresidents Form used to apply for a refund of the amount of tax withheld on the 2024 sale or transfer of Maryland real property interests by a nonresident individual or nonresident entity which is in excess of the transferor seller s tax liability for

English United States RELIEF Act Stimulus Portal To check your eligibility for a RELIEF Act stimulus payment enter the information below All fields are required If you are eligible for a stimulus payment you will be able to check the status of your payment Last updated December 02 2023 Stimulus checks from the federal government ended a couple of years ago but some states have provided financial relief through tax rebate checks or inflation

Maryland Tax Rebate 2024

Maryland Tax Rebate 2024

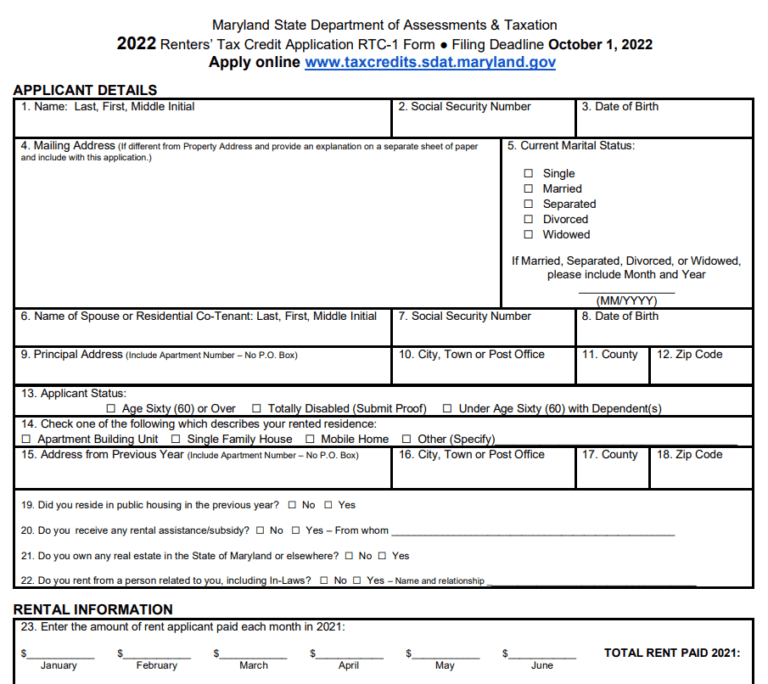

https://printablerebateform.net/wp-content/uploads/2023/02/Maryland-Renters-Rebate-2023-768x684.png

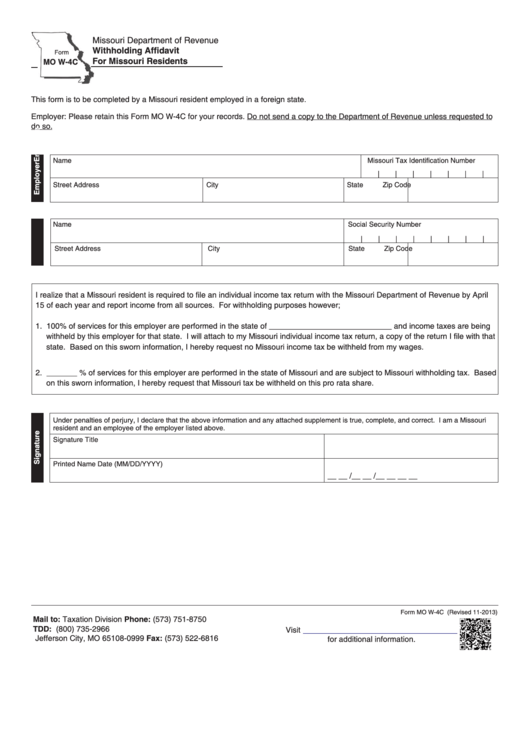

Maryland Withholding Tax Form WithholdingForm

https://i0.wp.com/www.withholdingform.com/wp-content/uploads/2022/10/fillable-form-mw-507p-maryland-income-tax-withholding-for-annuity-2.png?w=979&ssl=1

Maryland State Income Tax Withholding Form 2022 WithholdingForm

https://www.withholdingform.com/wp-content/uploads/2022/08/missouri-withholding-tax.png

You can check the status of your current year refund online or by calling the automated line at 410 260 7701 or 1 800 218 8160 Be sure you have a copy of your return on hand to verify information You can also e mail us at taxhelp marylandtaxes gov to check on your refund As Maryland s state energy office the Maryland Energy Administration MEA will be the applicant for two of the residential focused IRA rebate programs the HOMES Residential Energy Efficiency Rebate Program and the High Efficiency Electric Home Rebate Program

