Tax Rebate On Agricultural Income Web Tax policy affects agricultural competitiveness through its impact on farm income levels and variability investment in land and technology labour and other input use and the

Web 10 f 233 vr 2022 nbsp 0183 32 Les revenus provenant des exploitations agricoles appel 233 s b 233 n 233 fices agricoles sont soumis 224 l imp 244 t sur le revenu dans la cat 233 gorie des b 233 n 233 fices Web 25 mai 2018 nbsp 0183 32 Par Bercy Infos le 07 05 2019 Fiscalit 233 Lecture 5 minutes Les revenus des exploitants agricoles sont soumis 224 l imp 244 t sur le revenu dans la cat 233 gorie des

Tax Rebate On Agricultural Income

Tax Rebate On Agricultural Income

https://qph.cf2.quoracdn.net/main-qimg-aecb221d66b1d02be57dc6edcd228f64-lq

Agricultural Income Eligibility Calculation And Rebate

https://i2.wp.com/saral.pro/wp-content/uploads/2023/01/Agricultural-Income-Applicability-Calculation-Rebate.png?fit=1300%2C740&ssl=1&is-pending-load=1

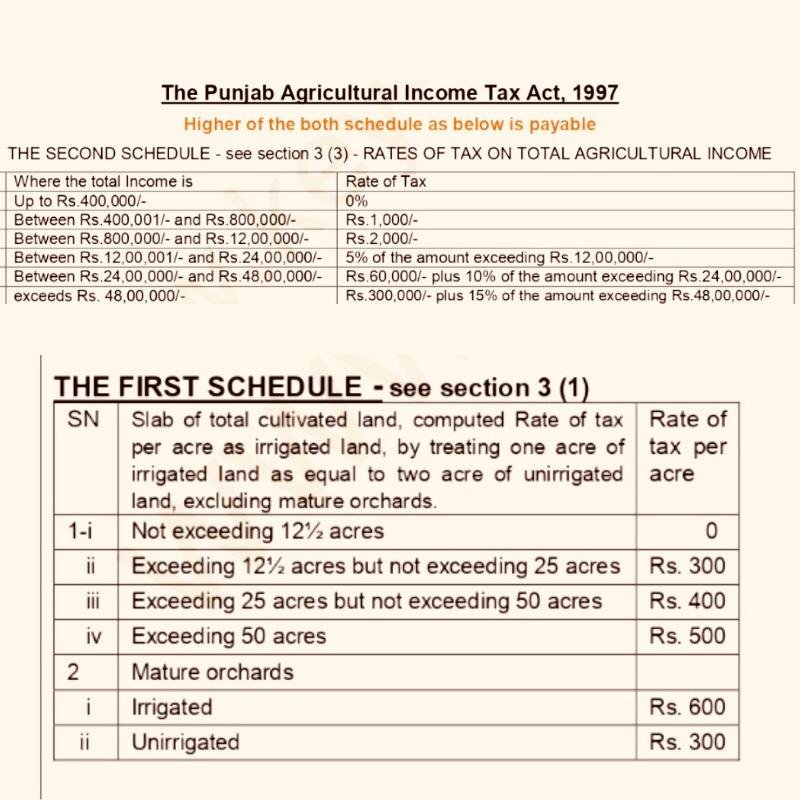

Tax On Agricultural Income In Pakistan 2022 Easy Latest Tax

https://tax.net.pk/wp-content/uploads/2021/01/Agriculture-Income-Tax-Rates-Provincial.jpeg

