Maximum Cpf Contribution For Tax Relief Individuals may continue to enjoy tax relief of up to 16 000 maximum 8 000 for self and maximum 8 000 for family members a year for eligible CPF cash top ups that do not attract MRSS grants

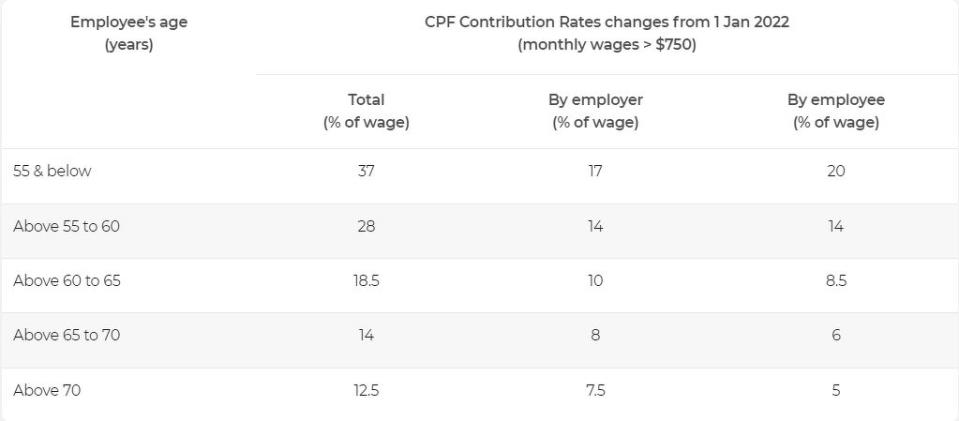

You may claim CPF Relief for making employee CPF contributions on wages that have not exceeded the Ordinary Wage ceiling and Additional Wage ceiling As announced in For YA2023 meant for contributions done in 2022 the maximum tax relief for making cash top ups to our CPF accounts is 16 000 8 000 for either RSTU or MediSave top ups to self and

Maximum Cpf Contribution For Tax Relief

Maximum Cpf Contribution For Tax Relief

https://www.asiaone.com/sites/default/files/inline-images/3322_moneysmartwageceiling_moneysmart.jpg

