Maryland Tax Rebate Check November 2024 The IRS has weighed in on state stimulus payments saying most special state payments won t be taxable on your federal return However there could be some exceptions in some state payments and in

The Maryland Comptroller has announced in a news release that 98 of payments will be processed by February 19th The Maryland Comptroller will issue direct deposit payments to the account where you received your 2019 state tax refund or mail a check to your last address on record The RELIEF Act of 2021 as enacted by the Maryland General Assembly and signed into law by the Governor provides direct stimulus payments to qualifying Marylanders unemployment insurance grants to qualifying Marylanders and grants and loans to qualifying small businesses

Maryland Tax Rebate Check November 2024

Maryland Tax Rebate Check November 2024

https://custercountymt.gov/wp-content/uploads/2023/06/June-2023-Tax-Rebate.jpg

When Will We Get The Extra Tax Rebate Checks In Montana Details

https://townsquare.media/site/990/files/2023/03/attachment-032923-MT-Tax-Rebate-.jpg?w=980&q=75

One time Tax Rebate Checks For Idaho Residents KLEW

https://klewtv.com/resources/media2/16x9/full/1015/center/80/bcd0e069-efe3-406d-b87f-b52ab4b43fd3-large16x9_IdahoTaxRebateCheckpic.jpg

Interest Rate Increase Interest is due at the rate of 10 0075 annually or 0 8339 per month for any month or part of a month that a tax is paid after the original due date of the 2023 return but before January 1 2025 Click here for assistance in calculating interest for tax paid on or after January 1 2025 You can check the status of your current year refund online or by calling the automated line at 410 260 7701 or 1 800 218 8160 Be sure you have a copy of your return on hand to verify information You can also e mail us at taxhelp marylandtaxes gov to check on your refund

If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit The Maryland earned income tax credit EITC will either reduce or eliminate the amount of the state and local income tax that you owe You can check on the status of your current year Maryland income tax refund by providing your Social Security number and the exact amount of your refund as shown on the tax return you submitted Enter this information in the boxes below If you filed a joint return please enter the first Social Security number shown on your return

Download Maryland Tax Rebate Check November 2024

More picture related to Maryland Tax Rebate Check November 2024

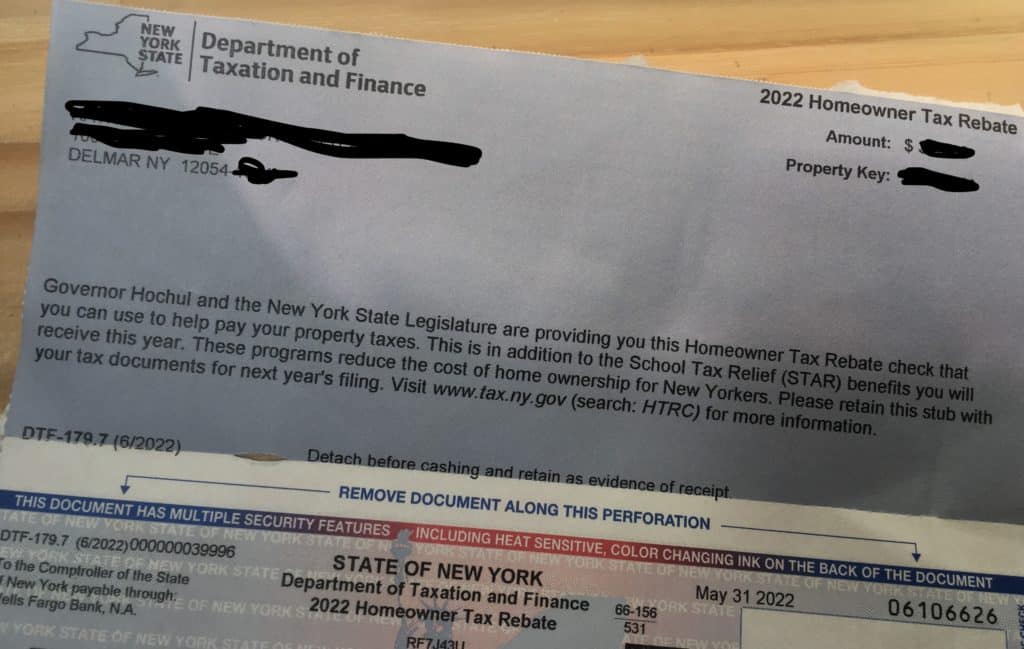

Tax Rebate Checks Come Early This Year Yonkers Times

https://yonkerstimes.com/wp-content/uploads/2018/09/check-2-2.jpg

Is Your State Sending Out A Tax Rebate Check In November South Carolina Taxpayers Will Soon Get

https://orbitbrain.com/blog/wp-content/uploads/2022/11/Is-Your-State-Sending-Out-a-Tax-Rebate-Check-in.jpg

Massachusetts Tax Refund 2022 When Will I Get My Check NBC Boston

https://media.nbcboston.com/2022/11/taxrefund.jpg?quality=85&strip=all&resize=1200%2C675

The RELIEF Act of 2021 is an emergency economic impact and tax relief package that will provide more than 1 billion for Maryland work ing families small businesses and those who have lost their jobs as a result of the COVID 19 pandemic There are two ways to qualify for Utility Tax Rebates 1 A resident must be 62 years or older by November 1 2023 and retired 2 A resident must be 18 years or older by November 1 2023 have a disability and make less than 10 000 a year excluding Social Security disability income or any other payments received as a result of the

Three states Alabama Arizona and Virginia are still giving out one time tax rebates in the final months of 2023 which is unique because most states that issued these stimulus check style payments concluded those programs last year The tax credit is based upon the amount by which the property taxes exceed a percentage of your income according to the following formula 0 of the first 8 000 of the combined household income 4 of the next 4 000 of income 6 5 of the next 4 000 of income and 9 of all income above 16 000 The chart below is printed in 1 000