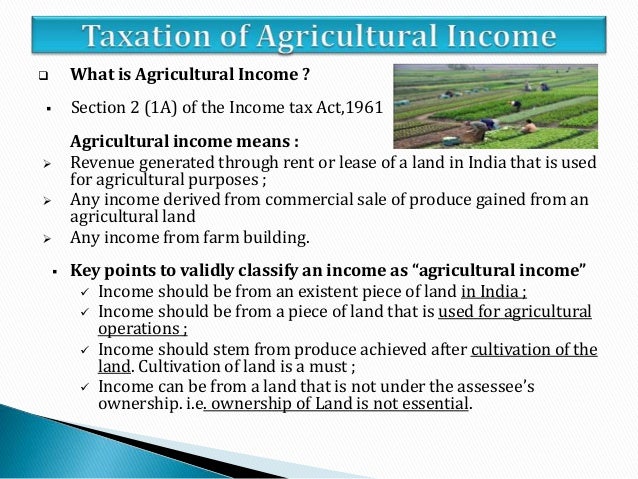

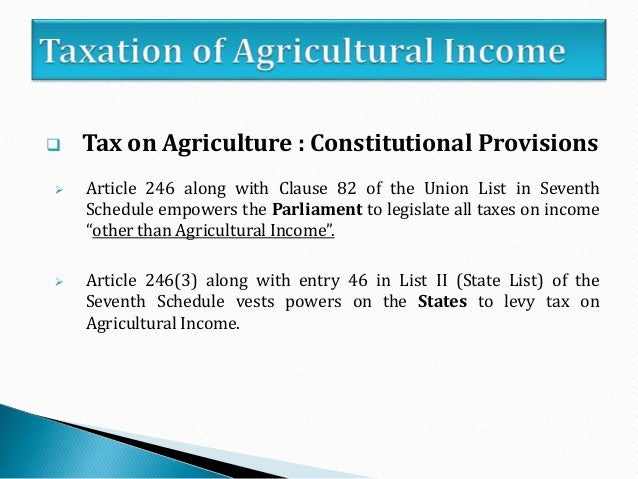

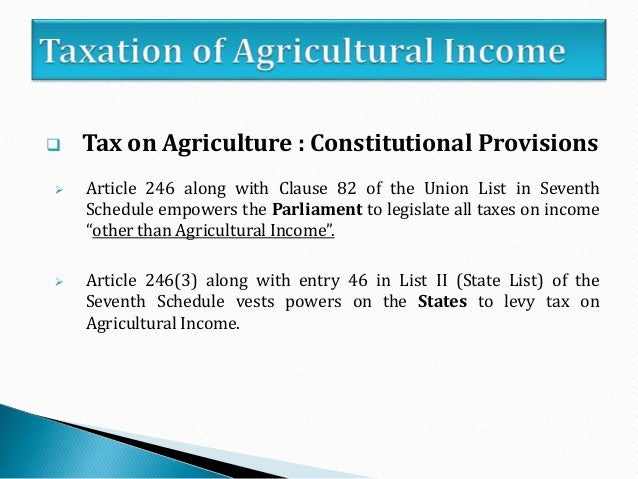

Web 18 mars 2020 nbsp 0183 32 Agricultural income is exempt from Income Tax under section 10 1 of the Income Tax Act 1961 However its included for rate purposes in computing the Web A complete tax rebate is possible if The total agricultural income is lt Rs 5 000 The income from agricultural land is your only source of income no other income You have

Web 30 juil 2023 nbsp 0183 32 Agriculture income and non agriculture income added Calculate tax on total income Add basic exemption limit to net agriculture income Calculate income Web Fiscalit 233 agricole r 233 gime du r 233 el normal Les exploitants soumis au r 233 gime r 233 el normal doivent d 233 poser une d 233 claration de r 233 sultats n 176 2143 et ses annexes Quant au

Download Tax Rebate On Agricultural Income

More picture related to Tax Rebate On Agricultural Income

Taxation Of Agricultural Income

https://image.slidesharecdn.com/taxationofagriculturalincome-181009065632/95/taxation-of-agricultural-income-3-638.jpg?cb=1539068264

Agricultural Income Tax Treatment Under Section 54B

https://navi.com/blog/wp-content/uploads/2022/08/41.-An-Overview-of-Agricultural-Income-Tax-in-India.jpg

The Urgent Need To Tax Agricultural Income

https://images.assettype.com/freepressjournal%2Fimport%2F2017%2F12%2F2017-12-14_FPJ-PW-Tax-Agricultural-income.jpg?auto=format%2Ccompress&w=1200

Web Bien que l imposition sur le revenu agricole ait un caract 232 re obligatoire elle ne prend pas en compte toutes les activit 233 s du secteur Pour que votre b 233 n 233 fice agricole soit impos 233 il Web Agriculture income is exempt under section 10 1 of the Income tax Act However it is included for tax rate purposes in computing the total Income tax liability if the following

Web 17 janv 2016 nbsp 0183 32 The rebate on agricultural income is calculated in the following manner 1 Calculate the total taxable income along with agricultural income 2 Then calculate Web 11 sept 2023 nbsp 0183 32 Agricultural income is not taxable under Section 10 1 of the Income Tax Act as it is not counted as a part of an individual s total income However the state

Taxation Of Agricultural Income

https://image.slidesharecdn.com/taxationofagriculturalincome-181009065632/95/taxation-of-agricultural-income-2-638.jpg?cb=1539068264

Should Government Tax Agricultural Income CoverNest Blog

https://covernest.com/blog/wp-content/uploads/2017/05/ag3.png

https://www.oecd-ilibrary.org/sites/073bdf99-en/index.html?itemId=...

