Tax Rebate On Principal Amount Of Home Loan Before Possession Web 22 juin 2023 nbsp 0183 32 Tax benefits on home loans can only be claimed once possession of the property is obtained Interest paid prior to

Web Shubham Agrawal Senior Taxation Advisor TaxFile in says quot Yes the principal portion of the EMI paid for the year is allowed as deduction under Section 80C in the year of Web 28 juin 2023 nbsp 0183 32 Les r 233 ductions d imp 244 ts au titre de l habitation principale en 2023 les charges d 233 ductibles des revenus locatifs qui peuvent permettre de cr 233 er du d 233 ficit

Tax Rebate On Principal Amount Of Home Loan Before Possession

Tax Rebate On Principal Amount Of Home Loan Before Possession

https://printablerebateform.net/wp-content/uploads/2022/09/PPI-Tax-Rebate-Form.png

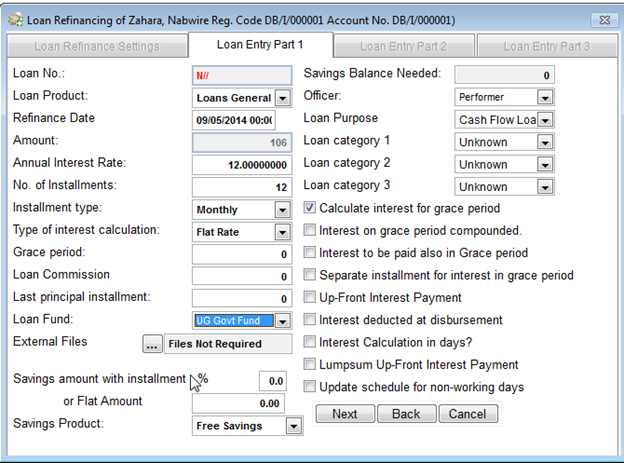

Payment View

https://support.insitebanking.com/welcome/documentation/insite8documentation/content/Resources/Images/MainMenu/Inquiry/Loan_Inquiry/Bottom_Panel/rebates_button.png

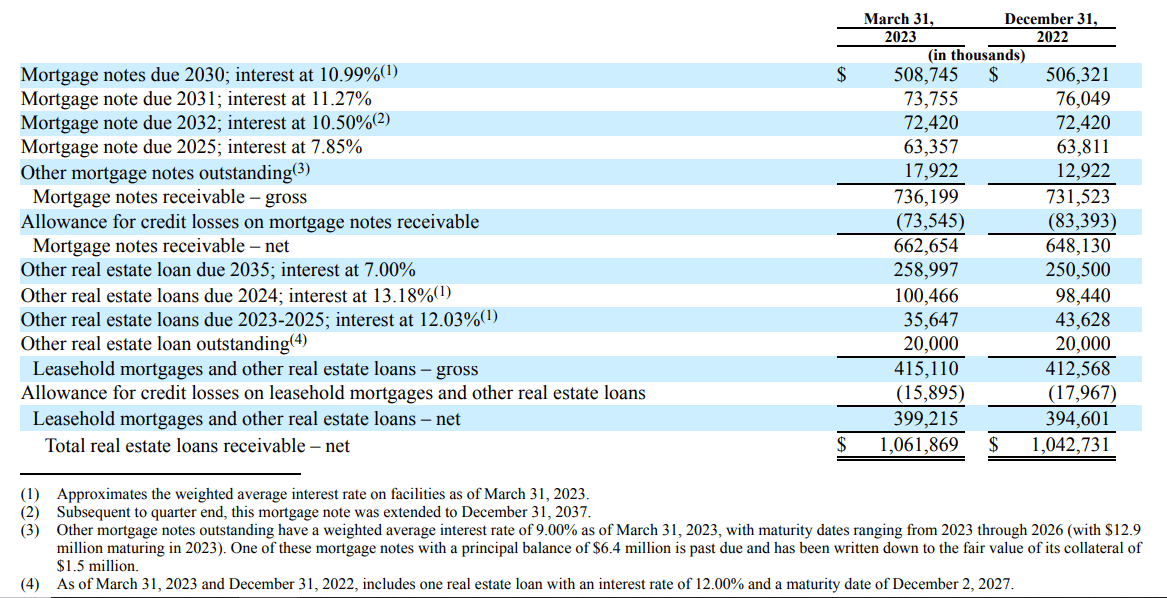

Omega Healthcare Why The Stock Is A Hold NYSE OHI Seeking Alpha

https://static.seekingalpha.com/uploads/2023/6/12/55366256-16866006631726663_origin.png

Web Can an individual claim Home Loan tax benefit before possession Yes it is possible to claim a tax rebate on Home Loan before possession However these tax rebates are Web 11 janv 2023 nbsp 0183 32 Tax deduction on the principal component is limited to Rs 1 50 lakhs per annum under Section 80C while rebate towards interest is capped at Rs 2 lakhs

Web 28 janv 2014 nbsp 0183 32 3 Answers Sorted by 1 The rebate is available from the financial year in which you have taken the possession of the property All the interest paid in that Web Combined with tax exemptions on the principal amount a home loan for under construction property makes your dream house more affordable Yes you can claim

Download Tax Rebate On Principal Amount Of Home Loan Before Possession

More picture related to Tax Rebate On Principal Amount Of Home Loan Before Possession

ITR Filing You Can Claim Interest Paid Before Possession Even If You

https://www.livemint.com/lm-img/img/2023/06/22/600x338/Home_loan_1687401215877_1687401216035.jpg