The tax credit is based upon the amount by which the property taxes exceed a percentage of your income according to the following formula 0 of the first 8 000 of the combined household income 4 of the next 4 000 of income 6 5 of the next 4 000 of income and 9 of all income above 16 000 The Comptroller s decision to issue or deny a refund and the determination of the amount of tax to be refunded is final and not subject to appeal DO NOT file this form after December 1 2024 This form is for closings that occurred during 2024 only

Download Maryland Tax Rebate 2024

More picture related to Maryland Tax Rebate 2024

How To Get Property Tax Rebate PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/pa-property-tax-rent-rebate-apply-by-12-31-2022-new-1-time-bonus-55.jpg?resize=1583%2C2048&ssl=1

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Virginia Tax Rebate 2024

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate-1024x576.jpg

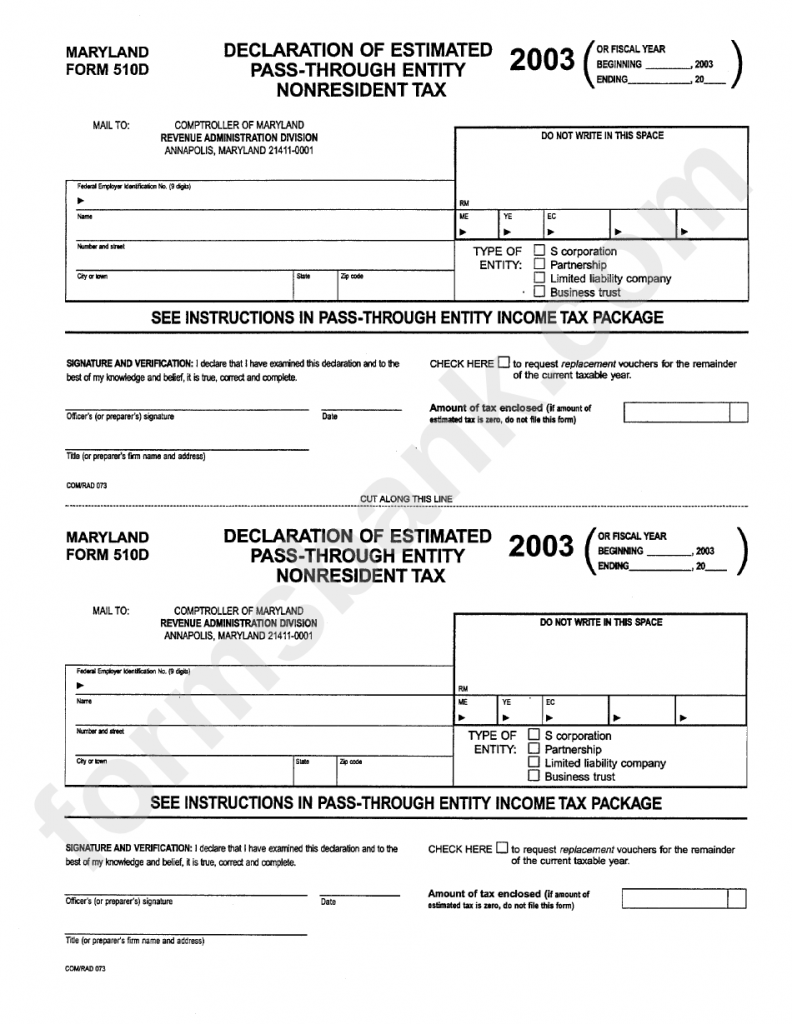

Corporation Income Tax Forms Number Title Description 500D Declaration of Estimated Corporation Income Tax Form used by a corporation to declare and remit estimated income tax for tax year 2024 Marylandtaxes gov The RELIEF Act of 2021 as enacted by the Maryland General Assembly and signed into law by the Governor provides direct stimulus payments to qualifying Marylanders unemployment insurance grants to qualifying Marylanders and grants and loans to qualifying small businesses

FY24 Program Now Open Residential Clean Energy Rebate Program Receive financial assistance to install solar photovoltaic solar water heating and geothermal heat pumps R ebates EmPOWER Maryland utility sponsored programs Beginning on September 1 2023 eligible applicants to the Residential Clean Energy Rebate Program must use the most up to date application form for Fiscal Year 2024 FY24 provided by MEA on the Residential Clean Energy Rebate Program webpage1 or if filling out an electronic application eApp must use the most up to date Applicant Signatu