Web Tax policy affects agricultural competitiveness through its impact on farm income levels and variability investment in land and technology labour and other input use and the

https://www.capital.fr/votre-argent/benefices-agricoles-revenus...

Web 10 f 233 vr 2022 nbsp 0183 32 Les revenus provenant des exploitations agricoles appel 233 s b 233 n 233 fices agricoles sont soumis 224 l imp 244 t sur le revenu dans la cat 233 gorie des b 233 n 233 fices

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Taxation Of Agricultural Income

Section 87A Income Tax Rebate Under Section 87A For FY 2019 20

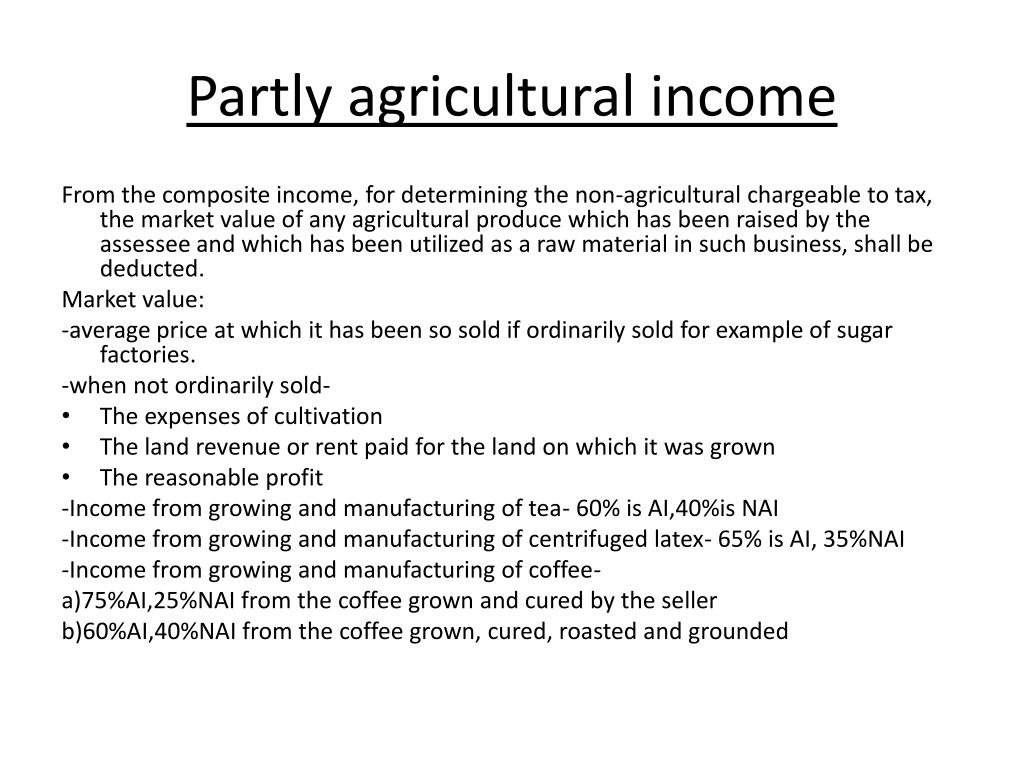

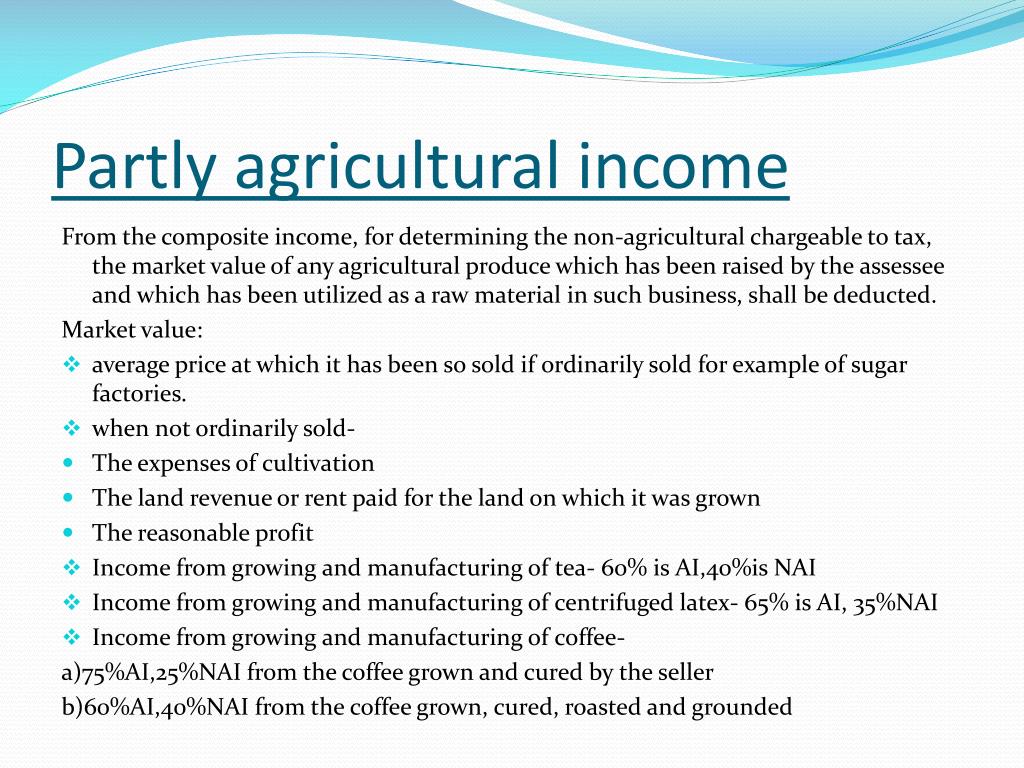

