Massachusetts Estate Tax Exemption 2023 Calculator This interactive calculator is a tool to help you estimate potential Massachusetts Estate Taxes Please note that this calculator is simply a tool and that a qualified MA Estate Tax professional should be consulted for a formal calculation and

The Massachusetts Estate Tax Calculator is a straightforward tool designed to help you quickly determine how much estate tax you might owe under the state s tax laws With just a few First on October 4 2023 a new law amended the estate tax by providing a credit of up to 99 600 thereby eliminating the tax for estates valued at 2 million or less and

Massachusetts Estate Tax Exemption 2023 Calculator

Massachusetts Estate Tax Exemption 2023 Calculator

https://www.helsell.com/wp-content/uploads/23-EP-Table-1024x284.jpg

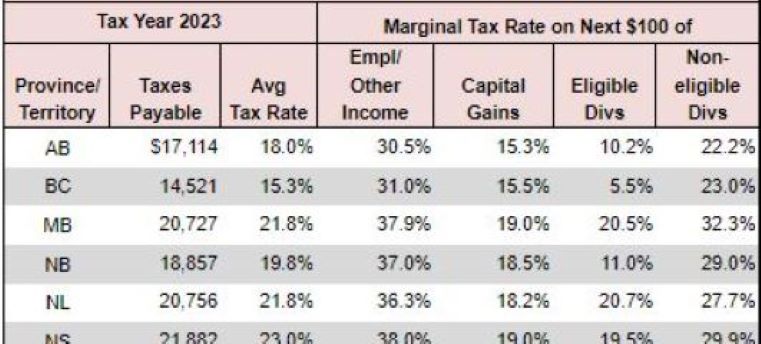

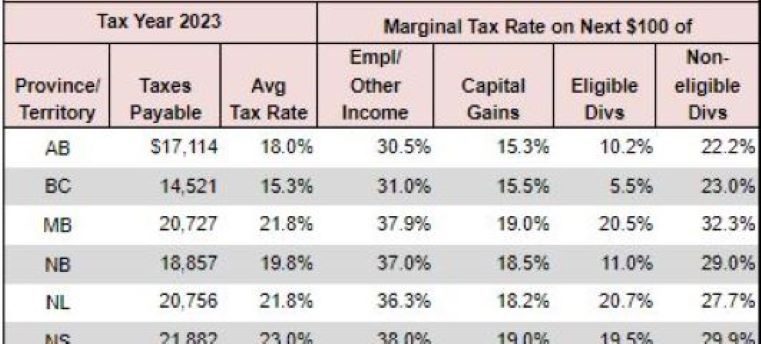

TaxTips ca 2023 Earlier Basic Tax Calculator Compare 2 Scenarios

https://www.taxtips.ca/calculators/enhanced-basic/2023-basic-tax-calculator-rates.jpg

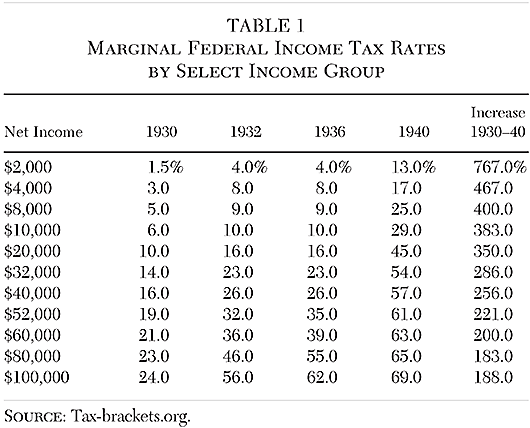

Top Tax Updates For 2023 Aegis Wealth

https://static.twentyoverten.com/5e78ba71d62eee51f5ffc2d0/FSOghNwDjT/IRS-update.jpg

Residents whose Massachusetts taxable estate is greater than 2 000 000 will be subject to Massachusetts estate tax calculated on a graduated scale with the tax rate The new law increases the Massachusetts estate tax exemption amount from 1 million to 2 million meaning that those who die with an estate valued at less than 2 million

As of October 4 2023 the Massachusetts estate tax exemption increased from 1M million to 2M for people dying on or after January 1 2023 When you die if your estate is valued at Use our Massachusetts inheritance tax calculator to estimate inheritance tax on an estate Input the estate value and beneficiary relationships to get an instant estimate of your inheritance tax liability Massachusetts does not levy an