Utility Rebate Programs In Maryland

https://www.energysvc.com/wp-content/uploads/2021/12/maryland-hero.jpg

Governor Hochul Mails Out Rebate Checks Early Suozzi Cries Foul Yonkers Times

https://yonkerstimes.com/wp-content/uploads/2022/06/FUVtPL9WIAM9l1Zggggg-1024x649.jpg

https://www.kiplinger.com/taxes/state-stimulus-checks

The IRS has weighed in on state stimulus payments saying most special state payments won t be taxable on your federal return However there could be some exceptions in some state payments and in

https://turbotax.intuit.com/tax-tips/tax-relief/maryland-state-stimulus-checks/L4oC546fV

The Maryland Comptroller has announced in a news release that 98 of payments will be processed by February 19th The Maryland Comptroller will issue direct deposit payments to the account where you received your 2019 state tax refund or mail a check to your last address on record

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

Utility Rebate Programs In Maryland

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

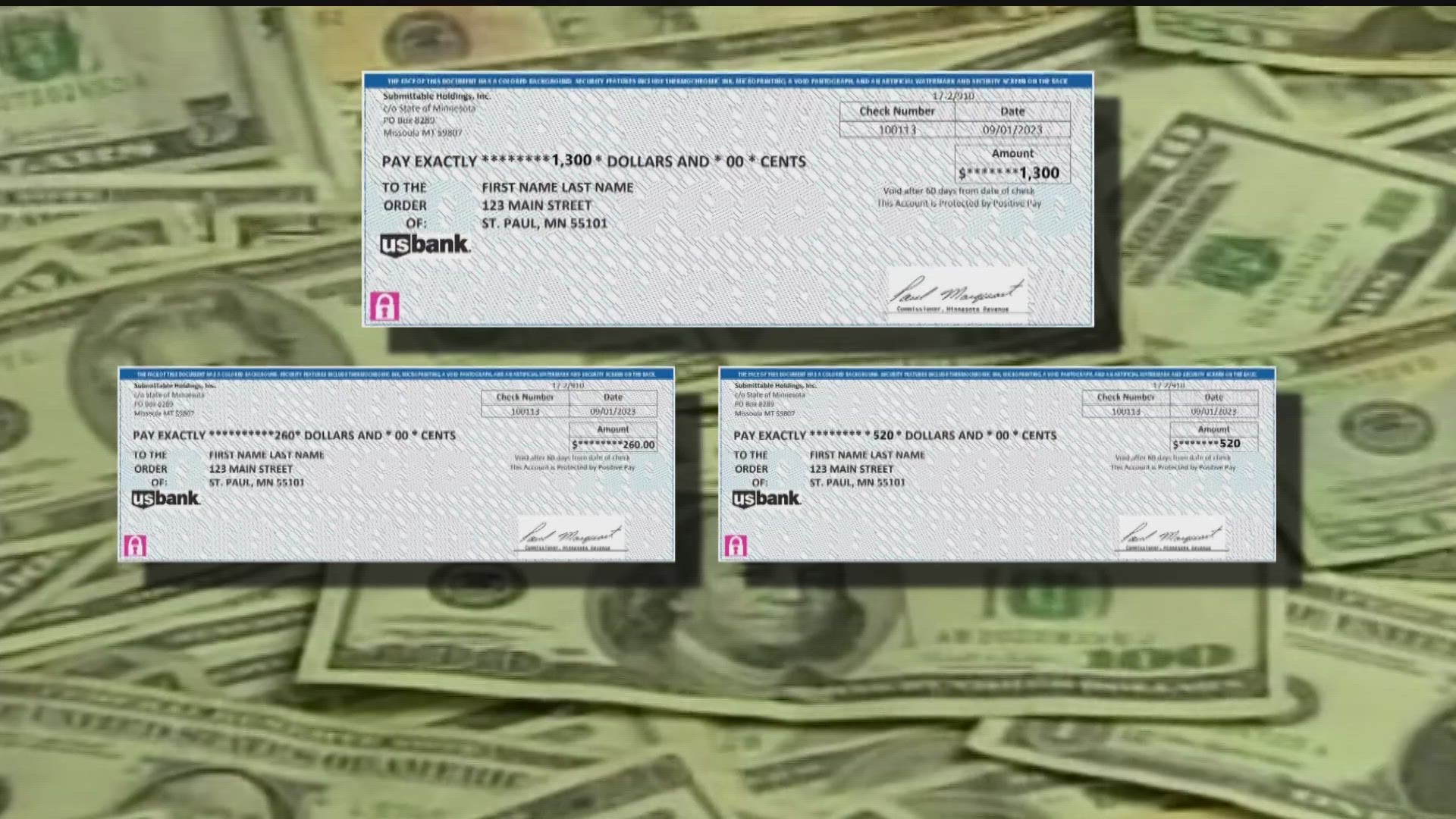

MN Tax Rebate Check Proof DocumentCloud

Minnesota Tax Rebate Checks From Montana Company Are Legitimate Kare11

PA Rent Rebate Form Printable Rebate Form

PA Rent Rebate Form Printable Rebate Form

Minnesota Tax Rebate Deadline Extended How To Get Your Money

LHDN IRB Personal Income Tax Rebate 2022

New Mexico Tax Rebate Checks To Be Sent In June

Maryland Tax Rebate Check November 2024 - As Maryland s state energy office the Maryland Energy Administration MEA will be the applicant for two of the residential focused IRA rebate programs the HOMES Residential Energy Efficiency Rebate Program and the High Efficiency Electric Home Rebate Program