Home Loan Tax Rebate 5

https://images.tv9marathi.com/wp-content/uploads/2022/01/26170837/Home-Loan-1.jpg

Writing Displaying Text Rate Of Interest Concept Meaning Percentage

https://thumbs.dreamstime.com/z/writing-displaying-text-rate-interest-concept-meaning-percentage-computed-principal-amount-loan-mortgage-sign-showing-260944193.jpg

Web Le plafonnement du cr 233 dit d imp 244 t pour la r 233 sidence principale et les travaux de d 233 veloppement durable est de 8 000 euros pour un c 233 libataire et de 16 000 euros pour Web 31 mai 2022 nbsp 0183 32 One of the primary benefits of home loans is that you get to enjoy substantial tax rebates which significantly reduce your tax outgo If you already have a home loan

Web 9 sept 2023 nbsp 0183 32 A home loan borrower can end up losing up to 85 of tax benefits available on the home loan premium payment if the builder fails to deliver possession of the Web 4 ao 251 t 2021 nbsp 0183 32 Any interest paid before possession is tax deductible in 5 equal installments beginning from the financial year in which construction was completed So you get

Deferred Tax And Temporary Differences The Footnotes Analyst

https://www.footnotesanalyst.com/wp-content/uploads/2022/04/FAG-DT1.png

Loan Amount Principal COOKING WITH THE PROS

http://www.loanperformer.com/NewsLetters/May2014/images/LoanRef2.png

https://www.livemint.com/money/personal-fina…

Web 22 juin 2023 nbsp 0183 32 Tax benefits on home loans can only be claimed once possession of the property is obtained Interest paid prior to

https://economictimes.indiatimes.com/wealth/tax/can-i-claim-deduction...

Web Shubham Agrawal Senior Taxation Advisor TaxFile in says quot Yes the principal portion of the EMI paid for the year is allowed as deduction under Section 80C in the year of

Handwriting Text Rate Of Interest Business Concept Percentage Computed

Deferred Tax And Temporary Differences The Footnotes Analyst

Home Loan EMI Calculator Free Excel Sheet Stable Investor

Sign Displaying Rate Of Interest Business Concept Percentage Computed

Loan Calc Adfition Principal Polizload

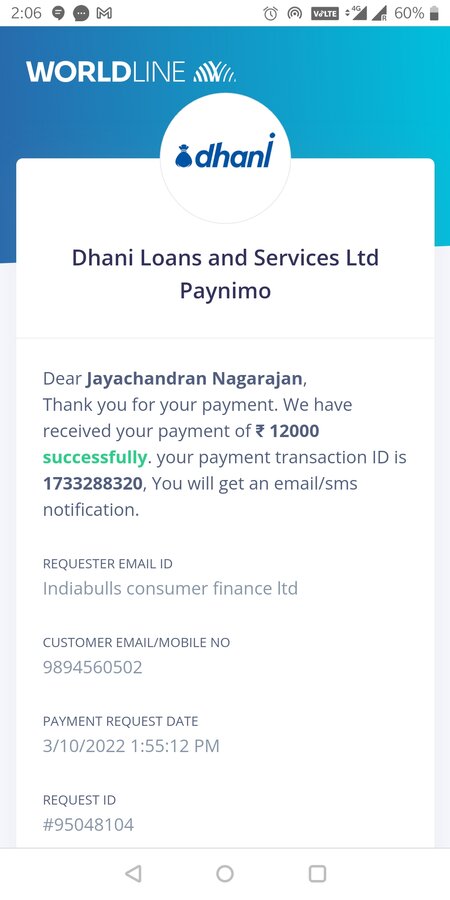

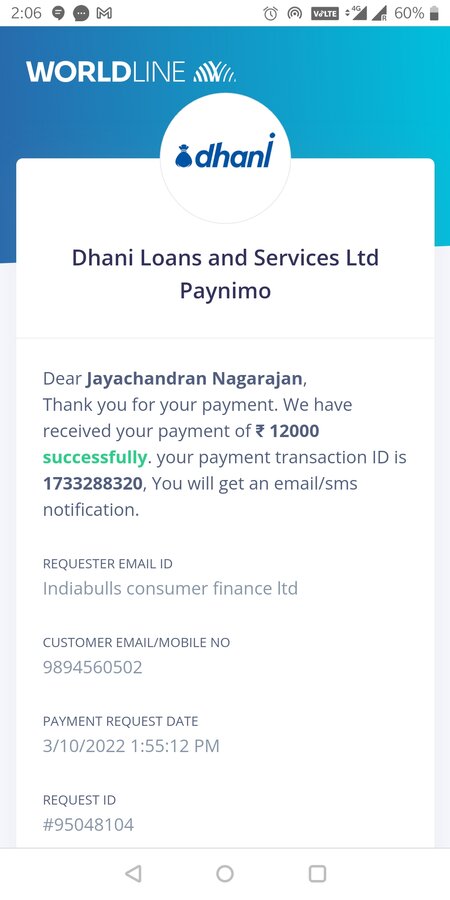

IndiaBulls Loan Foreclosure By Paying Entire Principal Amount And

IndiaBulls Loan Foreclosure By Paying Entire Principal Amount And

Conceptual Display Rate Of Interest Business Showcase Percentage

Text Sign Showing Rate Of Interest Conceptual Photo Percentage

Text Caption Presenting Rate Of Interest Business Idea Percentage

Tax Rebate On Principal Amount Of Home Loan Before Possession - Web Can an individual claim Home Loan tax benefit before possession Yes it is possible to claim a tax rebate on Home Loan before possession However these tax rebates are