Download Massachusetts Estate Tax Exemption 2023 Calculator

More picture related to Massachusetts Estate Tax Exemption 2023 Calculator

Massachusetts Estate Tax Table Brokeasshome

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-EstateTax-Napkin-12-14-20-v06.jpg

Massachusetts Estate Tax Rates Table

https://www.cato.org/sites/cato.org/files/styles/pubs_2x/public/2021-01/cj-v41n1-8-table-001.png?itok=tyU1ozNU

17 States That Charge Estate Or Inheritance Taxes Alhambra Investments

https://i0.wp.com/alhambrapartners.com/wp-content/uploads/2020/11/2.png?ssl=1

Massachusetts estate tax returns are required if the gross estate plus adjusted taxable gifts computed using the Internal Revenue Code in effect on December 31 2000 exceeds 1 000 000 for dates of death prior January This tool is provided to help estimate potential estate taxes and should not be relied upon without the assistance of a qualified estate tax professional Unless specifically stated this calculator

More specifically the new law increased the Massachusetts estate tax exemption from 1 million to 2 million and did so retroactively to January 1 2023 What is an Estate Tax To better understand what an estate tax is it is Free estate tax calculator to estimate federal estate tax in the U S Also gain in depth knowledge on estate tax and check the latest estate tax rate

Estate Tax Old Colony Law

https://oldcolonylaw.com/estate-planning/Massachusetts-Estate-Tax-Exemption-1024x1024.png

Should The Massachusetts Estate Tax Exemption Be Raised From The

https://bostonglobe-prod.cdn.arcpublishing.com/resizer/J8eRLKO6FapiL9m1GGJbtSrb0M4=/960x0/cloudfront-us-east-1.images.arcpublishing.com/bostonglobe/NBPS725AIPEMFTOWL4TYYHIE7M.JPG

https://capecodestateplanning.com › mass…

This interactive calculator is a tool to help you estimate potential Massachusetts Estate Taxes Please note that this calculator is simply a tool and that a qualified MA Estate Tax professional should be consulted for a formal calculation and

https://verisonalaw.com › tools › massachusetts-estate-tax-calculator

The Massachusetts Estate Tax Calculator is a straightforward tool designed to help you quickly determine how much estate tax you might owe under the state s tax laws With just a few