PPT AGRICULTURAL INCOME PowerPoint Presentation Free Download ID

PPT AGRICULTURAL INCOME PowerPoint Presentation Free Download ID

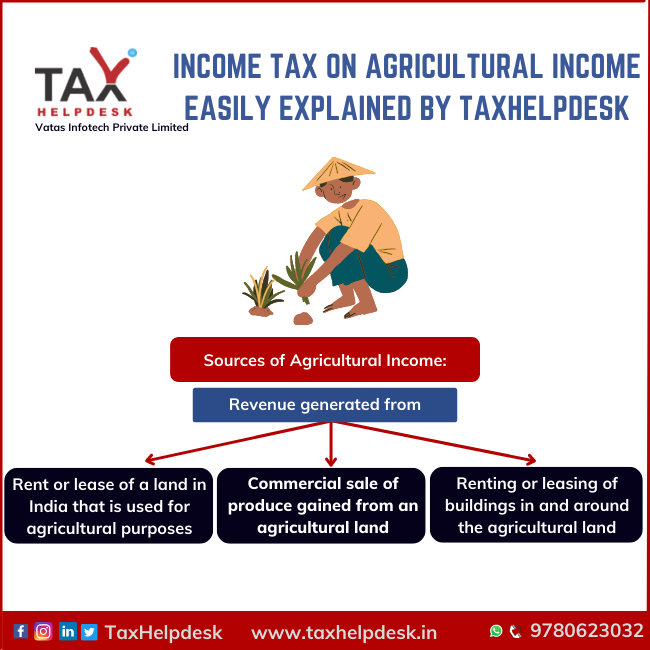

Income Tax On Agriculture Income Easily Explained By TaxHelpdesk

Income Tax On Agriculture Income Easily Explained By TaxHelpdesk

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

PPT AGRICULTURAL INCOME PowerPoint Presentation Free Download ID

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

Tax Rebate On Agricultural Income - Web Fiscalit 233 agricole r 233 gime du r 233 el normal Les exploitants soumis au r 233 gime r 233 el normal doivent d 233 poser une d 233 claration de r 233 sultats n 176 2143 et ses annexes Quant au