Utility Rebate Programs In Maryland

https://www.energysvc.com/wp-content/uploads/2021/12/maryland-hero.jpg

Printable 2023 Maryland Form PV Tax Payment Voucher Estimated Tax Form And Extension

https://www.tax-brackets.org/img/state_seals/maryland.svg

https://www.marylandtaxes.gov/individual/income/forms/2024-Withholding-Forms.php

MW506R Application for Tentative Refund of Withholding on 2024 Sales of Real Property by Nonresidents Form used to apply for a refund of the amount of tax withheld on the 2024 sale or transfer of Maryland real property interests by a nonresident individual or nonresident entity which is in excess of the transferor seller s tax liability for

https://interactive.marylandtaxes.gov/relief

English United States RELIEF Act Stimulus Portal To check your eligibility for a RELIEF Act stimulus payment enter the information below All fields are required If you are eligible for a stimulus payment you will be able to check the status of your payment

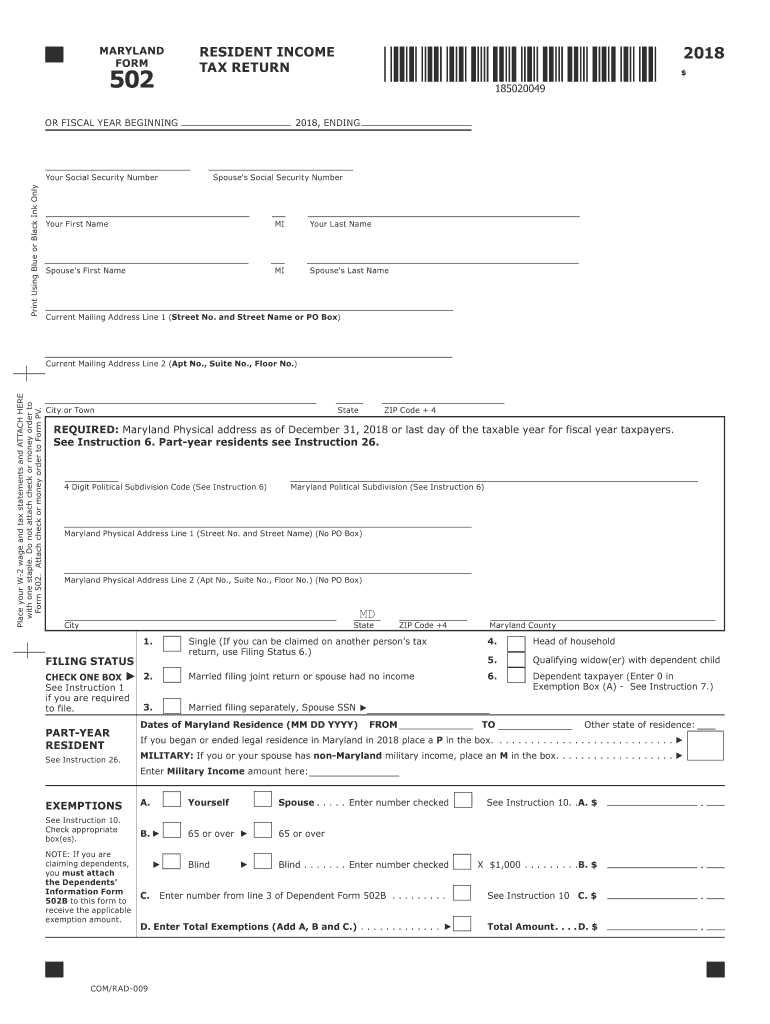

Md 502 Instructions 2018 Fill Out And Sign Printable PDF Template SignNow

Utility Rebate Programs In Maryland

Income Tax Rebate Under Section 87A

AlconChoice Rebate Form How To Qualify And Fill Out Printable Rebate Form

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

Property Tax Rebate Pennsylvania LatestRebate

Property Tax Rebate Pennsylvania LatestRebate

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

Maryland Printable Tax Forms Printable Form 2023

300 Bonus Tax Rebate For Thousands Of Families By Check Or Direct Deposit Do You Qualify

Maryland Tax Rebate 2024 - You are only eligible to receive a tax credit for rent paid in the State of Maryland The applicant must have a bona fide leasehold interest in the property and be legally responsible for the rent