Should The Massachusetts Estate Tax Exemption Be Raised From The

Estate Tax Old Colony Law

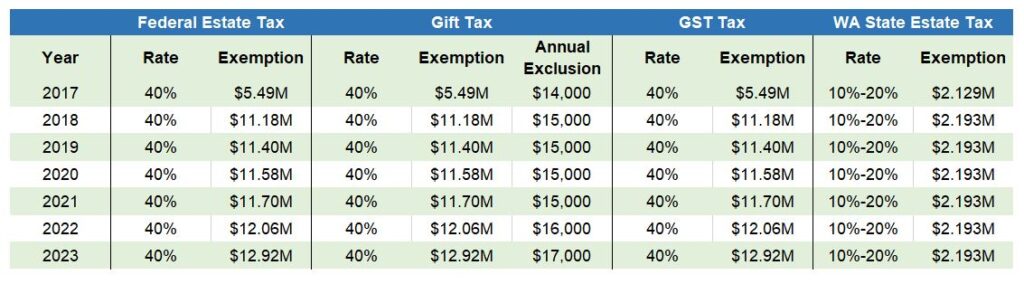

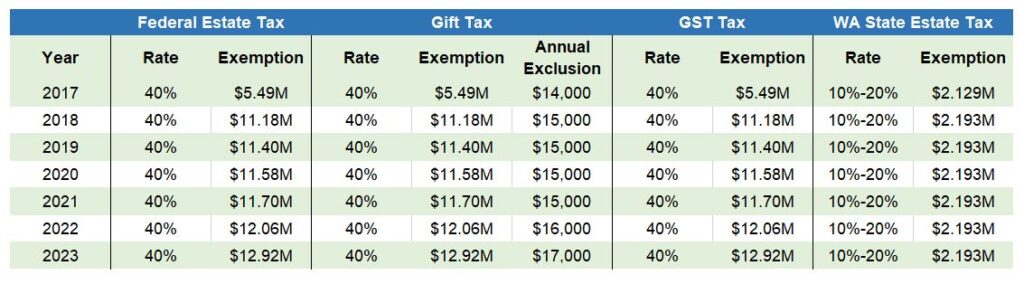

Federal And Washington Estate Tax Exemptions And The Annual Gift

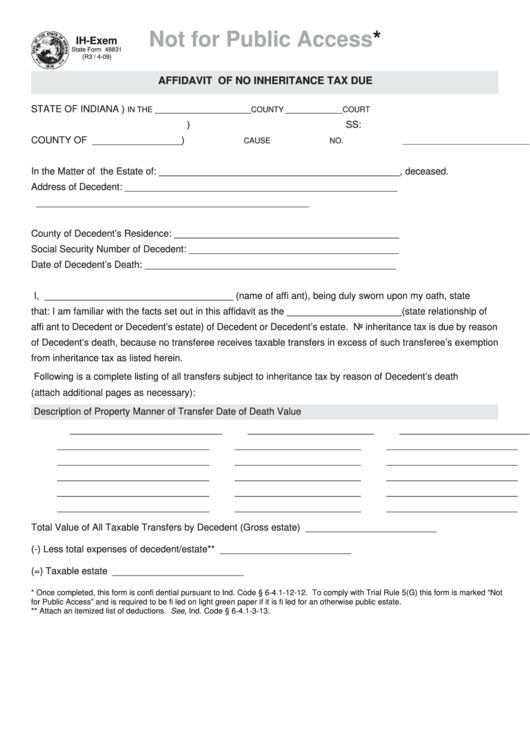

Affidavit Of No Estate Tax Due Massachusetts Form 2024

New Law Changes Massachusetts Estate Tax Exemption Amount Publications

Estate And Income Tax Provisions In Pending Massachusetts Tax Relief

Estate And Income Tax Provisions In Pending Massachusetts Tax Relief

Estate Tax Exemptions After 2025 Info For High Net Worth Families

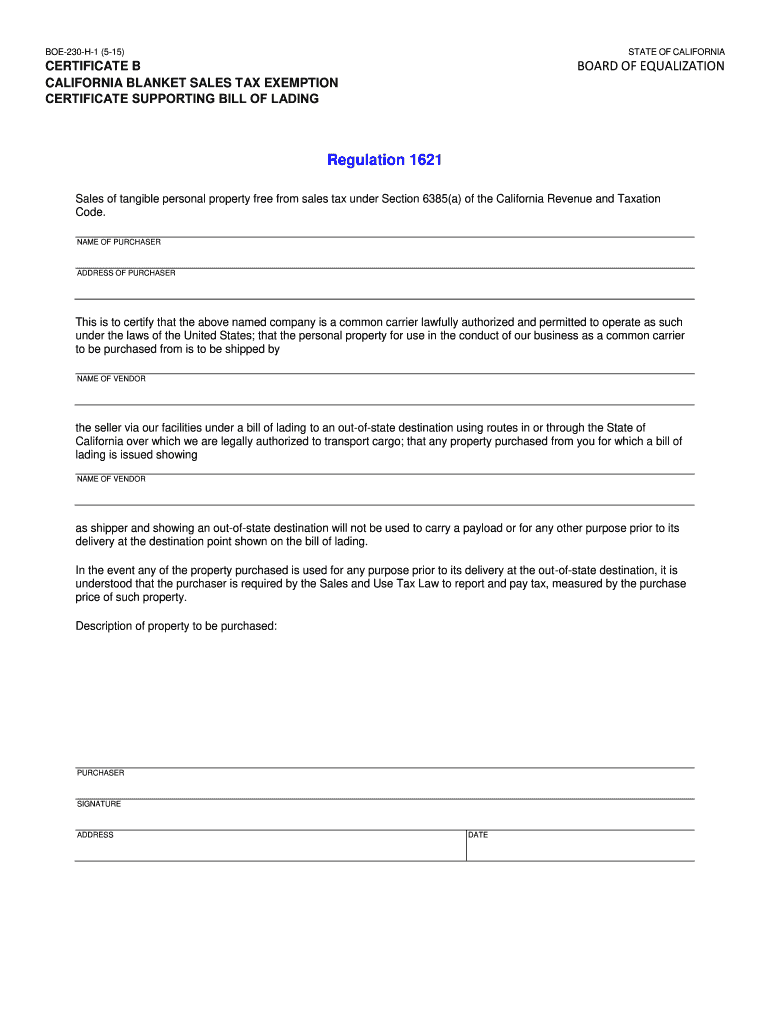

California Sales Tax Exempt Form 2023 ExemptForm

IRS Raises 2023 Estate Tax Exclusion To 12 92 Million Up From 12 06

Massachusetts Estate Tax Exemption 2023 Calculator - How to Calculate the Massachusetts Estate Tax Rather than try to reinvent the wheel and provide my own explanation the Massachusetts Department of Revenue has