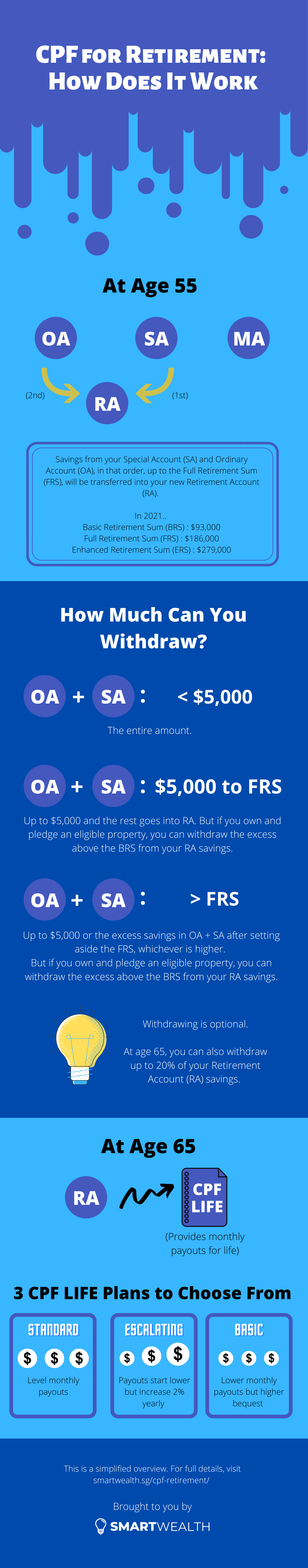

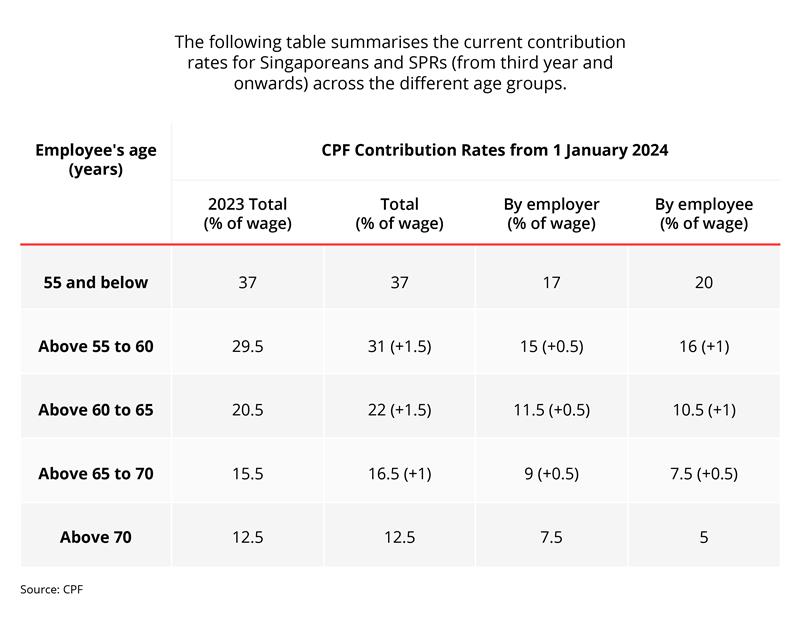

CPF Contribution Rate Current CPF Contribution Rates For Employee

https://quickhr.co/assets/images/webp/cpf_contribution_rate_n.webp

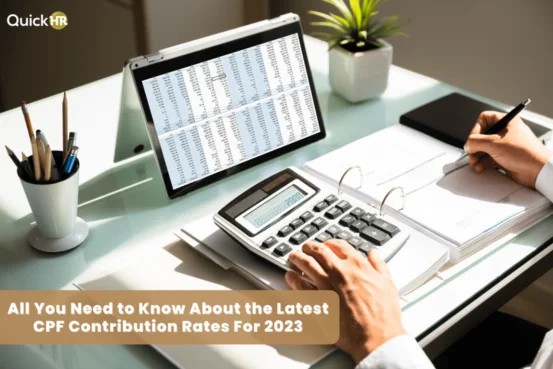

CPF For Retirement How Does It All Work A Simple Guide

https://smartwealth.sg/wp-content/uploads/2021/02/how-cpf-for-retirement-works.png

You can enjoy an equivalent amount of tax relief for cash top ups made in each calendar year of up to 8 000 if you make a top up to yourself and an additional 8 000 if you Maximising your personal income tax relief of 80 000 a year can help to reduce your tax bill The CPF relief for employees and the CPF cash top up relief are two types of CPF related tax reliefs that you

For YA 2024 your tax relief for your MediSave and voluntary CPF contributions will be capped at the lowest of 37 of your net trade income assessed or CPF relief cap of The maximum tax relief we can get for RSTU top ups is 8 000 This amount is also shared with contributions made to our MediSave Account We can also get another 8 000 tax relief if we

Download Maximum Cpf Contribution For Tax Relief

More picture related to Maximum Cpf Contribution For Tax Relief

CPF BRS To Be Raised By 3 5 Per Year From 2023 To 2027 Older Workers

https://s.yimg.com/ny/api/res/1.2/pIcuUt9xZSJj0ggZiROLew--/YXBwaWQ9aGlnaGxhbmRlcjt3PTk2MDtoPTQyMQ--/https://media.zenfs.com/en/the_edge_961/a2c23e7f493e583121c8412fd8bf1a7c

What Happens To Your CPF Contributions After You Hit Full Retirement

https://dollarsandsense.sg/wp-content/uploads/2022/01/cpf-allocation-rates.jpg

CPF Interest Rate MariskaEibhlin

https://s.yimg.com/ny/api/res/1.2/l3EaewXVhy0NDuuk2hzd_Q--/YXBwaWQ9aGlnaGxhbmRlcjt3PTY0MDtoPTQwNA--/https://blog-cdn.moneysmart.sg/wp-content/uploads/2018/01/cpf-allocation-rates-2018.png

While you are allowed to make a lump sum payment that will max out your CPF top ups do note that the maximum tax relief of up to S 8 000 per year will apply when you top up your SA or RA How much tax relief can you get on CPF top ups You can get tax relief on voluntary contributions to your SA RA and MediSave Account You are entitled to a maximum of 7 000 worth of tax

These are the criteria you must fulfill to qualify for the CPF Cash Top Up Relief in 2022 The CPF Cash Top up Relief is granted automatically to eligible based From 1 January 2022 the government has raised the maximum tax relief from 7 000 to 8 000 when you voluntarily top up your SA RA and MA The maximum

Calculating Employer CPF Contribution CPF Deduction In Singapore

https://linksinternational.com/wp-content/uploads/2021/12/image-1.png

What Is The Maximum Amount Of Tax Relief We Can Get From Our CPF Each

https://www.omy.sg/wp-content/uploads/2022/12/What-Is-The-Maximum-Amount-Of-Tax-Relief-We-Can-Get-From-Our-CPF-Each-Year.jpg

https://www.iras.gov.sg/taxes/individual-inc…

Individuals may continue to enjoy tax relief of up to 16 000 maximum 8 000 for self and maximum 8 000 for family members a year for eligible CPF cash top ups that do not attract MRSS grants

https://www.iras.gov.sg/taxes/individual-income...

You may claim CPF Relief for making employee CPF contributions on wages that have not exceeded the Ordinary Wage ceiling and Additional Wage ceiling As announced in

Increase In Central Provident Fund CPF Rates For Those 55 To 70 Years

Calculating Employer CPF Contribution CPF Deduction In Singapore

Should You Do CPF Contribution As A Self Employed It Depends Live

Significant Changes To CPF MediSave Cash Top Ups And Tax Relief

What The Self employed Should Know About CPF Contributions Endowus SG

Yes CPF Takes 20 Of Your Monthly Salary BUT Investment Stab

Yes CPF Takes 20 Of Your Monthly Salary BUT Investment Stab

Taxpayer Relief 2023 Contribution Limits Increase

Save More With CPF And SRS

SRS Contributions And Tax Relief IRAS Free Websites Share News And

Maximum Cpf Contribution For Tax Relief - You can enjoy an equivalent amount of tax relief for cash top ups made in each calendar year of up to 8 000 if you make a top up to yourself and an additional 8 000 if you